Verizon: Time To Buy Aggressively

Summary

- Verizon shares fell to a new one-year low on Friday due to rumors of an Amazon-DISH Network partnership for wireless phone services.

- All parties denied that talks about a partnership were taking place, suggesting that the market overreacted to those rumors.

- The market's overreaction presents a buying opportunity for dividend investors, as Verizon's dividend yield has risen to 7.6%.

photobyphm

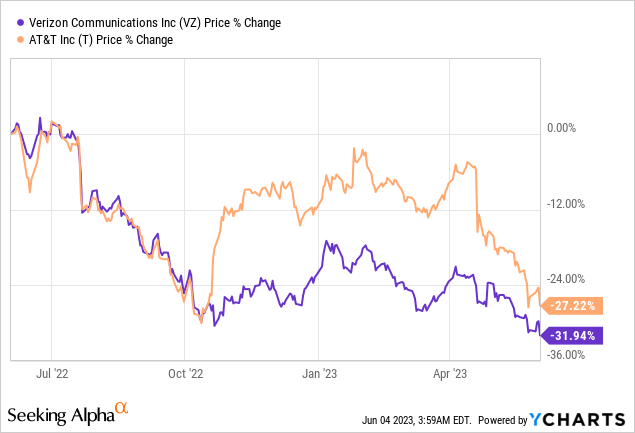

Shares of Verizon (NYSE:VZ) fell to a new 1-year low last week on concerns that DISH Network (DISH) was partnering with Amazon and rolling out a wireless phone service for the e-Commerce company's Prime customers. Those rumors led to a broad sell-off for telecommunications companies including Verizon, AT&T (T) and T-Mobile (TMUS). I believe the market is overreacting to such rumors and Verizon should continue to benefit from strength in its Consumer wireless business. Since shares of Verizon are now trading at a 7.6% yield and at an unreasonably low P/E ratio, I believe the risk/reward trade-off for VZ stock is very attractive right now!

Rumors about DISH Network/Amazon partnership in the wireless phone segment

According to Bloomberg, Amazon has allegedly been in conversations with DISH Network to potentially roll out low-cost wireless phone services to its Prime members, which stoked fears about an increase in competition in the already competitive wireless market and caused Verizon's shares to fall to a new 1-year low on Friday.

Amazon owns the largest e-Commerce platform in the U.S. and a deal with DISH Network would likely create more pressure on Verizon’s and AT&T’s wireless segments. However, according to Reuters, all companies involved, including Amazon, have denied talks, indicating that the sell-off on Friday is driven chiefly by unsubstantiated rumors.

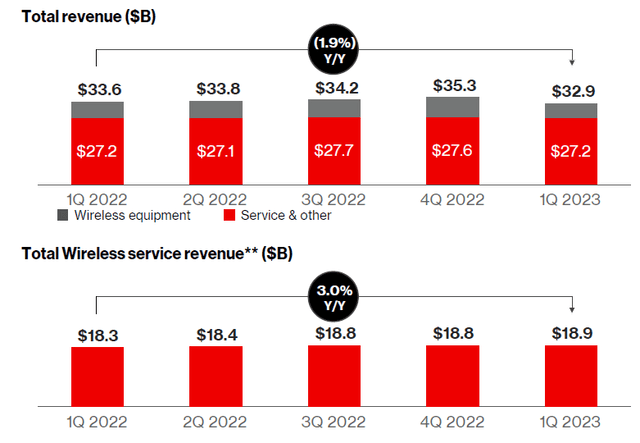

Verizon's wireless service is performing well, but not great. The company saw a revenue increase of 3% in Q1'23, in part due to strong postpaid phone gross additions. Verizon reported that it had 2.4M wireless retail postpaid phone gross adds in the first-quarter which was supported chiefly by strong growth in the Consumer business… which is where the company reported 1.6M gross adds. Overall, as I have said many times in the past, Verizon faces moderate top line growth prospects as the wireless carrier market is saturated. Verizon has guided for approximately 2.5-4.5% Wireless service revenue growth in FY 2023.

Source: Verizon

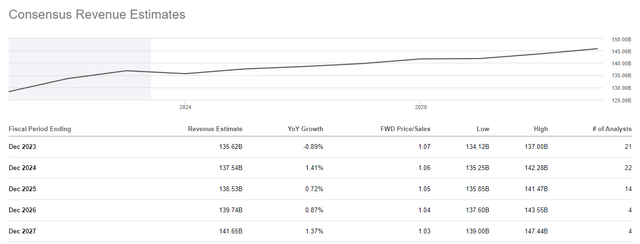

However, analysts don't expect much growth for Verizon's consolidated top line in the coming years. The average annual top line growth rate for the next five years is about 1% while Wireless services are expected to grow at faster rates.

