We Should See Rotation From Tech To The Average Stock

Summary

- We should see an end to the bear market in the S&P 500 this week.

- We are at an inflection point where earnings projections are now being adjusted upward.

- The technology sector should give way to the average stock, as breadth improves and the leaders consolidate their gains.

- This idea was discussed in more depth with members of my private investing community, The Portfolio Architect. Learn More »

FeelPic

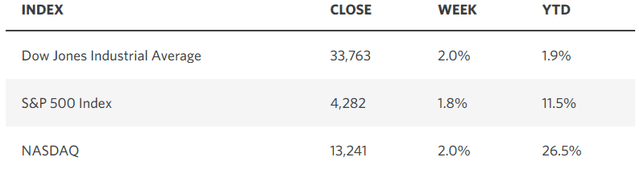

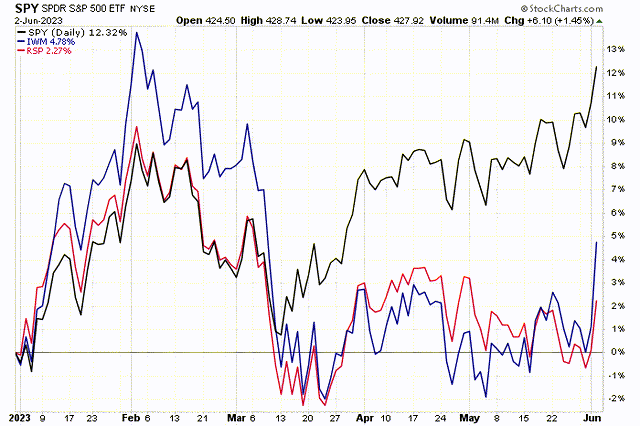

Last week was another strong showing for the bulls. The S&P 500 is now just a few points away from ending the bear market with a close above 4,292. Historically, most bear markets have ended in October, and this one looks to be no different. With the drama of the debt ceiling behind us, incoming economic data continues to show an economy that remains resilient, albeit slowing to just the right degree that inflation continues to recede. It looks to be what I have been calling a soft landing since the fall of last year. We saw a perfect example of this in Friday’s jobs report, which is why the Dow Jones Industrial Average soared more 700 points on Friday, as the stock market rally broadened significantly.

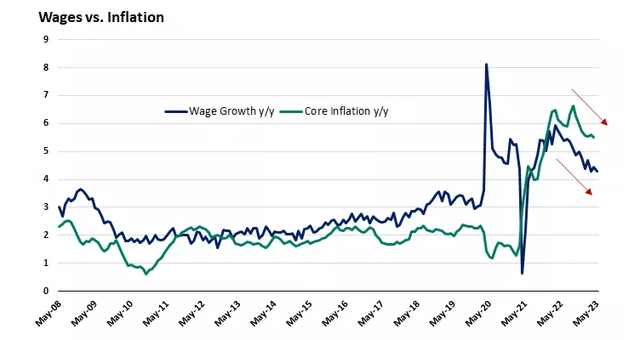

The economy continues to add jobs at a healthy base, as evidenced by the 339,000 in May, while the unemployment rate is creeping higher, which is partly due to more prime-age workers entering the labor force. Meanwhile, job openings have fallen by two million over the past year, job postings are in a gradual downtrend, and weekly unemployment claims have inched higher. For these reasons, we are seeing a slower rate of wage growth, which is music to the Fed’s ears. Wage growth fuels inflation, and its downward trajectory suggests that the rate of inflation will continue to fall. This is why investors expect the Fed to pause at its meeting next week, and it is why I believe the rate-hike cycle is over.

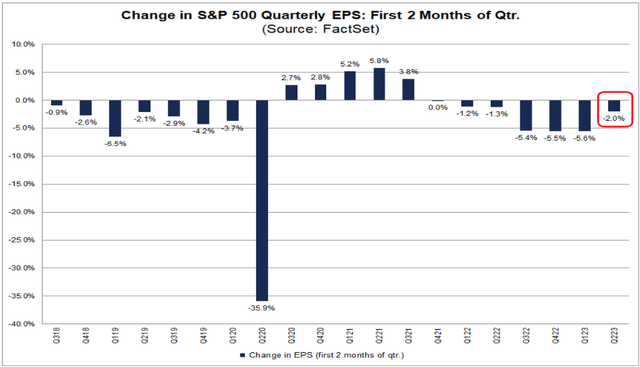

Friday’s goldilocks jobs report was not the only reason stocks performed well. I talk a lot about rates of change in my analysis, because my father taught me many years ago that the rate of change is always more important than the absolute number when it comes to markets, especially when we are at inflection points. According to FactSet, after reducing estimates during the first two months of each upcoming quarter in each of the past seven quarters by an increasing percentage, analysts have lowered their estimates by a significantly smaller margin. This looks like an inflection point, and it is not for just the upcoming quarter.

