Brandywine Realty Trust: The Valuation Has Become Dirt Cheap

Summary

- Brandywine Realty Trust is a smaller REIT with a focus on the Greater Philadelphia area and Austin, offering potential for deep market understanding and good local relationships.

- Despite struggling with occupancy, BDN has a solid balance sheet, a well-covered dividend yielding over 20%, and a stock price trading at just 3x FFO, representing a potential turnaround value play.

- I rate BDN as a BUY due to its strong position in the Philadelphia market and the potential for triple-digit upside once the commercial real estate market recovers.

Klaus Vedfelt/DigitalVision via Getty Images

It’s no secret that the commercial real estate market and especially office has been hit hard over the past few years. First by Covid and the work from home trend which emerged and more recently by high interest rates and fear of an economic slowdown. As a result of these events, office REITs have dropped by 60-80%. I’ve already covered some blue-chip office landlords which I believe are well positioned to not only survive this madness but post significant gains on the other side. My main argument for investing was the quality and good location of properties as well as some of the cheapest valuations we’ve had since the Great Financial Crisis. Well today I want to look at Brandywine Realty Trust (NYSE:BDN) which is a smaller REIT, but one that has become so cheap, I had to check it out.

BDN owns about 13 mil. sft of office space primarily located in the Greater Philadelphia area (75%) and Austin (19%), with a small exposure to Washington, D.C. A single city focus has some risks, but also presents opportunities as it allows the company to really have a deep understanding for the market and form a good quality relationship with their local partner. This is not something that’s possible with properties scattered across the whole country. Not only that but Philadelphia is actually considered one of the main hubs for Life Sciences, which is a sector that BDN has been leaning into with plans to make it up to 20% of their portfolio (though it’s at just 4% today). The rest of their tenants come from traditional office sectors such as Finance, Legal, and Business Services. The mix is spread across these traditional sectors and nothing really stands out.

What really matters for a REIT like this one is their occupancy. As of the end of Q1, it stood at 89% which was down from 89.8% last quarter. For year-end management target is 90-91% which is likely achievable with 180,000 sft already locked in forward lease commencements and relatively low lease expirations until the end of the year. While the company is struggling a bit with occupancy, it is able to raise its rents as same store NOI increased by 2.2% in Q1 2023 on a GAAP basis and 3.6% on a cash basis. Q1 FFO per share totaled $0.29. This is still very good when you consider that their current dividend stands at $0.19 per share. This makes the dividend quite well covered with a payout ratio of about 65%, which is great considering the dividend currently yields over 20%! That’s not to say that it won’t get cut, it probably will and it makes sense for the company to preserve some cash. But remember BDN is a REIT and REITs by law have to pay out 90% of their taxable income. That comes out to roughly 45-50 cents per share a year so even if the company cuts the dividend as much as legally possible, the stock will still yield over 10%.

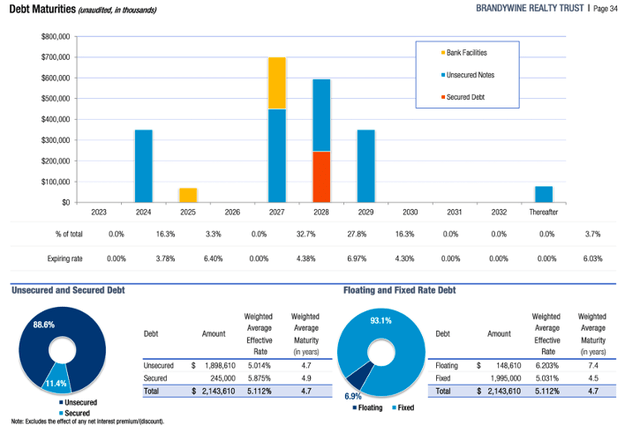

And it’s not like the company is going bankrupt. The balance sheet is solid, they already managed to refinance their debt which was due this year and the next maturity is not until October 2024. Moreover, 93% of their debt is fixed and though their average interest rate is a little bit higher (partly due to this year’s refinancing), 5.1% isn’t that bad when you consider the valuation of this company.

So let’s have a look at it, because this is where things get interesting. Regardless of operational results which really haven’t been that bad at all and a continually covered dividend which the management has reaffirmed for the time being, the stock price has absolutely plummeted and now trades at just 3x FFO. This is about a third of where it has traded historically as the historical average stands at 9.6x FFO. The only other time when the company traded this low was in 2009 when the valuation reached 1x FFO. When compared to peers such as City Office REIT (CIO) which I’ve also covered, BDN trades at a very similar level. CIO in particular trades at 3.1x FFO. All of this suggest that the company is fairly priced relative to peers, but majorly discounted vs its own history. Furthermore, as it has better operational metrics and a stronger balance sheet it is a better pick. Other authors have estimated the implied valuation of a square foot of space is just over $200 which is well below replacement costs. This is also confirmed by a really high implied cap rate that stands at roughly 10% which represents over a 500 bps spread over 10-year treasuries, well compensating for some of the risk. This to me confirms that the stock is indeed cheap and it represents a great turn around value play. I see the fair value at least 100% above current prices which would correspond to a still conservative 6x FFO and $400 per sft. I continue to average in slowly, because no one know how low the price will go. We could absolutely get to 1x FFO over the next 12 months is things take a turn for the worst, but on the other side of this madness I see triple digit upside potential which is well worth the wait. Philadelphia is not going anywhere which is why I rate BDN as a BUY.

Of course no investment is without risk and while a lot of risk has already been priced in, the bears argue that occupancy will continue to plummet due to WFH, office buildings in Philadelphia will eventually become empty and will have to be converted to another function such as residential. This of course would be a major blow to BDN’s bottom line. In terms of the dividend, while it is covered for now if it was cut in the future it could also negatively influence the stock price. In general, I don’t think offices are completely doomed and the market is giving us a large margin of safety to offset any modest decline in occupancy that might occur.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of BDN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.