ARKK Continues To Overpromise And Underdeliver

Summary

- ARK Innovation ETF has underperformed the S&P 500 over its eight-year track record, raising questions about its management and investment approach.

- The fund's high turnover rate and missed opportunities, such as the artificial intelligence hype, indicate indecisiveness and difficulty in market timing.

- The author suggests investors take responsibility for their finances by investing in ETFs that track the world economy and selecting individual stocks based on personal convictions.

imaginima

Investment Thesis

The ARK Innovation ETF (NYSEARCA:ARKK) of Cathy Wood and her team probably does not need a great introduction; it gets enough attention and free marketing through many articles and YouTube channels. The historical performance is worse than the S&P 500, and with the track record of now eight years, it seems like the concept or the management has failed in its approach. There are no indications that this will change in the future, and if it does, it will probably be sheer luck. Therefore I want to call on you to take responsibility for your money instead of paying someone else for it.

ETF Overview & Performance

The fund is relatively concentrated, with the top 5 stocks currently accounting for about 40%. Interestingly, we do not find former favorite stocks like Nvidia and Palantir at the moment. Depending on your perspective, this is either an example of market timing being difficult or management having an excessively high turnover rate; more on this later. Currently, Nvidia is not included in the fund, and Palantir's share is 0.95%.

With a track record now of eight years, we see worse performance than the S&P 500. Eight years was enough time to prove that the management team's focused stock selection would outperform. To prove that the in-house research team is doing a good job of anticipating future trends and translating them into investments. For several years, outperformance was visible in times of low-interest rates, but the concept of investing in unprofitable growth companies has become much less attractive in the current market phase.

The outstanding performance of the post-Covid period was a side effect of the rampant central bank liquidity and, thus, extremely high valuations. Since the fund invested in some small stocks and collected more and more money, rising prices of small stocks became a self-fulfilling prophecy. When Cathy Wood stated in early 2022 that the market was irrational, it damaged her reputation. The opposite was the case; the market reduced absurd valuations, which was completely rational. Back in April 2021, when the fund outperformed everything, there was criticism of the internal risk management. A Morningstar analyst said the risk management was based primarily on Cathy Wood's instincts. His warning at the time predicted later developments.

Without risk-management professionals to stress-test the portfolio's risk exposures, estimate its potential losses during historical or hypothetical market environments, and gauge worst-case scenarios, the team is poorly positioned to prepare and react.

Morningstar - Robby Greengold

At the same time, Cathy Wood was far from restrained in her announcements. A sustained annual return of 30-40% has hardly been achieved by anyone in history. Ok, she states that it "could deliver" but all in all the following and other quotes sound clearly too self-confident.

Cathie Wood draws attention again from the investment community from her latest market commentary note where she stated: "With a five-year investment time horizon, our forecasts for these platforms suggest that our strategies today could deliver a 30-40% compound annual rate of return during the next five years."

Cathy Wood, Dec. 21, 2021

Investors are too late

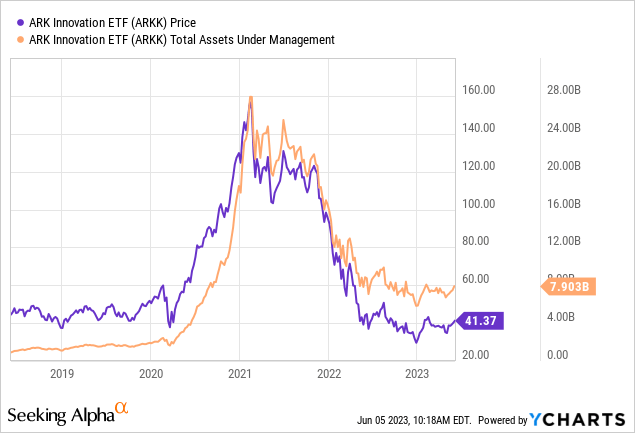

If we look at the replacement under management in relation to the price development, we can see that, especially from 2020 to 2021, there was extreme fear of missing out, and most investors got in far too late to profit from the hype. Or were just not aware that it was only hype? From this, we can conclude that most investors have lost money with that fund; if they got out in time, maybe 20%, but many probably over 50%.

ARKK is indecisive

We all know from our investments that market timing is tricky. It seems like it is also challenging for the ARKK management; the turnover rate is relatively high. Surprisingly high considering the fund only wants to invest in high-conviction stocks with long-term growth prospects. Artificial intelligence would fit perfectly into the fund concept, but the recent hype was largely missed, partly due to the unfortunate trade with Nvidia. This was justified by the high valuation, but this justification would apply to virtually all stocks in the fund.

In an interview with CNBC this past February, Cathie Wood said that the fund sold Nvidia as part of the process of "consolidating around their highest-conviction names" and that part of the reason that Nvidia didn't make the cut was that its valuation is very high.

According to ARKK, the average turnover ratio is 15%. YCharts says 55%, as does Morningstar (as of 07/31/22). Why so much trading if they are so convinced of their positions? As I said, high valuation applies to almost all of the stocks held anyway.

Conclusion: Care for your money yourself

My investment strategy is based on two pillars: Monthly fixed savings plans in various ETFs that track the world economy. Here I do not want to have overweight in any particular region or industry. Most global ETFs overweight U.S. equities; these are overrepresented in relation to the share of U.S. GDP. But offsetting this effect with a few ETFs is relatively easy. This strategy has the advantage of low expense ratios, and one benefits from the cost-average effect by investing regularly.

The second pillar is individual stocks that I select based on my convictions. Sometimes I get it right and outperform the market; in other phases, I don't. However, I know the risk that I might underperform and have higher volatility. With actively managed funds, you give this second pillar to someone else and pay a fee for it. Historically, however, most fund managers fail to outperform the market in the long run; there is much information on this. The fees alone mean they have to beat the market to achieve the same performance, in this case, about 0.7% p.a. In addition, there are hidden costs that do not even show up here.

For years and years - decades, really - the standard of comparing costs in mutual funds has been to take their total expense ratio, . . . but there are an awful lot of costs involved in mutual funds that aren't in the expense ratio

John C. Bogle

So I decided to take the average market return as a safe haven and, on the other hand, take responsibility for my finances instead of paying someone else to do it.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.