Cohu: Optimistic Growth Targets But A Hold For Now

Summary

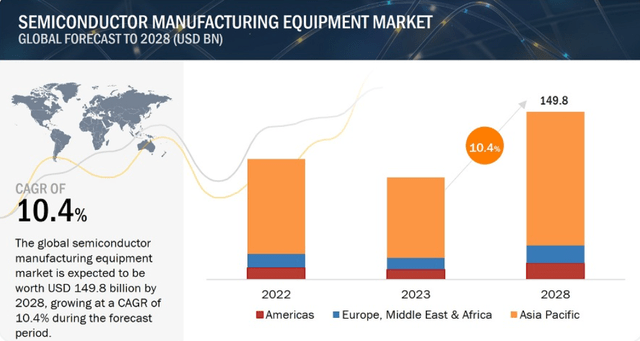

- Cohu Inc, a semiconductor testing and inspection solutions provider, has a strong balance sheet and high-margin business, but concerns remain over its ability to meet its $1 billion revenue target within 3-5 years due to recent declines in sales.

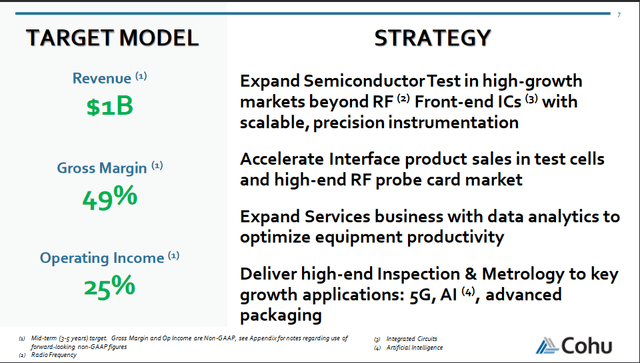

- The semiconductor equipment industry is expected to grow rapidly in the coming years, particularly in the Asia Pacific region, but Cohu needs to solidify its market position and showcase sales growth to justify its current valuation.

- Despite the risks, Cohu's negative net debt and share buybacks offer some value for investors, but a clear upward trend in revenue is needed to upgrade the hold rating to a buy.

SweetBunFactory

Investment Thesis

Cohu Inc (NASDAQ:COHU) specializes in offering a diverse array of solutions for semiconductor testing and inspection. Their comprehensive range of products and services is specifically designed to meet the unique requirements of semiconductor manufacturers, enabling them to guarantee the utmost quality and reliability of their semiconductor devices.

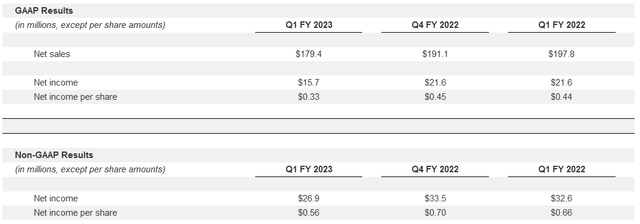

Company Target (Investor Presentation)

The company holds a mid-term target of $1 billion in revenues and a gross margin of 49%. Keeping up similar bottom line margins that would equate to an EPS of around $4 - $4.1 within 3 - 5 years according to the company. The last report didn't bring too much confidence the company can reach that target, as the revenues fell on a yearly basis and so did the bottom line. But with a solid balance sheet that boasts a negative net debt the company does deserve a hold rating nonetheless in my view.

Market And Growth Projections

As mentioned the company has a $1 billion target of revenues in 3 - 5 years. That would mean the EPS would land between $4 - $4.1 per share if the company doesn't continue buying back shares, which I find unlikely as FCF has strong and the balance sheet doesn't have any concerning debt right now.

With a p/e that reflects the sector and using the EPS I see them having the share price would land around $68 per share with a p/e of 17. That would equate to a CAGR of about 16% in 5 years' time. That seems phenomenal. So you might wonder why I am not rating it a buy, or even a string buy right now. Well for me it comes down to there still benign uncertainties about them actually reaching this target. The last report had the company experience a YoY decrease in net sales of close to 10%. That isn't very reassuring if the company wants to grow the top line by nearly 25% in the coming 3 - 5 years.

