Vista Gold: Smaller Scale Development Alternatives, A Last Chance For Mt. Todd

Summary

- VGZ has total cash of $6.65 million as of March 31, 2023, and has no debt. Total cash went down 48.3% since 1Q22.

- On March 1, 2023, Vista Gold announced that a smaller project could be feasible with an initial CapEx of $350 million and about 150K to 200K Au ounces of gold annually.

- I recommend buying VGZ between $0.58 and $0.59, with potential lower support at around $0.52.

- Looking for a helping hand in the market? Members of The Gold And Oil Corner get exclusive ideas and guidance to navigate any climate. Learn More »

claffra

Introduction

Denver-based Vista Gold (NYSE:VGZ) is a gold exploration and development company. The company's flagship asset is the Mt Todd gold project, located in Northern Territory, Australia, which is considered a Tier 1 mining jurisdiction.

Note: This article updates the article published on January 6, 2023. I have been following Vista Gold on Seeking Alpha since August 2020.

VGZ Mt Todd Australia (VGZ Presentation)

1.1 - Mt Todd: A quick snapshot

On March 17, 2022, Vista Gold appointed CIBC Capital Markets as its strategic advisor to assist the company in evaluating a broad range of alternatives for Mt Todd.

Unfortunately, this move has not produced anything concrete, and no partner is in sight after one year of search. It is not a good sign.

In the last presentation, the company referred to "unfavorable market conditions" to explain why Vista Gold could not secure an agreement while indicating interest "from a broad range of prospective parties."

Sadly, this situation has not changed, and the company was forced to scale back the project to reduce the initial CapEx needed to get a possible working deal. Smaller-scale development alternatives could be considered more attractive but do not eliminate the main issue, in my opinion.

The main issue for such a project to get the final investment decision is its low gold grade, well below 1 g/tonne, making it relatively unattractive even if phasing the construction offers a better overall outlook.

Frederick H. Earnest, President, and Chief Executive Officer of Vista Gold, said in the conference call:

During the first quarter, we completed an internal scoping study to evaluate the technical and economic merits of smaller scale development alternatives from Mount Todd, while preserving the opportunity for subsequent expansion or stage development. The work completed in the study leverages off of the 2022 feasibility study and gives us confidence that a smaller and easier to build initial phase of the project is viable and economically attractive.

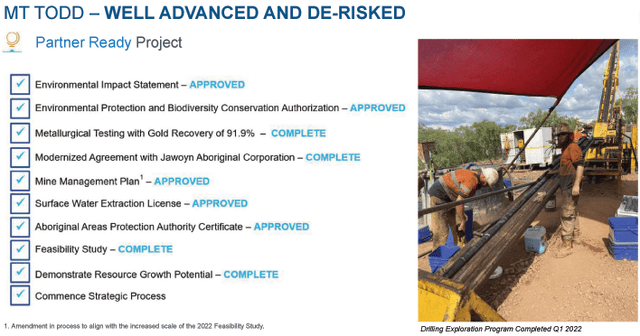

All major permits have been received, and Mt Todd is considered a partner-ready project, as shown below.

VGZ Mt Todd is ready to go (VGZ Presentation 2022)

Frederick H. Earnest, President, and Chief Executive Officer of Vista Gold, said in the conference call:

In March, we announced the completion of an internal scoping study, in which we evaluated the development of the Mount Todd project at a smaller initial scale. The results were very promising and contemplated significantly lower initial capital costs, while preserving the opportunity for subsequent expansion or stage development.

On March 1, 2023, Vista Gold announced that a smaller project could be feasible with an initial CapEx of $350 million and about 150K to 200K Au ounces of gold annually. However, AISC will go up but will remain competitive.

