ICAP: 5 Reasons JEPI Did Better And Will Continue To Outperform

Summary

- ICAP has brought a value dimension to covered call ETFs.

- The fund boasts of a big yield that has been maintained since inception.

- The lag vs. its benchmark has been very notable but there are signs that better days might be ahead.

- We compare this to JEPI and tell you why the latter won and will keep winning.

- Looking for option income ideas that focus on capital preservation? I offer this and much more at my exclusive investing ideas service, Conservative Income Portfolio. Learn More »

Gitanna/iStock via Getty Images

The ZIRP (Zero Interest Rate Policy) era did create several new innovative (and in some cases rather destructive) financial products. The idea was to create yield using more exotic methods. If Air Supply was active today, we would probably be singing "Making Income Out Of Nothing At All."

InfraCap Equity Income Fund ETF (NYSEARCA:ICAP) is an actively managed ETF which has also attempted to find the holy grail in this field. We look at what the fund does, why its first year was so poor and where it goes next. We also compare it to one of the most popular funds in this space, JPMorgan Equity Premium Income ETF (NYSEARCA:JEPI).

The Fund

The fund started out right on the cusp of the end of the ZRIP era, December 29, 2021. For those that may be unaware, December 3, 2021 marked the low point in the yield chasing stupidity. Investors were ready to accept 3.16% for a medium duration investment grade bond.

So right away you know, the timing could not be worse off.

The fund aims to generate diversified income via three sources. The first being by focusing on a diversified portfolio of equity securities that pay dividends. The fund also invests in preferred shares where appropriate and this is the second income source. Finally, the fund uses our favorite strategy, covered calls/option income, to enhance returns. It is here that the big similarities to JEPI come up.

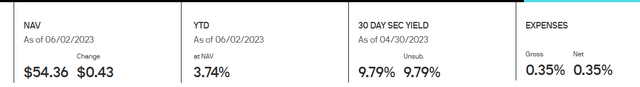

Expenses & Holdings

The fund has a management fee of 0.8% and a gross expense ratio of 1.71%. This is fairly high in an era of virtually zero percent expense ratios. Even taking into account the unique option strategy of the fund, the numbers ring in high. JEPI's expense ratio is a stunning 1.36% lower.

This is a very huge difference and most managers will generally struggle to overcome such a big drag.

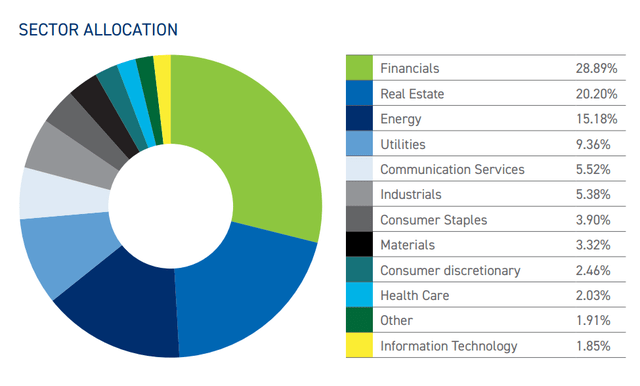

ICAP's holdings are focused rather heavily on financials and real estate sectors. Energy and utilities get a big boost versus S&P 500 index weights as well. For example Real Estate is at 2.5% in the S&P 500 whereas ICAP carries 8 times as much.

This has of course to do with the fact that these sectors have more components that pay large dividends. We also get the lower weighting for information technology which generally has "growth-oriented" companies.

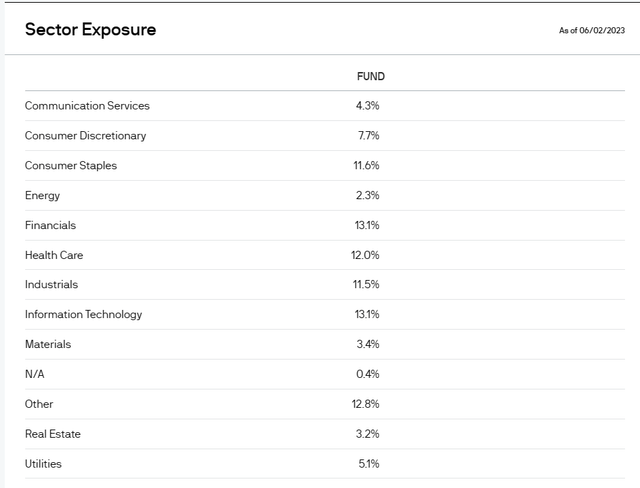

JEPI is also underweight information technology but most of the other sector weights are in line with the S&P 500 (SPY) holdings.

