S&P 500: Genuine Breakout? Week Starting 5th June (Technical Analysis)

Summary

- The S&P 500 is expected to reach a higher high above this week's 4290 high, but may fade again from 4311-25.

- The market has been following a pattern of reversing lower on Mondays, dipping into a mid-week bottom, and then rallying into a strong weekly close.

- 4231-41 is key to bullish momentum.

cemagraphics

A dip early in the week gave bulls the chance to get long for the breakout. As last week's article concluded, "...prepared with a bias, targets and important levels, the market should present opportunities." My tweet on Wednesday hopefully helped as it pointed out a potential bottom at 4163 (the bottom came 10 minutes later at 4166).

Next week will present more opportunities and it's again time to prepare. A variety of technical analysis techniques will be used to look at probable moves for the S&P 500 (SPY) in multiple timeframes. I will then use the evidence make a call for the week ahead.

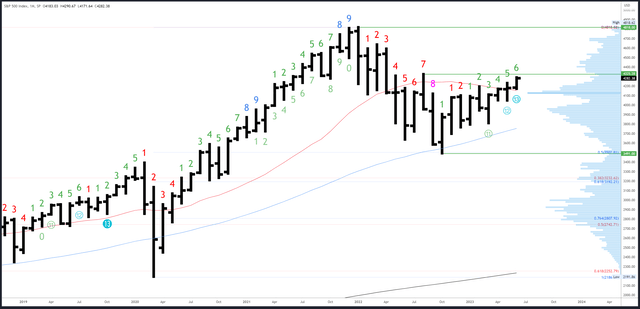

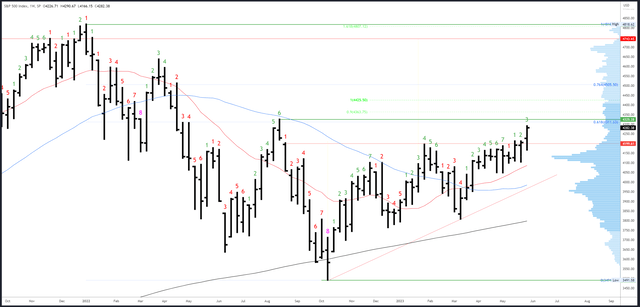

S&P 500 Monthly

The May candle closed at 4179, which was close enough to the 4166 open to be considered a 'doji'. June's higher high has already negated its bearish potential and any reversal pattern will need to time to develop. At this early juncture, this simply mean staying above the 4183 June open.

Resistance is at 4325 and the high of August, then the 4500 area.

It's taken a long time to break 4195-200 and it ideally now acts a floor. The VPOC at 4130 is the next support below.

An upside Demark exhaustion count is on bar 6 (of 9).

S&P 500 Weekly

This weeks bar is not to be second-guessed and looks like a true break-out/range expansion after extended coiling and consolidation.

The close at 4282 was near enough to the 4290 weekly high to expect immediate follow above 4290 early next week.

The next major targets are the 61% Fib retrace of the 2022 bear market at 4311, with the August high of 4325 just above. There's not too much resistance above that until 4500, but I have my eye on 4363 due to the measured move there.

4195-200 is the first support, then 4166 and 4098.

The upside (Demark) exhaustion count will be on bar 4 (of 9) next week.

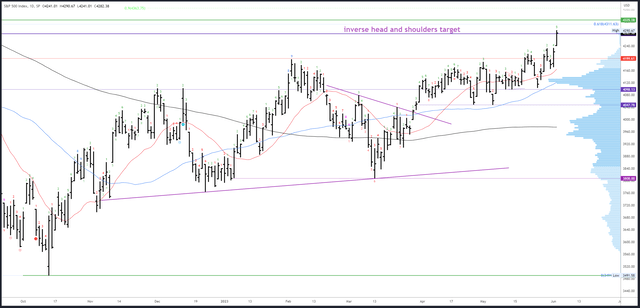

S&P 500 Daily

The inverse head and shoulders pattern has now played out to its target of 4280. We can now focus on the higher timeframe targets in play.

Friday's strong close should lead to at least a new high over 4290 before any reversal pattern can form. As mentioned earlier, 4311-25 is the first area of interest and price would then need to break back through 4231-41 to signal weakness.

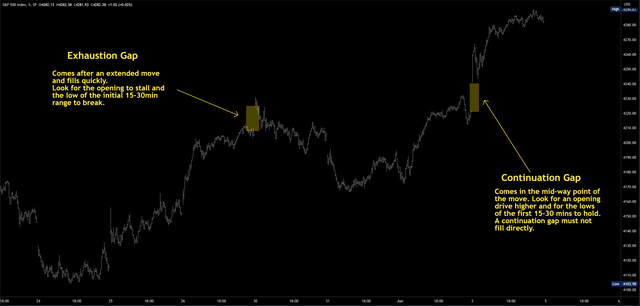

4231-41 is support created by Friday's continuation gap and it is worth revisiting the two different gaps created this week as I touched on the subject in my last article.

An upside Demark exhaustion count will be on bar 6 (of 9) on Monday. A reaction is expected on bar 8 or 9 so look out for a pause / dip from Wednesday onwards.

Events Next Week

Markets are now working on the assumption the Fed will pause in June which now has around a 75% probability according to the CME Fedwatch tool. No scheduled events or data next week are likely to change this situation and the Fed has just started its blackout period. CPI is the next 'big' release on the 14th June, the day before the FOMC meeting.

The resolution of the debt ceiling crisis means the Treasury General Account can be increased with new debt, potentially causing a drain on liquidity. To be honest, I don't know the impact or timeframe for this driver, and I doubt many do, at least in the context of near-term price action. I therefore revert to what I know, and the Demark exhaustion signal could have a similar effect i.e. a liquidity

Probable Moves Next Week

A higher high above this week's 4290 high is likely but should fade again. Markets have recently followed a pattern of reversing lower on Mondays, dipping into a mid-week bottom and then rallying into a strong weekly close. I will therefore look for another exhaustion gap on Monday similar to the one described above. 4311-25 remains the ideal target, and even when/if this is tested, the upper support area of 4267-71 could hold for consolidation and further highs to 4363.

Only a break of 4231 would dent the bullish momentum. If this happens directly (i.e. without a move to 4363 first), I wouldn't consider the top to be in, but I would need to re-evaluate before trying to get long again. This could be late next week so it's hard to foretell how things will line up when I'm writing this on a Saturday afternoon. 4195-200 is the first decent support on the higher timeframes.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.