Olo Reduces Forward Growth Guidance As Operating Losses Mount

Summary

- Olo reported its Q1 2023 financial results on May 9, 2023.

- The firm provides a SaaS platform for restaurant delivery, operations and payments in the U.S.

- OLO management has guided to lower 2023 revenue growth while the company is generating increasing operating losses.

- I remain Neutral [Hold] on OLO in the near term.

- Looking for more investing ideas like this one? Get them exclusively at IPO Edge. Learn More »

Lock Stock

A Quick Take On Olo

Olo (NYSE:OLO) reported its Q1 2023 financial results on May 9, 2023, beating both revenue and EPS consensus estimates again.

The firm provides software for restaurants seeking integrated digital ordering and delivery processing capabilities.

I previously wrote about Olo with a Hold rating.

With a high cost of capital environment, slowing revenue growth, higher operating losses, and continued macroeconomic uncertainties, I remain Neutral [Hold] on OLO in the near term.

Company

New York-based Olo was founded to develop an integrated SaaS software solution for restaurant operations' use cases.

Management is headed by Founder and Chief Executive Officer, Noah Glass, who was previously International Expansion Manager for Endeavor Global.

The company’s primary offerings include:

Digital ordering

Dispatch & delivery

Channel management

Integrations Network

Olo Pay

The firm pursues relationships with major restaurant brands to provide its SaaS solutions as the exclusive direct digital ordering provider.

The company's platform serves more than 76,000 restaurants, handles several million orders per day and integrates more than 300 restaurant technologies into its systems, such as 'POS systems, aggregators, DSPs, payment processors, user experience or UX, and user interface, or UI, providers, and loyalty programs.'

Olo’s Market & Competition

According to a 2018 market research report by Grand View Research, the global restaurant management software market is expected to reach nearly $7 billion by 2025.

This represents a forecast strong CAGR of 14.6% from 2019 to 2025.

The main drivers for this expected growth are continued technology development and disruption and the increased need by restaurants for technology solutions to enhance their efficiencies and improve their daily operations.

Also, front-end software held the largest share of the market in 2016 and is expected to continue to account for a majority of market share in 2025.

Major competitive or other industry participants include:

Tillset

Onosys

NovaDine

NCR Corporation

Xenial

GrubHub

DoorDash

UberEats

Others

Olo’s Recent Financial Trends

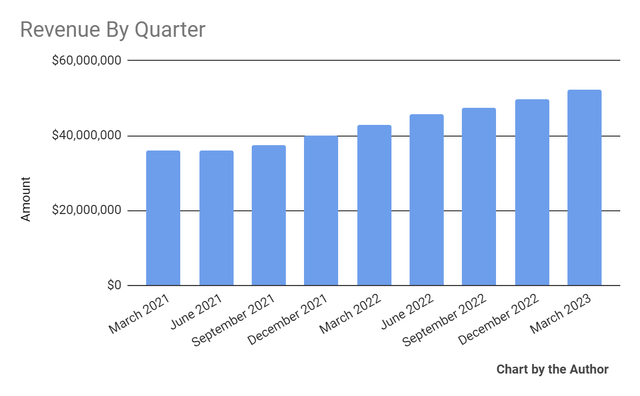

Total revenue by quarter has grown per the following chart:

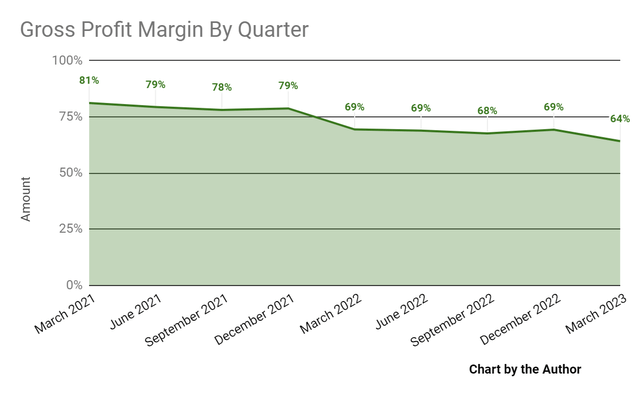

Gross profit margin by quarter has trended materially lower in recent quarters:

Gross Profit Margin (Seeking Alpha)