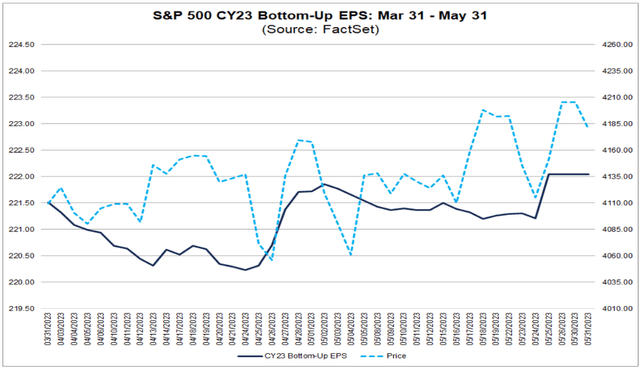

At the same time, the consensus bottoms-up estimate for 2023 has started to rise after bottoming in April. The inflection point came in April in what is another positive rate of change. The S&P 500 index has been trending up with the increase during April and May. We are seeing a similar uptrend, albeit very modest, in the estimate for 2024. It appears that the earnings recession is coming to an end with far less damage than the bears were expecting.

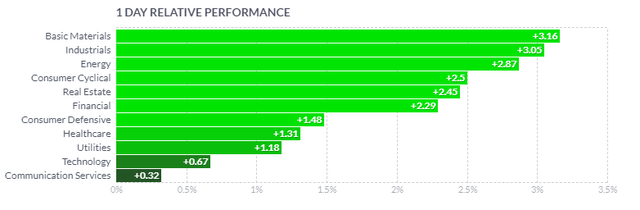

One of the most notable developments on Friday was the significant outperformance of the average stock over the largest technology names that have been driving the major market indexes higher this year. The Russell 2000 index of small-cap stocks, which is more domestically focused, had a breakout day with a gain of 3.6%. The equal-weight S&P 500 index outpaced the gain of the market-cap weighted index with cyclical sectors leading the way, while technology lagged behind.

This should be the theme of this bull market moving forward, as the mega-cap technology names consolidate their gains of the past three months and the rest of the market plays catch up. I suspect many bullish investors feel like they have owned the wrong stocks this year, but patience should be rewarded on this front as this theme plays out.

Lots of services offer investment ideas, but few offer a comprehensive top-down investment strategy that helps you tactically shift your asset allocation between offense and defense. That is how The Portfolio Architect compliments other services that focus on the bottom-ups security analysis of REITs, CEFs, ETFs, dividend-paying stocks and other securities.

This article was written by

Lawrence is the publisher of The Portfolio Architect. He has more than 25 years of experience managing portfolios for individual investors. He began his career as a Financial Consultant in 1993 with Merrill Lynch and worked in the same capacity for several other Wall Street firms before realizing his long-term goal of complete independence when he founded Fuller Asset Management. He graduated from the University of North Carolina at Chapel Hill with a B.A. in Political Science in 1992.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Lawrence Fuller is the Principal of Fuller Asset Management (FAM), a state registered investment adviser. Information presented is for educational purposes only intended for a broad audience. The information does not intend to make an offer or solicitation for the sale of purchase of any specific securities, investments, or investment strategies. Investments involve risk and are not guaranteed. FAM has reasonable belief that this marketing does not include any false or material misleading statements or omissions of facts regarding services, investment, or client experience. FAM has reasonable belief that the content as a whole will not cause an untrue or misleading implication regarding the adviser’s services, investments, or client experiences. Past performance of specific investment advice should not be relied upon without knowledge of certain circumstances or market events, nature and timing of investments and relevant constraints of the investment. FAM has presented information in a fair and balanced manner. FAM is not giving tax, legal, or accounting advice. Mr. Fuller may discuss and display charts, graphs, formulas, and stock picks which are not intended to be used by themselves to determine which securities to buy or sell, or when to buy or sell them. Such charts and graphs offer limited information and should not be used on their own to make investment decisions. Consultation with a licensed financial professional is strongly suggested. The opinions expressed herein are those of the firm and are subject to change without notice. The opinions referenced are as of the date of publication and are subject to change due to changes in market or economic conditions and may not necessarily come to pass.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.