Goldilocks Jobs Report And A.I. Boom Aside, I Am Bearish On SPY

Summary

- The A.I. boom and strong jobs report bode well for SPY.

- That said, we think that the A.I. boom is unsustainable, and the market is overvalued.

- We also see too many macro headwinds and geopolitical risks emerging to make SPY an attractive investment at this time.

- Looking for a portfolio of ideas like this one? Members of High Yield Investor get exclusive access to our subscriber-only portfolios. Learn More »

JLGutierrez

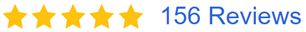

The SPDR S&P 500 Trust ETF (NYSEARCA:SPY) has been on a strong run in recent months, buoyed by the A.I. stock boom and - most recently - a Goldilocks jobs report:

Despite these very positive catalysts for SPY, I am bearish on SPY moving forward and share three reasons why in this article.

#1. The A.I. Stock Boom Is Already More Than Fully Priced In

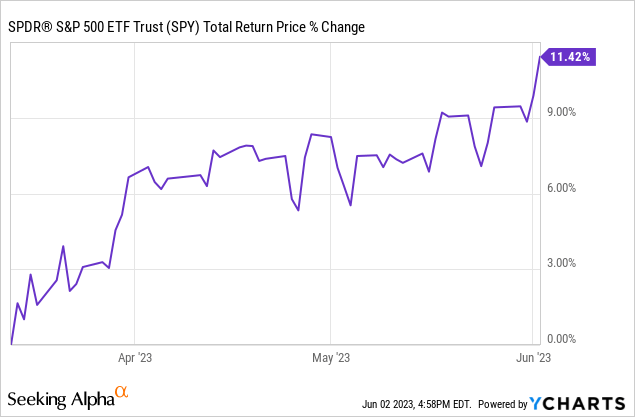

The A.I. stock boom was largely fueled by Nvidia's (NVDA) recent complete blowout of a quarter and guidance, which sent the stock - along with a host of other A.I.-related stocks - soaring higher:

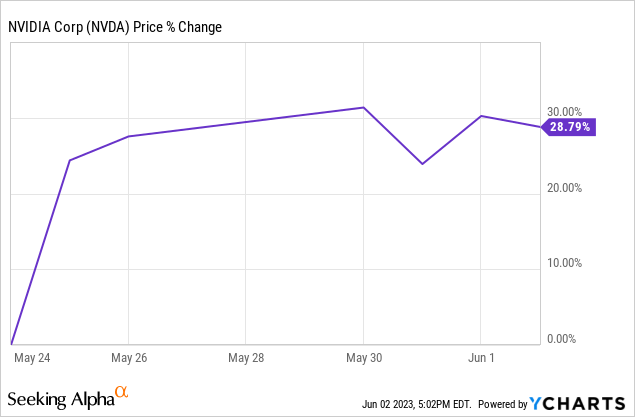

In fact, NVDA is now a member of the elite $1 trillion club and is currently the fifth-largest position in SPY. Moreover, technology stocks - which by far have benefited the most from the A.I. boom - now make up ~29% of SPY's portfolio, meaning that the fund has received a tremendous boost from NVDA's recent strong performance. In fact, ChatGPT's recent emergence and the corresponding increased buzz around A.I. technology has provided a tremendous boost to big tech companies such as Apple (AAPL), Alphabet (GOOG)(GOOGL), Microsoft (MSFT), Meta (META), NVDA, and Tesla (TSLA) this year - all of which are in SPY's top 10 holdings:

As a result, SPY's strong recent performance is entirely attributable to the A.I. fueled tech boom to start 2023. Is this rally sustainable? Perhaps in the short-term, but it is unlikely for the long-term. Each of these stocks currently trades at a valuation premium relative to its five-year average, despite interest rates rising dramatically over that period and forward economic prospects looking quite weak - if not bad - at the moment.

