Eagle Point Credit: 19% Yield, Monthly Payer, And Alternatives

Summary

- ECC's regular yield is 16.54%, and its monthly supplemental payouts add 2.36%.

- It also has 2 preferred issues and 3 Notes with attractive yields and good dividend coverage.

- This article looks at valuations and performance for the common stock and also at the comparative yields for all of ECC's alternative income vehicles.

- Looking for more investing ideas like this one? Get them exclusively at Hidden Dividend Stocks Plus. Learn More »

floridastock/iStock via Getty Images

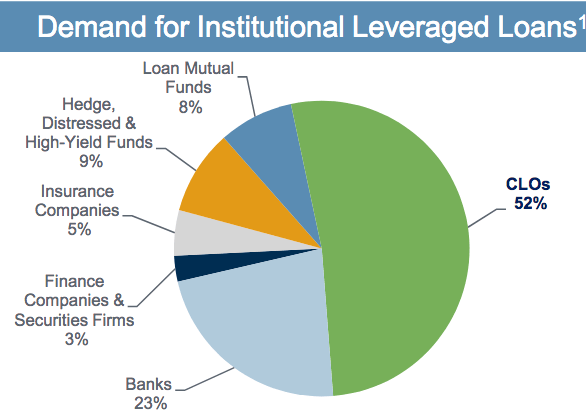

Does your portfolio have exposure to CLO-related investment vehicles? CLO's, Collateralized Loan Obligations, are securitizations of a portfolio of Senior Secured Loans. Funds like Eagle Point Credit Co LLC (NYSE:ECC) invest in CLO's. The CLO market is the largest source of capital for the U.S. senior secured loan market.

From 1992 through 2022, the Credit Suisse Leveraged Loan Index generated positive total returns in 28 of the 31 full calendar years. with an average annualized return of 5.5%.

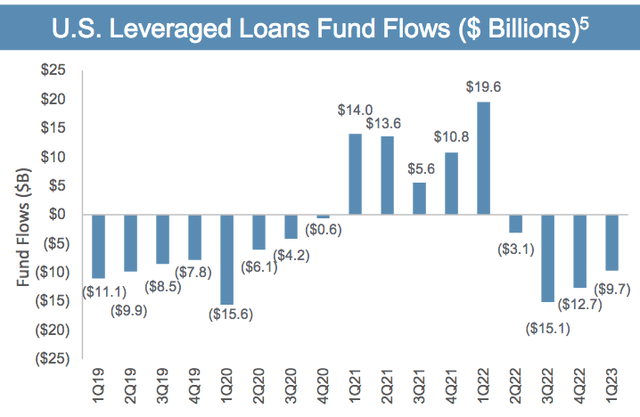

While the US Leveraged Loan market fund flows turned negative in the past 4 quarters...

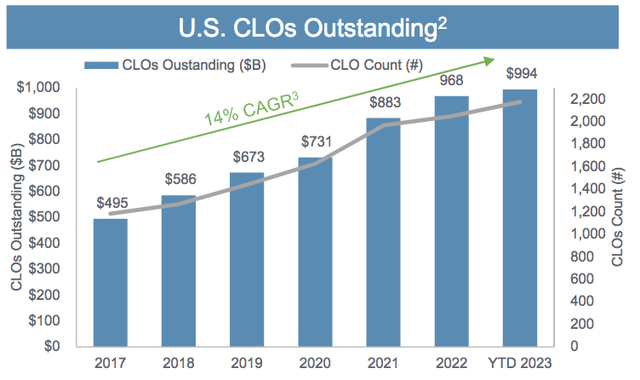

...US CLO's continued to rise. They've posted 14% growth since 2017:

CLO's dominate the demand for Institutional Leveraged Loans, with a 52% share, followed by Banks, whose share increased from 17% to 23% in 2023. Various types of funds, are at 8 - 9%:

ECC site

Fund Profile:

Eagle Point is a closed ended fund, a CEF, launched and managed by Eagle Point Credit Management LLC. It is focused on CLO securities and related investments (as well as other income-oriented investments), and each member of the senior investment team is a CLO industry specialist who has been directly involved in the CLO market for the majority of his career.

