XLE: Saudi Arabia Sends A Message

Summary

- Energy investors have endured significant volatility over the past two months as China's economic recovery has fizzled out.

- Saudi Arabia decided to cut its production, demonstrating its commitment to defend oil prices from falling further, lending stability to the market.

- However, OPEC+ members are mixed in their responses, as lower oil prices could crimp revenue further if they reduce their output.

- Energy investors need to assess the developments carefully, as XLE's recent price action has closely tracked underlying oil prices.

- Ultimate Growth Investing members get exclusive access to our real-world portfolio. See all our investments here »

bymuratdeniz

Investors in The Energy Select Sector SPDR ETF (NYSEARCA:XLE) have had to manage significant volatility over the past two months since our update. We urged investors to buy the steep selloff in March as the market worried about the banking crisis.

While XLE's March lows proved to be a buyable dip, as the XLE rallied through its April highs, sellers returned even as Saudi Arabia led an OPEC+ production cut in early April. As such, the XLE has dropped toward lows last seen at the end of March, as energy investors worry about the health of the global economy.

As such, the additional 1M barrels per day or BPD production cut in July initiated by Saudi Arabia in the OPEC+ meeting over the weekend will be assessed carefully by market operators.

Energy bulls could have been disappointed that the additional cut was anchored solely by Saudi Arabia. Brent crude oil futures (CO1:COM) are still hovering close to the psychologically important $70 support levels. Therefore, energy buyers likely hope the Saudi put is sufficient to discourage bearish speculators from intensifying the selling pressure.

Saudi Arabia oil minister Prince Abdulaziz bin Salman called it the "Saudi lollipop." Prince Abdulaziz has recently been vocal on taking the fight to the bearish speculators, warning them to "watch out." However, Saudi Arabia did not unveil its strategy moving ahead, although it highlighted that it aims to seek "price stability" in the market. As such, I believe the kingdom is keeping its cards very close to its chest, as it aims to thwart the efforts of the bearish investors with surprises.

The XLE has underperformed the S&P 500 (SPX) (SPY) since our rating upgrade in March. The weak momentum in China's nascent post-COVID economic recovery affected buying sentiments in energy stocks. As such, leading players such as Exxon Mobil (XOM) and Chevron (CVX) have underperformed the SPX, as value stocks took a backseat as investors rotated toward stocks participating in the AI hype.

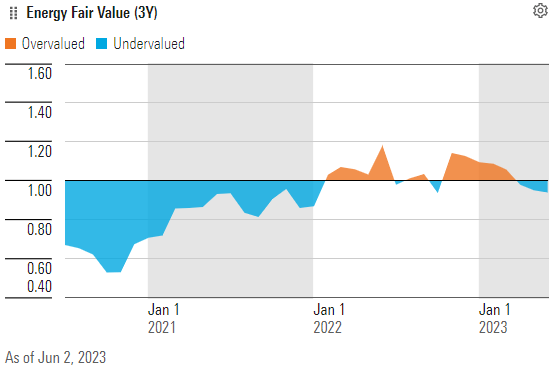

Energy sector valuation (Morningstar)

However, I believe investors must reassess the opportunities in the XLE with more optimism and pessimism. I assessed that the valuation in the energy sector had improved markedly over the past few months.

As seen above, we are no longer overvalued, as astute sellers took profit at the end of 2022, cutting their exposure and rotating into risk-on sectors. As such, the over-optimism seen at the heights of the energy sector mania has cooled down markedly. I also highlighted these risks in my previous articles on the XLE, with two Sell ratings in December 2022 and February 2023.

Hence, weak holders who didn't anticipate the warnings from XLE's price action and bought those highs from the astute sellers could also have bailed out, intensifying the recent selling pressure.

Energy analysts are also mixed in their outlook, much less bullish than in 2022. Keen investors should recall that Goldman Sachs (GS) upgraded its base case oil forecast to $135 in early March 2022, with a bull case of up to $175. JPMorgan (JPM) stoked even more bullish sentiments then, topping Goldman's target with a $185 bullish case.

Well, we will know what happened. Brent topped out at the $139 level in early March 2022. It then closed 2022 at the $80 level, considered critically important to Saudi's long-term plans to fund its economic transformation.

