Hillenbrand: Fully Valued After A Great Run

Summary

- Hillenbrand's revenue growth is driven by organic growth and acquisitions, but the stock may be fully valued based on an EV to EBITDA basis.

- The company offers a low dividend yield and poor share buybacks, making it less attractive for investors at its current price.

- Despite recent momentum, HI stock may be overbought and could sell off when market volatility increases, so investors may want to wait for a lower valuation.

GCShutter

Hillenbrand (NYSE:HI) offers its engineered products to attractive end markets. The company can continue growing rapidly using organic growth and acquisitions. But, the company generates a low return on invested capital and may be fully valued based on an EV to EBITDA basis. The stock offers a low dividend yield, which has grown slowly. When it sells off to about 8x or 9x EV to EBITDA multiple, investors can consider Hillenbrand.

Revenue growth is driven by organic growth and acquisitions

In Q2 2023, the company grew its revenue by 22% y/y. About 9% of that growth was driven organically, while the rest came from acquisitions. In Q1 2023, acquisitions were the primary driver behind revenue growth. Revenue grew by 16% y/y in Q1, with organic growth accounting for just 4% of that growth.

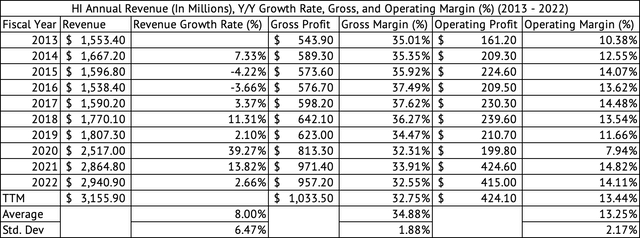

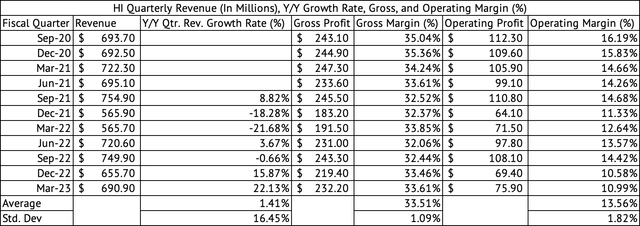

The company has shown remarkable stability in its gross and operating margins. Its gross margins have averaged 34.8% over the past decade but have been lower since 2020, with high inflation and supply chain disruptions increasing costs (Exhibit 1). The company's quarterly gross margins bottomed out in its June 2022 quarter at 32% and are recovering slowly (Exhibit 2).

Exhibit 1:

Hillenbrand Annual Revenue, Gross, Operating Profits, and Margins (%) (Seeking Alpha, Author Compilation)

Exhibit 2:

Hillenbrand Quarterly Revenue, Gross, Operating Profits, and Margins (%) (Seeking Alpha, Author Compilation)

Low dividend yield and poor buybacks

The stock's dividend yield of 1.71% is too low for the current rate environment, where the U.S. 2-year Treasury yields 4.5%. The Vanguard Industrials Index Fund ETF (VIS) yields 1.4%, and the Vanguard S&P 500 Index ETF (VOO) yields 1.54%. The company payout ratio of 25% is safe, and it has grown its dividend for 14 consecutive years. But the dividend has grown at a slow 1.1% CAGR over the past five years.

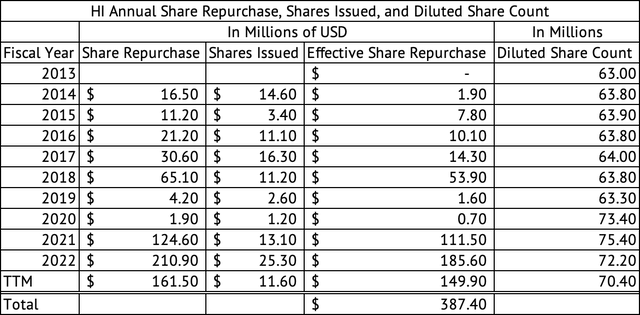

The company has spent $640 million on share buybacks since 2014 (Exhibit 3). But the company uses buybacks to prevent further dilution of its shares. Since 2014 the company's share count has increased by 6.6 million from 63.8 million to 70.4 million.

