Akasa Air is on an unprecedented flight plan. Can it really redefine flying in India?

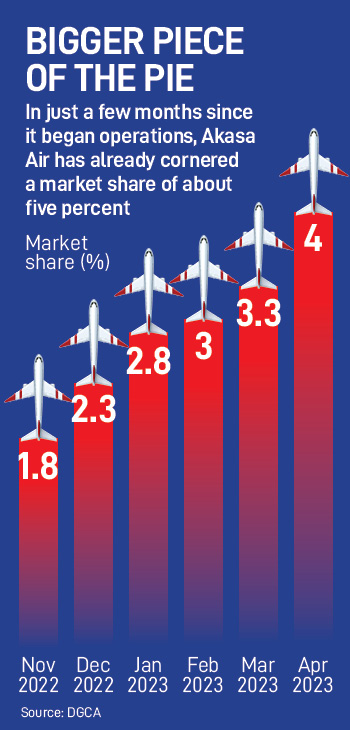

In under 10 months since it started operations, the airline has cornered about five percent market share, while adding a record 19 aircraft to its fleet. All eyes are on where it manages to go from here

Vinay Dube, CEO and co-founder, Akasa Air; Image: Mexy Xavier

Vinay Dube, CEO and co-founder, Akasa Air; Image: Mexy Xavier

“If you look at where aviation is going in India, we're just going to grow and grow,” Dube says. “We're going to get 2,000 more aircraft here in the next 15-20 years. And when you have that kind of exciting growth in aviation that doesn't have much to do with airlines but just with the economic engine that we're creating, the thought was the construct of another airline with the very simple characteristics done right from day one, that could be enduring and profitable.In August 2022, the Mumbai-headquartered airline of which Dube is also a co-founder and the CEO, took on its maiden journey between Mumbai and Ahmedabad. Since then, the airline has been on a flight path unlike any airline in the history of Indian aviation, or perhaps even globally.In just nine months since it began operations, Akasa Air has already cornered a market share of about five percent, while adding a record 19 aircraft to its fleet. That’s the fastest any airline has managed, both in terms of market share and fleet size, since India opened up its aviation sector to the private sector in the early 90s. The recent troubles at GoAir also crucially added to Akasa Air’s market share even though Dube maintains that market share isn’t something that the airline is actively chasing. “We had set ourselves an incredibly difficult task that no airline in the 120-year history of global aviation had ever done, which was to go from zero to 20 aircraft within 12 months,” the bespectacled CEO of Akasa Air says. “Many fast-growing companies are forced to make trade-offs but we’ve managed the growth with reliability, customer satisfaction, and employee centricity. We couldn’t have predicted that we would get there.”With 20 aircraft, Akasa Air can start flying internationally. Of course, rules have now been relaxed and airlines don’t need to mandatorily operate for five years in addition to 20 aircraft before it can start flying on international routes. Yet, the ramp-up of its fleet size is unprecedented. An aircraft from Boeing is expected in the next 45 days, which means, in all likelihood, as it celebrates one year of its operations, it will start flying internationally.“As for the routes it’s going to be the Middle East, Southeast Asia, Nepal, Sri Lanka, Bangladesh, and more of the usual routes that we would fly to begin with,” Dube says. “I wouldn’t look at anything exotic.”“Without a doubt, they have done a remarkable job so far,” Vinamra Longani, the head of operations at Sarin & Co, a law firm specialising in aircraft leasing and finance says. “Despite slot constraints at key metro airports, they have managed to build a sizeable network connecting key cities. Now, with the 20th aircraft coming in and depending on how quickly they take delivery of subsequent aircraft, they will face the same constraints at a larger level. Should Go First not return, slots from their portfolio if reallocated may address some of these concerns."