At writing, Brent is trading at the $76 level, nowhere close to the targets put out by the oil strategists from Goldman or JPMorgan (a reminder that no one has a crystal ball).

For now, Goldman Sachs is less "grandiloquent" with its forecasts. Its energy strategists believe that the "OPEC+ meeting was moderately bullish and offset some bearish downside risk to the bank's December forecast of $95 a barrel." The highly optimistic commentary was markedly missing, and I think that's good news for contrarian investors.

For investors who were stunned in 2022 as they bought the highs, expecting more "greater fools" to buy the overvalued sector then, it's not the time to bail out now. The time to run was late last year when they had the best opportunities to sell at a high. If they sell now, with the sector seemingly undervalued, the risk/reward is likely not in their favor.

Even if they want to cut exposure, they should consider waiting for a near-term spike, as speculators attempt to price in the recent OPEC+ meeting before getting out. Sell the rip, but don't sell the pullback.

XLE price chart (weekly) (TradingView)

The XLE was defended by energy buyers last week, as they likely anticipated positive action from OPEC+. The "Saudi lollipop" should help to stanch near-term downside risks.

Based on XLE's price action against the underlying Brent crude, I assessed that it's essential for energy investors to consider whether they have confidence in the ability of OPEC+ to mitigate downside risks.

The internal squabbles in OPEC+ recently highlighted the struggles from falling oil prices, as smaller producers could be hampered further if they were being "compelled" to cut production further.

As such, Saudi's leadership role will likely be tested in future meetings, which could deter some energy bulls from returning. In addition, energy investors might be concerned whether Saudi Arabia could muster enough influence to keep its peers satisfied if downside risks persist.

Hence, while I assessed that the risk/reward remains favorable, investors must be ready to be patient for the macroeconomic headwinds to subside, particularly in China. China's growth story is still predicated on a second-half recovery, which will likely be fundamental in helping to stem further weakness in the US and Europe.

Notwithstanding, I must caution that XLE's price action is increasingly worrying if it fails to regain bullish momentum above its 50-week moving average or MA (blue line).

Suppose sellers can establish a critical resistance zone at the $80 level over the next four to eight weeks. In that case, investors should consider cutting exposure and staying out, as the medium-term uptrend could reverse to a downtrend.

Rating: Speculative Buy (Reiterated). See additional disclosure below for important notes accompanying the thesis presented.

We Want To Hear From You

Have additional commentary to improve our thesis? Spotted a critical gap in our thesis? Saw something important that we didn't? Agree or disagree? Comment below and let us know why, and help everyone in the community to learn better!

Editor's Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

A Unique Price Action-based Growth Investing Service

- We believe price action is a leading indicator.

- We called the TSLA top in late 2021.

- We then picked TSLA's bottom in December 2022.

- We updated members that the NASDAQ had long-term bearish price action signals in November 2021.

- We told members that the S&P 500 likely bottomed in October 2022.

- Members navigated the turning points of the market confidently in our service.

- Members tuned out the noise in the financial media and focused on what really matters: Price Action.

Sign up now for a Risk-Free 14-Day free trial!

This article was written by

Ultimate Growth Investing, led by founder JR Research, helps investors better understand a range of investment sectors with a focus on technology. JR specializes in growth investments, utilizing a price action-based approach backed by actionable fundamental analysis. With a powerful toolkit, JR also provides insights into market sentiments, generating actionable market-leading indicators. In addition to tech and growth, JR also offers general stock analysis across a wide range of sectors and industries, with short- to medium-term stock analysis that includes a combination of long and short setups. Join the community today to improve your investment strategy and start experiencing the quality of our service.

Seeking Alpha features JR Research as one of its Top Analysts to Follow for the Technology, Software, and the Internet category, as well as for the Growth and GARP categories.

JR Research was featured as one of Seeking Alpha's leading contributors in 2022.

About JR: He was previously an Executive Director with a global financial services corporation and led company-wide, award-winning wealth management teams consistently ranked among the best in the company. He graduated with an Economics Degree from Asia's top-ranked National University of Singapore and currently holds the rank of Major as a Commissioned Officer (Reservist) with the Singapore Armed Forces.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.