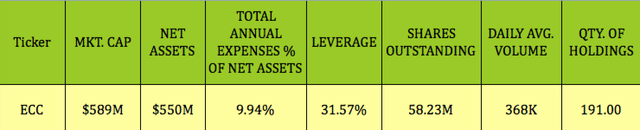

ECC had 191 holdings with 1860 unique underlying Loan Obligors, as of 4/30/23. Leverage was 31.57%, down from 33.74% at 9/30/22; and the expense ratio was 9.94%, vs. 9.71% at 9/30/22. Daily average volume decreased from 427K to 368K.

Common Dividend:

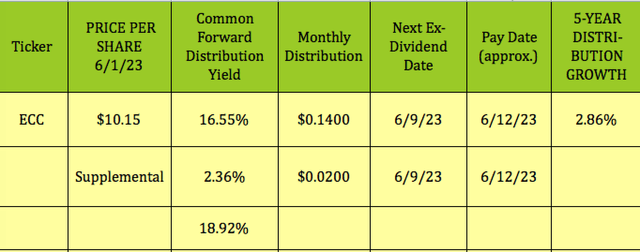

Management hiked the monthly distribution from $.12 to $.14 in April 2022, and began adding $.02 supplemental payouts in April 2023.

At its 6/1/23 closing price of $10.15, ECC's base dividend yield was a whopping 16.55%, while its $.02 supplemental distribution adds another 2.36%, for a total yield of 18.92%.

Management has already declared the same $.14 + $.02/share payout rate for July through September 2023.

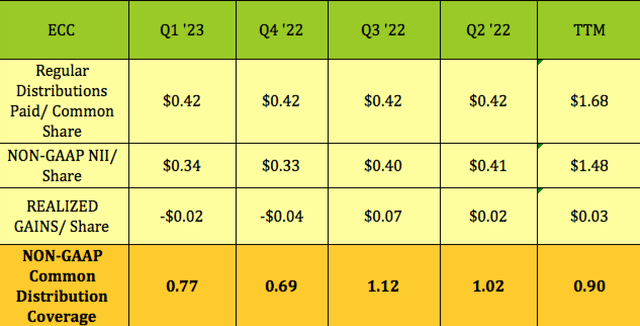

While that super high yield is impressive, ECC's NII/common distribution coverage isn't. Except for Q3 and Q2 2022, when coverage was 1.12X and 1.02X, common distribution coverage has been sub-par in the last 2 quarters - it was .77X in Q1 '23, and .69X in Q4 '22.

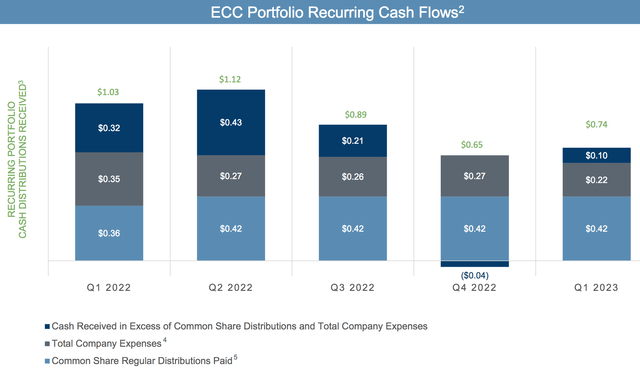

However, looking at the distribution coverage on a recurring cash flow basis tells a different story.

In Q1 '23, ECC had $.10/share in recurring cash flow over and above total expenses and common distributions, giving it a Cash Available For Distribution, CAFD, coverage factor of ~1.24X, ($.52/$.42). CAFD distribution coverage was sub-par in Q4 '22, at .90X, but much stronger in Q3 and Q2 '22, at 1.5X and 2.02X, respectively.

