EOG Resources: Supply Cuts Won't Support The Stock Indefinitely

Summary

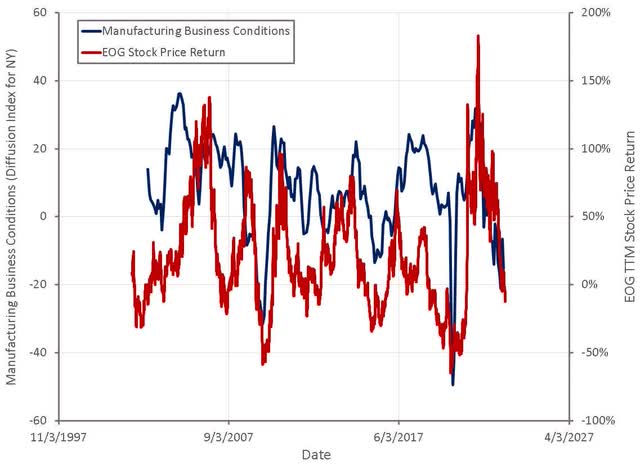

- EOG's stock price is currently more dependent on the macro outlook than the company's profitability, with leading economic indicators pointing towards a slowdown.

- Despite high profits and a modest valuation, EOG's stock may continue to tread water until the economic outlook improves.

- EOG is a well-managed company that could provide an attractive investment opportunity, if the stock pulls back significantly during a recession.

guvendemir

EOG Resources' (NYSE:EOG) stock has been treading water over the past 12 months, and is fairly flat over almost the past decade, despite the company generating more free cash than ever before. From a fundamental perspective, this may seem difficult to understand, but EOG's stock is currently far more dependent on the macro outlook than the company's current profitability. A broad range of leading economic indicators suggest a sharp slowdown is coming, which is weighing on the stock.

The bull case for oil over the past 12 months has generally been that Russian production would eventually roll over, along with strong demand from China and an end to SPR withdrawals. China's economy has largely bounced back, although the services recovery has been far stronger than manufacturing, leading to less oil demand than may have been expected. Russian production has also remained fairly resilient, declining by maybe half a million barrels, rather than the 2-2.5 million that many expected.

Over the weekend OPEC+ made no changes to its planned oil production for the remainder of the year. Although, after a planned 1.66 million bpd of OPEC production cuts in April, Saudi Arabia announced a voluntary output cut of approximately one million bpd. While this has obviously caused the price of oil to spike, the near term impact is unclear. A cut is clearly supportive of higher prices, but it also signals that demand is weak and it could be this narrative that determines oil prices going forward.

Recessionary fears have been driving oil markets as much as anything, although EOG continues to be upbeat. Inventory levels are currently near the five-year average and are declining. EOG’s management is also expecting that oil markets will be under-supplied globally in the second half of the year, barring a recession. Longer term, EOG is a believer that underinvestment in upstream projects over the past few years will support prices going forward.

Natural gas prices in the US are currently being driven by high inventory levels, in part due to a warmer winter and reduced LNG demand during repairs at Freeport. While natural gas prices in the US are currently depressed, EOG remains bullish long term. Management believes that natural gas has the ability to displace coal and offers reliability that renewables cannot. US LNG demand is currently at record levels, and an additional 7 Bcf per day of capacity is under construction or through FID, with expected startup between 2024 and 2027. Given production costs, the US should be competitive in global LNG markets, but there is still a question whether supply will still tend to outdo demand. As EOG has suggested with its Dorado play, it doesn’t take a lot of wells to generate significant volumes. If the industry begins chasing natural gas production in earnest, it is hard to see how a glut won’t be formed.

Energy prices, and EOG’s stock price, are to a large extent being driven by macroeconomic sentiment. While a strong argument can be made that there has been a period of underinvestment that will leave the market undersupplied, it should also be recognized that without OPEC production cuts and the war in Ukraine, oil prices and oil stocks would likely have been crushed in recent months.

Even with a pullback in oil and gas prices and a surge in costs, EOG’s profits remain high, and the company’s valuation modest. This doesn’t seem to matter though, as a broad range of leading economic indicators are showing weakness, which could threaten demand in the near term. Until the economic outlook picks up, EOG's stock may continue to struggle to move higher.

