Boston Properties: Is The 8% Dividend Yield Worth The Risk In Today's Office Market?

Summary

- Boston Properties offers a well-covered 7.7% dividend yield but faces industry challenges such as remote work trends and mounting loan pressure.

- BXP has a long-term track record of subdued dividend growth and elevated volatility, raising concerns for investors.

- High-quality dividend growth stocks with favorable valuations may be a more attractive option in a weakening commercial real estate market.

Matteo Colombo

Introduction

Whenever stock prices of high-quality companies show steep declines, the contrarian inside of me becomes excited. It happened in 2020 when I bought dirt-cheap energy and industrial companies. And it happened recently when I bought defense companies and beaten-down construction exposure.

However, my excitement is still very limited when dealing with beaten-down office stocks.

Boston Properties (NYSE:BXP) is the nation's second-largest office real estate investment trust ("REIT"), which focuses on high-quality assets in cities like Boston and San Francisco, where it caters to some of the most well-known tenants in the business.

Thanks to rising risks in the commercial office space, BXP's share price has fallen to levels not seen since the Great Financial Crisis.

In this article, I will not only assess its juicy yield, which has risen to 8% but also discuss why I'm not a buyer at these levels in light of the total return picture.

So, let's get to it!

A Quick Look Back

In December 2022, I wrote an article covering BXP's elevated dividend. Back then, it was 6.0%. This is what I wrote back then:

If I were a BXP investor, I would hold. BXP is too cheap to sell. While headwinds are serious and persistent, BXP is managing top-tier properties and trading at a very low FFO multiple. Moreover, I do not expect dividend cuts.

Unfortunately, I also do not expect BXP to be able to turn into an attractive long-term REIT. A REIT with steady long-term dividend growth, attractive assets, and secular growth.

Hence, even at a 6.0% yield, I do not recommend BXP shares to long-term dividend investors. I simply do not believe the risk/reward is good. Again, that's not based on its valuation alone (which is quite low), but on my expectations when it comes to long-term value generation.

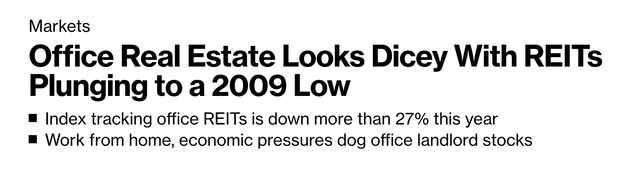

Office Real Estate Has Gotten Worse

Fast forward to May 2023, and ugly (read: even uglier) headlines are popping up. For example, this one from Bloomberg:

While we're dealing with a very serious subject here, I got a good laugh from the quote below:

There's two ways to lose money: You can own a boat, or you can own an office building," Piper Sandler analyst Alexander Goldfarb said. "At least with the boat you can take your friends out on a sunset cruise."

These comments are backed by facts. For example, as reported by the Wall Street Journal, a majority of companies, around 58%, now allow their employees to work remotely for part of the week, signaling a shift towards a hybrid work strategy. The number of companies mandating full-time office presence has declined from 49% to 42% over the past three months.

Hence, office occupancy rates are stuck at roughly 50%, which is horrible news as regional differences are big. This is putting tremendous pressure on investors as most properties aren't profitable anymore.

As reported by CBS, we're now seeing mounting pressure on loans, which could have a domino effect.

Many buildings are financed with short-term bank loans. Morgan Stanley estimates that approximately $1.5 trillion will be due by the end of 2025, potentially leading to a wave of loan defaults.

I think you're going to start seeing a lot of defaults on office buildings," said Patrick Carroll, CEO of Carroll, a real estate investment firm. Carroll manages a real estate portfolio worth over $7 billion.

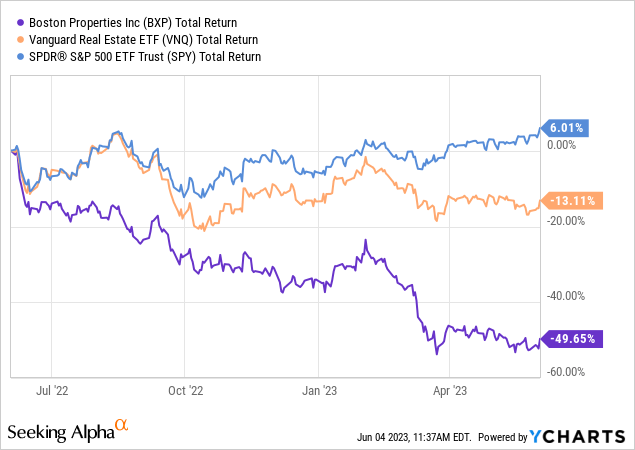

As a result, investors have de-risked their portfolios, leading to a 50% BXP share price decline over the past 12 months. In this case, dividends are included, which means capital losses are slightly worse.