Will A.I. have a transformative impact on civilization? As someone with a master’s degree in computational engineering and who has worked with the artificial intelligence on a highly theoretical level, I firmly believe so. However, I do not think that the current hype surrounding A.I.-related stocks is entirely justified for at least two reasons:

- Just as it was with previous transformative technologies such as the car, the airplane, the computer, and the internet, nobody knows for sure who the long-term winners will be. History has proven this to be a fool's errand. While investing in quality tech companies like those that occupy the top ranks in SPY's current portfolio is not necessarily a bad long-term investing strategy, the current valuations do not make it an asymmetrically positive bet at this point in my view.

- It will take quite some time before A.I. technologies lead to exceptionally large profits. Take, for example, TSLA's self-driving technology efforts. Even assuming that they end up mastering the technology (which I believe they will eventually), it will take years for them to get the necessary regulatory approvals and get their network of robo-taxis rolled out. By then, they may face competition in the space, or at least soon thereafter. When dealing with such speculative subjects, it is very difficult to model future cash flows and - with so much uncertainty about the future direction of interest rates and the global economy at large - it is arguably even more difficult to project the net present value of those far in the future cash flows.

When looking at the current SPY valuation based on several leading market valuation models, the picture is not bright. The market looks overvalued, and it appears unlikely that the A.I. technology boom will be able to sustain its currently rally for any material length of time. Once that rally fizzles out, SPY will likely head down again as investors come to grips with valuation realities.

#2. The Goldilocks Jobs Report Will Not Save The Economy

The latest jobs report was undoubtedly a strong dose of good news for the markets. On the one hand, the latest non-farm payrolls report revealed a higher-than-expected increase of 339,000 jobs in the economy, excluding the volatile agricultural sector. This indicates the that economy is still going strong and is being surprisingly resilient in the face of aggressive interest rate hikes, lingering high inflation, and the fallout from the regional banking crisis of recent months.

On the other hand, fears that such a strong jobs growth number would prompt the Federal Reserve to continue hiking interest rates in order to combat inflation were offset by other key numbers that came out in the jobs report. First of all, despite flat labor participation rate numbers, the unemployment rate rose by 30 basis points to 3.7%. Moreover, annual wage growth decelerated to 4.3% from 4.4% previously.

What these data points seem to indicate is that the Federal Reserve - despite all of the turbulence around them - may just pull off a soft landing. Maybe inflation is beginning to fall meaningfully even as the economy continues to chug along with strong job creation numbers and slow, but steady, GDP growth. Perhaps the Federal Reserve won't have to raise rates any more after all and we will be spared a recession: the best of both worlds.

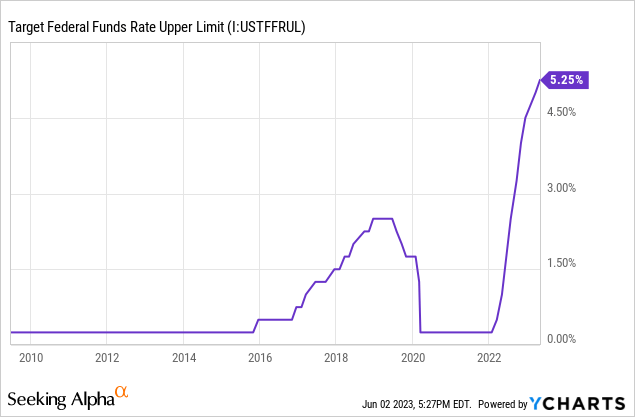

While this sounds great, I fear that things are unlikely to play out that way. First and foremost, there is just too much froth in the economy that needs to be cleared out, thanks to the Federal Reserve keeping interest rates near zero for so long and then suddenly hiking them so aggressively:

The biggest issue here is that the corporate, household, government, and real estate sectors have all accumulated so much debt - and executed so much long-term economic planning - based on the assumption that interest rates would remain in a low-ish band for a prolonged period of time.

As a result, if the Federal Reserve has to keep interest rates at elevated levels for the next year or two, we are in for a world of hurt. Interest on the national debt will balloon to levels that will put an incredible strain on the political environment in the U.S. and by extension the Federal Reserve's resolve to crush inflation. Meanwhile, roughly $1.5 trillion in commercial real estate debt is set to mature by the end of 2025. This debt was almost entirely underwritten during a period of economic prosperity and much lower interest rates.

