Novo Nordisk: Dominating In Diabetes And Obesity

Summary

- Novo Nordisk has performed extremely well in the past few years as it continues to dominate in diabetes and obesity.

- The massive market opportunities alongside the ongoing market share gain should continue to drive meaningful growth.

- The company's latest earnings were very strong as diabetes and obesity sales substantially boosted the overall growth.

- I rate the company as a buy.

JHVEPhoto

Investment Thesis

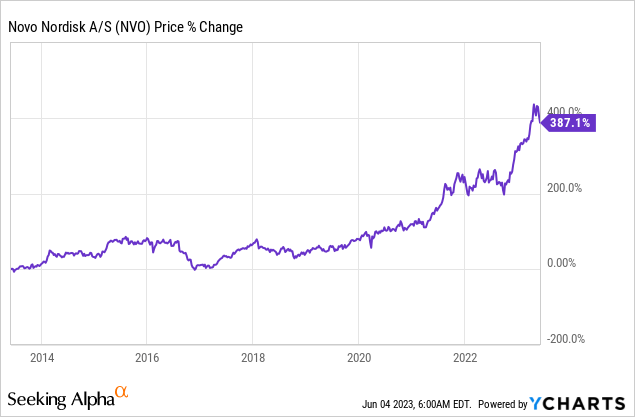

Novo Nordisk (NVO) has been one of the best-performing pharmaceutical companies in the past decade, with shares up nearly 390% during the period. Despite the recent rally, I still believe there is more room to run. The company is currently dominating the diabetes and obesity markets which are both massive and ever-expanding. The opportunities in these markets are huge and should continue to drive meaningful growth.

The strong momentum is clearly shown in its latest earnings with revenue up nearly 30%, vastly outpacing peers. While the current valuation is pretty lofty, it is still trailing behind major competitor Eli Lilly (LLY), which should present ample upside for a catch-up. The company has one of the best growth prospects in the industry and I rate it as a buy.

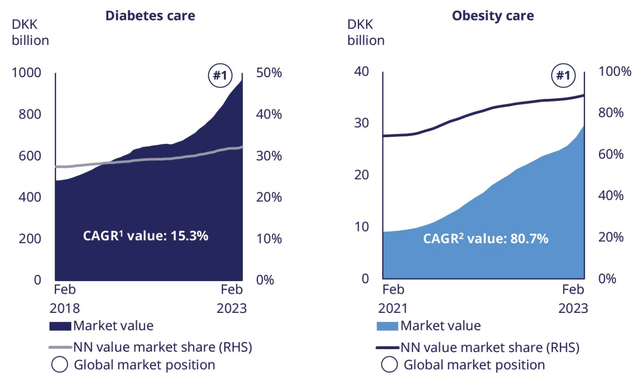

Dominating Two Massive Markets

Novo Nordisk is dominating the diabetes (type 2) and obesity markets with its injection-based semaglutide, which is branded as Ozempic or Rybelsus when used for type-2 diabetes and Wegovy when used for obesity. It also has another obesity therapy called liraglutide, which is a less effective drug often branded as Saxenda. In GLP-1 (Rybelsus, Ozempic), the company currently has a global market share of 54.4%, up from 53.6% in the prior year. Including insulin sales, the company's global market share in diabetes is 32.2%. In obesity, the company currently has a global market share of 89%, up from roughly 60% in 2020.

Diabetes and obesity are two massive and growing markets. According to Precedence Research, the market size of type-2 diabetes is forecasted to grow from $29.8 billion in 2021 to $61.6 billion in 2030, representing a CAGR (compounded annual growth rate) of 8.4%. While the market size of obesity treatment is forecasted to grow from $15 billion in 2022 to $32.5 billion in 2030, representing a strong CAGR of 10.1%.

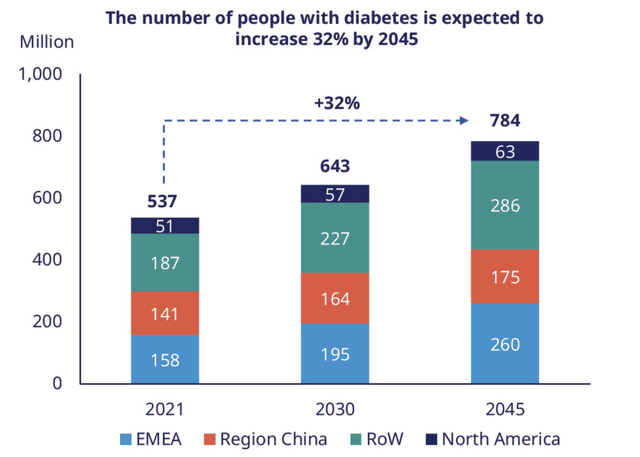

Both markets are poised to continue their expansion due to the rapid increase in diabetes and obesity cases, mostly driven by the lack of physical activities and the rising popularity of high-sugar food. According to Novo Nordisk, the number of people with diabetes is estimated to increase 32% from 537 million in 2021 to 784 million in 2045. The favorable long-term trends alongside the ongoing increase in market share should continue to drive growth moving forward.

Novo Nordisk

Strong Financials

Novo Nordisk announced its first-quarter earnings last month and the results are extremely impressive. The company reported net sales of DKK 53.4 billion, up 27% YoY (year over year) compared to DKK 42 billion. The growth is led by the strength in GLP-1 and obesity care. The GLP-1 segment grew 54% from DKK 17.4 billion to DKK 26.8 billion, accounting for 50.2% of net sales. This was mostly driven by the 63% increase in Ozempic sales. The obesity segment grew 131% from DKK 3.4 billion to DKK 7.8 billion, accounting for 14.6% of net sales. This was driven by the 225% increase in Wegovy sales amid its strong momentum in North America.

