NRG Energy - Seeking Identity

Summary

- NRG Energy offers a high dividend yield of 4.53%, but its defensive qualities have diminished due to a rising beta, making it more sensitive to market movements.

- The company's pursuit of a consumer-focused strategy, such as the acquisition of Vivint Smart Home, has increased execution risk and raised concerns among traditional and activist shareholders.

- Despite elevated net debt, NRG's forward valuations appear attractive due to expected EBITDA growth, but the stock's recent performance and institutional ownership trends suggest caution.

Klaus Vedfelt

Losing Its Defensive Stature

Investors typically gravitate to utility stocks for their dividend qualities, as well as their defensive hues. When it comes to the stock of Houston based- NRG Energy (NYSE:NRG), one can't have too many complaints about the first facet.

If you dive in at these levels, you could lock in a fairly tasty yield of 4.53%, over 180bps higher than the historical average. For context, note that the company has been paying dividends for a decade now, while also growing it over the last three years. Crucially, these dividends will likely grow at a fairly reassuring pace of 7-8% YoY, for the foreseeable future. All in all, no real complaints as far as the dividends go.

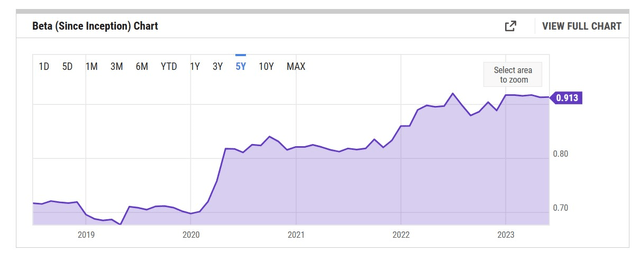

However, we're not entirely convinced NRG can be perceived to be a defensive play anymore, and this can be validated by its beta (since inception) which has been inching up over the years and is now not far from crossing 1x. Meanwhile, NRG's 5-year beta has already crossed 1x (for context, note that the average beta for electric utility stocks is 0.6x), making it one of the most sensitive electric utility stocks to market movements. Do consider that only four out of the 41 electric utility stocks have a beta in excess of 1x. All in all, for those who depend on utility plays as a portfolio hedging mechanism of sorts, this development is certainly not ideal.

Execution Risk

We believe NRG's sensitivity quotient has gone up because it is pursuing a strategy that is at odds with what traditional and activist shareholders want (whether you believe that strategy is good or bad, is another matter altogether).

In recent periods, NRG management has been keen to adopt a more consumer-focused strategy, and in that regard, completed the acquisition of Vivint Smart Home in March, for $5.2bn in cash and debt.

In fairness, even though there are some reputational damages to correct, this is not an egregious business to get into. However, one does wonder if it will be a good fit for NRG's profile, not to mention the excessive level of financial gearing that will be used to fund this. Also note that during the first three years, much of the value of this acquisition will only come from leveraging the existing infrastructure and better cost synergies.

If NRG can come through this phase successfully (and that's a big IF), then one may be able to look to the next stage with confidence, where you'd hope the company cannot just expand its customer base but also expand the average customer pie and the number of solutions per customer. For further context, also note that, globally, the smart home market is expected to grow at 12% for the foreseeable future; that's a better pace than what you'd expect for the broad utility markets. You'd also get fairly good revenue visibility, as 94% of Vivint's business consists of recurring revenue (also Vivint's contracts, which are typically 3-5 years, are non-cancellable).

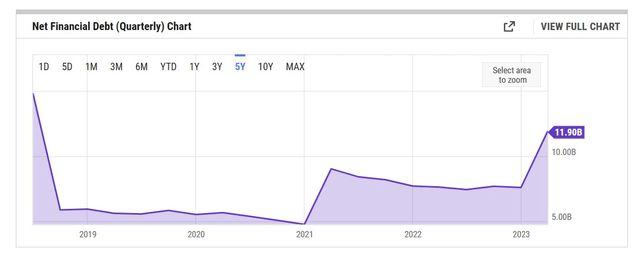

Nonetheless, as noted previously, in order to fund these M&A ambitions, NRG has also accumulated sizeable debt, with the net figure (after adjusting for cash on books) crossing the double-digit mark (in billions) recently, the highest it's been since Q2-18. NRG plans to close the current year at a leverage ratio (net debt to adjusted EBITDA) of 3.23x. This would still be above the 2.5-2.75x target range that would be needed to get an investment grade rating. NRG management believes they will likely only get there by late FY25 or FY26.

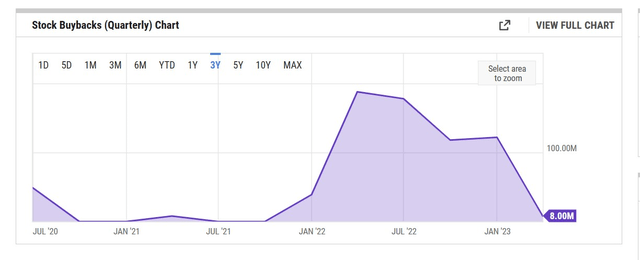

With the leverage the way it is, it is also understandable if NRG loses favor with the traditional shareholder base, who had previously come to rely on NRG as a dependable source of buybacks. Note that in recent periods its buyback spend per quarter has been sliding, and in the recent March quarter only stood at single-digit levels.

