Time To Focus On Quipt's Results, Reiterate Buy

Summary

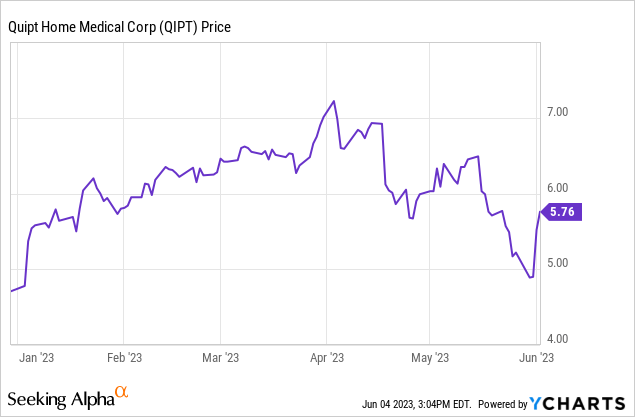

- Quipt started the year on fire following its largest acquisition in company history.

- QIPT dropped following a capital raise intended to give the company the flexibility to make continued acquisitions in the future.

- After largely recovering its momentum after the capital raise, QIPT reported outstanding earnings results, but the stock plummeted on the concurrent announcement of an ATM.

- While I believe the ATM was prudent, most investors disagreed; the company listened and terminated the ATM (at the market) program last week.

- The stock has again begun to recover following the ATM termination and the company is now set up to have a phenomenal back half of the year from both an operations and acquisitions perspective.

cherrybeans/iStock via Getty Images

Shareholders of Quipt Home Medical (NASDAQ:QIPT) - myself included - have been on quite the roller coaster ride so far in 2023. The year began strong for the stock on the heels of the company's largest acquisition. I wrote about that acquisition in detail for Seeking Alpha in January. By April, the stock broke out to new 52-week highs and everything seemed to be smooth sailing with strong results expected for all the reasons I outlined in that January article.

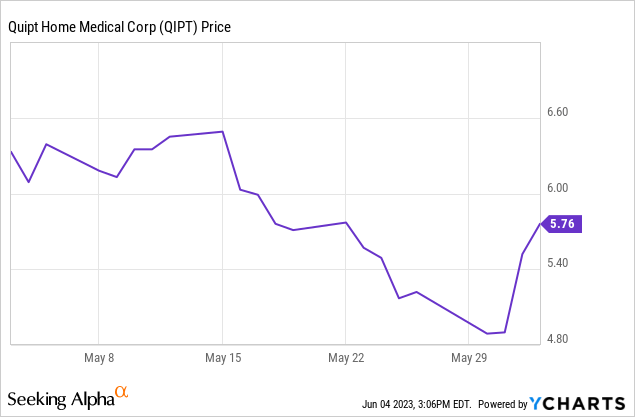

While all of those bullish factors are still holding true, to the surprise of almost all investors - again, myself included - the company decided to raise roughly $29M ($40M CAD) in a public offering and private placement. Because the equity financing was understandable, even if frustrating (I will explain more below), QIPT's share price began to recover ahead of its 2Q23 earnings report (QIPT's fiscal year is one quarter ahead of the calendar year). On May 16, QIPT reported its 2Q results, which were phenomenal and ahead of their own guidance. However, investors freaked out because, in tandem with the earnings report, QIPT opened an "at the market" (ATM) program, which would allow QIPT to raise up to $40M by selling its stock in the open market.

As with the capital raise, I will explain more details about the ATM in a section below. In short, however, we should note that after hearing from a multitude of shareholders, QIPT decided to terminate the ATM program last week. This move was favorably received and the stock has already rallied over 20% off its intra-day low the day before this termination announcement.

I believe now that we have the ATM saga behind us, we have a clearer picture of how management plans to expand via acquisition in the nearer term (12-18 months). Moreover, we can now focus on the outstanding job QIPT has been doing in growing both organically and by accretive acquisitions. Further, we can pay attention to the fact that QIPT's margins have begun to expand and that they continue to be recognized as a burgeoning national player in their space. Most importantly for shareholders, we should have a strong back half of the year, with plenty of justification for share price expansion.

Surprising Capital Raise

QIPT's April capital raise was surprising to most investors because the company used debt to finance their last acquisition, and seemed to be positioning itself to take on more debt for future acquisitions. In reality, it turns out management wanted to use a mix of debt and equity on their large acquisition of Great Elm in January 2023, but simply could not stand to raise equity with their stock so undervalued to begin the year. Consequently, management exercised restraint in January and waited for a 50% increase in the stock price before conducting the raise. This patience allowed QIPT to issue fewer shares to obtain the same amount of money, a net positive for shareholders.

In raising this money, QIPT made clear the funds were to be used to help pay down some of the debt they took on from the Great Elm acquisition. This move gives QIPT flexibility to use cash and/or debt for tuck-in acquisitions later this year. And, to be sure, management indicated on the 2Q23 earnings call that their acquisition pipeline remains robust, with the expectation of some acquisitions happening in 2H23. As noted, these deals are expected to be tuck-in acquisitions and nothing as large as the Great Elm deal. Management is wisely ensuring they integrate this larger acquisition well before looking for another big fish.

