TBIL: Crisis Averted; Upgrade To Buy

Summary

- The Fiscal Responsibility Act of 2023 has suspended the US debt ceiling until January 1, 2025, reducing concerns of a 'technical default' on treasury bills.

- The US Treasury 3 Month Bill ETF is recommended as a buy, offering a convenient way for investors to earn relatively high yields from idle cash.

- In an uncertain macro environment, a 'barbell' approach of investing in large companies and holding excess cash in TBIL may be the best strategy in my view.

All_About_Najmi

In my last article, I downgraded the US Treasury 3 Month Bill ETF (NASDAQ:TBIL) to a hold as I was concerned that a debt ceiling standoff may create a 'technical default' whereby the TBIL ETF may hold treasury bills that mature during a time period when the Treasury Department runs out of money. If that situation were to occur, there could be a delay in the principal repayment on TBIL's holdings, which could wreak havoc with the fund's NAV.

Fortunately, this past weekend, we saw rational heads prevail in Washington and President Biden was able to sign the 'Fiscal Responsibility Act of 2023' into law on June 3rd, two days before the Treasury Department was projected to run out of money.

Fiscal Responsibility Act Of 2023 Details

The Fiscal Responsibility Act of 2023 ("FRA") was the result of a long negotiation between President Biden and Congressional Republicans led by Speaker Kevin McCarthy. The FRA includes provisions to suspend the debt ceiling through January 1, 2025 in exchange for discretionary funding caps for fiscal 2024 and 2025.

While defense spending would continue to grow from $858 billion in FY2023 to $886 billion in FY 2024 and $895 billion in FY 2025, discretionary spending programs will decline from $767 billion in FY2023 to $704 billion in FY 2024 and $711 billion in FY2025.

Furthermore, the bill contained provisions for increased work requirements for the Supplemental Nutrition Assistance Program ("SNAP"), as well as provisions that prohibit President Biden from further extending the suspension of student loan payments.

The Congressional Budget Office ("CBO") estimates that the FRA bill will reduce the budget deficit by $1.5 trillion in the decade to 2033 compared to baseline projections.

Upgrade TBIL To Buy

With the overhang from the debt ceiling lifted, I feel comfortable reinstating my buy recommendation on the TBIL ETF.

Brief Fund Overview

Briefly, for those not familiar with the TBIL ETF, the US Treasury 3 Month Bill ETF is an ETF recently launched by F/m Investments that seek to provide investment results that correspond to the performance of owning 3 Month treasury bills ("T-Bills").

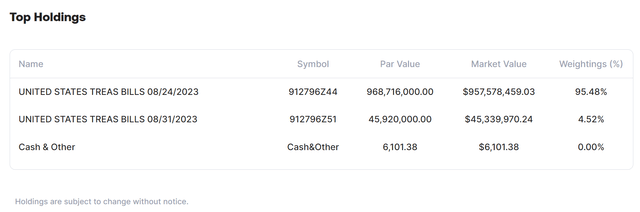

The fund's holdings only comprise of U.S. treasury bills that are rolled every month, so there is virtually zero credit and interest rate risk (Figure 1). The TBIL ETF gives investors a convenient way to earn relatively high yields from their idle 'cash'.

Figure 1 - TBIL ETF holdings (ustreasuryetf.com)

The TBIL ETF currently has a 30-Day SEC yield of 4.9% and its most recent monthly distribution of $0.2092 / share annualizes to 5.0% yield. The TBIL ETF has $970 million in assets and charges a 0.15% net expense ratio.

Cash As A Real Option In An Uncertain World

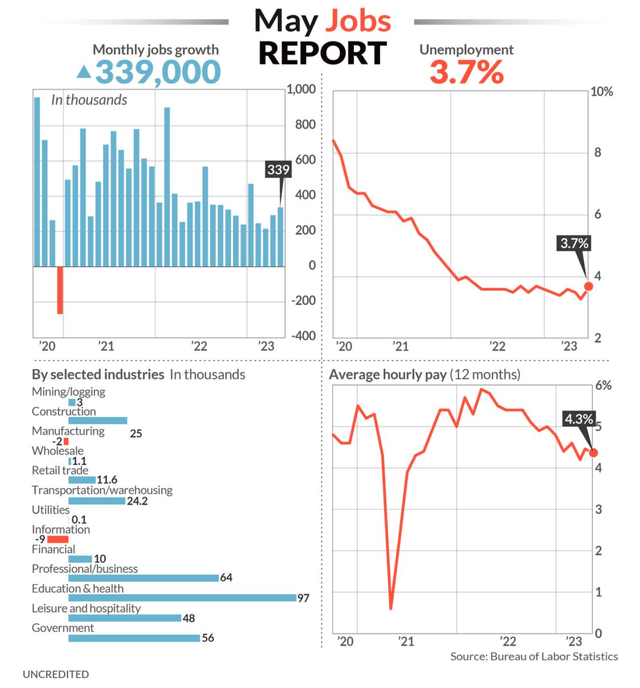

While many economists have been predicting a recession in the U.S. economy since late 2022, the labor market apparently has not gotten the memo and continues to show resiliency. For example, the latest U.S. non-farm jobs report showed the U.S. economy added 339,000 jobs, smashing expectations for a 195,000 gain (Figure 2).

