DraftKings: Tech-Esque Valuation For A Deeply Unprofitable Company

Summary

- DraftKings' stock has experienced significant growth, but concerns about their long-term business strategy and profitability may lead to a pullback in the coming weeks and months.

- The company faces strong competition from FanDuel and other established sportsbooks, and their high marketing costs and reliance on strategic partnerships may hinder their ability to maintain market share.

- DraftKings' financial metrics show a company going further into the red, and their tech-style valuation may not hold up if they cannot achieve profitability through app usage alone.

South_agency/E+ via Getty Images

Co-produced with Mike Dzikowski.

Thesis

DraftKings (NASDAQ:DKNG) has started the year immensely well. It has been a consistent climb from $11 to $25, an increase of 125%. However, many recent signs would suggest that it is due for a bit of a pullback in the coming weeks and months. There are reasons for concern regarding their long-term business strategy. Eventually, the time will come when shareholders demand profitability. How much longer will they be patient as senior management celebrate claims such as slowing the pace of increased spending?

Reasons for Concern

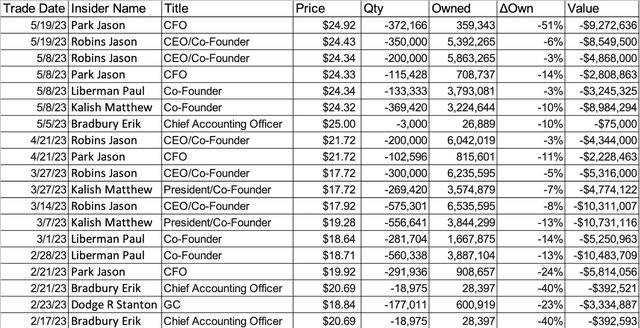

DKNG 2023 Insider Sales (OpenInsider)

DraftKings top brass is telling us that they believe the stock is at a good selling point. Markets reacted to the strong Q1 earnings report, and insiders reacted in turn by selling off over 1.5 million shares, worth around $37 million, since the beginning of May.

Let's dive into the Q1 earnings report that resulted in a 15% share price increase on May 5. From SportsHandle:

DraftKings has faced some criticism in the past for high marketing costs, and the company ended the quarter with $389.1 million in sales and marketing expenses, an increase of 21% from last year's quarter. In terms of percentage increase, DraftKings slowed the pace of spending. In last year's first quarter, DraftKings spent $321.5 million in the category, up 40.6% from the same period in 2021. In another category, which DraftKings dubbed "cost of revenue," expenses swelled 66.4% to $521.7 million.

DraftKings is celebrating a decrease in the rate of increase of spending. When you deconstruct this statement, you realize it is not as encouraging as it sounds. Their spending is ever-rising and there is no indication that a decrease is on the horizon. There is a reason DraftKings has to keep their spending high. Management deferred the majority of the hard-hitting questions regarding a timeline for profitability to their Investor Day.

A deeper dive into senior management presents some cause for skepticism. CEO and founder Jason Robins, who has a firm control on capital stock voting power, raised his salary 238% year-over-year and expensed $132,000 for his family's Super Bowl experience. Combined with stock grants on May 5, 2022 with generous strike prices, it makes one wonder why the executives and board members at DraftKings continue to compensate themselves so handsomely as a reward for their -50% operating margin. Q1 of 2023 alone reported over $100 million in stock-based compensation.

A Look at the Competitive Landscape

One of the main reasons DraftKings is here today as a consensus top 2 Sportsbook in America is because they were in the right place at the right time when it comes to Daily Fantasy. People had experience depositing and withdrawing money in their product, and they parlayed that name brand recognition and reputability into a strong market share in the infantile stages of sports betting in the US.

Another reason DraftKings is at the top of the online Sportsbook hierarchy is their aggressive approach to marketing. Eye-popping deals with sports media personalities like Dan LeBatard, along with institutional partners including ESPN and the UFC have allowed DraftKings' name to stay relevant and considered to be one of the more popular products.

