The Global Pace Of Interest Rate Hikes

Summary

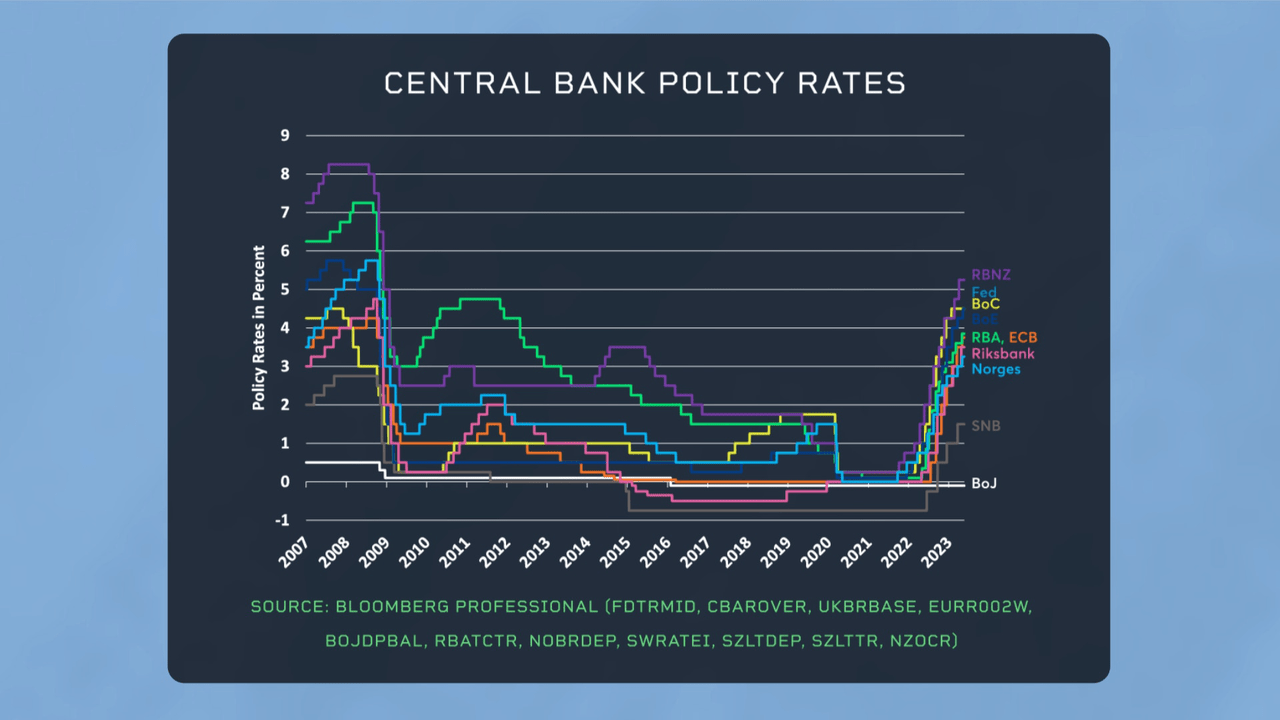

- Central banks have been raising rates globally, but the extent of rate increases varies significantly between countries.

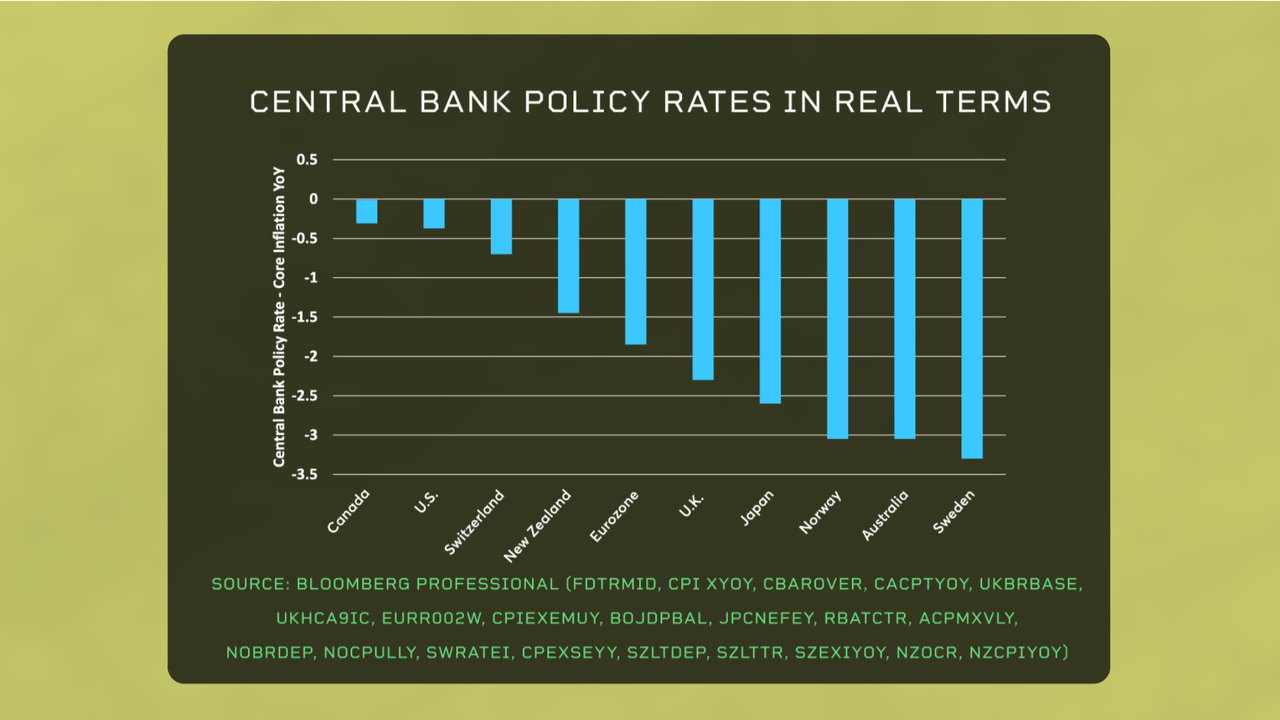

- In highly developed economies, central bank rates remain 1.5% to 3% below the rate of core inflation.

- The global trend toward higher rates masks the strong divergences in how far central banks are willing to go to tackle inflation.

Boy Wirat/iStock via Getty Images

By Erik Norland

The most marked market trend of the past 12 months has been the sharp global rise in central bank rates. But how tight is monetary policy really?

While most central banks outside of China and Japan have been raising rates, the extent to which they have increased rates varies a great deal from one country to another.

In Canada and the United States, for example, central banks have taken rates up to roughly the level of core inflation. By contrast, in most other highly developed economies, central bank rates remain anywhere from 1.5% to 3% below the rate of core inflation.

Some countries, like Japan and Switzerland, might like it this way since inflation has finally, after many years of being too low, come up to their central banks' target levels. But central banks in places like the United Kingdom, Australia, and Sweden might be afraid of the political and economic consequences of tightening policy further. All three of these countries have high real estate prices, and a large portion of the population is on variable rate mortgage loans. If these central banks keep raising rates, they could provoke a crash in the real estate market which could, in turn, impair bank balance sheets (as happened in places like the U.S., Spain, Ireland, and Japan in past decades). As such, the global trend toward higher rates masks the strong divergences in how far central banks are willing to go to tackle inflation.

Editor's Note: The summary bullets for this article were chosen by Seeking Alpha editors.

This article was written by