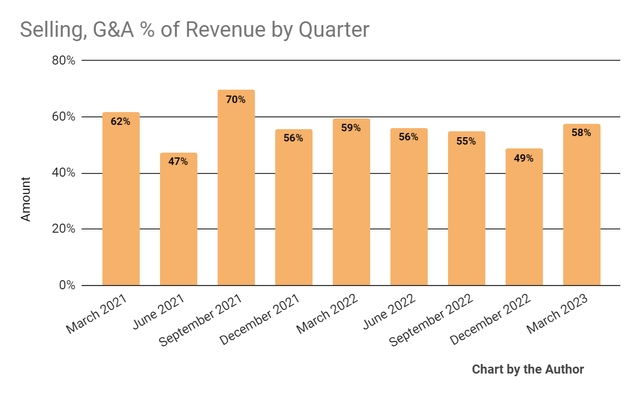

Selling, G&A expenses as a percentage of total revenue by quarter have largely fluctuated within a range:

Selling, G&A % Of Revenue (Seeking Alpha)

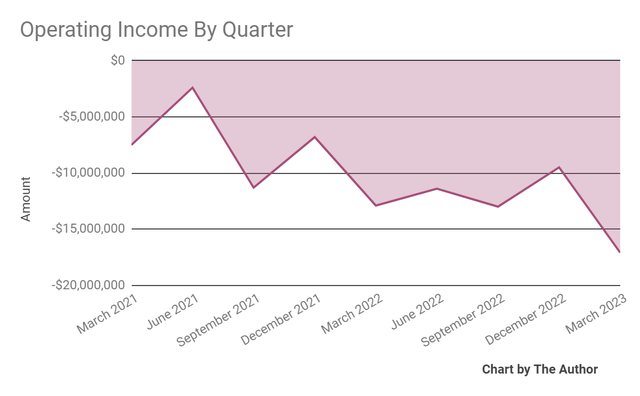

Operating losses by quarter have worsened in recent quarters:

Operating Income (Seeking Alpha)

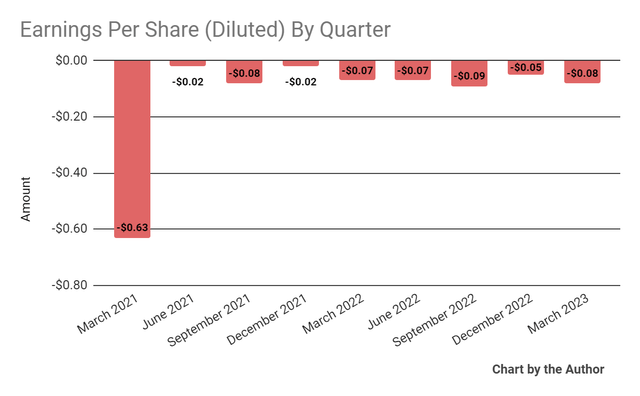

Earnings per share (Diluted) have remained negative:

Earnings Per Share (Seeking Alpha)

(All data in the above charts is GAAP)

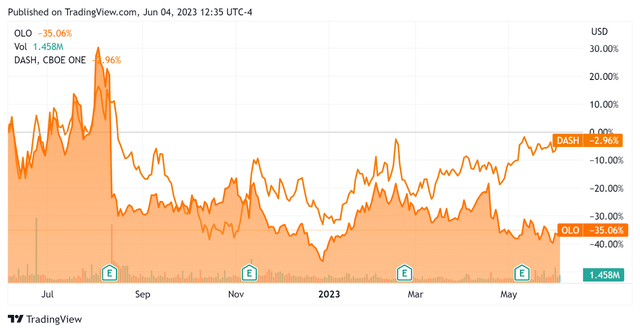

In the past 12 months, OLO’s stock price has dropped 35.06% vs. that of DoorDash’s (DASH) fall of 2.96%, as the chart indicates below:

52-Week Stock Price Comparison (Seeking Alpha)

For the balance sheet, the firm ended the quarter with $422.2 million in cash, equivalents and short-term investments and no debt.

Over the trailing twelve months, free cash flow was $10.1 million, of which capital expenditures accounted for $0.4 million. The company paid $48.4 million in stock-based compensation in the last four quarters, the highest rolling twelve-month amount in the past eleven quarters.

Valuation And Other Metrics For Olo

Below is a table of relevant capitalization and valuation figures for the company:

Measure (TTM) | Amount |

Enterprise Value/Sales | 3.8 |

Enterprise Value/EBITDA | NM |

Price/Sales | 5.8 |

Revenue Growth Rate | 24.9% |

Net Income Margin | -24.7% |

EBITDA % | -22.4% |

Net Debt To Annual EBITDA | 9.7 |

Market Capitalization | $1,130,000,000 |

Enterprise Value | $730,580,000 |

Operating Cash Flow | $10,480,000 |

Earnings Per Share (Fully Diluted) | -$0.29 |

(Source - Seeking Alpha)

As a reference, a relevant partial public comparable would be DoorDash (DASH); shown below is a comparison of their primary valuation metrics:

Metric (TTM) | DoorDash | Olo | Variance |

Enterprise Value/Sales | 3.2 | 3.8 | 16.1% |

Enterprise Value/EBITDA | NM | NM | --% |

Revenue Growth Rate | 36.0% | 24.9% | -30.7% |

Net Income Margin | -19.0% | -24.7% | --% |

Operating Cash Flow | $784,000,000 | $10,480,000 | -98.7% |

(Source - Seeking Alpha)

Commentary On Olo

In its last earnings call (Source - Seeking Alpha), covering Q1 2023’s results, management highlighted the 22% increase in ARPU (Average Revenue Per Unit), ending the period with around 76,000 active locations on its platform.