Figure 2 - Labour market remains resilient (marketwatch.com)

For every negative datapoint like the March failure of multiple regional banks due to rising interest rates, there is an equally strong bullish argument like the resilient labour market cited above. To be honest, the current macro environment is one of the toughest to analyze in my 20+ year investment career.

That is why I believe it makes sense to hold a portion of my portfolio in 'cash' securities like the TBIL ETF or the WisdomTree Floating Rate Treasury Fund (USFR), as cash provides investors with a 'real' option.

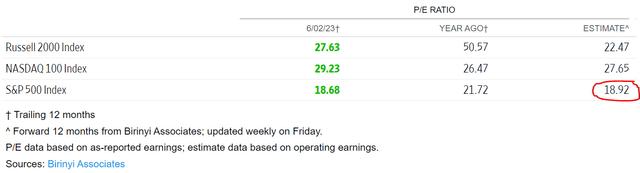

With cash securities like TBIL currently yielding 5.0%, I do not feel compelled to chase stocks, as represented by the S&P 500 Index, currently trading at an 18.9x Fwd P/E ratio (Figure 3).

Figure 3 - S&P 500 is currently trading at a 18.9x Fwd P/E (wsj.com)

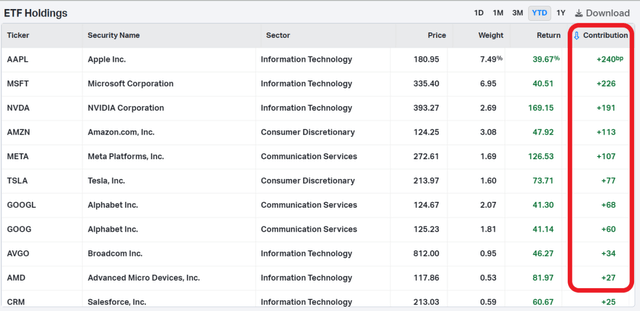

The current equity rally is troublesome, as just 10 stocks account for more than 90% of the S&P 500's 12.3% YTD rally (Figure 4).

Figure 4 - The current equity rally is extremely narrow, as just 10 stocks account for 90% of gains (SPY ETF returns attribution from koyfin.com )

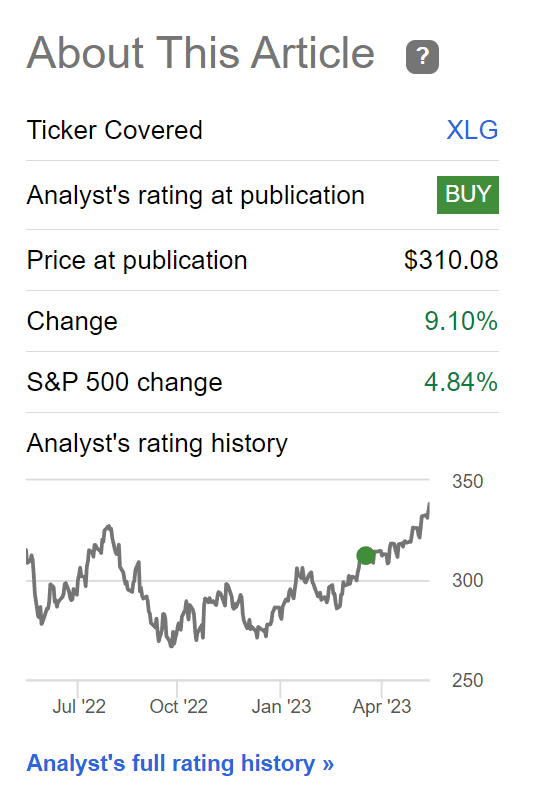

Until we see more signs of broad market participation, I believe a 'barbell' approach where investors own the largest mega-cap stocks via investment funds like the Invesco S&P 500 Top 50 ETF (XLG) and cash may be the best course of action. I recommended the XLG ETF a few months ago and it has performed extremely well compared to the market (Figure 5).

Figure 5 - XLG ETF has outperformed SPY (Seeking Alpha)

How Long Will High Treasury Yields Last?

One concern with regards to floating rate treasury funds like the TBIL ETF is how long will the current high short-term interest rate environment last? Investors scarred by years of zero interest rate policy ("ZIRP") are constantly looking over their shoulders, expecting interest rates to decline imminently.

