British American Tobacco: Buy The Blood Bath - 8.79% Income Yield

Summary

- British American Tobacco has underperformed compared to its peers but remains a viable income stock with a forward dividend yield of 8.79%, exceeding the sector median.

- BTI's combustible segment outperforms the market trend, suggesting its robust brand stickiness as the top line expands, despite the decline in volume.

- BTI is also expanding its non-combustible offerings, with the segment's revenue growing to £2.89B (+40.9% YoY) and profitability expected by 2024.

- Despite the regulatory headwinds in the tobacco industry, BTI's execution remains excellent, making it an opportunistic buy for bottom-fishing income investors seeking steady dividend payouts.

We Are

The 17Y Low Investment Thesis

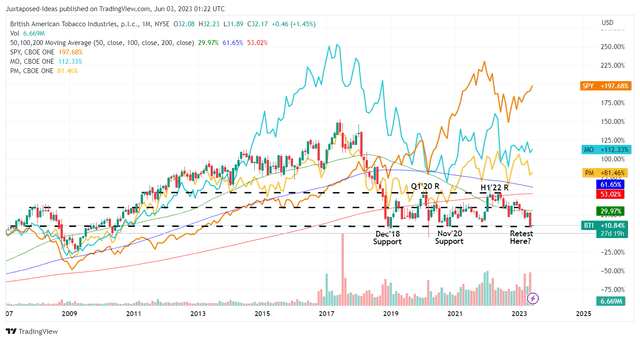

BTI 17Y Stock Price

British American Tobacco p.l.c. (NYSE:BTI) has dramatically lost much of its gains over the past few years, retracing to its 17Y critical support levels of low $30s. Interestingly, this ran against the market-wide trend for other tobacco stocks and the SPY alike.

For example, BTI has only recorded a stock price return of +10.84% since 2007, while Altria Group (NYSE:MO) has returned handsomely at +112.33% and Philip Morris International (NYSE:PM) at +81.46%, against the SPY at +197.68%.

However, investors must also take one step back and understand that BTI is an income stock, which has provided shareholders with excellent total returns of +153.90% since 2007, including dividends. Unfortunately, the returns underperform against its peers, MO at +444.08%, PM at +270.96%, and SPY at +308.56%.

Then again, while BTI may have delivered less than expected returns, we are not overly concerned now, since most income investors are unlikely to realize losses by selling the stock, due to the stellar 4Y dividend yield of 7.23% compared to the sector median of 2.42%. The yield is still excellent, compared to MO's 4Y historical yield of 7.63% and PM's 5.46%.

These numbers have allowed us to conclude that while MO may have been the better tobacco stock, BTI remains a viable income stock thus far, especially made attractive by its depressed stock prices.

The Seeking Alpha Quant rating already projects an exemplary forward dividend yield of 8.79% for those who choose to start a position here. BTI is a highly attractive steady income stock indeed since the tobacco company's profitability and balance sheet remain excellent.

In FY2022, BTI reported an excellent EPS of 291.9p (-1.3% YoY) and a dividend payout per share of 230.9p (+6% YoY), sticking to its historical ratio of ~75%. Its long-term debts remain moderate at £38.13B (+7.3% YoY), significantly aided by the expanding Free Cash Flow generation of £8.04B (+8.1% YoY).

Naturally, not everything is roses with BTI, since the tobacco industry is facing a sustained decline in combustible demand, transiting toward a vaping/ smoke-free future. For now, the tobacco company, as with MO and PM, is aggressively expanding its non-combustible offerings, with the segment's revenue already growing to £2.89B (+40.9% YoY), as losses narrow and profitability is expected by 2024.

While the FDA continues to ban flavored/ menthol e-cigarettes, investors need not fret yet, since BTI's Vuse still commands a large share of the e-cigarette market at 41.8% by April 2023, expanding from 30.2% in December 2022.

This cadence has explained why its non-combustible consumer has risen tremendously to 22.5M by the end of 2022 (+22.9% YoY), thanks to the Juul fiasco thus far.

Therefore, we are cautiously optimistic that BTI may be able to achieve its non-combustible revenue CAGR of 25.99% between £1.25B in FY2019 and £5B by FY2025, even after its exit from Russia and Belarus.

Meanwhile, we must also highlight that combustibles remain BTI's revenue driver at £24.76B (+4.7% YoY), comprising 89.5% (+2.5 points YoY) of the £27.65B sales in FY2022 (+7.7% YoY), despite the decline in volume by -4.2% YoY. This cadence alone proves that the two-pronged approach may ensure its long-term success ahead, no matter the uncertain macroeconomic outlook and the noncombustible's supposed health benefits.

Incidentally, the top-line expansion in the combustibles segment also demonstrated the tobacco company's brand stickiness despite the raised prices, since MO and PM both experienced top-line declines by -2% YoY in their combustible segments over the last twelve months. This is despite the increase in their volumes at 1% and decline by -9% YoY, respectively.

As a result, we are not overly concerned about the peak recessionary fears potentially impacting BTI's performance, since the management still guides a more than decent "constant currency adjusted EPS growth." This may translate into a healthier balance sheet and decent growth in dividend payout per share, despite the 2023 share repurchase program still under review.

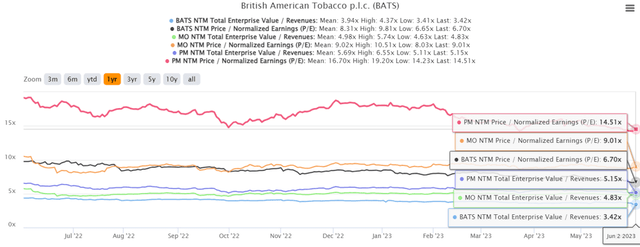

BTI, MO, & PM 1Y EV/Revenue and P/E Valuations

As a result of the factors discussed above, we believe the pessimism embedded in BTI's stock prices is unwarranted, with its valuations naturally depressed compared to the 1Y means and peers. Its execution remains excellent in an industry that is almost recessionary-proof, with the FDA regulations only a temporary headwind, since Vuse continues to enjoy four FDA marketing authorizations in the US.

As a result, we are rating the BTI stock as a Buy here for income investors who seek steady dividend payouts. Naturally, this rating comes with a caveat, that they must also consider the tobacco industry's headwind, since the highly profitable combustibles may very well be a sunset industry, taken over by e-cigarettes with slimmer margins.

Therefore, while BTI may be suitable for a lower-risk retirement portfolio, investors must also prudently monitor the tobacco company's execution in the non-combustible market.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The analysis is provided exclusively for informational purposes and should not be considered professional investment advice. Before investing, please conduct personal in-depth research and utmost due diligence, as there are many risks associated with the trade, including capital loss.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.