FRA: Another Distribution Increase

Summary

- Floating rate funds, such as BlackRock Floating Rate Income Strategies Fund, have benefited from the Fed's interest rate hikes and could still be a worthwhile investment option.

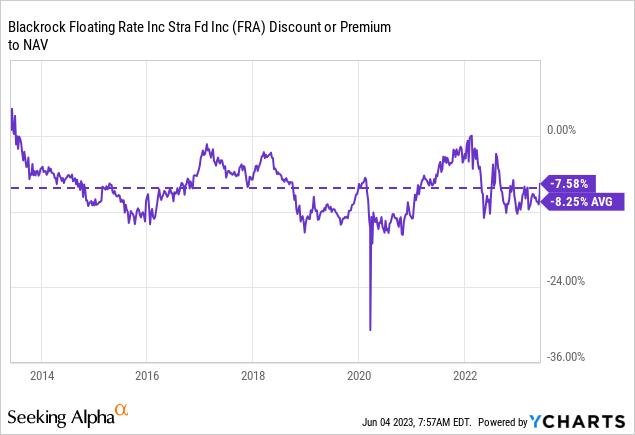

- The fund's discount has narrowed recently but still represents a fairly attractive entry level for investors.

- Investors should consider their outlook on interest rates and potential risks, such as a recession, when deciding whether to invest in FRA or other floating rate funds.

- This idea was discussed in more depth with members of my private investing community, CEF/ETF Income Laboratory. Learn More »

Dilok Klaisataporn

Written by Nick Ackerman, co-produced by Stanford Chemist. This article was originally published to members of the CEF/ETF Income Laboratory on June 4th, 2023.

Floating rate funds that invest primarily in senior loans have been benefiting from the Fed, as they've been driving interest rates higher. Those increases have slowed substantially from where we were last year. We are now at a point where most are expecting that we are close to the end of this rate hiking cycle. However, rates are still expected to stay higher for longer. Therefore, floating rate funds could still be a worthwhile place to invest some of your portfolio.

BlackRock Floating Rate Income Strategies Fund (NYSE:FRA) recently announced another distribution increase. It wasn't as substantial as the previous 38.8% increase we received earlier in 2023 or the bump last year, but the increase was still welcomed. It was good for a bump of 4.84%.

Interestingly though, the distribution coverage is no longer over 100%. This could have to do with timing or the fund being expected to grow into the distribution, or they may be banking on capital gains from their portfolio too. So that will be something to watch going forward.

The fund's discount has narrowed substantially quite recently, but it still represents a fairly attractive entry level. Those that can be patient may be able to wait for a double-digit discount that comes rather frequently.

Our last update was right before the banking crisis that sent floating rate funds such as FRA and the others all lower. However, the total return results at this point, thanks to that recent discount narrowing, have been pushed into positive territory.

FRA Performance Since Prior Update (Seeking Alpha)

The Basics

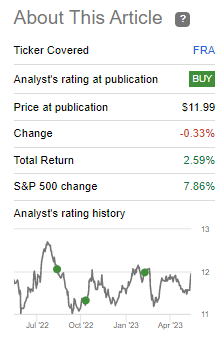

- 1-Year Z-score: 0.83

- Discount: 7.58%

- Distribution Yield: 11.75%

- Expense Ratio: 1.15%

- Leverage: 23.55%

- Managed Assets: $597.607 million

- Structure: Perpetual

FRA's investment objective is "to provide shareholders with high current income and such preservation of capital as is consistent with investments in a diversified, leveraged portfolio consisting of floating-rate debt securities and instruments."

To achieve this investment objective, "at least 80% of its assets in floating rate debt securities, including floating or variable rate debt securities that pay interest at rates that adjust whenever a specified interest rate changes and/or which reset on predetermined dates." As is typical with these sorts of funds - the portfolio "invests a substantial portion of its investments in floating rate debt securities consisting of secured or unsecured senior floating rate loans that are rated below investment grade."

The expense ratio of 1.15% is fairly low relative to their other senior loan CEF peers. When including leverage, the fund's expense ratio climbs to 2.17%. The fund operates with a fairly modest amount of leverage compared to peers. However, they are still leveraged, and that means higher volatility and risk, regardless. They also reduced their borrowings in fiscal year 2022 from fiscal 2021. They had $147 million in borrowings outstanding at the end of December 31st, 2023; today, they've taken that down a touch again to $142 million.

