Southwestern Energy's Leadership Continues To Maximize Shareholder Value Through This Soft Market

Summary

- Southwestern Energy is in a gray area following high natural gas prices in 2022, but has taken strategic steps to diversify and enhance assets for future production in the Haynesville/Bossier region.

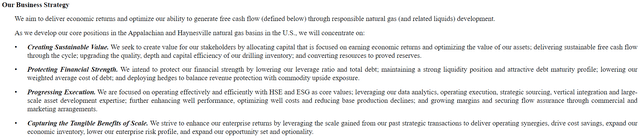

- The company has focused on maximizing free cash flow, reducing leverage, and optimizing shareholder value, including a $1 billion share buyback program and debt extinguishment.

- Despite near-term challenges in commodities pricing, Southwestern Energy is on the right track to fix its capital structure and take advantage of potential upswings in the market.

krblokhin/iStock via Getty Images

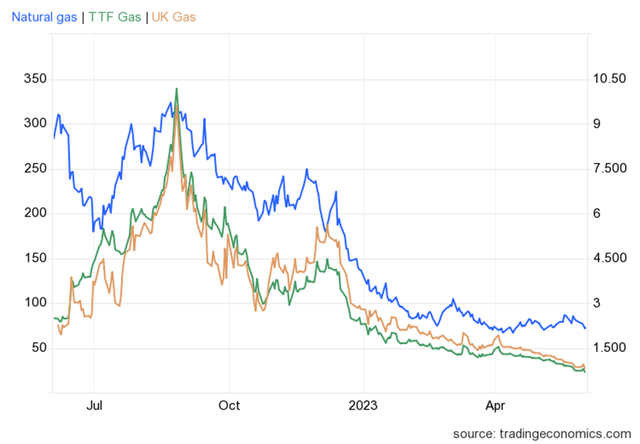

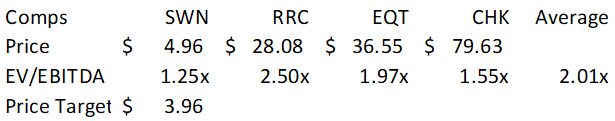

Southwestern Energy (NYSE:SWN), like all domestic natural gas E&Ps, is in a very gray area following a banner year for the industry as a whole. 2022 experienced sky high, or to the moon, natural gas pricing across Europe as leadership scrambled to secure gas to fill up their strategic reserves for a potentially harsh winter that never came. Since then, natural gas prices, both domestic and international have settled back down to the lower end of the price cycle. Based on various macroeconomic and geopolitical factors that affect the price of natural gas, I provide SWN a hold rating with a price target of $3.96/share.

Despite the cyclicality of natural gas prices, the strip prices for CY23 rest below $3.00/mcf through December 2023 and don't appear to show signs of an upswing anytime soon (for those outside of the industry, the strip price is the estimated future price of a commodity based on the futures contract outlay. For valuation purposes, I use the average monthly close). I will applaud Southwestern for taking strategic steps to both diversify and enhance their assets for future production, specifically in the Haynesville/Bossier region. Though it might be too soon to fully realize the value of this move, I believe the acquisition will pay off in the long-run as more LNG terminals are built out across the Gulf Coast. Southwestern is currently valued at 1.21x TTM EV/EBITDA; however, this figure may quickly turn on anyone looking for a value play given the current strip pricing for CY23. Assuming leadership holds true to their word and sets production flat at the high end of their range of 1,650 - 1,725Bcfe for FY23, forward EV/EBITDA figures will look something like 4.40x, holding all else equal. With this, I give SWN a hold recommendation and suggest opportunistic share purchasing throughout the year for macroeconomic reasons stated below. Using average comps as found at the end of this report, I give SWN a near-term price target of $3.96/share.

One thing I’d like to point out is management’s resiliency in laying out and sticking to their gameplan. Management has previously stated, and continues to state for that matter, that they are going to maximize free cash flow, reduce leverage, and optimize shareholder value. This includes a $1b share buyback program initiated in June 2022 with $875mm remaining, $1b in debt extinguishment throughout FY22, and an additional redemption of their 7.75% 2027 notes, bringing their total debt down to just under $4b, rightsizing production and capital investment to maintain a sustainable free cash flow target, and enhance their well assets.

Overview

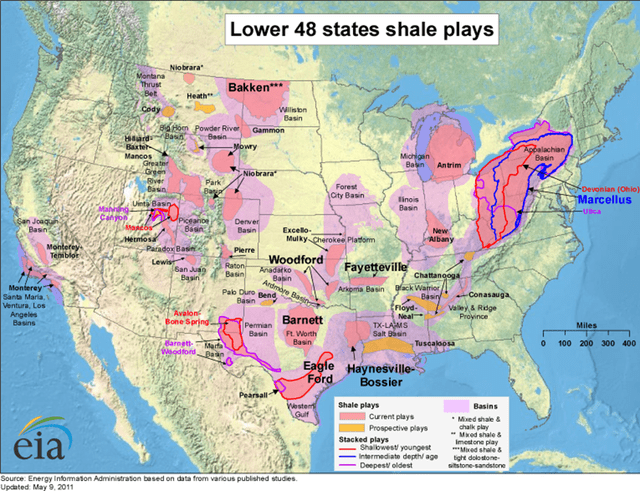

Southwestern Energy is a natural gas E&P company based out of Houston, Texas, with primary operations in the Appalachia and Haynesville shale regions. They have historically produced in the Fayetteville shale region and over time moved operations to the Appalachia region covering the Marcellus, Utica, and Upper Devonian shale, similar to Range Resources (RRC), and more recently have diversified their exposure to the Haynesville/Bossier region, where they’re primarily focusing their capital budget on E&P development.