Alternative Dividends/Interest:

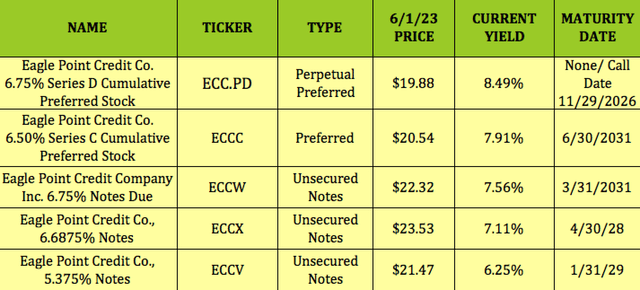

ECC has a mix of 2 preferred issues and 3 unsecured Notes, all with attractive yields. The Eagle Point Credit Co. 6.75% Series D Cumulative Preferred Stock (ECC.PD) is the smallest issue, with ~$27M in principal outstanding, while the 2029 Unsecured Notes (ECCV) are the largest, at ~$93M.

At their 6/1/23 prices, ECC.PD had the highest yield, at 8.49%, followed by Eagle Point Credit Co. 6.50% Series C Cumulative Preferred Stock (ECCC), which has a 6/30/31 maturity date, at 7.91%.

The 3 unsecured notes yield 6.25% for ECCV, 7.11% for ECCX, and 7.56% for ECCW, and are all below their $25.00 par values:

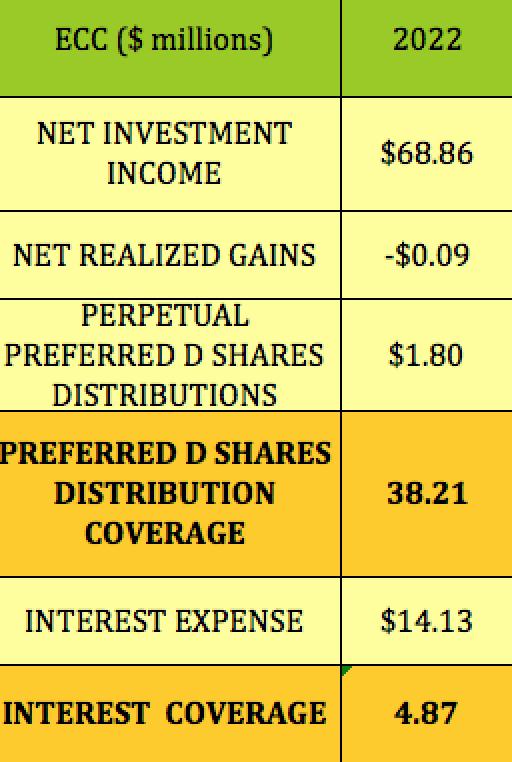

All but ECC.PD are calculated as interest expenses. ECC had strong NII/Interest coverage of 4.87X in 2022. With the ECC.PD distributions being just $1.8M in 2022, that coverage factor was a massive 38.21X:

Hidden Dividend Stocks Plus

Holdings:

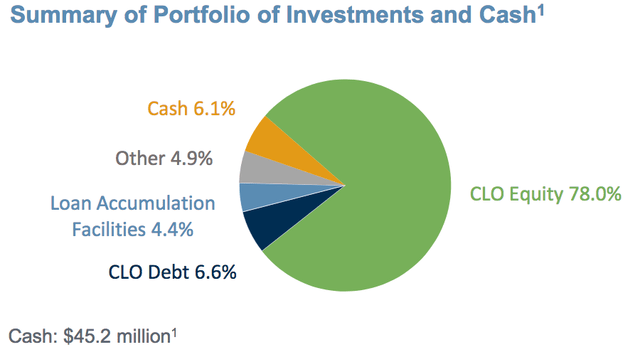

CLO Equity forms 78% of ECC's portfolio, followed by 6.6% in CLO Debt, 6.1% in Cash, and 4.4% in Loan Facilities:

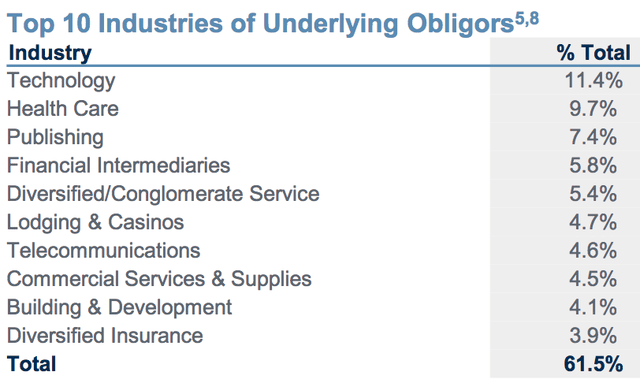

Tech remains the top industry holding, up .6%, at 11.4%, followed by Health Care, steady at 9.7%, and Publishing at 7.4%. The entire top 10 industry holdings form 61.5% of the portfolio:

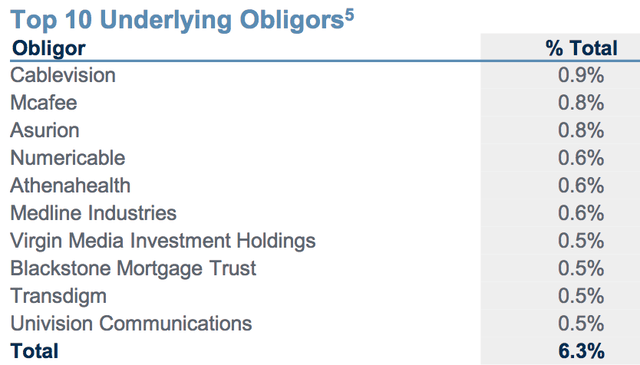

The top 10 obligors list includes many well-known names, such as Cablevision, McAfee, and Blackstone, and only amounts to 6.3% of the portfolio:

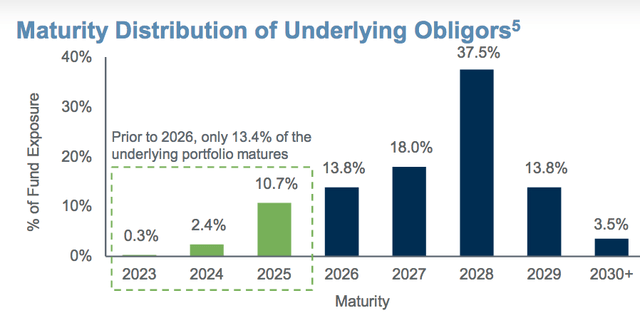

86.6% of these holdings don't mature until after 2025, with 37.5% maturing in 2028.

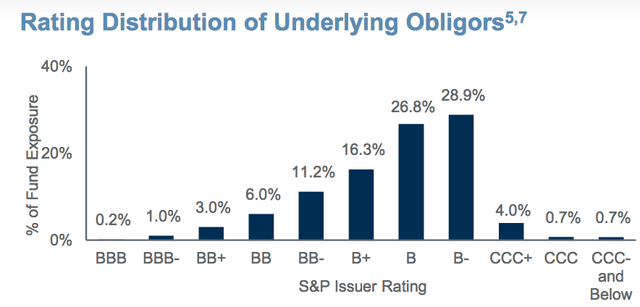

~73% of the holdings are rated non-investment grade:

Performance:

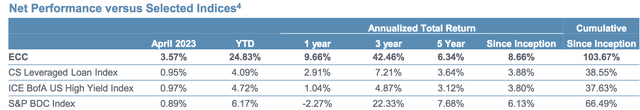

Since its inception in October 2014, ECC has returned 8.66%, besting the S&P BDC index's 6.13% return, the CS Leveraged Loan Index, and the ICE US High Yield Index.