They have been impacted just as other leveraged funds are by higher interest rates driving up the costs of their borrowings. However, unlike equity or other fixed-income funds, their portfolio naturally offsets the rising costs with their own portfolio being floating rate based. So they haven't put in place any derivatives, such as interest rate swaps, to hedge against higher interest rates. That said, they still have other derivatives, such as default swaps, that have benefited the fund.

A Look At Performance And Valuation

In 2022, there was a lot of discussion on floating rate funds when rates were rising. While they had performed quite well, most led to losses anyway. It's important to understand that they are a hedge against interest rate risks but aren't completely immune either.

They still have interest rate sensitivity. For example, the duration of FRA comes to 0.28 years. That means for every 1% increase in interest rates; the underlying portfolio should decline 0.28%. One of the reasons I like FRA is because they don't try to do anything fancy, they are a floating rate fund, and that's basically what they stick to.

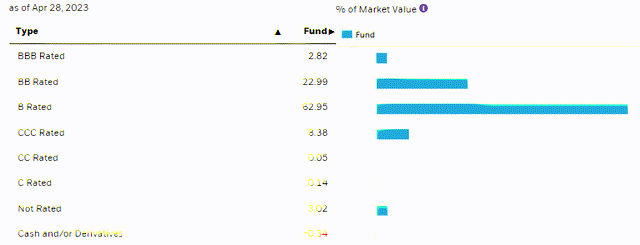

FRA Portfolio Exposure (BlackRock)

Additionally, they are primarily holding loans in companies that are below investment grade. That means credit risks are a factor that needs to be considered.

FRA Portfolio Credit Rating (BlackRock)

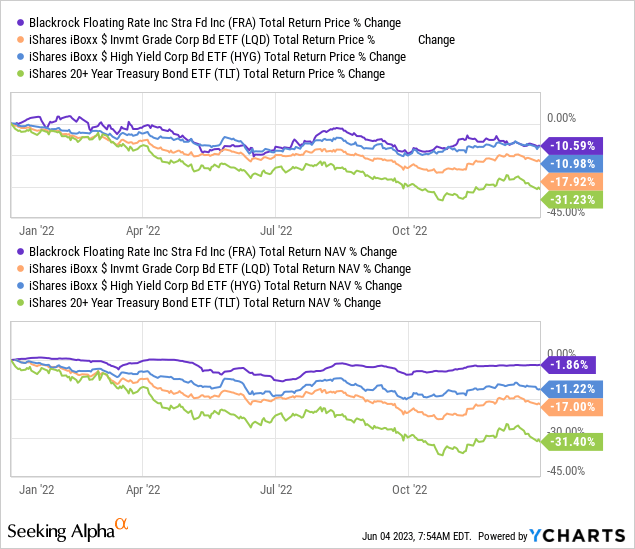

Here's the performance of FRA compared to the iShares iBoxx Investment-Grade Bond ETF (LQD), iShares iBoxx High Yield Bond ETF (HYG) and iShares 20+ Year Treasury Bond ETF (TLT) to provide some context for 2022's performance.

YCharts

As we can see, the safer the debt asset, the worse off an investor was. This is because the maturity of these safer assets tends to be longer and therefore tends to lead to a higher duration. What hurt FRA the most wasn't what its underlying portfolio was doing, but how much the fund's discount widened in the year. As we can see, FRA's total price return was essentially in line with HYG, but at the same time, FRA's underlying portfolio was essentially flat for the year on a total NAV return basis.

Today, the fund's discount sits near its longer-term average. Though that's off from the 10%+ discounts we were recently seeing.

YCharts

All this being said, to me, this is basically what I was expecting. I didn't know how aggressive the Fed was going to be with rates in 2022. They ended up being way more aggressive than I thought, but regardless, FRA actually performed quite well when compared to other asset classes.

Now if we look at a YTD comparison of these same funds, FRA is still performing admirably and came out on top. However, TLT was also performing exceptionally well for a period, and all of these other ETF counterparts rushed higher more recently. We also see what I mentioned on how FRA has narrowed its discount substantially recently. That came from that spike higher in the fund's share price that wasn't backed up by the same spike higher in its underlying portfolio.