U.S. Energy Information Administration - EIA - Independent Statistics and Analysis

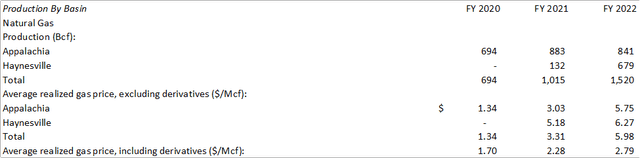

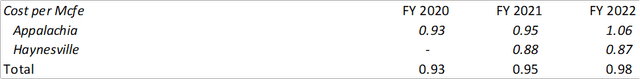

Though developing the Haynesville raised SWN’s capital investment by ~$1b for FY22, there are many benefits they will experience going forward. Net of hedges, SWN has historically realized a better price for Haynesville natural gas.

Though Drilling costs in the Haynesville are significantly more expensive than the Marcellus ($1,950-2,150/lateral foot vs. $900-950/lateral foot), the cost of production in the Haynesville region is ~$0.19/Mcfe less than the Marcellus.

Producing in this region will also greatly reduce the distance to transport natural gas to the Gulf Coast for processing into chemicals and LNG. According to their February 2023 investor presentation, Southwestern has 20 years of gas assets in the Haynesville region with 65% of gas production reaching the Gulf Coast region and 1.5Bcf/d being sold to LNG exporters. Management expects a total of 19Bcf/d of LNG export capacity to be built out by 2026, opening the door to more value creation in the Haynesville region.

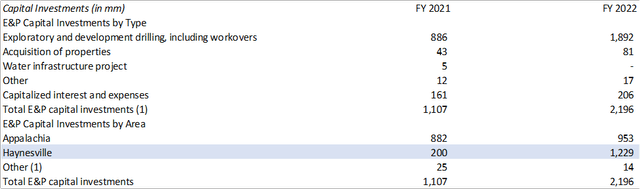

It’s no wonder why E&P capital investment is so focused in the Haynesville region.

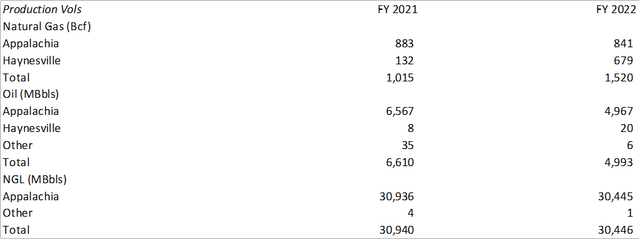

Comparing production volumes, Appalachia gas production dropped -5% y/y in FY22 as compared to a 414% increase in volumes (you read that right) in the Haynesville basin. I’m expecting this trend to continue going forward as Southwestern pivots more capital investment in the Haynesville and Bossier region. Given their projections of domestic natural gas demand to increase by 10Bcfe by 2025, I expect the Marcellus to level out to producing ~1,000Bcfe while increasing production in the Haynesville shale for LNG exports.

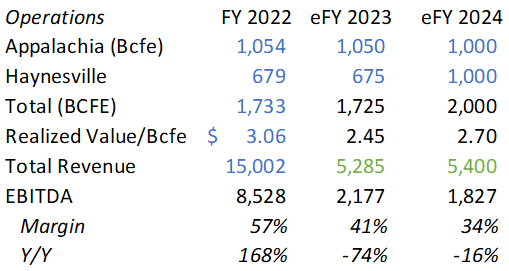

Now the negative news

There will be challenges in valuation for SWN amongst other natural gas E&Ps given the strip pricing for natural gas futures. The CME Group quotes Henry Hub natural gas futures remaining below $3.00/mcf through December 2023. 2024 figures are an improvement though they still remain below $4/mcf through December. Given this expectation for FY23, revenue will likely fall back to a more normalized figure to something in the range of $5,000-5,300mm with EBITDA margins falling to ~40%, holding all else equal. Though there are a lot of factors involved in coming up with these numbers, it is near impossible to estimate what natural gas prices in the US, EMEA, and APAC will look like throughout the year and may be severely understated. Disclaimer: these are my projections based on the strip price with the assumption of relatively flat production for FY23.

FY22 10-K

Conclusion

I do believe SWN is on the right track to fixing their capital structure by optimizing their assets through strategic acquisitions, extinguishing expensive debt, and returning value to shareholders. Though there are some near-term hills to climb in commodities pricing, I do believe management will be able to proactively manage their resources to take advantage of any upswings, whether it’s by utilizing their in-house OFS to ramp production, or right size production to maintain lower pricing levels. My final thoughts reference my research on the energy transmission space covering Quanta Services (PWR) and Argan (AGX), both in the business of constructing power plants. The work for constructing natural gas-fired power plants is projected to increase throughout the next decade, providing some foreshadowing for the strength in demand for natural gas.

Using average TTM comps, I came up with a price target of $3.96/share for FY23. Despite the near-term challenges Southwestern faces that may affect their share price, I believe their long-term strategy laid out above will benefit shareholders. My recommendation is to dollar cost average and hold SWN as a long-term strategy.

SeekingAlpha

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.