When comparing DraftKings to their biggest competitor, FanDuel, you would see that FanDuel has them beat in every way, short of giving out money. Many believe that FanDuel has a superior product, better odds, better offering and better interface. In fact, FanDuel also beat them to turning a profit.

The reason that FanDuel has DraftKings beat at every turn is because they are part of a larger company, Flutter Entertainment. Formerly known as Paddy Power, this is one of the best products in Europe. When gambling was legalized, companies worked with European companies who already had experience with both retail and digital Sportsbook offerings. While FanDuel was able to leverage their in-house product, DraftKings took a more arduous path to getting where they are today. Initially they partnered with Kambi, before going in-house following their 2019 merger-turned-IPO with SBTech. SBTech has their own set of issues and controversy, as outlined by Hindenburg Research.

When it comes to a longer-term view of the two, it is difficult to find reasons that DraftKings would be able to keep up with FanDuel, let alone surpass them. If anything, it is more likely that the Caesars and MGMs of the world are able to make up ground on DraftKings as their odds boosts and bonuses become more restricted over time.

While it is expected that user acquisition will be expensive, compare this to others in the space, and it will become clear that DraftKings is hemorrhaging money at an abnormal rate. It also assumes that when their boosts and bonuses become less generous, customers will stay on board. This is a bold assumption. Certainly, some will be used to the interface and deposit/withdrawal methods and remain loyal by virtue of familiarity, but many bettors are fickle and will migrate to the next book with a "risk-free $1000 sign-up bonus." Even if more established Sportsbooks move to reduce their offers, expect newcomers in the space such as Fanatics to make waves by any means necessary.

DraftKings might be able to find themselves a sweet spot in some states, when they stop giving out generous bonuses but have yet to lose market share. They are quick to point to New Jersey, one of the longest-tenured states in terms of legality, as being close to profitable. Based on these early trends from NJ, DraftKings wants to forecast other states will follow suit and become profitable. But we do not know how the NJ story ends. It remains to be seen if they will be able to retain the market share they have now without their aggressive marketing over an extended period of time remains to be seen.

While most other companies in the space can fall back on their brick-and-mortar casinos to compensate for their lack of digital Sportsbook profitability, DraftKings' physical presence is limited to their strategic partnerships. Per the risk section of their 2022 Annual Report:

We rely on strategic relationships with casinos, tribes and horse-tracks in order to be able to offer our Sportsbook and iGaming product offerings in certain jurisdictions. If we cannot establish and manage such relationships with such partners, our business, financial condition and results of operations could be adversely affected.

It is highly unlikely that anything would happen to legitimately jeopardize their ability to offer their product, but it is important to note how reliant they are on others due to current legislation.

Financial Analysis

Performing financial analysis of a deeply unprofitable company can be misleading at times, so it is important to consider that much of the valuation of DraftKings lies in the ability to look forward. UBER has a market cap of nearly $80 billion and still operates at a loss, albeit a much healthier margin than DraftKings.

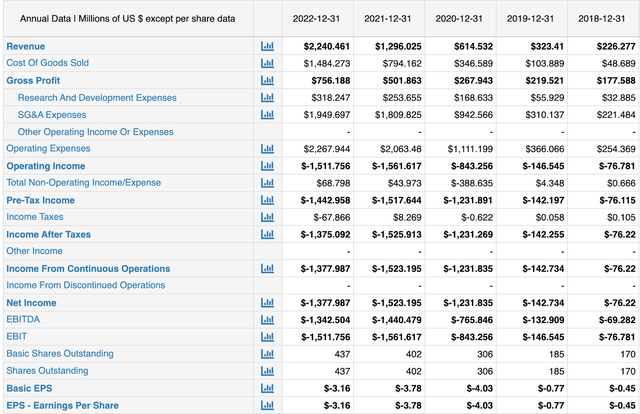

DraftKings funds through offering more shares. The number of shares has swelled over 150% from 170 million in 2018 to 455 million in 2023, including a big secondary offering in 2020. All of their major metrics are still highly negative. Their operating margin is -50%. Their EPS has consistently hovered in the -$3 to -$4 range the last few years, and their EBITDA is consistently below -$1 billion TTM.

