Bristow: Improvement Expected For The Remainder Of 2023 And Beyond

Summary

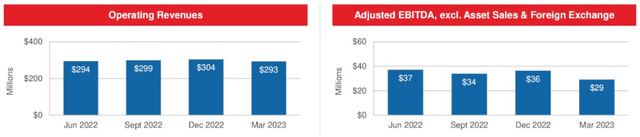

- Bristow, a leading helicopter services provider, reported another set of mediocre quarterly results, with revenues and profitability being impacted by seasonality and the recent loss of a large contract in Guyana.

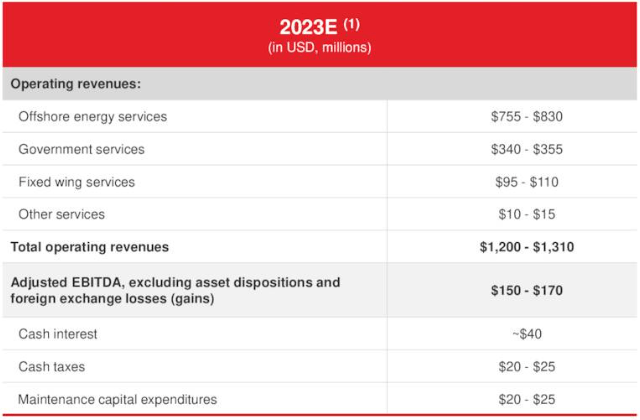

- VTOL continues to expect full-year revenues of between $1.20 billion and $1.31 billion and adjusted EBITDA to range from $150 million to $170 million.

- Results are expected to improve meaningfully over the course of the year as new contracts kick in.

- Discussing the most recent SAR contract award in Ireland which should provide stable revenue and decent margin contributions for many years. On the flip side, the company might again face substantial capital expenditures which would put additional pressure on near-term liquidity and cash flows.

- With Q2 unlikely to show major improvements and cash flows pressured by ongoing preparations for the commencement of the UKSAR2G contract next year, I am reiterating my "Hold" rating on the shares.

Photofex/iStock Editorial via Getty Images

Note: I have covered Bristow Group (NYSE:VTOL) previously, so investors should view this as an update to my earlier articles on the company.

Last month, leading offshore helicopter services provider Bristow Group or "Bristow" reported another set of mediocre quarterly results with revenues and profitability being impacted by seasonality and the recent loss of a large contract with Exxon Mobil (XOM) in Guyana:

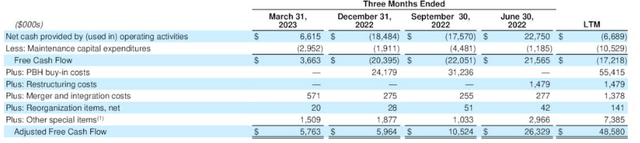

While the company generated $6.6 million in cash from operations and another $23.4 million from helicopter sales during the quarter, capital expenditures of $31.5 million mostly related to preparations for the recently awarded large-scale search-and-rescue ("SAR") contract in the United Kingdom also known as "UKSAR2G" resulted in negative free cash flow of $1.5 million for the quarter as disclosed in the company's quarterly report on form 10-Q.

Considering only maintenance expenditures, free cash flow was positive $3.7 million. In its adjusted free cash flow calculation, the company also added back an aggregate $2.1 million in merger and integration costs and other special items:

Bristow continues to expect total capital expenditures of $159 million for the UKSAR2G contract with the vast majority expected to be incurred in 2023 and 2024.

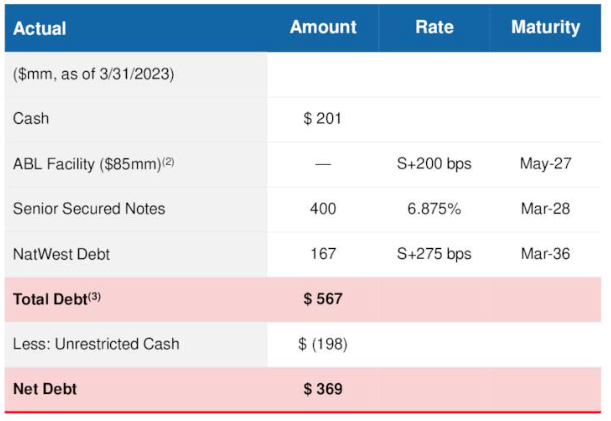

Unrestricted cash of $198 million and available liquidity of $274.9 million increased substantially from the end of 2022 due to the recent equipment financing agreements with National Westminster Bank Plc. Net debt of $369 million was up just slightly quarter-over-quarter.

Company Presentation

Bristow continues to expect full-year revenues of between $1.20 billion and $1.31 billion and Adjusted EBITDA to range from $150 million to $170 million:

Company Presentation

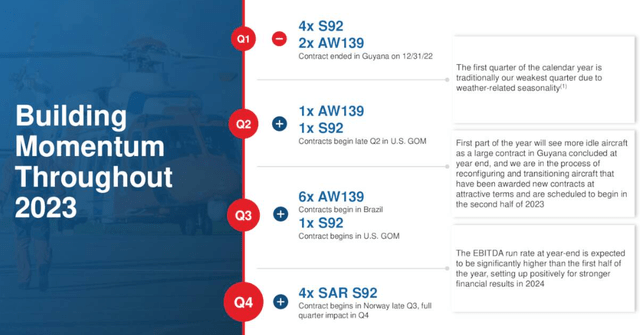

Results are expected to improve meaningfully over the course of the year as new contracts are scheduled to commence with the company's EBITDA run rate at year-end projected to be significantly higher than in the first half:

On the conference call, management expressed satisfaction with the company's quarterly results which came in somewhat better than internal expectations and remained constructive for the remainder of the year but was reluctant to commit to additional share buybacks which isn't exactly a surprise given the massive capex requirements under the new UKSAR2G contract.

Last week, Bristow announced that it has been confirmed by the Irish Department of Transport as the preferred bidder for the next Irish Coast Guard SAR contract with an estimated value of €670 million over ten years with the company replacing competitor CHC Helicopter ("CHC") following a fatal helicopter crash in 2017 which raised questions regarding CHC's approach to safety regulations.

As of late, CHC operated five S-92 helicopters from four bases in Ireland. With Bristow expected to commence a new SAR contract with Equinor (EQNR) in Norway with the requirement to provide four S-92 helicopters later this year, the company might very well have to invest in additional aircraft to serve the new Ireland SAR contract. Hopefully, management will comment on this issue on the Q2 conference call.

Bottom Line

While Bristow's first quarter report was nothing to write home about, the scheduled commencement of new contracts should boost results over the course of the year.

In addition, the company recently managed to win another SAR contract which should provide stable revenue and decent margin contributions for many years. On the flip side, this latest award might again require substantial capital expenditures which would put additional pressure on near-term liquidity and cash flows.

Following the recent rally in the shares, discount to estimated net asset value has narrowed to approximately 43%.

With Q2 unlikely to show major improvements and cash flows pressured by ongoing preparations for the commencement of the UKSAR2G contract next year, I am reiterating my "Hold" rating on the shares.

Investors looking for better exposure to the anticipated multi-year recovery in offshore oil and gas should consider shares of leading offshore drillers Noble Corporation (NE), Transocean (RIG), Seadrill (SDRL), Valaris (VAL), Diamond Offshore (DO) and Borr Drilling (BORR) or offshore support vessel providers like Tidewater (TDW) and SEACOR Marine Holdings (SMHI) as well as specialty services provider Helix Energy Solutions (HLX).

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.