The firm is also continuing to invest in AI enhancements to its systems to optimize order throughput and other operational aspects for clients.

Also, the company announced a strategic partnership with Adyen to enable clients using its Olo Pay system to ‘accept and oversee both digital and card present payments from the same Olo platform in which they manage the rest of their digital business.’

The company’s net revenue retention rate was 114%, an increase of 6 percentage points ‘sequentially driven by continued growth in ARPU, due to further sell through of Olo’s product suite.’

Total revenue for Q1 2023 rose an impressive 22% YoY, but gross profit margin dropped 5.2 percentage points.

Selling, G&A expenses as a percentage of revenue dropped 1.7 percentage points, a positive sign, but operating losses increased by 32.6% year-over-year.

Looking ahead, management guided full-year 2023 revenue to $216.5 million at the midpoint of the range, or 16.7% growth. If achieved, this would be significantly lower than 2022’s 24% growth rate over 2021.

The company has $60 million remaining in its repurchase authorization.

The company's financial position is solid, with over $422 million in liquidity, no debt and positive free cash flow.

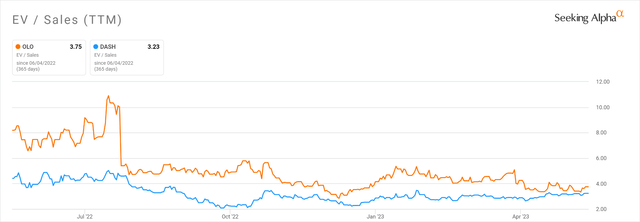

Regarding valuation, the market is valuing Olo at a higher EV/Sales multiple than DoorDash, despite a lower revenue growth rate and worse negative net income margin.

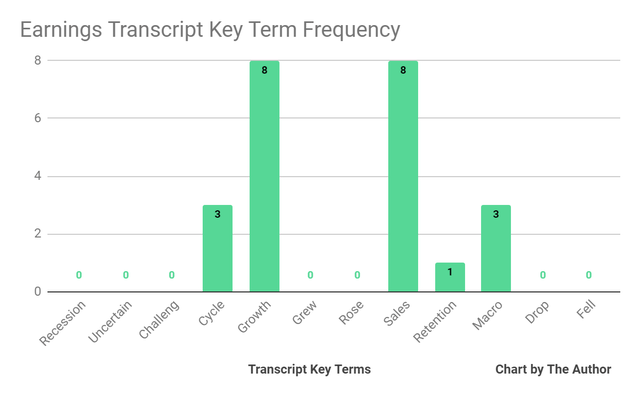

From management’s most recent earnings call, I prepared a chart showing the frequency of key terms mentioned (or not) in the call, as shown below:

Earnings Transcript Key Terms Frequency (Seeking Alpha)

I’m most interested in the frequency of potentially negative terms, so management or analyst questions cited ‘Macro’ three times.

The ‘Macro’ term refers to the environment the company's customers are experiencing and management said they are seeing ‘a lot of resiliency and growth frankly’ within end-user business.

In the past twelve months, the firm's EV/Sales valuation multiple has fallen sharply, as the chart from Seeking Alpha shows below:

EV/Sales Multiple History Comparison (Seeking Alpha)

Olo is a company with promise in its Olo Pay segment, but its forward outlook shows reduced growth, while operating losses have been worsening.

With a high cost of capital environment, slowing revenue growth, higher operating losses, and continued macroeconomic uncertainties, I remain Neutral [Hold] on OLO in the near term.

Gain Insight and actionable information on U.S. IPOs with IPO Edge research.

Members of IPO Edge get the latest IPO research, news, and industry analysis.

Get started with a free trial!

This article was written by

I'm the founder of IPO Edge on Seeking Alpha, a research service for investors interested in IPOs on US markets. Subscribers receive access to my proprietary research, valuation, data, commentary, opinions, and chat on U.S. IPOs. Join now to get an insider's 'edge' on new issues coming to market, both before and after the IPO. Start with a 14-day Free Trial.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.