Vista’s work to date indicates that a nominal 5 million tonne per year project could be designed and constructed with an initial capital expenditure of less than US$350 million for scenarios that include contract mining and would achieve annual production in the range of 150,000 – 200,000 ounces of gold per year. Operating cost analyses suggest that all-in sustaining costs would be higher than those estimated in the Company’s 2022 feasibility study on Mt Todd (the “2022 Feasibility Study”), largely from higher unit costs for the contract mining scenarios and adjustments for inflation, but would remain very competitive in today’s environment.

Also, Vista Gold announced the results of the surface exploration program on two specific areas within the exploration licenses at Mount Todd. They returned excellent anomalous gold assays from surface soil sampling, including up to 4 grams of gold per tonne at Irwin's target.

The results demonstrate strong geologic similarities to the area in the mining licenses where we previously delineated four highly prospective exploration targets potentially representing up to an additional 1.8 million to 3.5 million ounces of gold through our 2021-'22 drilling program.

Finally, the Northern Territory Government released its final report of the mineral development task force, which summarized a series of recommendations and actions to enhance the competitiveness of the Northern Territory as a mining investment destination. Notably, the report recommends updating the current royalty regime to make it more competitive to support the mining industry.

1.2 - Stock performance

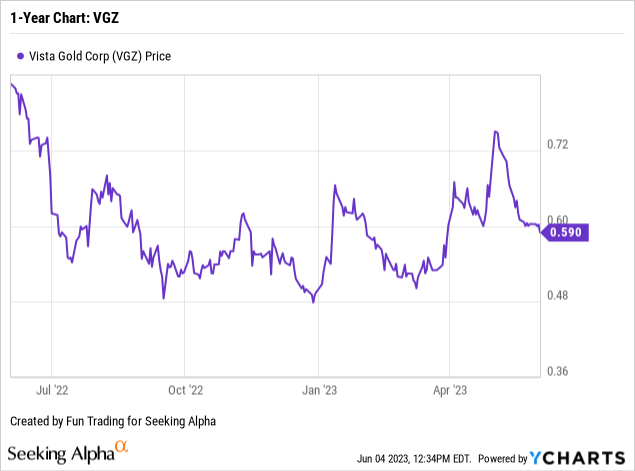

VGZ dropped significantly since May 2023, down to $0.59 per share. The stock now trades in a tight range between $0.48 and $0.73, moving mainly with the price of gold.

1.3 - Vista Gold balance sheet history ending in 1Q23. The raw numbers

Note: The company is not generating revenue.

| Vista Gold | 1Q22 | 2Q22 | 3Q22 | 4Q22 | 1Q23 |

| Net Income in $ Million | -0.32 | -1.42 | -1.69 | -1.50 | -1.97 |

| EBITDA $ Million | -3.19 | -1.86 | -1.70 | -1.54 | -1.97 |

| EPS diluted in $/share | 0.00 | -0.01 | -0.02 | -0.01 | -0.02 |

| Operating Cash Flow in $ Million | -2.45 | -1.80 | -1.50 | -1.66 | -1.78 |

| Total Cash $ Million | 12.86 | 11.07 | 9.58 | 8.11 | 6.65 |

| Long-term Debt in $ Million | 0 | 0 | 0 | 0 | 0 |

| Shares outstanding (diluted) in Million | 117.44 | 118.08 | 118.13 | 118.36 | 119.04 |

Source: Vista Gold press release

The balance sheet for Vista Gold provides specific data that could help your investment strategy, notably the cash on hand.

VGZ has total cash of $6.65 million as of March 31, 2023, and has no debt. Total cash went down 48.3% since 1Q22.

It is a source of concern for shareholders. Looking at the cash-burn rate, the company may eventually use another public offering in 2023, which will hurt existing shareholders again and push the stock price to below $0.50.