Exhibit 3:

Hillenbrand Shares Issued and Repurchased (Seeking Alpha, Author Compilation)

The company's dividend yield is too low, and its share buybacks are not reducing its outstanding shares. This is another reason to avoid the stock at these prices.

Fully valued

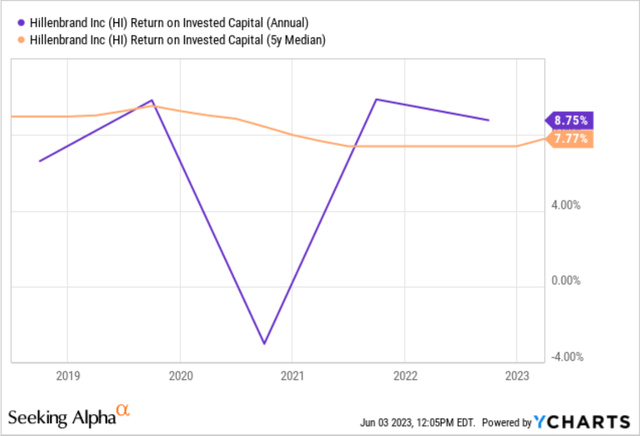

The company does not generate enough return on its invested capital to justify investing in the stock. The company generated an ROIC of 8.7% based on the calculations made by Seeking Alpha/YCharts (Exhibit 4). My calculation, which considers goodwill, yields an ROIC of 8%. With an assumption of 8% for its cost of capital in the future, the company does not generate any excess return above its capital costs. Interest rates will need to trend lower for the company to generate returns in excess of its cost of capital. This low return may be why the stock lags the market's performance. When investors can get a better return on an index, they shun stocks that do not produce adequate returns.

Exhibit 4:

Hillenbrand Return on Invested Capital (Seeking Alpha)

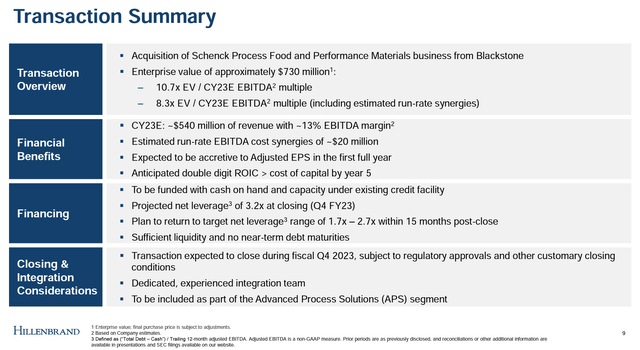

The stock trades at a forward GAAP PE of 6x and a forward EV-to-EBITDA multiple of 9.8x. The stock is fully valued on an EV-to-EBITDA basis but looks undervalued based on GAAP PE. The EV-to-EBITDA multiple may be better in valuing the stock, and a 10x multiple would put the stock at fully-valued. Hillenbrand recently acquired Schenck Process Food and Performance Materials business for a 10.7x EV-to-EBITDA multiple (Exhibit 5), proving a 10x multiple would fully value the company. Hillenbrand promises to generate a double-digit return on invested capital, which would exceed its cost of capital, from this acquisition by year 5.

Exhibit 5:

Hillenbrand Acquisition Multiple (Hillenbrand Investor Presentation)

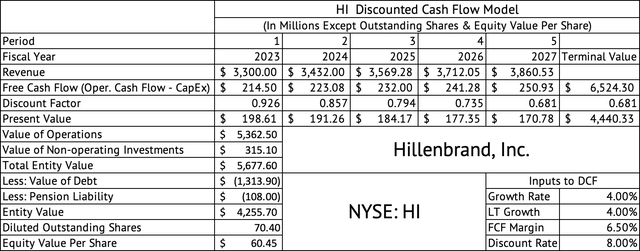

A discounted cash flow model estimates the per-share equity value at $60.45 (Exhibit 6). This model assumes a total revenue of $3.3 billion as a starting point for the model. The company is projected to have $3.3 billion in annual revenue after the close of the Schenck Food and Performance Materials acquisition. This model also assumes a low free cash flow margin of 6.5% and a discount rate of 8%. The 6.5% free cash flow margin may be at the low end for the company.