There is some overweighting of consumer staples but the rest are holding the line. While sector weights are similar outside of information technology, JEPI follows a very value conscious methodology.

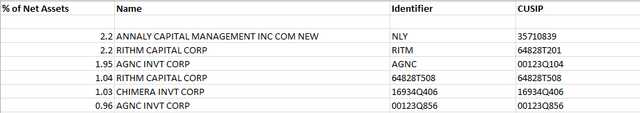

Looking deeper beyond the sector weights, we can see which of ICAP's holdings help explain a lot of the underperformance. ICAP has a pretty heavy weighting to mortgage REITs where it holds common and preferred shares.

As we have pointed out previously, the mortgage REIT common shares remain "return-free-risk" and remain a drag on performance. One other thing to keep in mind is if you are going on a yield chasing exercise and buying everything with a high yield, you will have a big overlap. If you hold mortgage REITs and ICAP, you will get some punishment for that decision in both holdings.

Covered Calls

We love covered calls but most funds tend to use very short dated options which offer very little protection on the downside. This is reflected in ICAP where notional premiums captured are very small. This might enhance yield in the short term but there is a big downside. You can buy a stock at $25 and then sell the $28 call for one month out. If it does not cross $28, you captured the premium. Yea! But if the stock declines to $20 what do you do? Are you selling the $23 call next? Shorter calls keep pushing investors into even harder market timing decisions than traders. You not only need to get the direction correct, you need to get the timing almost perfect.

JEPI uses equity linked notes and these tend to be slightly greater duration than what we see with ICAP. Also, as JEPI is long more "value" and short SPY linked notes, it is following pseudo "long value-short growth" strategy. These characteristics give it a big edge over ICAP.

Performance

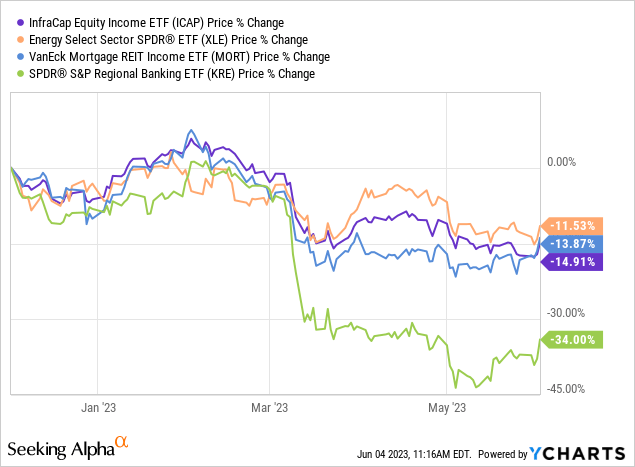

A cursory glance at the performance shows a clear winner from a total return standpoint.

It is interesting here to note that both ICAP and JEPI were beating the S&P till early 2023 and then things fell apart for ICAP. It was around that time that energy, mortgage REITs and the regional banks dived in sync.

ICAP has relatively heavy exposure to these assets versus the SPY and also is leveraged at around 25% of net assets. So the combination of leverage and rapidly declining assets threw the fund into a spin.

JEPI had some above average banking exposure but it sidestepped energy and mortgage REIT landmines in this time frame.