YCharts

Going forward, it really depends on what your outlook on rates is. FRA probably would not be a great fund if you expect cuts to come sooner based on a deep recession. Defaults would negatively impact the fund's portfolio in the future. With cutting rates, we will see the fund have to cut its distribution once again.

If your outlook is for rates to stabilize where they are for now, FRA could still be an appropriate investment choice. It should mean that the distribution can stay where it is now; hopefully, defaults don't increase substantially, and the Fed can get its soft landing.

The other scenario would then be seeing further interest rate increases from the Fed. While that would suggest it could continue to benefit FRA, I don't know how long that would last. In the short term, I feel it would be a benefit, and we could see further distribution increases. However, every time the Fed raises, it pushes us closer to companies not being able to afford their debt payments.

As rates rise, the yields rise on the underlying portfolio, and that's where the high income-generation comes from. But there is a certain point where the Fed pushes too much, propelling us into a recession, and defaults would push higher. At that point, the higher income from the companies that can survive would likely not be enough to offset the losses experienced due to defaults. That's the risk of higher rates going forward that needs to be weighed against the benefit of what could be received. This is compounded by the leverage employed in most floating-rate funds.

If we are pushed into a recession, rates will ultimately be cut at that point. Rates being increased too far is something I've started to consider, and it is why I reduced my floating rate exposure earlier this year. I've been more recently putting dollars to work in non-leveraged and investment-grade exposure via Western Asset Investment Grade Income Fund (PAI). I've also put capital to work in Nuveen AMT-Free Municipal Value Fund (NUW), a muni fund that limits itself to no more than 10% leverage.

I continue to hold FRA because it's less leveraged than others, and the discount is still attractive. It also continues to be a hedge if rates are increased, and we don't ultimately get interest rate cuts heading into 2024.

Distribution Bump But Coverage Slips

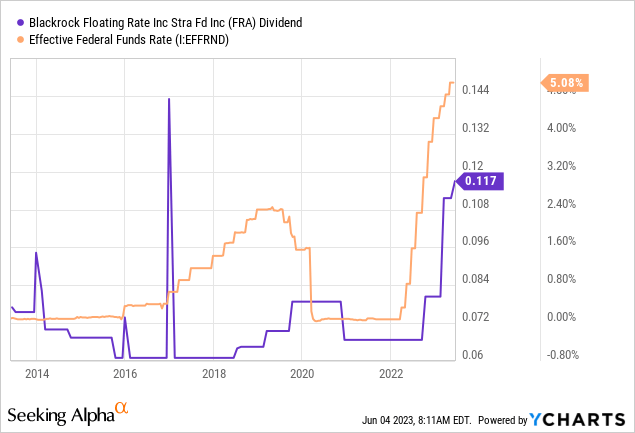

As mentioned, the latest distribution increase was smaller than the previous two, but the pace of increases has also been smaller. So this makes sense; as we can see, FRA's distributions loosely follow the effective fund's rate.

YCharts

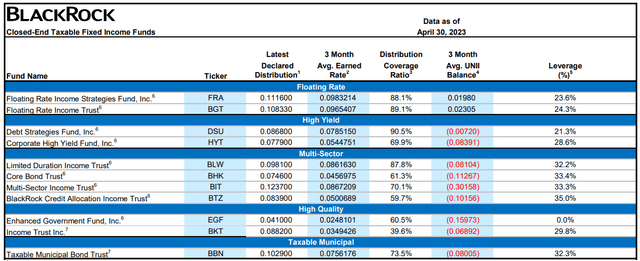

With the latest UNII report from BlackRock (BLK), we actually see that FRA is coming in a bit light on their coverage. This was for the period ending April 30th, 2023, so it doesn't reflect the latest distribution increase. All else being equal, that would mean that the coverage would have fallen a bit further.

BlackRock CEF UNII Report (BlackRock April UNII Report)

A quarter alone doesn't always give us the best picture, and a six-month or full-year period can be more reliable. The last time we looked at FRA, we saw the Q4 2022 data that showed the average NII rate for the quarter was $0.0914487. That was prior to when the fund increased its distribution rate, so at that time, we saw distribution coverage of 113.7%. That tells us that the NII increased by 7.84% quarter over quarter.

Additionally, as rates have still been increasing, it's possible that there is still some catching up to do in terms of the NII earnings over the last several months. Just as we saw in the last quarter over quarter, the next quarter could see another increase.