Figure 1: Current General Business Conditions (Diffusion Index for New York) and EOG Stock Price Returns (source: Created by author using data from The Federal Reserve and Yahoo Finance)

While the macro outlook looks weak, EOG remains a well-managed company that would be a good investment opportunity at the right price. EOG is a multi-basin operator with a deep inventory of high quality drilling locations. The company has core assets in the Eagle Ford and Permian, and a number of emerging assets, which the company believes have high potential:

- South Powder River Basin (Mowry and Niobrara)

- South Texas Dorado

- Utica

EOG believes that the Dorado play could be the lowest cost natural gas play in the US. The company is still delineating the Utica combo play, but is seeing good results there.

Shale is more akin to manufacturing than traditional oil and gas production, and as a result is amenable to continuous improvement. EOG capitalizes on this as well as anyone, demonstrating improved productivity and lower costs over an extended period of time, even as inventory quality has potentially declined. The company is focused on economies of scale within each of the basins it operates in and invests in infrastructure (local sand, water reuse systems, water lines, gas lines) to lower field costs. EOG also strategically participates in different pieces of the supply chain (drilling mud, motors, sand, water) when it believes it can add value.

EOG's operational improvements are partially indicative of why the undersupply thesis may be wrong. EOG continues to make large productivity gains, meaning a dollar of shale CapEx in 2023 isn't comparable to a dollar of shale CapEx in 2013. In addition, service prices were highly inflated in the early 2010s, and at the industry level exploration spending was often wasted on frivolous projects that didn't amount to anything.

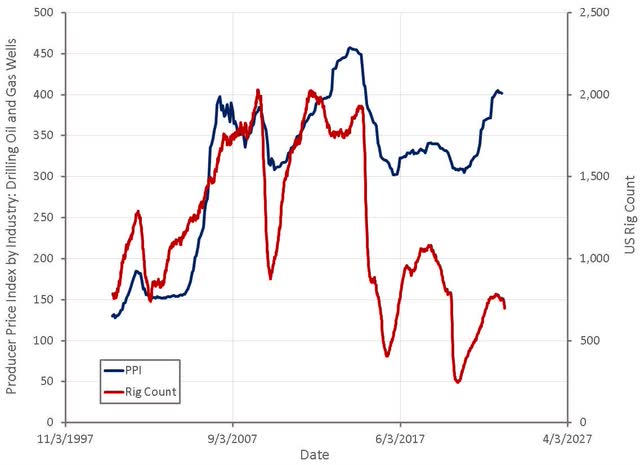

EOG believes that inflationary pressures have begun to plateau, and as a result expects that its average well cost should increase by no more than 10% in 2023. There are early indicators of service prices beginning to moderate, although this is uneven across basins. EOG has stated that any reduction in service and tubular costs will take time to translate into well costs and cash operating costs, most likely 2024.

This goes against the expectations of service companies, who generally believe that this cycle is different and that prices will continue to move higher. Given the rapid rise in prices in 2022, it would not be surprising to see a lot of this given back if activity moderates.

Figure 2: Drilling PPI and US Rig Count (source: Created by author using data from The Federal Reserve and Baker Hughes)

EOG remains committed to returning free cash flow to shareholders, through a growing regular dividend, special dividends and opportunistic buybacks. Management recognizes the cyclical nature of the industry and is using it to its advantage. For example, pre-purchasing pipe in 2020 due to favorable pricing. EOG also targets counter-cyclical buybacks, opportunistically repurchasing shares when management believes the stock is undervalued.

EOG repurchased roughly 300 million USD of stock in the first quarter of 2023 at an average price of 105 USD per share. This creates an interesting situation, as EOG still has around 5 billion USD of cash on the balance sheet, and the company may choose to use this to support the stock at around 100 USD. In addition, OPEC is currently providing a backstop, stepping in to try and support oil prices at around 70 USD per bbl for WTI. While there is support below EOG’s current share price, this ultimately won’t matter if the economy heads where leading economic indicators are suggesting.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.