Yields

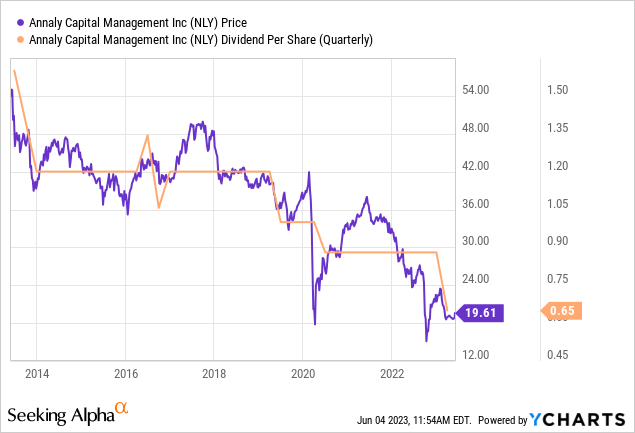

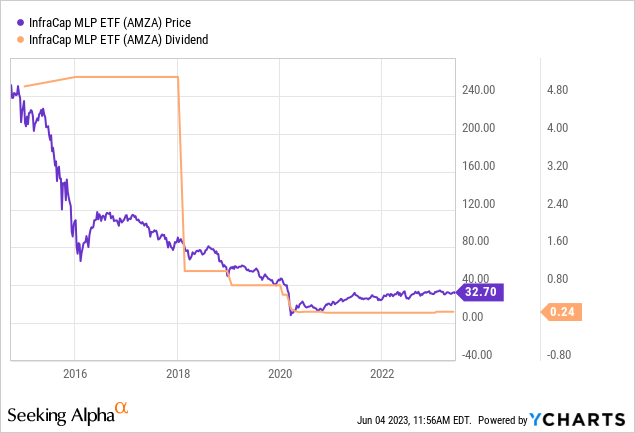

Both funds offer big yields currently and these dwarf the tiny returns you get from SPY. Yields are of course ultimately dependent on NAV. You cannot generate the same return on $8 as you did on $10. People unfortunately forget that second grade math.

That above is a mortgage REIT but here is a fund if you need to see it in that form.

So yields will ultimately follow NAV. While yields are important, they should be only examined in light of where the fund total return is headed.