The company has shown high variability in its margins. Its free cash flow margin has averaged 10.4%, with a standard deviation of 4.3% over the past decade (Source: Seeking Alpha, Author Calculations). This approximate 6.5% margin was determined by deducting the company's average from its standard deviation. The company is assumed to grow at 4% over the long term. The stock looks undervalued based on this model. It potentially has approximately 17% upside from its current price of $51.

Exhibit 6:

Hillenbrand Discounted Cash Flow (Seeking Alpha, Author Calculations)

Expect Hillenbrand's price momentum to fade

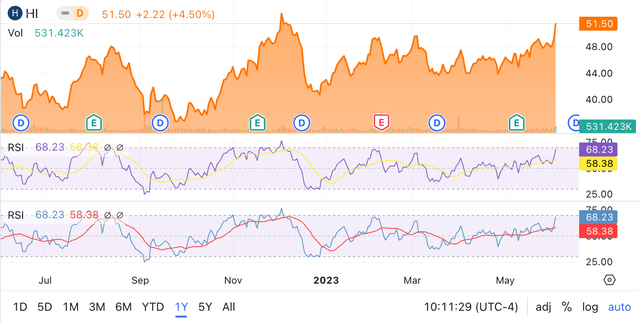

The stock has had good momentum over the past year, returning 18.9%, while the sector median return is 0.42%. The stock has done so exceedingly well over the past year that its technical indicators, RSI and MFI, are at overbought levels (Exhibit 7). The technical indicators may be signaling a pause in the stock's rally. These overbought levels are another sign that investors may be better off waiting for the stock to pull back to below $45 before opening a position or adding to an existing holding in the stock. Over the past year, there have been multiple instances when the stock has dropped to around $44, which has served as a floor. If the stock drop below $44, it may revisit its 52-week low price of $36.16, providing a great buying opportunity.

Exhibit 7:

Hillenbrand Technical Indicators (Seeking Alpha)

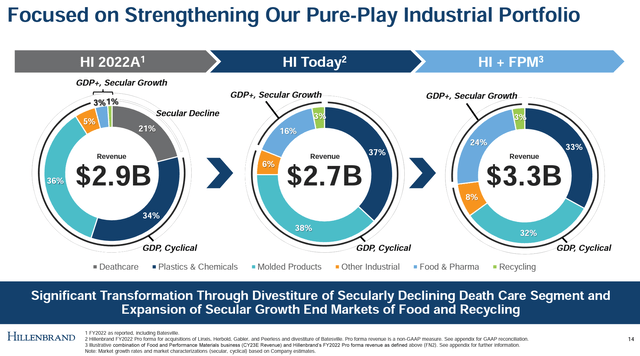

The stock has a beta of 1.49, indicating that for every 1% move in the market, the stock is expected to change by an average of 1.49%. In essence, the stock would amplify the market's move to the upside and the downside. This beta relationship has primarily held in the past year, with the stock returning over 18%, while the Vanguard S&P 500 Index ETF has returned 2.5%. This volatility in the stock can be attributed to the company's revenue mix. The company generates nearly 73% of its revenue from cyclical industries rather than secular growers (Exhibit 8). This revenue and profitability volatility is reflected in the stock.

Exhibit 8:

Hillenbrand Revenue From Various Industries (Hillenbrand Investor Presentation)

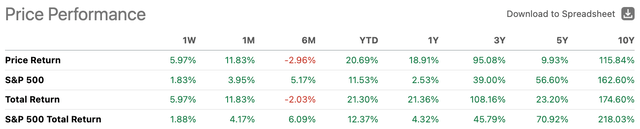

Another reason to approach this stock cautiously after its nice run is its long-term performance. The stock has handily beaten the S&P 500 Index over a 1-year and 3-year period (Exhibit 9). But, it has lagged the index over a 5-year and 10-year period.

Exhibit 9:

Hillenbrand Price Performance (Seeking Alpha)

There are multiple reasons to like Hillenbrand as a long-term holding in a portfolio. But, the company may be fully valued, and its dividend is too low for investors to consider. The stock has outperformed the market over the past year but looks overbought and may sell off when the market's volatility increases. Investors may have to wait for higher market volatility and a lower stock valuation.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of VOO, VIS either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.