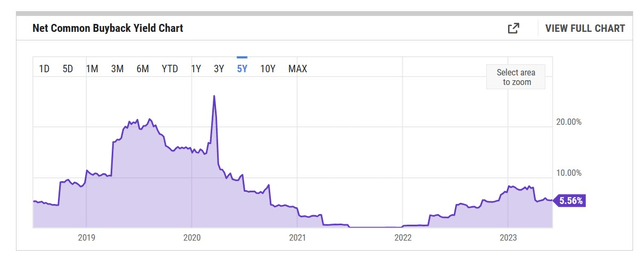

Besides that, at current price levels, the stock's buyback yield is 200bps lower than the historical average.

Admittedly, NRG may be better positioned to boost its flailing buyback profile with another $650m of buyback ammunition (in addition to the pending $350m), once it closes the STP sale, but this is likely to come through only next year.

Do note that activist investor, Elliott Investment Management recently raised question marks over NRG's recent "operational and strategic missteps", and has asked NRG to "conduct a strategic review of its home services strategy including Vivint". NRG has stated that it is open to dialogue, but it remains to be seen if Elliott can get the former to pivot away from this existing strategy. We've recently also seen a shift in the C-suite level, with a new CFO joining the company. It's fair to say that all these developments are likely to cause a lot of volatility in NRG's stock, something defensive-oriented investors hate.

Forward Valuations Look Cheap

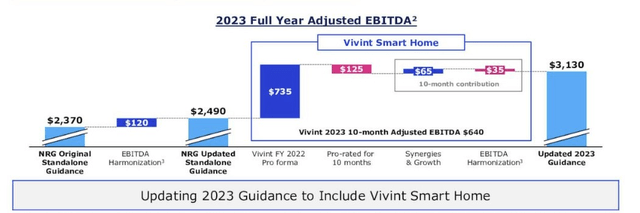

Despite NRG's elevated net debt position (net debt accounts for over 60% of the total Enterprise value), the company will likely generate a decent enough cadence of EBITDA (buoyed largely by NRG's 10-month contribution) to make the forward valuations look attractive. Previously, NRG was only expecting to deliver EBITDA of $2.27-$2.47bn for the year, but with Vivint poised to contribute $0.62-$0.66bn this year, EBITDA expectations have been beefed up to the $3-$3.25bn mark.

Interestingly enough, the consensus is currently perched at the base of that range, with an expected EBITDA figure of $3.08bn; that would translate to a reasonable forward EV/EBITDA multiple of 6.57x. For context, NRG has traditionally traded at 8x forward EV/EBITDA on average. Needless to say, if NRG can generate more superior synergies this year, and hit the upper end of that range, valuations could look even cheaper at 6.21x!

Closing Thoughts

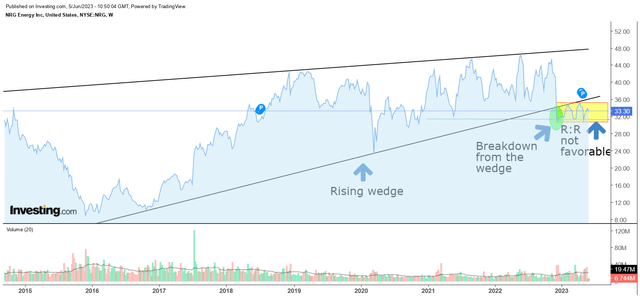

If we consider the long-term price imprints of NRG, we can see that it was something akin to a rising wedge pattern which was likely to exhibit its bearish hues sooner or later. In late November/early December 2022, we finally saw a breakdown below the lower boundary of the wedge (area highlighted in green). Since then, the stock has made attempts to recoup its old ground, but to no avail. All in all, what we're seeing now is a trading range below the old wedge, within the $30-$35 levels. Even if you want to trade those boundaries, the reward-to-risk equation at current price levels looks unfavorable at only 0.51x (ideally you need to consider a long position when this crosses 1x).

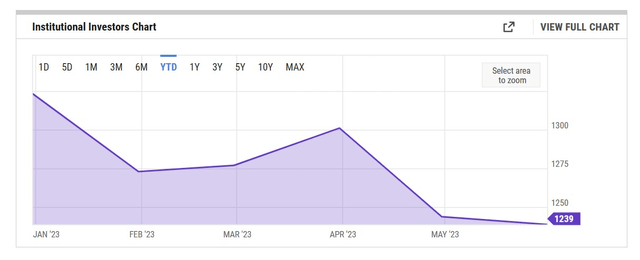

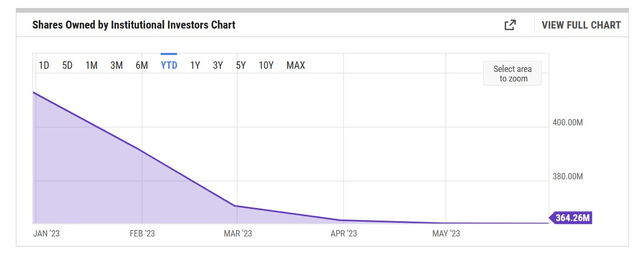

If NRG is to start demonstrating strength and break past the $35 resistance, we suspect, it's going to need the support of institutional investors. That however is yet to come through. On the contrary, the number of institutions that own the stock, as well as the shares owned by them, have been on a declining trend, all through 2023.

These institutions typically also take their cue from what the sell-side club is telling them, and the takeaway here is that there's no great incentive to rotate to, or, out of NRG. Currently, 60% of all sell-side analysts have a HOLD rating on the stock, and we'd be inclined to go with the same rating, as NRG goes through this ongoing state of flux.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.