Different Thinking

In many ways, the spectacular growth in recent times, is also a result of a focussed and realistic approach to flying that Dube and his team are pursuing. And he is clear about one thing, aviation isn’t a glam business.That’s also why, even as Go First went ran into headwinds, Akasa Air is not focussed on ramping up capacity to capitalise on the demand and supply mismatch, especially during the ongoing peak travel period. “When airlines try and stretch beyond their limits, and have knee-jerk reactions to get a little bit of share and don't operate in a disciplined manner, that's when things go horribly wrong,” Dube says. “There's not a single aircraft that we are going to take out of order ahead of time.” The delivery expected in the next few days is only the 20th of the 72 aircraft that it ordered in 2021, close on the heels of the US FAA (Federal Aviation Administration) approving the Boeing 737 Max to return after being grounded for more than a year following separate crashes. “The reason we planned it that way was that when you go from zero to 20 aircraft very, very quickly, we want to make sure there's no other unintended consequence that happens. The deliveries were planned in a particular manner and we're going to stick to that.”Also read: Jet Airways 2.0 was supposed to be a dream come true. Can it really fly out in 2023?That means not chasing short-term gains, particularly market share, which can cost heavily in the long run, and instead, a focus on what Dube reckons is building an airline in which generations can take to skies. In India’s aviation history, barring Air India, and Indian Airlines (which later merged with Air India), no other airline has survived three decades of operations. Jet Airways, which began operations in 1994 was the second longest surviving airline in India before it shut down operations in 2019. All the other incumbent airlines began operations only after 2000.“When you are giving yourself this degree of difficulty of being the fastest growing airline in history, it's typically the sanctity of the operations that could feel some unintended pressures like degradation of on-time performance or higher cancellation rates or lower technical dispatch reliability,” Dube says. The airline has consistently clocked on-time performance between December and April this year. As of April this year, it has a 94 percent on-time performance across the country’s four metro airports, followed by Air India, which is also attempting an incredible turnaround under the Tata Group.“Everything that we are building is with the intention of creating a durable airline that our grandchildren will enjoy,” Dube says.That’s also perhaps why, Dube is very clear that the airline, despite being a start-up, is being operated and run on par with some of the top global companies in the world, with a professional and empowered management team. “Some airlines in the past have had professional management teams that haven't been empowered,” Dube says. “This is not a glam business. This is a hardcore business of operations, numbers, financial prudence, cost management, liability, and focus on your employees. It has every facet highly driven by technology and you need to have a management that is driving the airline at every moment in time. “Akasa’s growth coincided with the tail-end of Covid, and within a marketplace that was still relatively weak, allowing it to exploit the situation and claw a sizeable chunk,” says Shukor Yusof, founder of Malaysia based aviation consultancy Endau Analytics. “The cash outlay has been well-projected and budgeted. Plus, the carrier came at an opportune time. The growth in Indian aviation market post-Covid has overtaken all other Asian countries, including China. Of course, there remains structural issues at airports as well as the persistently high jet fuel prices in India. Still, there are some concerns surrounding the slow delivery of aircraft. “Akasa has not been forthcoming about their aircraft delivery plan, and now with lessors seeing India as a risky market post Go First, there will be concerns about Akasa,” an industry expert says on conditions of anonymity. “Sale and leasebacks provide much-needed finance, as IndiGo has been doing. The more aircraft you induct, the more money you can make. There are also reported worries about whether the Jhunjhunwala family plans to stay on since his death.

