Templeton Dragon Fund: Time To Nibble Again

Summary

- The Templeton Dragon Fund is recommended as a contrarian play on China's recovery, as the Chinese economy has been slowly recovering, despite recent volatility.

- China does not have an inflation problem, giving the government and central bank the capacity to stimulate the economy if needed.

- Risks to the bullish call include a potential US recession and deteriorating US-China relations, but the author believes the current bust phase is near its nadir.

yaom/iStock via Getty Images

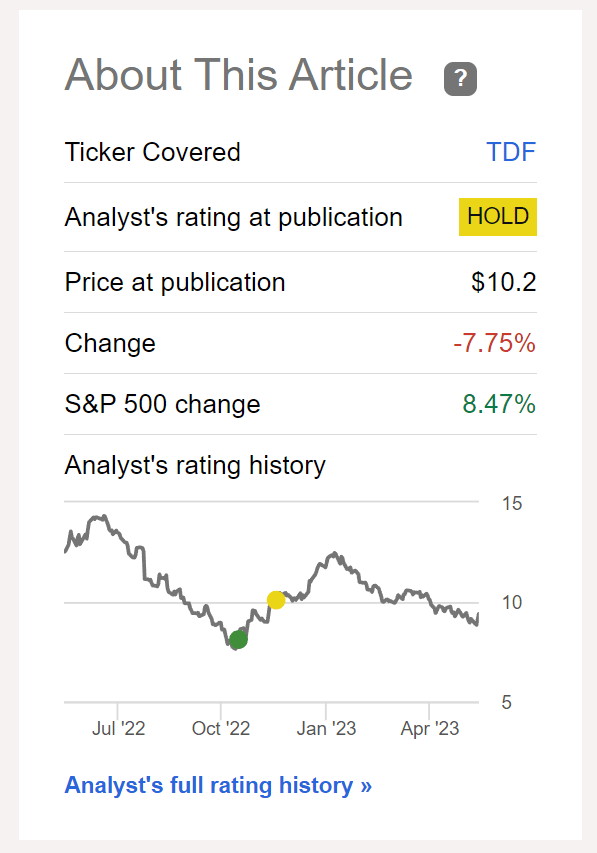

In November, I recommended readers buy the Templeton Dragon Fund (NYSE:TDF) as a contrarian re-opening play on China, when many pundits said China was 'uninvestable'. From its bottom in late October, Chinese stocks including the TDF fund rebounded strongly, as other investors rapidly reversed their defensive posture and rushed into Chinese equities.

Boom-Bust Sentiment...

However, by December, I recommended investors start to take profits, as sentiment had gotten wildly bullish in the span of 2 months (Figure 1). As I commented in my December article, there is "nothing like price to change sentiment".

Figure 1 - TDF rallied strongly since November to January but is now back near lows (Seeking Alpha)

I personally exited my TDF position on February 7th for a 44% total return, although I had taken profits on half my position in December (Figure 2).

Figure 2 - TDF returned 44% from when I first recommended it until when I sold my last shares (Seeking Alpha)

Since exiting my position, I have watched pundits like Goldman Sachs go from euphoric, to cautious optimism, to concern, and back to despair as the 'recovery falters' and Chinese stocks enter a new bear market.

However, beneath the surface, is the Chinese economy really that bad? Or were expectations just too high?

...Belies Volatile Recovery

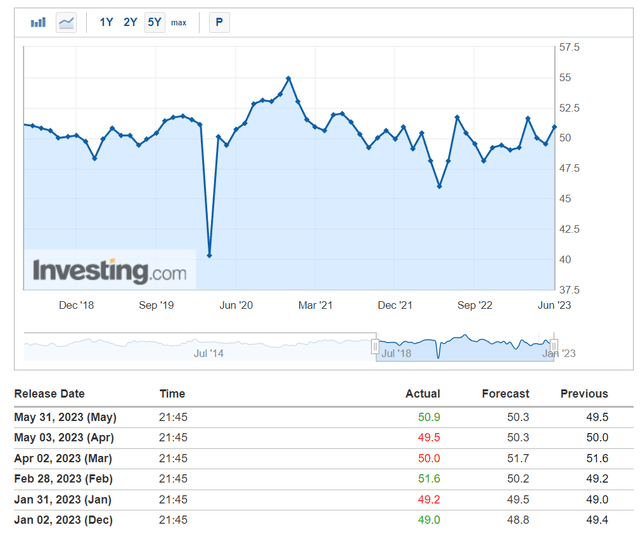

If we look at the China Caixin Manufacturing PMI as one measure of the Chinese economy, we can see that manufacturing activity has improved, from a COVID-pandemic induced low of 46.0 in April 2022 to 48.1 in September 2022, 51.6 in February 2023, and a recent 50.9 in May 2023 (Figure 3).