Source: Seeking Alpha

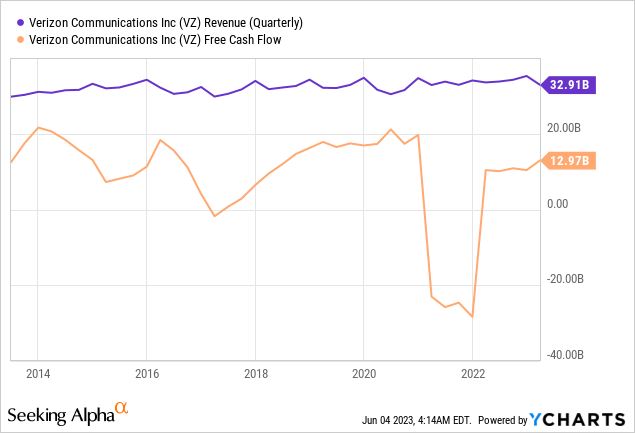

Free cash flow shortfall in Q1'23, but Verizon's dividend should remain covered on a full-year basis

Verizon did not fully earn its dividend with free cash flow in the first-quarter. The telecom reported an approximate $400M free cash flow shortfall, however, as I pointed out in my work on Verizon after the earnings report -- It's Too Early To Give Up On Verizon's 6.7% Yield -- it is too early to write off the telecommunications company.

In the longer term, Verizon has covered its dividend with free cash flow and the company has seen a significant rebound in FCF after the pandemic. While Verizon has not given a guidance for FY 2023 free cash flow, I believe the telecom could achieve free cash flow of about $13-15B in FY 2023. Since Verizon's dividend costs approximately $10.8B, Verizon is looking at a potential free cash flow payout ratio of 72-83%.

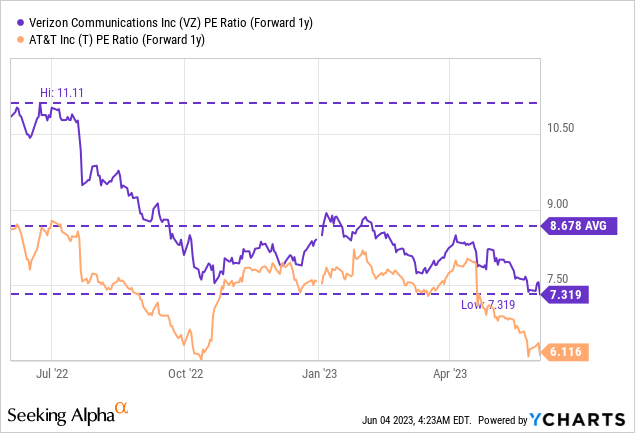

Verizon’s and AT&T’s valuation

Shares of Verizon fell to a new 1-year low on Friday after rumors about an Amazon-DISH Network partnership spread and created confusion. Shares of Verizon are now trading at a P/E ratio of 7.3X... which is 16% below the 1-year average P/E ratio of 8.7X. AT&T's shares are even cheaper than Verizon's with a P/E of 6.1X, but I believe both telecoms are currently a great deal for dividend investors that want to take advantage of last week's sell-off.

Risks with VZ and other telecoms

Verizon and AT&T are operating in a saturated telecommunications market which is reflected in very light top line revenue growth expectations. I highlighted above that Verizon is expected to see only low-single digit revenue growth in the next five years with broadband and 5G being bright spots, however. What would change my mind about Verizon is if the company saw declining momentum in its growth segments, especially broadband, and saw a drop-off in its free cash flow. Declining free cash flow could indicate a potential dividend cut.

Final thought

Shares of Verizon fell to a new 1-year low on Friday on concerns over an Amazon-DISH Network Partnership in the wireless phone market. It is likely, in my opinion, that those concerns are overblown, in large part because the involved parties have denied that they are even considering such a deal. As a result, I believe the irrational sell-off last week creates a buying opportunity for dividend investors: Verizon’s dividend yield has risen to 7.6% and shares are now cheap based off of P/E. I also expect Verizon to report solid dividend coverage for FY 2023 which should imply that the dividend is safe as well!

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of VZ, T either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.