With that said, let's take a deeper look behind the ticker.

What To Make Of BXP'S 8% Yield

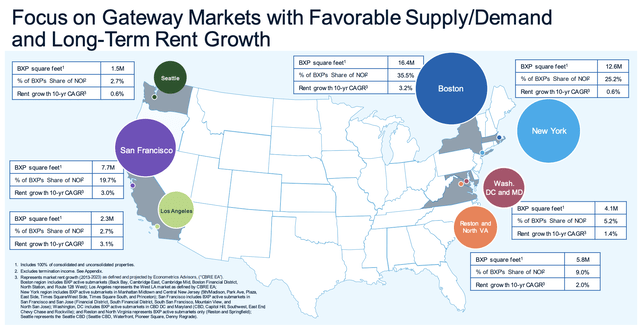

With a market cap of $8.0 billion, BXP is the second-largest office REIT in the United States. It owns properties in seven high-profile regions, with Boston, New York, and San Francisco accounting for most of its exposure.

The company owns 192 properties. It's also an S&P 500 member.

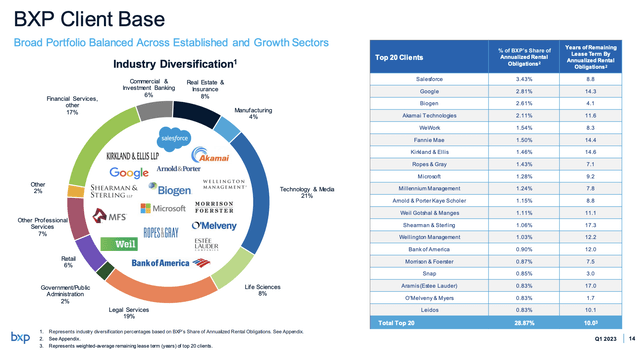

Roughly 78% of its assets are located in central business districts, where it caters to some of the biggest tenants in the United States, including mega-cap technology companies, lawyers, industrial firms, biotechnology, and banks.

While its tenant profile provides some stability, the company is far from immune to the carnage we're witnessing in the industry.

In its 1Q23 earnings call, the company discussed two important trends influencing its long-term performance in the office sector.

- The first trend is the deceleration in leasing, which was forecasted as a cyclical trend rather than a secular one caused by remote work. BXP's own leasing experience in 2022 showed that, despite fewer workers using offices, they leased a significant amount of space. However, with the current weaker economy, although more workers have returned to the office, leasing has slowed. Slowing economic growth and increased cost control measures by companies have impacted leasing decisions. The return to office trend is expected to improve as economic conditions recover. However, for now, these comments confirm the data and comments I used in the first half of this article.

- The second trend is the growing importance of building quality. Premier workplaces, which offer high-quality assets and consistent ownership, outperform the broader office market. Companies are upgrading their buildings to attract employees back to the office. On the other hand, lower-quality buildings face more pressure due to remote work practices for support workers in certain industries.

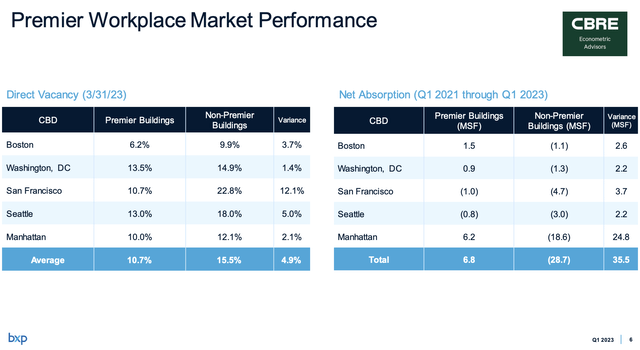

With that said, the company also highlighted the performance of Premier workplaces in the US and the five Central Business Districts ("CBDS)" where BXP operates.

Premier workplaces represent approximately 17% of the total space and less than 10% of the total buildings.

In the first quarter, direct vacancy for Premier workplaces increased by only 20 basis points to 10.7%, while the balance of the market saw a larger increase of 80 basis points to 15.5%.