Figure 3 - Caixin Manufacturing PMI have gradually improved (investing.com)

As I have said in my prior article, China's recovery from COVID was unlikely to be a one-way street, and the volatile manufacturing PMI series certainly showed that.

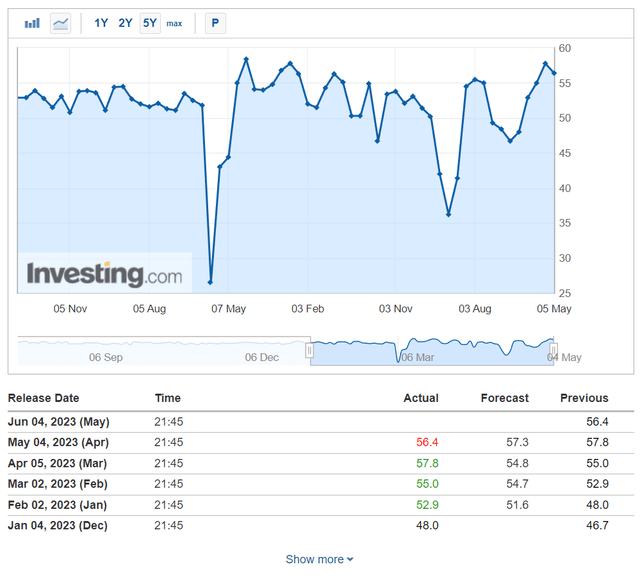

Similarly, the Caixin Services PMI have also shown a recovery since the steep COVID contraction in May 2022 of 36.2 to a recent level of 56.4 in April (Figure 4).

Figure 4 - As has the Caixin Services PMI (investing.com)

BullWhip Effect From The U.S. Partly The Reason For Weak Chinese Growth

Part of the reason for China's spotty economic recovery has been the bullwhip effect from the U.S. economy. If readers can recall, in early 2022, U.S. retailers were facing historic shipping costs and wait times as the Chinese supply chain broke down due to COVID restrictions. This led to companies double and triple ordering from their suppliers, which led to a glut of inventory that hit U.S. shores in the second half of 2022.

Since Q3 of 2022, many American retailers have been running down excess inventory, which meant they did not place as many orders from their Chinese suppliers, leading to weaker manufacturing activity in China.

By Q1 of this year, U.S. retailers like Walmart and Target have mostly worked through their excess inventory, which means supply chains are now normalizing.

Looking forward, as long as the U.S. economy remains resilient and consumers continue to buy goods, Chinese manufacturing activity should continue to recover, supporting the Chinese economy.

Frosty Geopolitics Does Not Help Investment Case

Furthermore, frosty relations between the Chinese government and the U.S. and European governments have not helped, as many multinational companies have begun shifting their supply chains out of China. First, companies don't want to relive the COVID-related goods shortages from a sole-sourced supply chain.

More importantly, the ban of key technological exports to China like semiconductor manufacturing equipment is making it difficult for companies to conduct their business.

There is also the spectre of a potential Chinese invasion of Taiwan, which could cause catastrophic damage to the advanced semiconductor manufacturing supply chain and crippling sanctions against Chinese companies.

Where Is The Rumoured Chinese Stimulus?

One thing that has surprised many China pundits have been the relatively mild stimulus that the Chinese government unleashed in the last few months to boost its economy. The main reason many western investors got very bullish on China in November and December was because they remembered the previous 2009 investment-led stimulus by the Chinese government driving massive demand in raw materials and commodities.

However, as I warned in one of my January articles, "many studies have pointed to the waste and corruption that was associated with the prior Chinese stimulus program. China may be hesitant to unleash a stimulus plan as large and broad as the 2009 stimulus." So far, it appears the risk I highlighted was proven correct, as we have not seen any massive investment-led stimulus programs.

However, recently, we got rumours that the Chinese government may consider further stimulus in the property sector, to boost its faltering recovery. Could this signal a shift towards more investment-led stimulus?

China Has Room To Stimulate

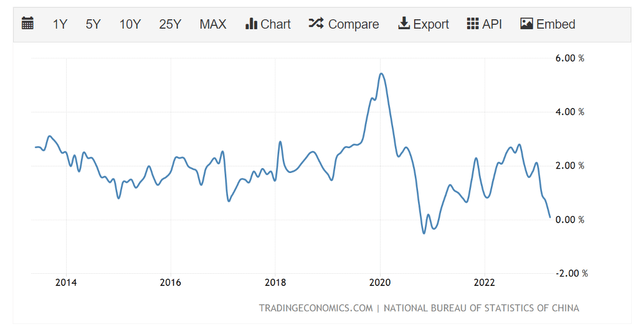

Looking ahead, I continue to be bullish on the Chinese economy for one main reason: China does not have an inflation problem. While western central banks continue to grapple with soaring inflation, including a 5.5% core inflation reading in the latest U.S. CPI, China's CPI inflation continues to be well contained (Figure 5).