Outlook & Verdict

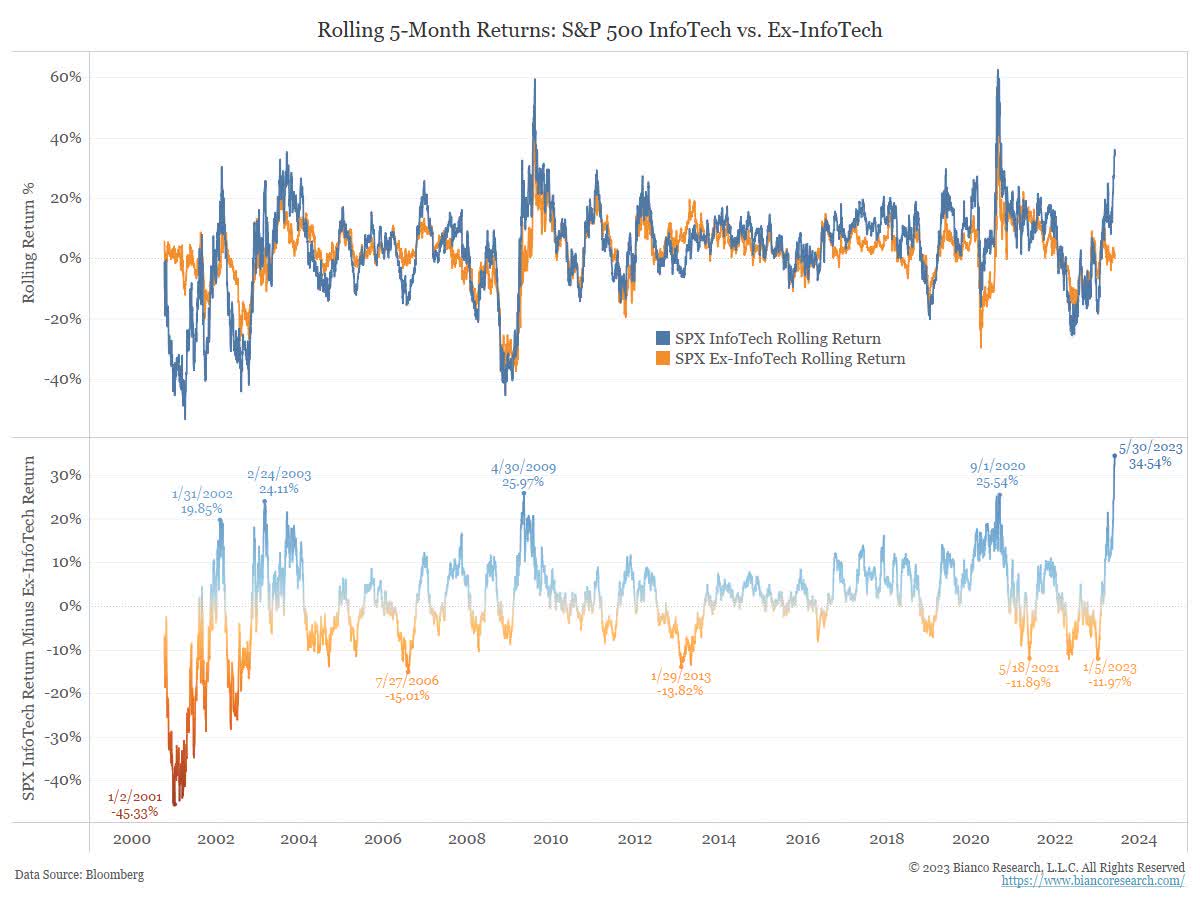

We are sympathetic to the cause of active management. The indices are now laden with some of the worst valued stocks at the largest weights since the dot-come era. Passive index investing is not going to be your friend. The 34% outperformance of tech vs non-tech is a record dating back to 2000. You know what is coming next.