Their cash on hand has decreased from as high as 2.63 billion in 2021 down to $1.52 billion in Q1 2023. Their long-term debt has swelled from a negligible amount in 2020 up to $1.25 billion as of Q1 2023. The following table depicts a company who is going further and further into the red while promising shareholders that it will eventually turn a profit:

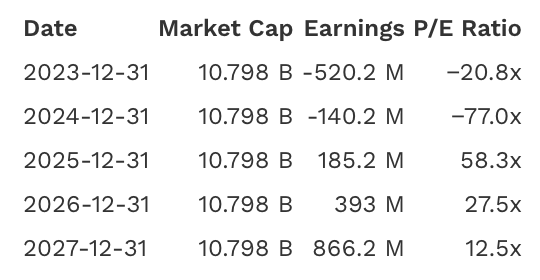

Projections for the future are very generous. Here are the Earnings forecasted through 2027:

macrotrends

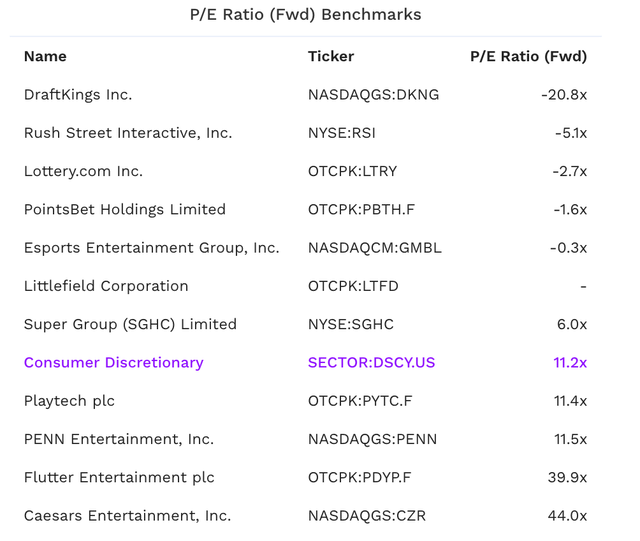

Now look at this forward P/E ratio to the rest of the industry, who can boast much healthier ratios due to their more diversified business models:

Finally, they have $1.1 billion of convertible notes that mature in 5 years. In one scenario, DraftKings will need the cash to pay it back. In the other scenario, shares would be further diluted.

In terms of risk, it is never a guarantee that a stock will move in line with what its intrinsic value is. The stock is extremely popular and trades at significantly higher volumes than other companies in the space with similar market caps. Investors are attracted to the high market share of what many believe is an industry with plenty more of room left to grow.

| Stock | Market Cap | Volume on 6/1/23 |

| DKNG | $10.76B | $16.68M |

| MGM | $14.29B | $5.73M |

| CZR | $8.87B | $2.92M |

There is always the threat of a buy-out, which would lock the stock into its current valuation. If things become untenable at DraftKings, a more financially sound company might look to add it to its portfolio for their database. Additionally, it is possible that DraftKings is able to achieve their goals and scale back their promotional budget while growing profit and maintaining market share. While this seems unlikely at the present moment, it is certainly a possibility to be aware of.

Conclusion

DraftKings has been given a tech-style valuation for their unprofitable business model. Many assumptions are being made about future profitability based on their market share and reduced costs over time. However, there are yet to be any strong indications that this is true, or anywhere near close to happening. Additionally, they lack the brick-and-mortar revenue streams to fall back on. They are limited to app usage as their only way of achieving profitability. With this likely being far away, a reasonable target price would be as low as $10.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

This article was written by

Analyst’s Disclosure: I/we have a beneficial short position in the shares of DKNG either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.