eXp World Holdings: Good Business Model But Extremely Expensive

Summary

- EXPI runs a cloud-based online brokerage.

- This leaves more commission for agents and reduces the company's overhead.

- The business model is very good and has tremendous growth potential.

- Still, I cannot reasonably buy its stock at 88x this year's earnings.

fizkes/iStock via Getty Images

eXp World Holdings (NASDAQ:EXPI) is a 100% online real estate brokerage. As such its business model is relatively simple. It hires agents and provides them with a cloud-based solution to help them with training and the sales process via a strong back-office. The model presents itself as a win-win solution compared to a traditional brokerage. This is because the agents get to keep a larger percentage of their commission (90% vs 70% traditionally). The realtor also benefits, because their overhead is significantly lower with to brick-and-mortar branches (no rent, equipment, and less support staff). It also allows the company to expand globally way faster than a traditional brokerage could. The value proposition is very interesting here, making EXPI a technology company more so than a real estate one.

As you can probably tell, there are several key drivers of performance for the company. The first one is their extremely low operating expense on a per agent as well as per transaction basis. This is their main competitive advantage. When compared to more traditional peers, EXPI’s expense is almost negligible ($859 per transaction compared to $1,522 for Real Brokerage, $3,575 for Anywhere, and over $10,000 for Redfin). This allows the company to scale way quicker than competition and reduces risk during market downturns.

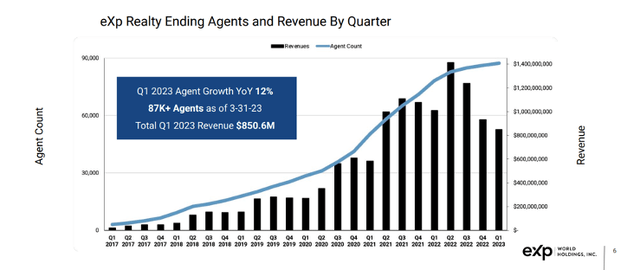

With such low overhear, EXPI really tries to grow their agent count as much as possible, because more agents generally translate into higher revenue and the cost associated with each additional agent is very small. They have a really solid track-record of growing the number of agents, though understandably the growth has slowed in 2022 due to a lot of uncertainty regarding real estate, especially as presented by mainstream media.

As of Q1 2023, the company had over 87,000 agents on their cloud-based service generating quarterly revenue of $850 million. That’s around $10,000 per agent in commission related revenue. Obviously not all agents are equal and EXPI does a really good job of incentivizing the best producing agents with their stock program. The company also offers high quality training programs for their agents.

Looking at the chart below, you also notice that revenue has declined about 16% from the peak in Q2 2022. That’s a significant drop, but not bad when you consider that home sales have dropped by 29% over the same period as outlined in the earnings report. This hardly comes as a surprise in the current high interest rate environment which has significantly slowed the pace of transactions in the real estate market.

But here’s the thing, though obviously not ideal, EXPI doesn’t suffer nearly as much as their competition, because their overhead is extremely low. This means that whenever rates decrease and home sales resume (which they almost definitely will), EXPI should come out ahead of the competition on the other side and continue its growth trajectory.

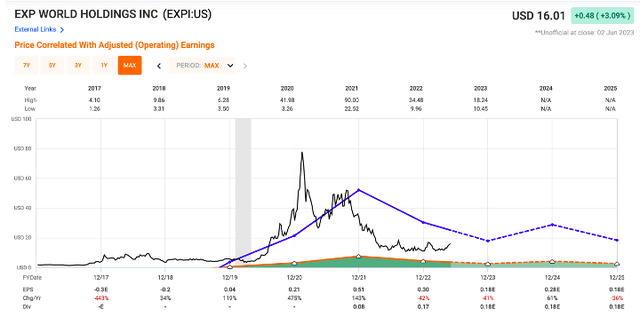

For 2023 management’s main goals are (a) maintaining strong cash flow and balances sheet (as of Q1 the company had NO debt and $123 million in cash), (b) strong cost management to maintain EBITDA profitability, and (c) increasing operational efficiencies through technology. Beyond this year, growth is expected to pick up again. The consensus on FAST Graphs is that earnings will fall to $0.18 per share this year but should rebound by 61% to $0.28 per share next year. That’s a really aggressive forecast and I’m not entirely buying it, but I do see some growth when rates stabilize and transactions start happening again.

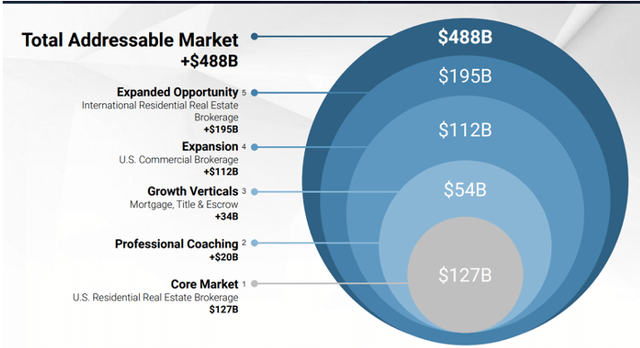

The growth opportunity over the long term is huge, which means that EXPI will have endless growth opportunities if it continues to scale their business model successfully. The US Residential Brokerage market alone is over $100 billion per year. EXPI currently accounts for under 4% of that and aims to increase their market share aggressively over the next years.

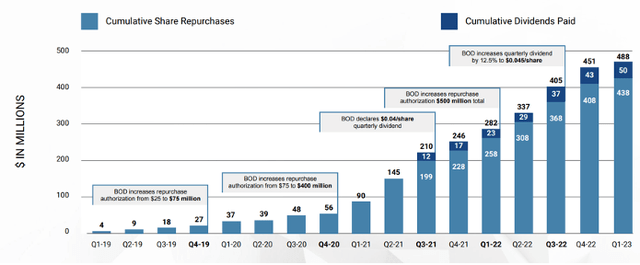

EXPI is a growth play, but they do return wealth to shareholders in two ways. The dividend which yields just above 1% is pretty negligible, but the company repurchases a significant amount of stock each year. In Q1 2023 they continued their repurchase program with $438 Million in repurchases which is a significant part of the $2.5 market capitalization. I always like to see repurchases at low price levels and that’s exactly what EXPI is doing right now.

If you believe that the company will continue to grow its model, then you probably won’t mind paying a forward P/E of 88x (based on 2024 estimates the forward P/E would be 57x). Personally though, I consider myself a value investor so I cannot get behind this kind of multiple, especially in a high interest rate environment where real estate is clearly suffering.

FAST Graphs

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.