Looking a comment from the CEO Luis Muller, “Going forward, we are aligning investments with major trends in industrial automation, autonomous vehicles, increased processing and sensing power. We are expanding our factory footprint in the Philippines to support future growth in recurring business.” I think it will be vital to see solid top-line growth and margin expansion in the coming quarters if there is to be an investment case here at all. Where there is still value to be had here for investors is the buybacks the company is doing. From the 2022 levels, the shares have decreased by about 2%. It should be mentioned that they rose quite quickly between 2020 and 2021 as a result of the company needing to raise capital as levered FCF were low and debt far higher than it is currently.

Market CAGR (Marketsandmarkets)

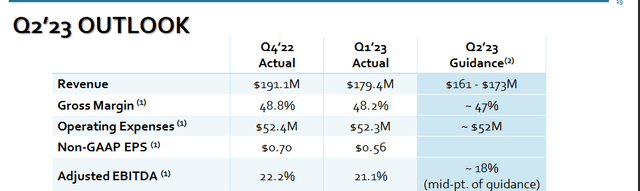

Looking ahead it seems the semiconductor equipment industry is estimated to grow at a strong rate, with much of that being in the Asia Pacific. A 10.4% CAGR until 2028 comes in line with what we mentioned before with COHU and its potential growth. Where the challenge lies for COHU is to solidify its place in the market to grow at this rate. The industry saw a difficult first start to the year but it seems the challenges are clearing and the second half of 2023 is estimated to be much better. The industry is incredibly competitive and it will be key for COHU to continue benign able to grow their margins even through this market environment to justify the current valuation. Looking at the second quarter for the company they see the net sales coming in at $163 - $173 million, which on the high end even would be a QoQ decrease. A surprise upward is needed I think and would bring more comfort for investors. But as mentioned, the second half of the year is estimated to be better, so looking at the third and fourth quarter results will be even more important.

Financials

As mentioned before the company balance sheet is phenomenal right now and has been heavily improved over just the last couple of years. In 2020 the company had over $300 million in long-term debt, which resulted or at least helped reason that share dilution was necessary to pay down debts. But that seems to be turning around now, with shares decreasing.

Balance Sheet Assets (Earnings Report Q1)

COHU has grown its balance sheet and now boasts a negative net debt which just goes to show the low likelihood of dilution being an issue from here. Long-term debts at $37 million do leave room for COHU to take on debt if they wish to more aggressively invest into their business and grow market share. I think that could be wise if they want to achieve their $1 billion revenue target within 3 - 5 years' time.

Balance Sheet Liabilities (Q1 Earnings Report)

A quite impressive fact the company has on its balance sheet is the cash position can actually cover the entire current liabilities. With the $1 billion revenue target that would equate to around $200 million in levered FCF if the same margins today are true in 3 - 5 years. Which would value the company at a p/FCF of about 8 right now on a forward basis. That is quite low and a very fair price to pay for the company in my opinion. Pair that with a p/b of under 2, which is likely to decrease further as the company continues building up its cash position and build up its inventories. But as mentioned, what needs to happen is a clear showcase of the sales growth to make this hold rating turn into a buy instead.

Risks

As mentioned throughout the article the biggest concern I have is the sales decreasing on a yearly basis and a quarterly too. The management even estimates the sales to drop in Q2 compared to Q1. The market doesn't have the same pricing it did in 2022, which likely helps decrease the sales like this.

Company Outlook (Investor Presentation Q1)

Looking at the Q2 outlook I think the company needs to achieve and even outperform these targets to bring confidence to investors. Looking at the company on a fundamental level they are solid. They have a strong balance sheet and great margins. The industry they are in is estimated to grow rapidly over the coming years. But trading at around 19x forward earnings with a recent large run-up does create a little uncertainty. A failure to meet these targets would in my opinion create a risky scenario where the current valuation would need to be adjusted downwards a fair bit. Somewhere around 14 - 15x FWD p/e would seem fair, given the solid balance sheet the company at least boasts.

Final Words

I think that Cohu Inc is a very interesting company within the semiconductor space. They have managed to grow their business into a high-margin one and generate solid cash flows, able to pay down all long-term debts if they so choose to. They have improved the balance sheet immensely from the 2020 levels and have a negative net debt right now even.

But as mentioned the last earnings report didn't bring me confidence in the company's ability to meet its revenue target within 3 - 5 years. A yearly decline can be blamed on a softer pricing environment, but Q2 is expected to result in a decrease as well. Until there is a clear trend upwards for the revenue I won't bring the hold rating up to a buy. The third and fourth quarters of 2023 will be key to watch to make sure this is actually happening. But with a hold rating investors are able to get some value at least as the company is starting to buy back shares with their strong cash flows.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.