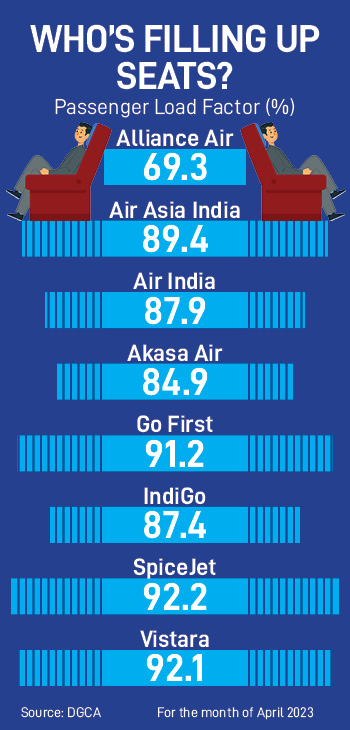

The delivery expected in the next few days is only the 20th of the 72 aircraft that it ordered in 2021, close on the heels of the US FAA (Federal Aviation Administration) approving the Boeing 737 Max to return after being grounded for more than a year following separate crashes. “The reason we planned it that way was that when you go from zero to 20 aircraft very, very quickly, we want to make sure there's no other unintended consequence that happens. The deliveries were planned in a particular manner and we're going to stick to that.”Also read: Jet Airways 2.0 was supposed to be a dream come true. Can it really fly out in 2023?That means not chasing short-term gains, particularly market share, which can cost heavily in the long run, and instead, a focus on what Dube reckons is building an airline in which generations can take to skies. In India’s aviation history, barring Air India, and Indian Airlines (which later merged with Air India), no other airline has survived three decades of operations. Jet Airways, which began operations in 1994 was the second longest surviving airline in India before it shut down operations in 2019. All the other incumbent airlines began operations only after 2000.“When you are giving yourself this degree of difficulty of being the fastest growing airline in history, it's typically the sanctity of the operations that could feel some unintended pressures like degradation of on-time performance or higher cancellation rates or lower technical dispatch reliability,” Dube says. The airline has consistently clocked on-time performance between December and April this year. As of April this year, it has a 94 percent on-time performance across the country’s four metro airports, followed by Air India, which is also attempting an incredible turnaround under the Tata Group.“Everything that we are building is with the intention of creating a durable airline that our grandchildren will enjoy,” Dube says.That’s also perhaps why, Dube is very clear that the airline, despite being a start-up, is being operated and run on par with some of the top global companies in the world, with a professional and empowered management team. “Some airlines in the past have had professional management teams that haven't been empowered,” Dube says. “This is not a glam business. This is a hardcore business of operations, numbers, financial prudence, cost management, liability, and focus on your employees. It has every facet highly driven by technology and you need to have a management that is driving the airline at every moment in time. “Akasa’s growth coincided with the tail-end of Covid, and within a marketplace that was still relatively weak, allowing it to exploit the situation and claw a sizeable chunk,” says Shukor Yusof, founder of Malaysia based aviation consultancy Endau Analytics. “The cash outlay has been well-projected and budgeted. Plus, the carrier came at an opportune time. The growth in Indian aviation market post-Covid has overtaken all other Asian countries, including China. Of course, there remains structural issues at airports as well as the persistently high jet fuel prices in India. Still, there are some concerns surrounding the slow delivery of aircraft. “Akasa has not been forthcoming about their aircraft delivery plan, and now with lessors seeing India as a risky market post Go First, there will be concerns about Akasa,” an industry expert says on conditions of anonymity. “Sale and leasebacks provide much-needed finance, as IndiGo has been doing. The more aircraft you induct, the more money you can make. There are also reported worries about whether the Jhunjhunwala family plans to stay on since his death. The Giant Leap