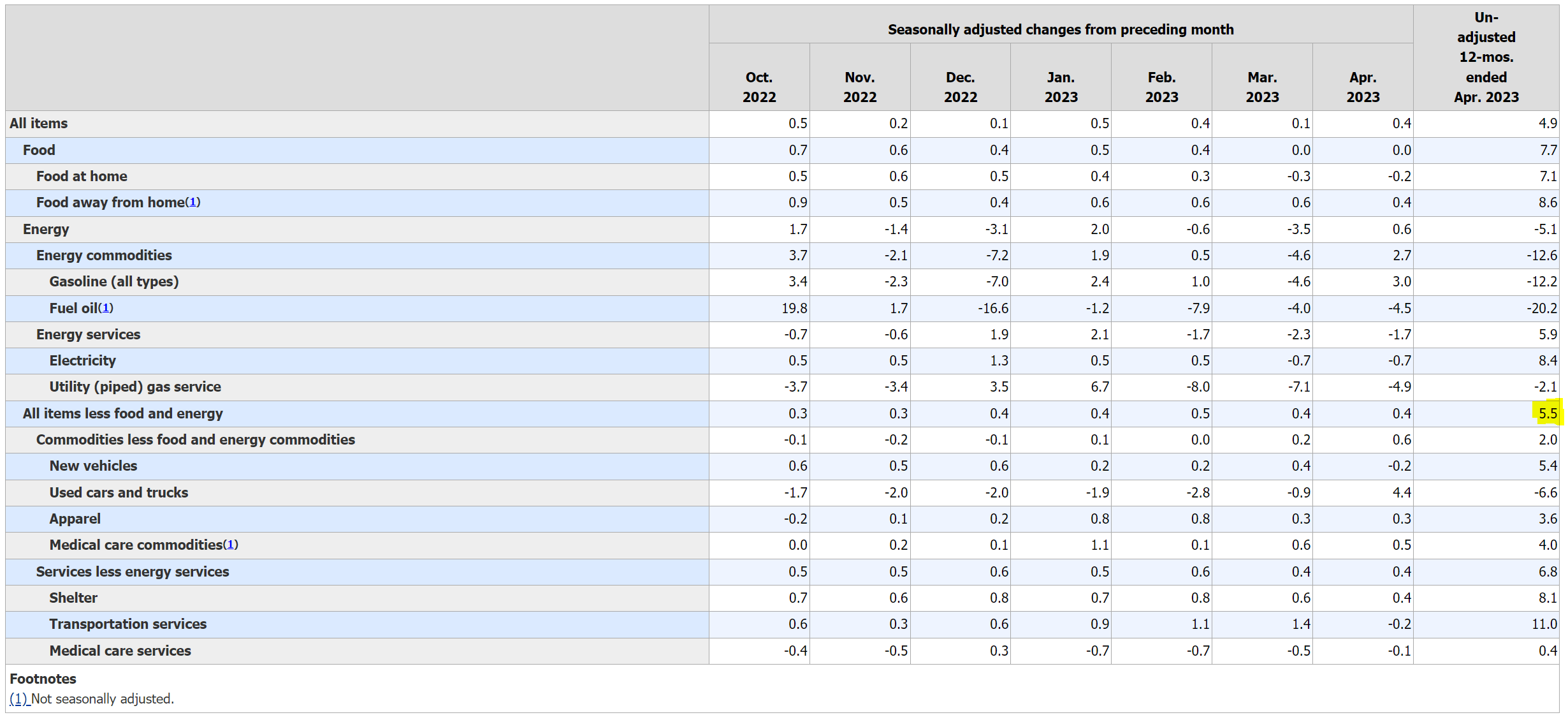

I believe we should take the Federal Reserve at their word and expect high short-term interest rates to last for many quarters. In fact, with core CPI inflation still increasing at a 5.5% YoY rate, I believe the Fed will not be able to justify lowering interest rates anytime soon (Figure 6).

Figure 6 - Core CPI inflation still rising at 5.5% YoY rate (BLS)

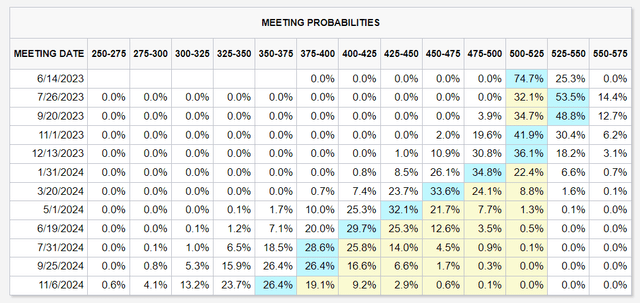

If the Fed were to lower interest rates in the coming months, as fixed-income traders are currently predicting, that will most likely be in response to a 'hard landing' recession (Figure 7). In that scenario, holding 'cash' like TBIL will likely give investors peace of mind.

Figure 7 - Traders expect the Fed to start rate cuts in coming months (CME)

Conclusion

With the debt ceiling crisis averted, I am reinstating my buy recommendation on the TBIL ETF. I believe treasury funds like the TBIL ETF, yielding 5%, deserve a place in investors' portfolios in an uncertain macro environment.

Given the narrowness of the current equity rally, a 'barbell' approach of buying the largest companies while holding excess cash may be the best equity strategy.

Furthermore, if treasury yields were to decline in the coming months as traders predict, that will most likely be due to a 'hard landing' recession, in which case, excess cash holdings like the TBIL ETF should protect investors' capital.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of XLG, TBIL, USFR either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.