CareTrust REIT: Opportunistic Capital Structure At The Right Moment

Summary

- CareTrust REIT has a strong balance sheet and a well-structured debt profile, allowing it to take advantage of depressed property prices in the senior housing sector.

- CTRE's debt to EBITDA ratio is significantly lower than the sector average, and its debt financing structure allows for opportunistic acquisitions and aggressive pricing.

- The company's current valuation does not fully reflect its growth potential and strong financial position, making it an attractive investment opportunity.

Hispanolistic/E+ via Getty Images

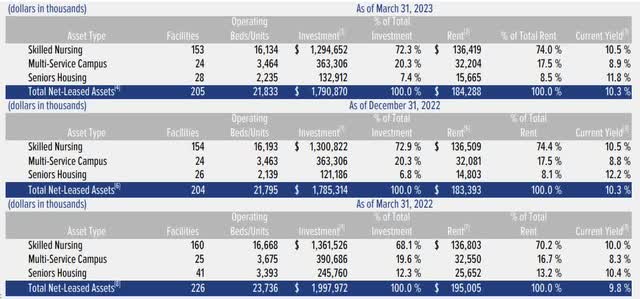

CareTrust REIT (NYSE:CTRE) is a senior housing and healthcare REIT operating across 24 states with a portfolio of 205 net-lease properties. As of Q1, 2023, CTRE had a roster of 18 operators, where the top ten accounted for ~89% of leases.

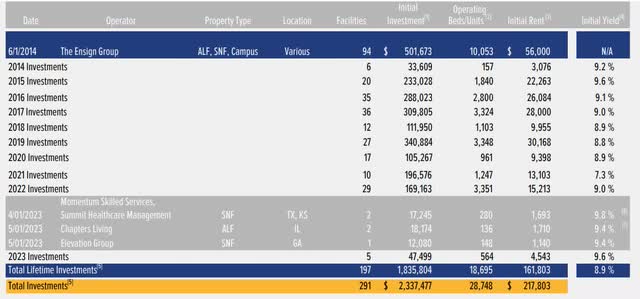

Since the IPO in 2014, the Company has made rather accretive M&A moves by growing its portfolio from ~$0.5 billion to more than $1.8 billion in 2023. The average yield of these investments (annualized rent as of the date of acquisition divided by total investment) stands at juicy 8.9% level.

CTRE has also shown that it possess great management skills and the right expertise to enhance the asset quality even further. In trailing twelve month period, the portfolio yield has increased from 9.8% to 10.3% mainly due to an uptick in rents and portfolio optimization. The current total portfolio yield of 10.3% is by ~ 140 basis points higher than compared to the average initial yield (i.e., when properties were purchased).

The portfolio optimization did not only bring the portfolio yield higher, but it also allowed to strengthen the underlying cash flows. Namely, by divesting close to 20 properties in the past year, CTRE successfully eliminated the presence of overly risky operators in its portfolio.

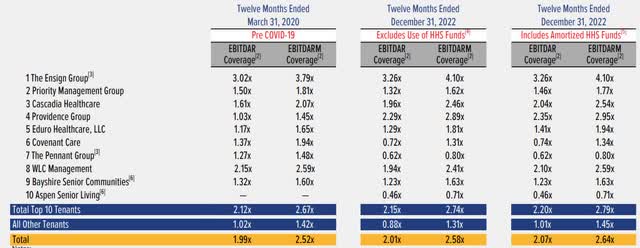

As it can be seen in the table above, the average EBITDAR coverage metric has improved. What is even more noteworthy is the fact that the financial health of CTRE's operators is at greater position than in the pre COVID-19 era.

The thesis

In my opinion, CTRE is well-positioned to take advantage of the depressed property prices in the senior housing sector thereby boosting the underlying FFO without making sacrifices on the financial risk front.

Fortress balance sheet

CTRE carries one of the strongest balance sheets in the sector (among other senior housing publicly traded equity REITs). CTRE's debt to EBITDA stands at 5.2x, which compared to the sector average of 10.5x can be deemed extremely safe. The same applies to the debt ratio - 27% vs 43%.

Furthermore, if we incorporate the presence of cash in the CTRE's debt profile, the net debt to EBITDA lands at just 3.8x.

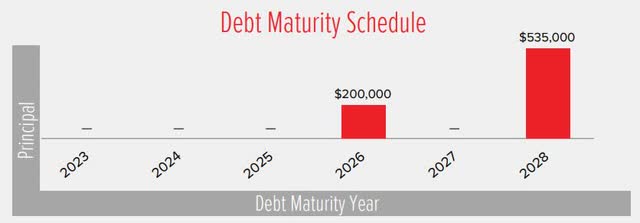

At the same time, the structure of debt financing is rather favourable allowing CTRE to not worry about major refinancings until 2026.

In fact, almost 75% of the total outstanding debt has no refinancing risk until 2028. Plus, majority of the 2028 obligations are based on fixed rate at ~3.8% allowing CTRE not only to act opportunistically in the foreseeable future, but also to be more aggressive on the pricing of new acquisitions.

CTRE already reaping the benefits of strong capital structure

On June 2, 2023, CTRE announced that it has signed a purchase agreement acquiring a 105-unit, two-facility memory care portfolio with facilities located in Ohio and Michigan.

The purchase price was ~ $21 million with an annual base rent of ~$1.8 million, resulting in an initial yield of 8.5% (backed with 15-year master lease agreement).

The investment was funded by a combination of cash and proceeds stemming from the revolving credit facility (priced at 5.9%). This should warrant a direct boost to the FFO.

Favourable entry point

If we zoom back and take a look on how CTRE has performed since the FED started to aggressively combat the inflation and compare CTRE's performance to the broader REIT market, the picture seems quite attractive.

The same conclusion applies if we look at CTRE's share price movement since the outbreak of COVID-19. Currently, CTRE trades at about the same level before we entered the pandemic period.

From the valuations perspective (P/FFO), CTRE trades at a very minor premium to the sector - 9%. And here we can notice a significant discrepancy between the state of fundamentals and pricing.

As indicated above, CTRE has considerably stronger capital structure than that of its peer average, and has effectively no material exposure to financial risk up until 2028. The combination of overall pessimism in the commercial real estate space and robust balance sheet allows the Company to devise accretive M&A tactics to stimulate abnormal FFO growth. This we can already see happening by looking at how CTRE has recently rotated its portfolio and acquired more high-yielding real estate.

Now, given the above, a premium of 9% does not seem justified.

In closing

In my view, CTRE is true diamond in the rough. The overall CRE space is facing serious headwinds due to surging interest costs and in some instances (e.g., office) unfavourable secular dynamics that lead to an unexpected oversupply. Also the healthcare REIT sector is exposed to some idiosyncratic risks that create challenging environment for the healthcare operators to maintain profitability and financial health.

To weather this storm, a well-structured debt profile in conjunction with fortress balance sheet is a must. In the CTRE's case, the state of balance sheet is so strong that it provides the luxury for the Company to make very profitable deals by buying facilities from other real estate owners, who have to de-leverage their capital structure to maintain their covenants. The healthy FFO payout ratio of 80% (for sector average it is 89%) also comes in handy to fund new investments in a sustainable manner.

I think the current valuation does not reflect this potential growth aspect and certainly does not fully take into account the state of CTRE's balance sheet.

Finally, CTRE, in my humble opinion, should deliver strong returns via new property acquisitions and at the same time provide stability (both on the share price and 5.5% dividend) due to no refinancing risk in the foreseeable future.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.