Akasa Air’s founding team includes some of the country’s best-known aviation veteran, including Jet Airways veterans Belson Coutinho and Praveen Iyer, former GoAir vice president Anand Srinivasan, Jet Airways strategist Bhavin Joshi, former Indian Air Force officer and Honeywell Aerospace India’s former president Neelu Khatri, apart from Dube and Aditya Ghosh.“Akasa has come into the market with a model suited for the market and a team that invested in the success of the airline,” says Satyendra Pandey, the managing director of aviation services firm, AT-TV. “The accelerated growth is important given the competitive dynamics. The team at Akasa knows the India market well and the airline plans seem to be well planned and executed. It is all but certain that by the end of the year they will start flying international. But the true test will be profitability and the returns on capital.”Among its biggest investors was Rakesh Jhunjhunwala, who reportedly invested $50 million into the airline. Jhunjhunwala passed away a week after Akasa Air took to the skies in August 2022. While Jhunjhunwala was critical to Akasa’s success, Dube also credits Boeing with taking the risk, especially with a bunch of professionals, when they approached them with a mammoth order of 72 aircraft. It also helped that Aditya Ghosh, credited with taking the airline to soaring heights was also a co-founder at Akasa Air.Also read: Rakesh Jhunjhunwala: The billionaire-investor who lived on his own terms and never gave up“It's sort of heart-warming that they (Boeing) looked at the management team, not an individual,” Dube says. “They looked at the strength of the management team and said this is the kind of professional team we'd like to bet on and that's what made the match.” Dube also reckons that the decision to go after the Boeing 737 Max—which had been grounded after two fatal crashes in six months that claimed 346 lives—was based on a firm belief that the aircraft had undergone one of the closest scrutinies for any aircraft in global aviation history. Reportedly, Akasa Air also got a steal of a deal due to all the scrutiny around the aircraft.“This is the most scrutinised aircraft in the history of aviation,” Dube says. “And therefore I thought that this would be the best aircraft for Akasa. It's one of the most fuel-efficient aircraft with the most amazing legroom. When you look at the interior noise, air pressure, circulation of the air, we thought that this was the aircraft that would provide not just the best economics for us, but also in improving the longevity of our planet by being extremely green.”Akasa Air is now gearing up to place a three-digit order for aircraft by the end of the year. The company's current order book runs until March 2027. “We haven’t identified who we will be buying from,” Dube says. In February this year, the Tata group-owned Air India signed what can now safely be referred to as the mother of all aviation deals, at least in India. The airline agreed to purchase 470 aircraft from airline manufacturers Airbus and Boeing, valued at a staggering $80 billion.“They have had a great start and hit the ground running,” adds Longani. “International operations are a key growth avenue but there too a significant number of key routes are bilaterally constrained. Nonetheless, if timed appropriately, international operations improve aircraft utilisation and being in forex which helps offset dollar costs.” Rival IndiGo, which has often been credited for sticking to the A320 for the bulk of its operations, helping it reduce the cost of operations, is also reportedly looking at ordering over 500 aircraft. "It's not just the manufacturer of the aircraft but it's also the engine,” Dube says about the factors determining the purchase. “Having the same aircraft and a similar engine does provide a lot of benefits. That would be ideal for us. We also need to ensure that we get the right economics from the same engine and aircraft manufacturer and that process is on.” Akasa Air crew membersIn the process, Dube is also not alarmed by the Indian aviation market emerging into something of a duopoly, with the Air India group—with four airlines under its wing—and IndiGo, which together account for over 80 percent of the domestic aviation market. “In the US, you have an oligopoly between United, American, Southwest, and Delta,” Dube says. “They have 80 plus percent market share and you have Alaska Airlines that may have 5 percent or 8 percent of the market share, but has some of the happiest employees, customers, and shareholders as a whole.” “Market share is quite misunderstood,” says Pandey of AT-TV. “A large market share is not a clear advantage in that it does not translate into pricing power and profitability. And in an extremely price sensitive market, smaller airlines with minor market shares can still influence pricing for the overall market. In the final analysis, the airline must deliver a return on capital and for that both the cost base and the revenue integrity need to be constantly monitored.”Akasa Air is credited with turning over a new leaf when it came to crew uniforms. Unlike other airlines, Akasa’s women's crew don’t have to wear heels, instead choosing to wear sneakers. In fact, the sole of the shoe is made from recycled rubber. “We wanted to have a set of uniforms that is gender neutral,” Dube says. “It was important for us to be gender neutral as we wanted to have men and women flight attendants both, and we didn't want to pick one gender and discriminate over the other. We wanted to have comfortable uniforms, and we wanted to have uniforms that used recycled material.”That focus on sustainable flying— the airline has also moved away from the ceremonial water canon salutes—also means that the airline now wants to redefine the very idea of flying in the country, choosing not to be pigeonholed into a low-cost carrier or a full-service one. “I'd like to think of us as almost a category-redefining airline,” Dube says. “If you look at on-time performance and couple that with the most comfortable seat in Indian aviation, more leg room the best food, some of the warmest, most well trained, most empathetic and kind flight attendants, I think you've got customer experience that is second to none.”“Akasa seems to be thinking ahead with a focus on being a green airline or even something as simple as allowing crew to wear sneakers,” adds Pandey of AT-TV. “Initiatives such as these speak to culture. But at the same time they are in a market where price continues to be a key determinant of demand. So whether or not these initiatives pay off in terms of profitability is yet to be seen.” So, where does Akasa Air go from here? “We're not worried about what others are doing,” Dube says. “If we focus on our employees, customers, operations, cost structure, capitalisation, we'll be just fine. India is a market where you can have multiple airlines thrive if they're run properly. And we're just focusing on running a good proper airline.”If the numbers are anything to go by, Dube is certainly third time lucky.