It has also beaten them by wide margins over the past 1, 3, and 5-year periods, as of 4/30/23; and is outperforming so far in 2023.

Valuations:

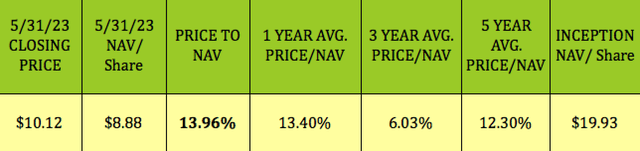

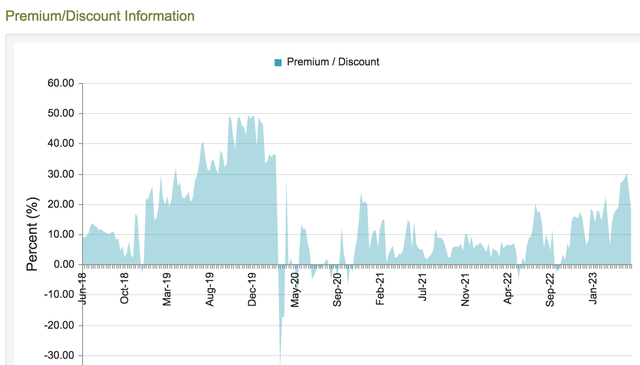

Since NAV/Share is calculated at the end of each trading day, you have to look at the most recent closing values to determine the current NAV discount or premium. Buying CEF's like ECC at a deeper discount than their historical average discounts/premiums can be a useful strategy, due to mean reversion.

So, with all of this outperformance by ECC, it's not surprising to see it selling at a ~14% premium to NAV/Share. That's slightly higher than its 1-year average, but much than its 3-year average of 6%, and its 5-year 12.3% average:

As noted above, ECC tends to sell at a premium to NAV.

The best time to buy it is when there's a panic, such as the March-April 2020 COVID pullback, when ECC sold for a big -20% to -30% discount. It also sold for a slight discount in the fall of 2022.

Parting Thoughts:

We don't advise buying ECC at its current high premium, but if you have a long term horizon, the ECC.PD preferred shares are selling at a 20% discount to their $25.00 call value. Although they have no maturity date, their call date is in 2026 - there's a chance that ECC may redeem them then.

The other preferred, ECCC, doesn't mature until 2031, but is selling at an 18% discount to its $25.00 call value.

The 3 Notes are also selling at discounts, with maturities running between 2028 and 2031.

All tables furnished by Hidden Dividend Stocks Plus, unless otherwise noted.

Our Marketplace service, Hidden Dividend Stocks Plus, focuses on undercovered, undervalued income vehicles, and special high yield situations.

We scour the US and world markets to find solid income opportunities with dividend yields ranging from 6% to 12%-plus, backed by strong earnings.

We publish exclusive articles each week with investing ideas for the HDS+ site that you won't see anywhere else.

Our portfolio's average yield is over 10%. Find out now how you can take advantage of that.

This article was written by

Robert Hauver, MBA, was VP of Finance for an industry-leading corporation for 18 years, and publishes SA articles under the name DoubleDividendStocks. TipRanks rates DoubleDividendStocks in the Top 25 of all financial bloggers, and Seeking Alpha rates us in the Top 5 of several categories, including Dividend Ideas, Basic Materials, and Utilities.

"Hidden Dividend Stocks Plus", a Seeking Alpha Marketplace service, which focuses on undercovered and undervalued income vehicles. HDS+ scours the world's markets to find solid income opportunities with dividend yields ranging from 5% to 10%-plus, backed by strong earnings.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Short position through short-selling of the stock, or purchase of put options or similar derivatives in ECC.PD over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Disclaimer: This article was written for informational purposes only, and is not intended as personal investment advice. Please practice due diligence before investing in any investment vehicle mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.