Net absorption for the Premier segment over the last nine quarters was a positive 6.9 million square feet, compared to a negative 28.6 million square feet for the balance of the market.

Rents and rent growth are higher for Premier workplaces, indicating their desirability. The private real estate capital markets have experienced a slowdown in transaction volume, not limited to the office sector.

Furthermore, real estate values have reset due to higher capital costs, resulting in a bid-ask gap in declining markets. Mortgage financing for office assets is challenging and primarily available for high-quality leased assets and sponsors.

In light of these developments, BXP's occupancy stands at 88.6% for in-service properties, rising to 91% when considering leases signed but not yet commenced.

Leases signed but not commenced account for approximately 1.3 million square feet, with 1.2 million square feet anticipated to commence in 2023. Leases in negotiation total 900,000 square feet, and there is an active pipeline of proposals totaling over 1.5 million square feet.

With that in mind, the company maintains a solid balance sheet.

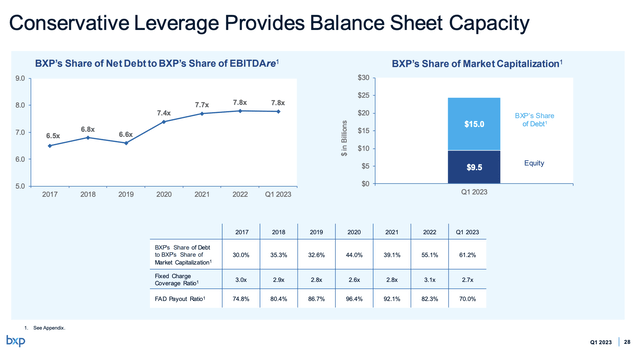

The company's net leverage ratio is at 7.8x EBITDAre. The company has $3.2 billion in available liquidity. Roughly half of it consists of cash. 78% of its debt is unsecured.

Its dividend is protected by a 70% payout ratio, which hasn't exceeded 97% in recent years, including the 2020 pandemic.

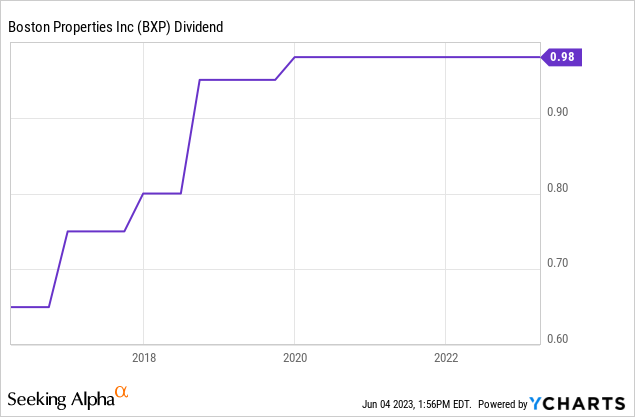

The current dividend is $0.98 per share per quarter, which translates to a yield of 7.7%.

This dividend has been hiked by 4.8% per year over the past five years.

The most recent hike was announced on December 17, 2019, when the board approved a 3.2% hike. Since then, the dividend has been flat.

With that said, there's more good news.

Valuation & Relative Performance

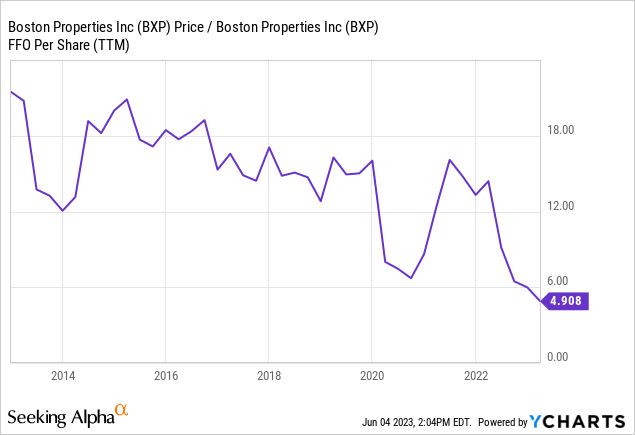

Despite challenging economic conditions, BXP exceeded first-quarter market consensus and midpoint guidance for FFO per share. It reported a 1Q23 FFO result of $1.73, beating estimates by $0.05.

The company also increased its FFO per share guidance for the entire year of 2023.