Akasa Air crew membersIn the process, Dube is also not alarmed by the Indian aviation market emerging into something of a duopoly, with the Air India group—with four airlines under its wing—and IndiGo, which together account for over 80 percent of the domestic aviation market. “In the US, you have an oligopoly between United, American, Southwest, and Delta,” Dube says. “They have 80 plus percent market share and you have Alaska Airlines that may have 5 percent or 8 percent of the market share, but has some of the happiest employees, customers, and shareholders as a whole.” “Market share is quite misunderstood,” says Pandey of AT-TV. “A large market share is not a clear advantage in that it does not translate into pricing power and profitability. And in an extremely price sensitive market, smaller airlines with minor market shares can still influence pricing for the overall market. In the final analysis, the airline must deliver a return on capital and for that both the cost base and the revenue integrity need to be constantly monitored.”Akasa Air is credited with turning over a new leaf when it came to crew uniforms. Unlike other airlines, Akasa’s women's crew don’t have to wear heels, instead choosing to wear sneakers. In fact, the sole of the shoe is made from recycled rubber. “We wanted to have a set of uniforms that is gender neutral,” Dube says. “It was important for us to be gender neutral as we wanted to have men and women flight attendants both, and we didn't want to pick one gender and discriminate over the other. We wanted to have comfortable uniforms, and we wanted to have uniforms that used recycled material.”That focus on sustainable flying— the airline has also moved away from the ceremonial water canon salutes—also means that the airline now wants to redefine the very idea of flying in the country, choosing not to be pigeonholed into a low-cost carrier or a full-service one. “I'd like to think of us as almost a category-redefining airline,” Dube says. “If you look at on-time performance and couple that with the most comfortable seat in Indian aviation, more leg room the best food, some of the warmest, most well trained, most empathetic and kind flight attendants, I think you've got customer experience that is second to none.”“Akasa seems to be thinking ahead with a focus on being a green airline or even something as simple as allowing crew to wear sneakers,” adds Pandey of AT-TV. “Initiatives such as these speak to culture. But at the same time they are in a market where price continues to be a key determinant of demand. So whether or not these initiatives pay off in terms of profitability is yet to be seen.” So, where does Akasa Air go from here? “We're not worried about what others are doing,” Dube says. “If we focus on our employees, customers, operations, cost structure, capitalisation, we'll be just fine. India is a market where you can have multiple airlines thrive if they're run properly. And we're just focusing on running a good proper airline.”If the numbers are anything to go by, Dube is certainly third time lucky. Check out our Festive offers upto Rs.1000/- off website prices on subscriptions + Gift card worth Rs 500/- from Eatbetterco.com. Click here to know more.

Post Your Comment