PSP: Private Equity Shining Bright As Clouds Protrude Over Public Markets

Summary

- Private equity firms may benefit from market downturns by acquiring quality assets at lower prices and restructuring struggling companies.

- Private equity may be less volatile and more "recession-proof" compared to other financial subsectors like banking and insurance.

- The growing demand for private funding within innovative spaces like artificial intelligence presents opportunities for private equity businesses to capitalize on market trends.

- I rate PSP a Buy, as what is to come for the economy could turn more heads toward private markets.

ra2studio

Private markets may be well-positioned for future economic downturns, especially in the United States. This could give private equity firms a silver lining in the near term. As recession fears loom, public asset valuations are likely to take a hit sooner rather than later. This could give firms the opportunity to acquire quality assets at more reasonable prices, allowing the same firms to emerge stronger when the dust settles in the market. That being said, I believe the Invesco Global Listed Private Equity ETF (NYSEARCA:PSP) is a fund of choice as public markets start to fall into the crosshairs of the Federal Reserve. I rate PSP a Buy.

Private equity tends to be less procyclical and more recession-proof than other financial subsectors like banking. As market trends become more volatile and more businesses start to sink, banks could start to submerge as well. However, private equity may find it easier to stay afloat, and could even find treasure in a sinking economy. Furthermore, the corporate distress that comes from a recession could provide private equity names with opportunities to take struggling companies private and restructure them. This way, companies taken in can avoid economic turmoil. After being fixed up by private equity services, the same companies can then return to a recovered economy, but in a stronger, more robust condition.

Emerging innovation trends, especially artificial intelligence (AI), are also becoming a lucrative avenue for private equity institutions. As AI becomes a popular focus for startups, many of these startups will receive funding from private equity firms and venture capitalists during their initial stages. For example, OpenAI, known for creating the iconic ChatGPT, is still private. I think many companies similar to OpenAI may emerge shortly, allowing private equity businesses to capitalize on such trends.

Strategy and Holdings Analysis

PSP tracks the Red Rocks Gbl Listed Private Eqty TR USD Index and uses a full replication technique. This ETF invests in assets across a range of market capitalizations, ranging from roughly $200mm to $110B. Companies within the designated index identify primarily as business development companies, master limited partnerships and alternative asset managers. Such companies are similarly involved in investments, capital lending, and the provision of services to privately-held institutions.

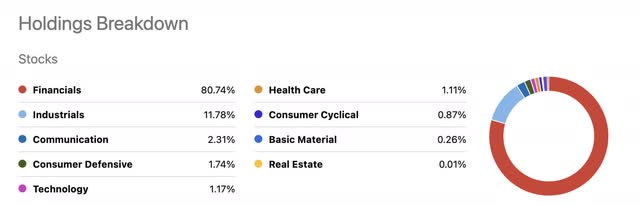

This ETF’s holdings mainly fall into financials, which take up all but a fifth of the total sector composition. Other sectors within PSP include but are not limited to industrials, communication, and consumer defense.

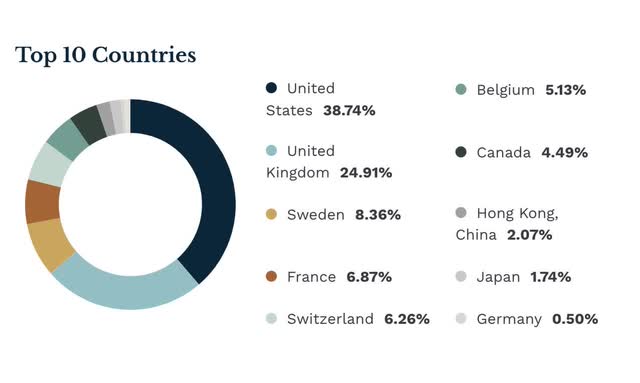

This ETF’s holdings reside mainly in the United States and the United Kingdom, which together comprise all but a third of PSP’s geographical makeup. Other regions in this ETF lie mainly in Northwestern and Central Europe.

On an individual holdings basis, PSP is quite top-heavy, as the top 10 holdings account for almost half of the entire fund, which consists of 67 stocks.

Investors might therefore want to consider concentration risk, and how much they're willing to rely on just a few big names to move the needle in this fund. Even with this in mind, PSP is still less concentrated than its primary alternative: the ProShares Global Listed Private Equity ETF (PEX), whose holdings are shown below.

Strengths

The private equity space has room to grow during the next few years, and this industry's growth forecasts are quite strong.

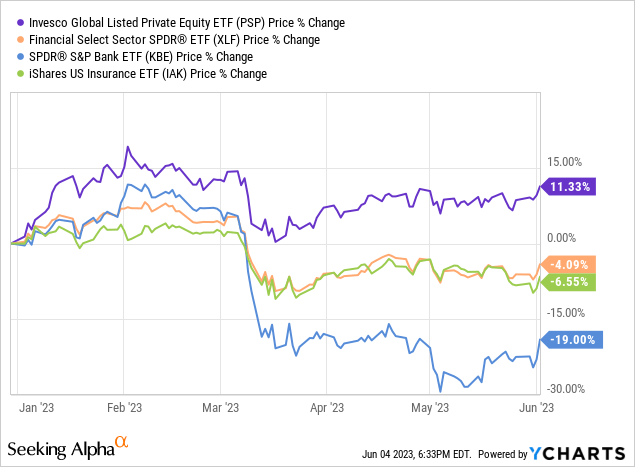

As seen above, private equity profits are accelerating, which could catalyze PSP in the coming periods. Furthermore, This ETF has done quite well this year compared to other financial ETFs, which have really borne the brunt of the ongoing economic downturn.