Their last annual report showed us that NII per share went from $0.67 in fiscal 2021 to $0.84 in fiscal 2022. Meaning we saw a substantial climb in NII, and the full effect hasn't materialized yet. Based on this first quarter of NII data, we would be looking at NII per share of $1.18 if annualized.

The lack of coverage is also seen in its sister funds, the BlackRock Floating Rate Income Trust (BGT) and BlackRock Debt Strategies Fund (DSU). DSU can include a more flexible portfolio into high-yield and investment-grade holdings, but it is currently heavily allocated to bank loans.

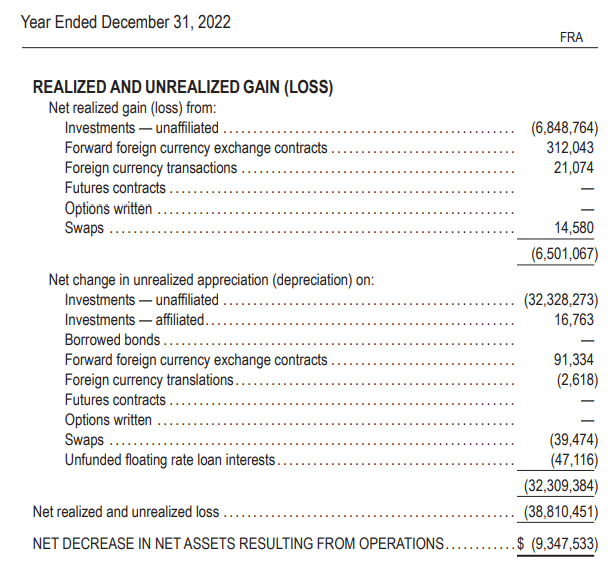

Generally speaking, I want to see a fixed-income fund generate sufficient distribution coverage from NII alone. That said, they can and have the ability to realize gains such as an equity fund. One way of doing this is through buying and selling the underlying investments in their portfolio. However, another way is through derivatives, which can potentially benefit a fund no matter what the rest of the market is doing if the management succeeds.

For FRA, in the last annual report, they were able to generate some small gains from forward foreign currency exchange contracts, foreign currency contracts and their swaps. In this case, it wasn't a material amount that had a meaningful impact, but I didn't want to ignore the potential completely. Any gain is also better than nothing at all.

FRA Realized/Unrealized Gains/Losses (FRA Annual Report)

Conclusion

FRA performed relatively well in 2022; even with its losses, the losses were substantially less than other fixed-income assets. The largest negative impact on the fund was the fund's significant discount widening. Investors were basically selling this fund off like it was any bond fund. So while the underlying portfolio of FRA held up, investors didn't see the benefit due to these actions.

In general, closed-end funds have seen their discounts widen to historically wide levels. This was the opposite of what we saw in 2021 when they were historically narrow. That could have been some of what was at play, as investors tend to lump CEFs as if they are homogeneous.

So far this year, we've seen that discount narrow meaningfully and reverse some of what we saw last year. I'm not sure if the latest discount narrowing we've seen in the latest week sticks, but for the most part, the fund is still doing fairly well. The discount is still fairly attractive, around its longer-term average too. The longer-duration debt categories of Treasuries, investment-grade and non-investment-grade bonds should outperform if rates are cut. However, if rates stabilize or increase further, FRA could have a chance to stay competitive. The main risk would seem to be that the Fed pushes things too far and pushes the US into a recession.

Profitable CEF and ETF income and arbitrage ideas

At the CEF/ETF Income Laboratory, we manage ~8%-yielding closed-end fund (CEF) and exchange-traded fund (ETF) portfolios to make income investing easy for you. Check out what our members have to say about our service.

At the CEF/ETF Income Laboratory, we manage ~8%-yielding closed-end fund (CEF) and exchange-traded fund (ETF) portfolios to make income investing easy for you. Check out what our members have to say about our service.

To see all that our exclusive membership has to offer, sign up for a free trial by clicking on the button below!

This article was written by

---------------------------------------------------------------------------------------------------------------

I provide my work regularly to CEF/ETF Income Laboratory with articles that have an exclusivity period, this is noted in such articles. CEF/ETF Income Laboratory is a Marketplace Service provided by Stanford Chemist, right here on Seeking Alpha.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of FRA, PAI, NUW, BLK either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.