The bottom line was also very strong as spending remains disciplined. The gross profit increased 29% YoY from DKK 35.1 billion to DKK 45.2 billion. The gross profit margin expanded 120 basis points from 83.5% to 84.7%. Sales and distribution expenses as a percentage of sales declined 90 basis points from 24.2% to 23.3%, as organic traction improved. This resulted in the net income up 39% YoY from DKK 14.2 billion to DKK 19.8 billion. The net income margin grew 330 basis points from 33.8% to 37.1%. The diluted EPS was DKK 8.78 compared to DKK 6.22, up 41% YoY amid a lower share count.

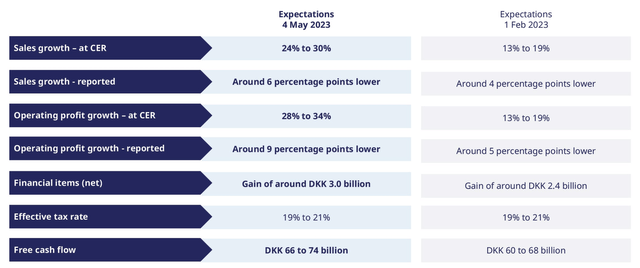

The company's balance sheet remains healthy with $4 billion in cash and only $3.8 billion in debt. Amid the strong momentum, the company also raised its guidance for FY23. It now expects revenue growth to be between 24% to 30%, up from the range of 13% and 19% previously announced.

Valuation

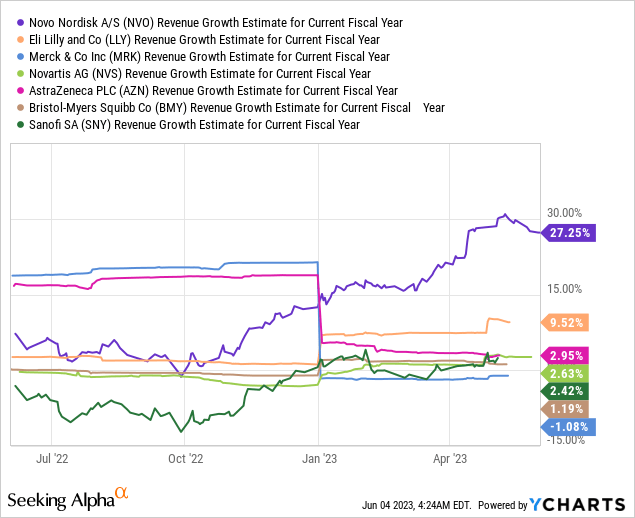

It is quite hard to value Novo Nordisk as the company is such an outlier in the pharmaceutical industry. Its valuation is pretty elevated but its revenue growth is also substantially stronger than other pharmaceutical giants such as Merck (MRK) and Novartis (NVS). As you can see in the first chart below, the company is basically in its own lane regarding growth and it should continue to outpace peers given the strong market opportunities.

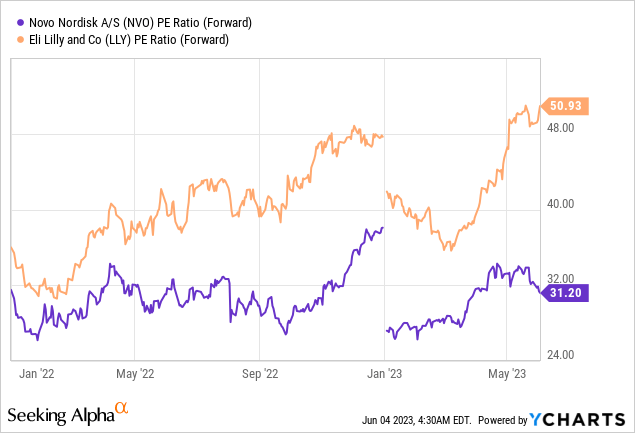

Given the backdrop, I am only comparing the company to Eli Lilly as they are targeting the same markets and are both expected to post double digits growth rates moving forward. While Novo Nordisk's share price has rallied meaningfully in the past year, its current fwd PE ratio of 31.2x is still substantially lower than Eli Lilly's fwd PE ratio of 50.9x, as shown in the second chart below. The massive discount of 38.7% provides ample room for Novo Nordisk to catch up, which should translate to further upside potential.

Risks

While Novo Nordisk is currently dominating the diabetes and obesity markets, competition will likely increase moving forward, especially from oral-based therapies which are often preferred by patients. For instance, the phase 2 data of Pfizer's (PFE) oral GLP-1 receptor agonist danuglipron reported upbeat results. Type-2 diabetes patients saw a ~2.7% and ~4.9% weight loss following a 120 mg and 80 mg twice-daily regimen at Week 16. The results are similar to the mid-stage data of Novo Nordisk's injection-based Ozempic and Wegovy.

Besides Pfizer, Eli Lilly is also starting the Phase 3 trial for its oral GLP-1 agonist orforglipron. The outcome of the trials remains highly uncertain but the potential success of these oral therapies will likely put pressure on Novo Nordisk's market share in the future.

Investors Takeaway

I believe Novo Nordisk will continue to outperform in the long run considering the massive market opportunities and the favorable trends. I am not too worried about the potential threat from oral-based therapies at the moment. Even if Pfizer's and Eli Lilly's trials are successful, it will still take quite a while before their products can be officially launched in the market. Novo Nordisk is also launching its own oral-based therapy soon which should fend off some of the competition.

The current multiples are elevated but it should grow into its valuation fairly quickly given the strong momentum. Not to mention it is still trading at a meaningful discount compared to Eli Lilly. It is rare to see a company dominate such large markets therefore I rate Novo Nordisk stock as a buy.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.