Figure 5 - China CPI inflation well contained (tradingeconomics.com)

Arguable, with April CPI inflation of only 0.1% YoY, China is at risk of deflation, not inflation. Therefore, it is my belief that the Chinese government and its central bank have lots of capacity to stimulate its economy if it so chooses. The question is how much will they stimulate?

I believe the Templeton Dragon Fund is an ideal vehicle to play this Chinese recovery theme.

Brief Fund Overview

The Templeton Dragon Fund is a bottom-up, fundamentals driven, closed-end investment fund focused on Chinese investments. The TDF fund has almost $400 million in assets and charged a 1.37% net expense ratio.

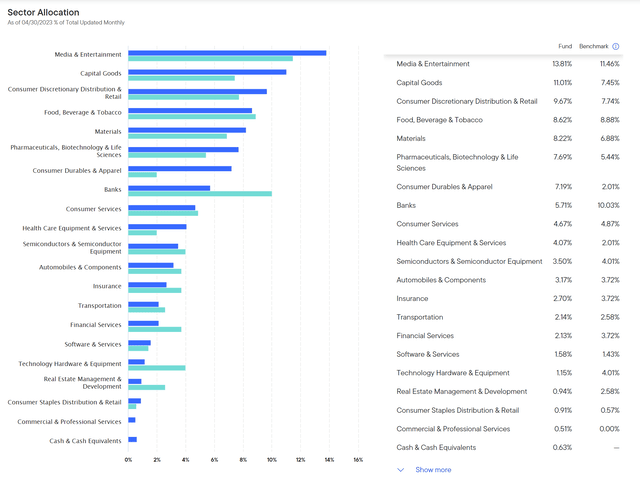

The TDF fund is broadly diversified with major sector bets on Media & Entertainment (13.8%), Capital Goods (11.0%), Consumer Discretionary (9.7%) and Food & Beverage companies (8.6%) (Figure 6).

Figure 6 - TDF sector allocation (franklintempleton.com)

Investors should note that to avoid potential U.S. sanctions against Chinese Communist Party-controlled companies, the TDF fund holds minimal weights in the materials, energy, and industrial sectors.

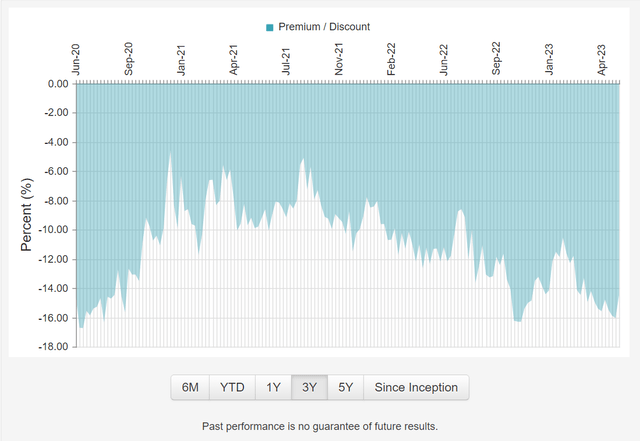

The TDF fund also trades at a wide 13.5% discount to NAV (Figure 7).

Figure 7 - TDF trades at a wide discount to NAV (cefconnect.com)

TDF's discount to NAV can be used to gauge investor sentiment towards China. Before the late 2022 rally, TDF's discount was at 16%. At the peak in January, TDF's discount closed to 10.5%. Recently at the end of May, TDF's discount widened back to 16%.

Historically, a ~16% discount to NAV on the TDF fund has been a good time to accumulate shares.

Risk To My Call

The biggest risk to my bullish China / TDF call is if the U.S. economy falls into a recession. This will reduce demand for Chinese-made goods, which will decrease industrial profits and Chinese economic growth.

Another risk is geopolitical. Clearly, relations between the U.S. and China have seen better days, with the Chinese defence minister reportedly refusing to meet his American counterpart in recent days. Any deterioration in the Sino-American relationship will have investment implications. However, recent trips by Elon Musk and Jamie Dimon to China may hint at a potential thaw in the bilateral relationship. Time will tell.

Conclusion

Global investors are a manic bunch. They often love to rush in and out of investment themes en masse, creating boom/bust cycles. I believe we are near the nadir of the current bust phase, as China has once again become near 'uninvestable' as its stock markets re-enter 'bear market' territory and investor fears are palpable.

For contrarian-minded investors, I recommend they ignore the pundits on CNBC and follow the data and logic. While the Chinese economy has been erratic in recent months, it has been slowly recovering nonetheless.

If the U.S. and western economies continue to consume goods, then Chinese manufacturing should continue to grow and power China's economy. Furthermore, with 0.1% YoY CPI inflation, Chinese central planners have lots of room to stimulate their economy. The real question is how much stimulus will they permit in the coming months and quarters?

With the TDF fund back to November 2022 levels, I believe investors can start accumulating shares again.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in TDF over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.