Green Brick Partners: Stock With Low Valuation, Strategic Advantages, Long-Term Growth

Summary

- Green Brick Partners is a thriving land development and home building company with a low valuation and strong expected long-term growth.

- The company has strategic advantages, high margins, and returns, as well as a positive Q1 2023 performance.

- Green Brick Partners has an attractive low valuation and a positive long-term outlook, making it a potentially profitable investment.

- Looking for a helping hand in the market? Members of Margin of Safety Investing get exclusive ideas and guidance to navigate any climate. Learn More »

cscredon/iStock via Getty Images

Green Brick Partners (NYSE:GRBK) operates as a thriving land development and home building company in the United States. Green Brick handles many aspects of the industry such as land acquisition/development, design, construction, entitlements, mortgage/title services, and marketing/sales. The company builds patio homes, townhomes, single-family homes and luxury homes in residential and planned communities. Green Brick owns/controls sites in the Atlanta, Austin, Dallas-Fort Worth, Colorado Springs, and the Treasure Coast of Florida regions. These are high-growth areas, which provides Green Brick with excellent conditions for the company's growth.

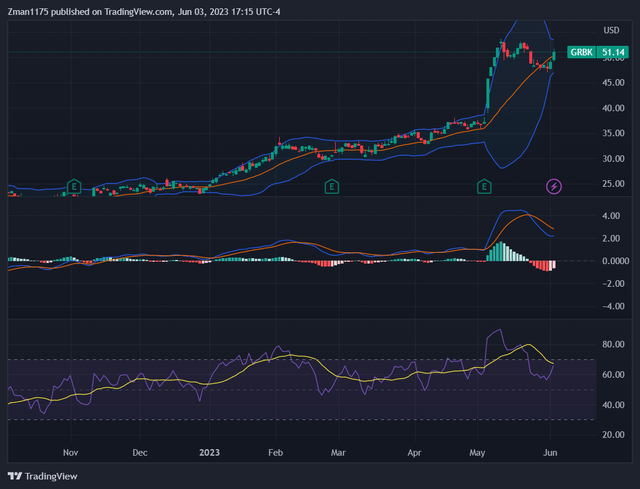

Green Brick stands out as a stock with an attractive, low valuation with strong expected long-term growth. The stock's technical set-up shows a bull-flag formation, indicating that the price is likely consolidating before the next break out to the upside.

Green Brick Partners' Strategic Advantages

Green Brick has a number of strategic advantages that contribute to the company's success. The company tends to have properties located in the better markets of the Dallas-Fort Worth and Atlanta areas. One of the reasons for this is that there were over 200 business relocations/expansions to the Dallas area since the pandemic. Companies find this area attractive. The job migration and creation associated with this provide long-term tailwinds for Green Brick Partners.

Another advantage is that Green Brick derives a significant amount of revenue from areas that have low housing inventory on the market. The company derived about 80% of Q1 revenue from these supply-constrained areas. This means that Green Brick benefits from low competition in these regions. The company also has plenty of expertise in the complex entitlement and regulatory processes that can be associated with these in-fill communities.

Green Brick has a superior lot and land position which allows the company to effectively sustain operations and to be opportunistic for future growth. The company owned or controlled about 25,500 home sites in high-growth submarkets as of the end of 2022. GRBK's strong land position allows the company to self-develop lots with high margins with the capability to start more homes under construction without an outlay of cash to purchase the finished lots when demand returns.

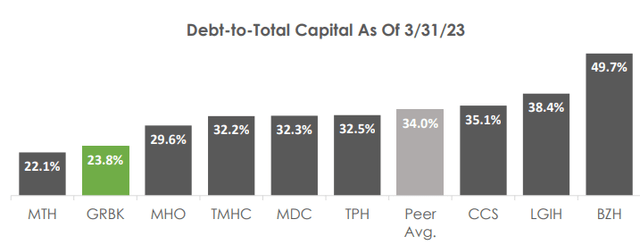

GRBK has the advantage of having a strong balance sheet. The company tends to maintain one of the lowest debt-to-total capital ratios in the industry at 23.8%, which is significantly below the peer average of 34%. Green Brick has fixed rate debt at a low 3.3% interest. The company had positive operating cash flow of over $259 million and free cash flow of $176 million for the trailing 12 months.

Debt-to-total capital ratio comparison (Green Brick Partners Q1 2023 Earnings Call Presentation)

These advantages help Green Brick to grow effectively while maintaining an edge over the competition.

High Margins & Returns

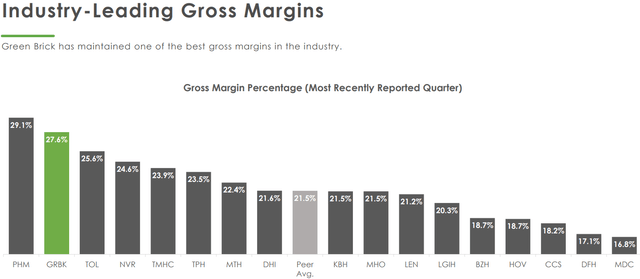

GRBK tends to maintain one of the highest gross margins in its industry. Green Brick's GM of 27.6% is higher than the industry average of 21.5%. The company's EBITDA margin of 20% is much higher than the sector median of 10.9%.