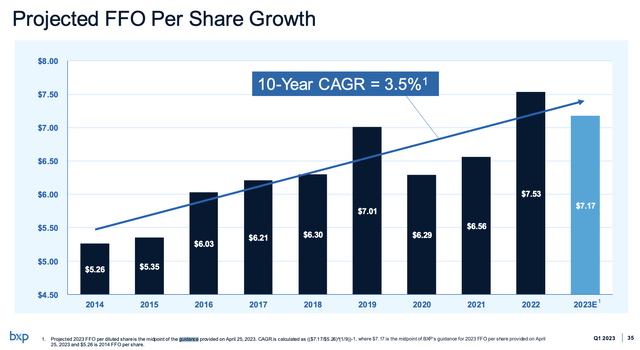

This year, the company is expected to generate $7.17 in funds from operations per share.

This indicates a valuation of 7x FFO, which is extremely low. The sector median is 12.5x FFO. The company's longer-term median is close to 12x FFO.

At this point, there are two possibilities:

- Either the company is wrong, and it will have to cut guidance in the next few quarters.

- Or, the company is right, and the market is wrong, which would make current prices extremely attractive.

I believe it's a mix of both. While office real estate is in serious trouble, Boston Properties is one of the best places to be.

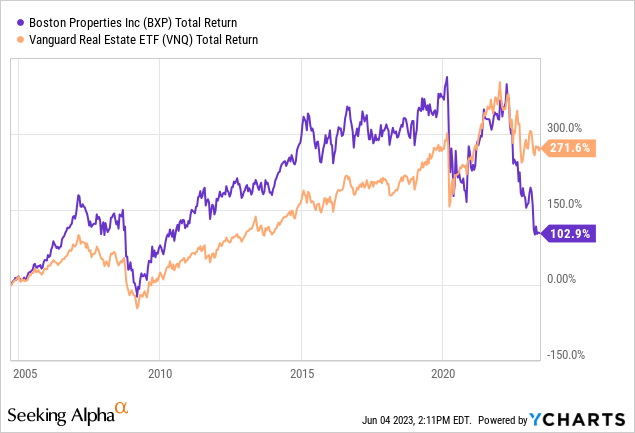

However, I have avoided the stock for a few reasons. The biggest one is its terrible total return. Since 2005, the stock has returned just 103%, including dividends.

While I'm measuring the total return as a highly unfavorable price, it needs to be said that BXP investors have been through three major downturns since 2005.

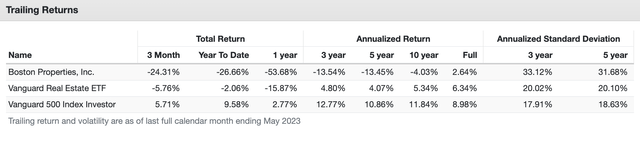

Also, when looking at the chart below, we see that the stock has consistently underperformed its peers and the market - with significantly higher volatility.

So, the pros of owning BXP are buying a well-covered dividend yield of 7.7%, which is protected by a portfolio of high-quality assets and tenants. While BXP has a terrible long-term track record of subdued dividend growth and elevated volatility, buying a steep discount may be beneficial for income-seeking investors.

The cons are high volatility, likely underperformance, and industry risks that could, eventually, endanger dividend safety if even the big guys start to cut down on their office employee count - or if high vacancy rates trigger a full-blown price war.

Additionally, if commercial real estate starts to weaken further, I prefer to buy high-quality dividend growth stocks that are likely to reach highly favorable valuations as well.

Again, I'm not trying to scare people out of owning BXP. There are certainly reasons to buy the stock. I'm just not a fan of the long-term risk/reward, just for the sake of buying a high yield.

Takeaway

While the decline in stock prices of high-quality companies excites the contrarian in me, beaten-down office stocks, such as Boston Properties, do not generate the same enthusiasm. BXP, a leading office real estate investment trust, has seen its share price fall to levels not seen since the Great Financial Crisis due to rising risks in the commercial office space.

Although BXP offers a juicy 8% yield, it's important to consider the total return picture. The office real estate industry is facing significant challenges, with remote work trends and mounting pressure on loans contributing to low occupancy rates and potential defaults. BXP's performance is influenced by two key trends: a deceleration in leasing and the growing importance of building quality. While BXP maintains stability with its high-quality assets and tenants, its long-term track record of subdued dividend growth and elevated volatility raises concerns.

Income-seeking investors may find value in BXP's well-covered dividend yield and discounted stock price. However, the risks of high volatility, underperformance, and potential industry disruptions should be carefully evaluated.

Alternatively, considering high-quality dividend growth stocks with favorable valuations may be a more attractive option in a weakening commercial real estate market.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.