As a result, there is a high probability that a meaningful portion of this debt will be defaulted on, which will likely result in another hit to the banking system (which holds a high percentage of real estate debt), which could then reverberate throughout the economy, ultimately hitting SPY quite hard. After all, nearly 15% of SPY's holdings are in the financials and real estate sectors.

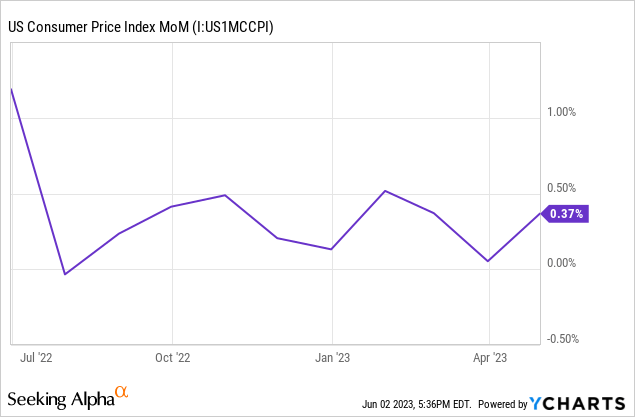

The only thing that can save the economy at this point is if inflation falls fast enough that the Federal Reserve will be able to slash interest rates meaningfully over the next twelve months. However, this is unlikely given that inflation has remained persistently high so far this year, and it appears unclear how it will fall at an accelerated pace in the coming six to twelve months:

Yes, it has been falling on a year-over-year basis, but the month-over-month inflation numbers have remained range-bound over the past year and in fact have actually increased over the past few months:

#3. There Are Too Many Serious Potential Negative Catalysts

In addition to the inflation and interest rate problem which will lead to the demise of the economy and the SPY by extension if not resolved in the next 6–12 months, there are simply too many serious potential negative catalysts that could materialize in the very near future.

Beyond the potential for any number of bubbles to burst and economic crises to emerge from the effect of such a stunningly rapid rise in interest rates, there are several geopolitical challenges emerging. First and foremost is the threat of global war and depression should China decide to invade Taiwan and/or should Russia decide to go nuclear in its war with Ukraine. While some may view these as unlikely events, the threat is real enough that it must be accounted for when determining the risks to an investment thesis. It goes without saying that SPY would crash in the event of either of these scenarios taking place.

Another major risk is the growing threat of war between Israel and Iran, which could lead to a spike in energy prices if it were to break out. Such a scenario would send inflation shooting higher and crush any hopes of the Federal Reserve slashing interest rates.

Last, but not least, is the growing threat to the U.S. Dollar's status as the world's reserve currency, with China, Russia, and Brazil spearheading efforts to create an alternative currency or currencies to unseat the U.S. as the dominant global economic superpower. This too would send SPY into a tailspin while also sending inflation through the roof in the U.S. should it materialize.

Investor Takeaway

While the recent A.I. boom and the strong jobs report were certainly positive developments for the U.S. economy and SPY's outlook, I believe they are not enough to make it attractive for investment. Between the rich valuation of its largest holdings and the fund as a whole, the increasingly daunting debt, interest rate, and inflation picture, and the slew of potential negative geopolitical catalysts emerging, SPY is simply not an attractive investment at the moment. As a result, we rate it a Sell.

If you want full access to our Portfolio and all our current Top Picks, feel free to join us at High Yield Investor for a 2-week free trial

We are the #1-rated high-yield investor community on Seeking Alpha with 1,500+ members on board and a perfect 5/5 rating from 150+ reviews:

You won't be charged a penny during the free trial, so you have nothing to lose and everything to gain.

Start Your 2-Week Free Trial Today!

This article was written by

Samuel Smith is Vice President at Leonberg Capital and manages the High Yield Investor Seeking Alpha Marketplace Service.

Samuel is a Professional Engineer and Project Management Professional by training and holds a B.S. in Civil Engineering and Mathematics from the United States Military Academy at West Point and a Masters in Engineering from Texas A&M with a focus on Computational Engineering and Mathematics. He is a former Army officer, land development project engineer, and lead investment analyst at Sure Dividend.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.