Every ETF depicted suffered to some extent after the regional banking debacle in March, but PSP was the least fazed. From looking at this ETF’s performance against the Financial Select Sector SPDR Fund ETF (XLF) during this time, private equity might be the more resilient choice for those looking to dabble in financials when economic forecasts are cloudy. Additionally, PSP might also be a relatively robust alternative to bank ETFs like the SPDR S&P Bank ETF (KBE), as well as insurance funds like the iShares U.S. Insurance ETF (IAK). Bank ETFs in particular could suffer greatly from a credit crunch.

Weaknesses

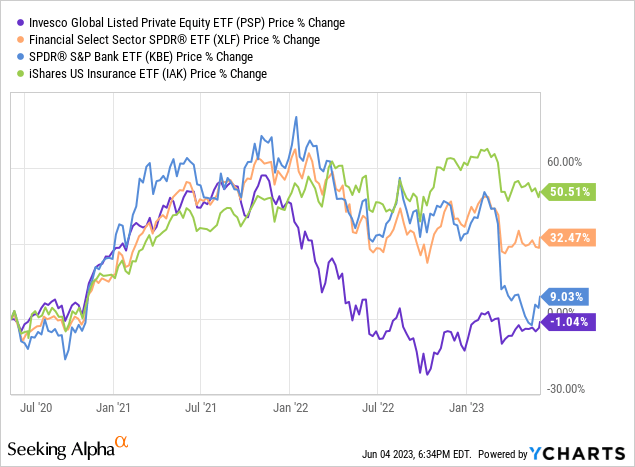

Though this ETF has performed quite well amid treacherous market conditions, PSP’s net profits don’t compare to XLF, KBE, and IAK when looking back further.

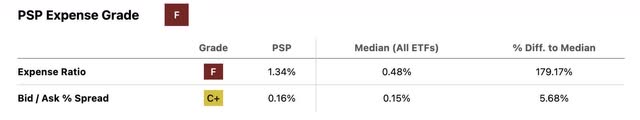

PSP may therefore hedge economic downturn to some extent, but it might not benefit the same as its non-private equity alternatives when the economy recovers. Furthermore, this ETF also has some concerning metrics that distinguish it from its peers in a negative fashion. PSP’s expenses are significantly higher than many other financial ETFs that I have covered thus far. As seen below, this ETF’s expense ratio is almost threefold that of all ETFs’ median.

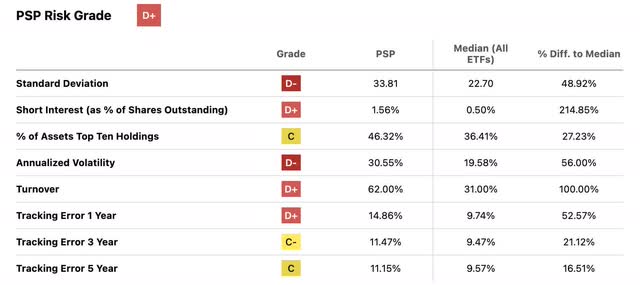

Even though this ETF is quite expensive, PEX’s expense ratio is more than double that of PSP. I therefore still believe PSP to be the better private equity fund. Furthermore, PSP does not pay a dividend and is also quite volatile. The absence of a dividend therefore places more emphasis on growth and capital appreciation which as seen in the metrics below, can get quite shaky.

Opportunities

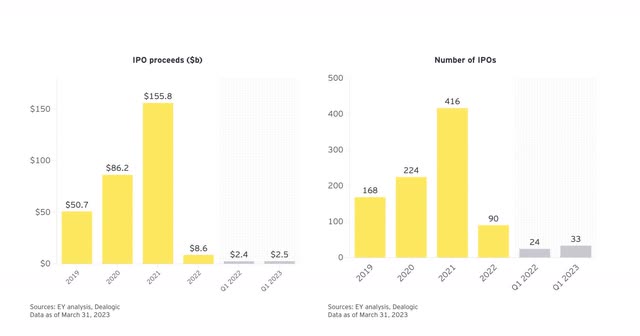

The number of initial public offerings (IPO) declined tremendously in 2022 when the bear market took over. As of recent times, the IPO scene is yet to regain its former momentum.

The current economic forecast likely foresees a further decline in IPOs, especially when considering the increasing likelihood of a recession in the United States. This recession-induced downturn may dampen investor sentiment and corporate activity, which could then reduce the number of IPOs in the coming periods. A relatively inactive IPO space could catalyze the demand for alternative sources of funding, namely private equity. This development could boost the returns of PSP and similar securities.

Threats

More capital is flowing through the innovative technology space by the day, which has provided private equity firms with a new and lucrative business opportunity. Few technologies have been as innovative as generative AI in 2023. However, generative AI has also been subject to regulatory scrutiny and increasing ethical and safety concerns. Going forward, AI companies could become a greater liability to work with. Private equity companies could therefore go from making substantial amounts of money funding AI ventures to having to fight various legal hurdles when working with these same companies. Furthermore, transparency in funding has become a salient topic in 2023, especially after the financial downturns in March. Private equity firms tend to only disclose information on a limited basis, making it hard for investors to accurately assess the true prospects of their investments. Though investing in a private equity ETF rather than a stock partially hedges this problem, I believe it should still be considered.

Conclusion

The forecast is quite grim for public equity markets, especially within the United States. I believe this case could give private equity names the opportunity to outperform traditional financial institutions like banks and insurance companies. Furthermore, the momentum behind innovation like generative AI could boost startup formation across the economy, and therefore increase the demand for private funding. For these reasons, I rate PSP a Buy.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.