Bloomberg -Jim Bianco-Twitter

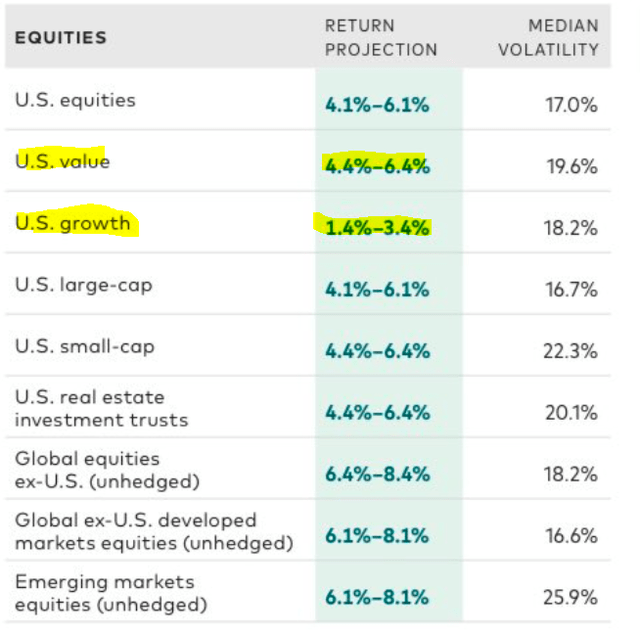

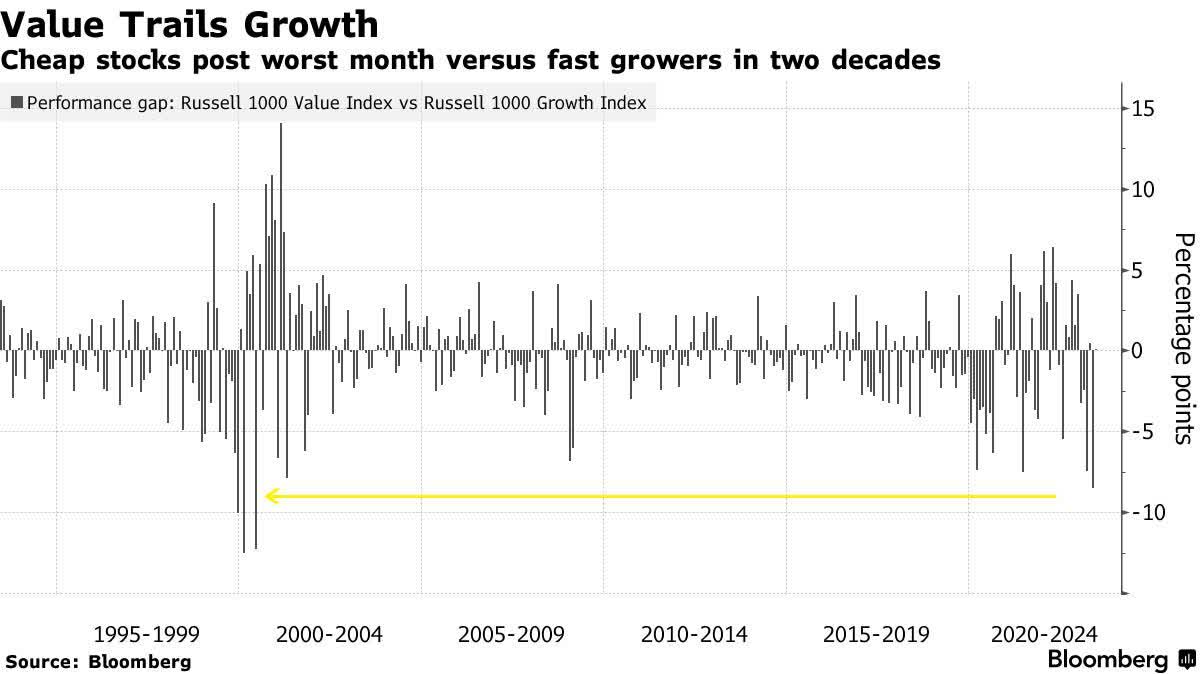

In that sense both JEPI and ICAP have been at the receiving end of value vs growth underperformance.

Bloomberg

We think there is definitely going to be a massive mean reversion here as investors finally discover who is the last person hitting the ask. But we think JEPI benefits abnormally compared to ICAP for five reasons.

1) The first being that it is indirectly "shorting" growth via its strategy. We think this should at least 1-2% extra annually. Vanguard agrees with this.

2) JEPI has also sidestepped the landmines in mortgage REITs. ICAP is heavy here with picks like Annaly Capital Management Inc. (NLY), AGNC investment Corp. (AGNC) and RITM Capital Corp. (RITM). We believe this sector is in for more pain as the heavily inverted curve continues to wreck their models. One point to note that in November 2022, ICAP was even heavier in this sector than it is now.

3) JEPI is also very light on equity REITs as a whole vs ICAP and we don't think the sector has hit its bottom.

4) JEPI is running with a very heavy advantage on the total expense ratio. Some might argue that ICAP does pay interest expenses thanks to its leverage and hence should run a higher expense ratio. Fair enough. But at these level of risk-free rates, we categorically see leverage as a disadvantage. That also brings us to point 5.

5) Finally, if we are off on the timing of this call, JEPI can survive this better being non-leveraged.

Please note that this is not financial advice. It may seem like it, sound like it, but surprisingly, it is not. Investors are expected to do their own due diligence and consult with a professional who knows their objectives and constraints.

Are you looking for Real Yields which reduce portfolio volatility? Conservative Income Portfolio targets the best value stocks with the highest margins of safety. The volatility of these investments is further lowered using the best priced options. Our Enhanced Equity Income Solutions Portfolio is designed to reduce volatility while generating 7-9% yields.

Give us a try and as a bonus check out our Fixed Income Portfolios.

Explore our method & why options may be right for your retirement goals.

This article was written by

Conservative Income Portfolio is designed for investors who want reliable income with the lowest volatility.

High Valuations have distorted the investing landscape and investors are poised for exceptionally low forward returns. Using cash secured puts and covered calls to harvest income off value income stocks is the best way forward. We "lock-in" high yields when volatility is high and capture multiple years of dividends in advance to reach the goal of producing 7-9% yields with the lowest volatility.

Preferred Stock Trader is Comanager of Conservative Income Portfolio and shares research and resources with author. He manages our fixed income side looking for opportunistic investments with 12% plus potential returns.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.