Homebuilder Industry gross margin comparison (Green Brick Partners Q1 2023 Earnings Call Presentation)

GRBK's gross margin helps drive profitability. The company also achieves strong returns to drive profits. Green Brick's ROE of 30%, ROIC of 16%, and ROA of 17% significantly outperform the sector median ROE of 10%, ROIC of 6%, and ROA of 3.6%. I'm pleased to see these strong double-digit margins and returns which demonstrates Green Brick's solid financial performance.

Positive Q1 2023 Performance

Green Brick recently reported strong Q1 performance, demonstrating the company's effectiveness and competitive edge in the industry. Net new home orders increased 75.3% to $630.9 million in Q1 2023 over Q1 2022. This was the highest increase among the industry's peers and a record for GRBK. The company also achieved a record of $449.4 million for new home closings revenue which increased 24% and a record EPS of $1.37 which increased 14%.

Net sales increased by a strong 78% y-o-y to 1,067 homes which was the second highest quarter in company history. The company's cancellation rate improved by 14% from the previous quarter to 6.2%. This was the lowest cancellation rate among home builders. The backlog increased 49% from the previous quarter to $551 million.

GRBK attributed its success in Q1 on a lower cost of living, a strong job market, no state income taxes, and a warmer climate, making the Dallas-Fort Worth area attractive for young professionals. The company is seeing the Millennial generation in their prime home buying years driving a lot of this growth. Green Brick expects these trends to continue to drive more housing demand for the long-term.

Attractive Low Valuation

Green Brick Partners is trading with an attractively low forward PE of 9.9 which is lower than the sector median of 13.9. The stock also trades with a low PEG ratio of 0.14 which is lower than the sector median of 1.32. It is not too common to find many profitable companies with strong growth trading with a PE near 10 and with a PEG ratio significantly below one. Therefore, GRBK looks like a bargain in a market where many stocks are trading with above-average valuations.

The PEG ratio is based on Green Brick's estimated 3 to 5 year annual earnings growth of 73%. GRBK's forward PE is based on expected EPS of $5.16 for 2023. These EPS expectations were upgraded from $3.40 just 3 months ago. EPS estimates were also increased from $3.82 to the current estimate of $5.54 for 2024. These upgrades have been driving the stock higher over the past few months. However, I see more upside for the stock given the low valuation.

Technical Perspective

GRBK daily stock chart with MACD and RSI (tradingview.com)

GRBK's price chart is showing a bull flag formation. It looks like the stock price might be starting to break higher. The MACD in the middle of the chart is showing that the selling momentum is waning after the stock pulled back from the highs. The purple RSI at the bottom shows a pullback from a previously overbought condition followed by another rise. The RSI is bullish as it is pointing upwards and remains above 50. As a result, it is possible that the stock may run higher over the next few weeks and months.

Green Brick Partners Investment Outlook

The long-term outlook looks positive for Green Brick Partners. The housing supply/demand situation should provide GRBK with long-term tailwinds. The United States has a 4 million housing unit deficit. The Millennials are in their prime home buying years and Generation Z will be moving into their prime as we get deeper into the decade. This bodes well for GRBK's high growth areas of focus.

Green Brick has numerous strategic advantages that can drive strong performance for the company over the long-term. Investors should be aware that higher interest rates are having a negative impact on the real estate market and it could slow down the economy. This is the biggest risk for the company in the near term as it could lower demand for GRBK's homes. GRBK's advantages could allow the company to better weather a recession and to bounce back quickly during a recovery phase.

With the valuation so low and long-term growth looking robust, I see plenty of room for multiple expansion to drive the stock higher at an above-average pace over the next several years.

Consider joining Kirk Spano's Margin of Safety Investing which offers a more in-depth analysis of individual companies.

Try Margin of Safety Investing free for two weeks and get your first year for 20% off.

Learn the 4-step investment process that top hedge funds use.

Invest with us in a changing world that demands a margin of safety.

This article was written by

Through diligent analysis, he is ranked in the top 1% of blogging analysts on Tipranks.com for performance and accuracy. David previously contributed to Kirk Spano's Margin of Safety Investing [MoSI] Marketplace Service and Risk Research Inc.

David focuses on growth & momentum stocks that are reasonably priced and likely to outperform the market over the long-term. He is a long term investor of quality stocks and uses options for strategy.

David told investors to buy in March 2009 at the bottom of the financial crisis. The S&P 500 increased 367% and the Nasdaq increased 685% from 2009 through 2019.

He wants to help make people money by investing in high-quality growth stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The article is for informational purposes only (not a solicitation or recommendation to buy or sell stocks). David is not a registered investment adviser. Investors should do their own research or consult a financial adviser to determine what investments are appropriate for their individual situation. This article expresses my opinions and I cannot guarantee that the information/results will be accurate. Investing in stocks involves risk and could result in losses.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.