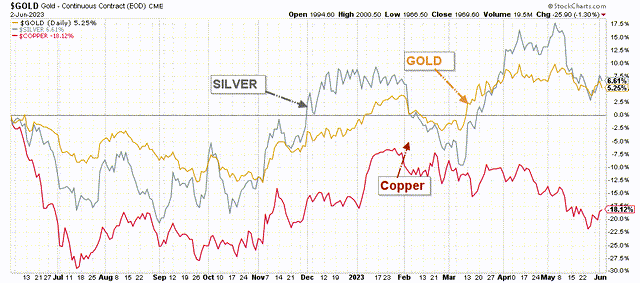

1.4 - The future Gold price is of paramount importance

The gold price is now well over $1,900 per ounce and should help VGZ. However, the recent USA data are unfavorable for gold; the metal has retraced significantly this month. The gold price is up about 6% YoY.

The gold price is very important for the company and its attractiveness to potential acquirers willing to invest and build the project.

VGZ 1-Year Gold performance (Fun Trading StockCharts)

Technical Analysis and Commentary

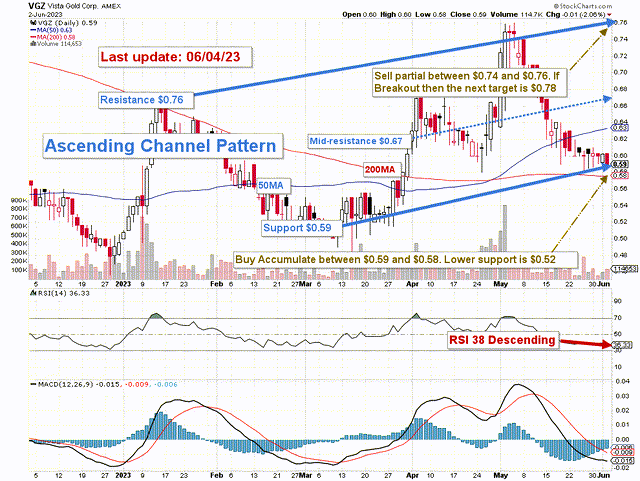

VGZ TA Chart Short-Term (Fun Trading StockCharts)

VGZ forms an ascending channel pattern with resistance at $0.76 and support at $0.59.

Short-term strategy: I suggest trading LIFO about 75%-85% of your position and keeping a small core long-term for a more outstanding payday in case of success.

The gold price has retraced due to the Fed's action, and VGZ dropped significantly from its recent highs in May. Also, a lack of real interest in the project for sale for over a year has started to carry a negative momentum. I recommend accumulating between $0.58 and $0.59, with potential lower support at around $0.52.

Also, it is important to take profits between $0.74 and $0.76, with a potential higher resistance at $0.78. The significant catalyst would be the company finding a partner to develop the project, which seems quite laborious. In this case, VGZ could jump well over $1.

Warning: The TA chart must be updated frequently to be relevant. It is what I am doing in my stock tracker. The chart above has a possible validity of about a week. Remember, the TA chart is a tool only to help you adopt the right strategy. It is not a way to foresee the future. No one and nothing can.

Editor's Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

Join my "Gold and Oil Corner" today, and discuss ideas and strategies freely in my private chat room. Click here to subscribe now.

You will have access to 57+ stocks at your fingertips with my exclusive Fun Trading's stock tracker. Do not be alone and enjoy an honest exchange with a veteran trader with more than thirty years of experience.

"It's not only moving that creates new starting points. Sometimes all it takes is a subtle shift in perspective," Kristin Armstrong.

Fun Trading has been writing since 2014, and you will have total access to his 1,988 articles and counting.

This article was written by

I am a former test & measurement doctor engineer (geodetic metrology). I was interested in quantum metrology for a while.

I live mostly in Sweden with my loving wife.

I have also managed an old and broad private family Portfolio successfully -- now officially retired but still active -- and trade personally a medium-size portfolio for over 40 years.

“Logic will get you from A to B. Imagination will take you everywhere.” Einstein.

Note: I am not a financial advisor. All articles are my honest opinion. It is your responsibility to conduct your own due diligence before investing or trading.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of VGZ either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I primarily trade short-term VGZ and own a small long-term position hoping for a positive ending.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.