In my opinion, the only reasonable criticism of the April raise would be the fact that QIPT took around a 15% discount on its market share price in order to get the deal done. That said, it is not as though management did not shop this deal around. Unfortunately, I believe the likely reason for the discount is the fact that the company still has a majority ownership in Canada and has, to date, largely needed to rely on Canadian bankers for its financings. However, with about 45% of the company now in the hands of US investors and institutions, it is just a matter of time until the company is required to file directly with the SEC, and not as a foreign filer, as is the case currently. I believe sometime in 2024 QIPT will begin filing directly with the SEC and will then have opportunities for any future raise to take place in the US. It should be noted that QIPT had not raised any equity in three years prior to the April raise, so I would not expect another one imminently.

In response to investor frustration over the capital raise discount, and to provide the company with ultimate flexibility, QIPT decided to put in place the aforementioned ATM program in May.

An ATM Saga

With an ATM in place, QIPT management could theoretically raise money at any time they desired by selling shares into the open market, at market prices. Such a program would eliminate the possibility of the company having to accept a discount from a banker and would minimize the associated banking fees. I explained the rationale for this ATM prior to it being put in place. Now, for those who think QIPT's volume is too minimal to pull something like this off, keep in mind the company regularly has new investors/institutions who want into the stock, but who must take a long time to buy in so as not to run the price up on themselves. With an ATM in place, these investors could have bought in size if and when QIPT was ready to raise funds for an acquisition (important to note: QIPT does not need to raise funds for working capital; only for some medium to large acquisitions).

Together with the earnings release and announcement of this ATM, QIPT made crystal clear they had no intent to use the ATM in the near-term. Instead, management viewed the ATM as another tool in their belt to steward investor funds for accretive acquisitions. In my opinion, management's continued disciplined approach to acquisitions, as well as their demonstrated ability to seamlessly integrate these acquired companies into their business, earned them the benefit of the doubt to use this ATM wisely. Based upon the stock's reaction after the ATM - despite outstanding 2Q23 results - it became apparent the majority of investors disagreed with my way of thinking.

NOTE: May 15 is the date on which QIPT announced the ATM.

After hearing from a multitude of investors, dialoguing with them, and still watching their share price plummet, QIPT made the decision to terminate the ATM program. After all, as noted, they did not need the money near-term; so, cancelling the ATM was not a big deal from that standpoint. The market responded quite favorably to this move, with the stock moving up over 15% the following two trading days.

I think this ATM saga, while painful for both investors and QIPT management, helped clarify a few key points. First, QIPT really did not need or want any money from the ATM now, as I pointed out prior to the termination. Second, QIPT management proved themselves to be trustworthy (again!). I heard from multiple experienced investors who assured me, based on their decades of experience with small cap management teams, that QIPT really was going to use the ATM - "why else would they put it in place?!!!" But, QIPT proved to be true to their word. Finally, QIPT management showed themselves to be sensitive to shareholder feedback. They could have chosen to stubbornly stand on the principle that the ATM was the economically right thing to do; instead, they understand that investor psychology is also important to running a publicly-traded company.

With the ATM issue now resolved, and with a capital raise in the rearview mirror, investors can now focus on the robust organic growth and margin expansion QIPT has been reporting and forecasting.

Earnings Results & Guidance

QIPT's 2Q23 results were ahead of management's guidance. This was due to both revenue and margins being higher than forecasted. At its current pace, QIPT boasts a $232M revenue run rate (a 73% YoY increase!). Moreover, margins expanded significantly, rising 150 basis points over the same quarter in 2022. Management seems to expect this increased margin to hold steady or slightly increase throughout 2023. Consequently, adjusted EBITDA (AEBITDA) moved to $13.1M for the quarter, or an annualized run rate of $52.4M.

Perhaps more importantly from a valuation perspective, QIPT's organic growth is on track to exceed management's guidance for the year. Management expects to see 8-10% organic growth in calendar year 2023. Because of all their acquisitions and internal targets to incentivize their team, QIPT reports organic growth on a sequential, rather than annual, basis in the quarterly reports. In 2Q23, organic growth clocked in at 2.5%, which annualized, is roughly 10.4%, 40 basis points above the high-end of guidance.

In both QIPT's earnings press release and call, management reiterated the business momentum and noted the favorable regulatory environment in which they currently operate. They further highlighted the strong acquisition pipeline and their intent to continue their "tried-and-true" approach of acquiring and integrating smaller companies in the back half of this year. They also pointed to the new national insurance contract signed with Aetna in early April. Not only does this second national contract validate QIPT's increasing scale and presence nationwide, it helps the company bolster its organic growth and broadens its base of potential acquisition targets. In the healthcare space, having these large insurance contracts is a key component to success.

With QIPT having raised funds to provide flexibility for future acquisitions and with the ATM drama in the rearview mirror, QIPT's share price should be free and clear to begin reacting to the company's fundamental results and future acquisitions. As I will discuss in the Valuation section below, that should be good news for shareholders.

Risks

As with any company, QIPT is not without risk. Below, I will highlight the two primary risks I monitor.

Equity raise

I incorrectly thought an equity raise was no longer a risk in my January article, so for that reason alone, I have to place this back on my list. Still, with QIPT having just executed a sizable raise, and with them having terminated the ATM because of the reaction and the fact they do not need money anytime soon, I believe this risk is minimal over the next 12-18 months. Frankly, I would almost certainly personally view any future equity raise as a bullish indicator. Why? Because QIPT raises money not out of need, but rather out of a desire to make accretive acquisitions.

If QIPT can raise money at 6x AEBITDA or higher, then every acquisition they have ever made would be immediately accretive. Normally, with small-to-midsize companies, QIPT acquires for 2-4x AEBITDA, after which that AEBITDA then becomes immediately valued at QIPT's AEBITDA valuation. With the Great Elm acquisition - a larger, more mature company than most of QIPT's acquisitions - QIPT paid 6x AEBITDA, after which that AEBITDA then became quickly valued at QIPT's multiple, which became slightly higher than 6x AEBITDA. In other words, to date, all of QIPT's acquisitions became almost instantaneously accretive to shareholders. Therefore, if QIPT needs to raise money for future acquisitions, it would almost certainly become accretive to shareholders.

Regardless, QIPT has not been quick to raise capital. Prior to April, they had not raised in three years. Moreover, the company continues to express a willingness to take on some more debt. They seem to be more comfortable with taking on that debt in smaller chunks, and also with companies that are more immediately financially accretive than larger companies. Although larger companies offer scale and more immediately stable operations, there is not quite as much "juice to squeeze" out of them from a purely financial perspective. Put differently, many of these smaller acquisitions are for companies with pitiful margins. When QIPT layers on its proprietary technology for re-orders and leverages its growing, national scale, they can quickly bring these smaller players up to their normal, strong margins of 20%+.

All of this to say, even if QIPT were to raise funds, it would almost certainly be bullish. That said, it will be even more bullish if QIPT uses, as it seems they will, debt to leverage their upcoming tuck-in acquisitions.

Integration issues

Because QIPT has shown itself to be adept at integrating acquisitions, including, to date, its largest-ever in Great Elm, I view this risk as being minimal. Still, as an acquisitive business, both investors and management have to be keenly aware of this risk. As I have pointed out for well over a year now, QIPT continues to show discipline and restraint in making acquisitions. In fact, not long ago, QIPT announced a letter of intent to acquire a company, only to later back away from that transaction after looking more closely under the hood. Simply put, QIPT is not afraid to walk away from an acquisition that does not make sense.

To fully appreciate QIPT's approach in this area, one needs to understand QIPT's CEO, Greg Crawford. Mr. Crawford is, first and foremost, an operator. He intuitively understands how the DME business works, and he has proven to be an expert at both identifying and actually integrating companies that are a good fit for his own business. Still, no one is perfect and the possibility exists that Mr. Crawford could make a mistake. But I would certainly not bet on that given his brilliant track record.

Valuation

As noted previously, QIPT is now at a $52.4M AEBITDA run rate, with margins up significantly from last year and the possibility existing that they expand a little higher later this year. The industry norm for valuing companies like QIPT is the EV/AEBITDA valuation multiple. Based on QIPT's increasing margins and annualized double digit organic growth, I believe QIPT could reasonably fetch an 8-10x EV/AEBITDA valuation multiple with a couple more quarters of showing these continued strong results. For those interested, you can refer to my previous article linked in the intro section above that gives some recent comps to justify this EV/AEBITDA valuation multiple (of course, the acquisition of Great Elm, a regional player about ¼ of QIPT's current size at 6x EV/AEBITDA would seem to be an absolute floor in terms of valuation downside).

At 8x EV/AEBITDA, I would currently value QIPT at roughly $9.05/share, representing a 57% return from last week's closing price. At 10x EV/AEBITDA, I would value QIPT at $11.55/share, a 100%+ increase from last week's closing price. It should be noted, these prices are based on past earnings reports and do not reflect the expected accretive acquisitions and continued double digit organic growth. When factoring those into the equation, I think QIPT can continue to grow beyond these prices I am currently highlighting.

Conclusion

QIPT came out of the gate to start the year strong before faltering after an unexpected capital raise and a now-terminated ATM program. With those two issues now in the rearview mirror, investors should start to focus on QIPT's increasingly strong financial results. With a couple more quarters of demonstrated annualized double digit organic growth, an accretive tuck-in acquisition or two, and sustained AEBITDA margins above 22%, I believe QIPT's valuation multiple could expand to a level more comparable with industry leaders. If so, QIPT investors could see returns in the 55-100% range over the next 12 months.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of QIPT either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.