Atlantica Sustainable Infrastructure: Finally Attractive Again

Summary

- Atlantica Sustainable Infrastructure's shares have fallen back into buy territory, offering potential long-term returns of over 10% with relatively low risks.

- AY operates renewable energy assets and has predictable cash flow growth, making it an attractive investment for retirees and high-yield investors.

- Risks include counterparties not fulfilling their obligations in long-term contracts and the possibility of agreements being revoked or terminated at the discretion of the off-takers' government.

pidjoe

My first investment in Atlantica Sustainable Infrastructure (NASDAQ:AY) dates back to 2019 when the name was still Atlantica Yield. At the time, AY traded below $18, the dividend yielded above 8.5%, and the down-to-earth corporate name reminded investors that the company is an asset play structured as a yieldCo (since utilities can't usually structure themselves as REITs or MLPs). I exited the investment towards the end of 2020 at $33, missing the top at $46, driven entirely by the green/ESG-investing fad. My fair value for AY was $30; I called it a day when the stock flew 10% above that. Unfortunately, I did not maximize my potential profits, but I knew AY was getting wildly overvalued. Fast-forward two years, AY lost almost 50% from that peak, vindicating my stance.

The collapse in Atlantica's share price, accelerated by the financial troubles of its sponsor Algonquin Power & Utilities (AQN), picked up my interest in AY again. I can immediately sense that, at $24, this is no hard bargain: investors are being paid 7.5% for a junk-rated (BB+), slow-growth company, while risk-free money in CDs is giving more than 5%. On the flip side, shares finally came down to a level where the potential long-term returns are again in line with my objectives, and investors can get exposure to a green-energy pure play that will continue to be looked upon favorably by the market participants and regulators alike. At about $24 or below, AY is a BUY, which is why, on May 31st, I picked up some shares.

AY Business Review

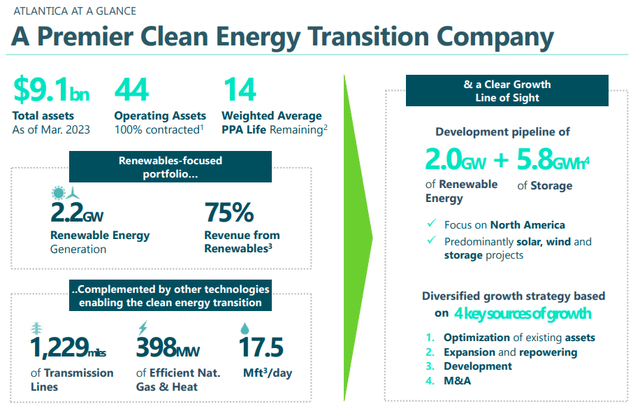

To those unfamiliar with the name, Atlantica Sustainable Infrastructure is an owner and operator of renewable energy assets, with the addition of some storage, water, and electric transmission ones. 75% of the portfolio is in North America and Europe. In particular, Spain used to be a focus country as Atlantica's original sponsor was the now-defunct Spanish firm Abengoa, while the company's current focus is now the US. AY primarily operates assets under long-term agreements, with 14 years remaining average PPA life. Almost 50% of AY's revenues include some indexation to inflation or, anyways, an escalator, providing the company with predictable cash-flow growth.

AY May23 Investor Presentation

Cash flow has increased nicely over the last few years, reaching almost $600 million for FY22. However, since AY grows by issuing new shares and must pay down the principal related to project indebtedness, investors should primarily keep an eye on cash available for distribution (CAFD) routinely reported. Over the last four years, AY kept flat its CAFD payout ratio at 85%-86% while modestly growing dividends from $1.57 to $1.78, a 3.2% CAGR. While investors shouldn't look forward to higher numbers than this, the long-term total equity return potential from now on, based on a $24 purchase price per share, could theoretically stand at about 7.4% yield +3.2% growth = 10.6%.

Fair Value Assessment And Catalysts For Re-rating

Based on the above yield data, it does not seem too farfetched to expect AY to trade up again towards $28 - $30 per share. The value would represent normalized equity returns of 9.25% - 9.50%, which I find appropriate for the company. The $30 fair value is my base-case scenario for the company today, and I am willing to pay up to $24 to provide myself with a nice 20% margin of safety. Below $24, AY is a buy.

Further upside could be, however, in the cards if the company continues to deliver on its growth plans. When I first became interested in AY in 2016-2017, the company was rated BB- by S&P. The company got upgraded as it improved the scale of its operations in 2018 (to BB) and 2021 (to BB+). Atlantica's credit is now on the verge of becoming investment-grade. If that were to happen, it would open up re-rating potential as the company could become more attractive to institutional investors. These investors will likely accept lower long-term equity returns of 8.0% - 8.5% for investing in a predictable cash-flow, assets-backed, ESG-friendly business. This catalyst is the foundation for my bullish scenario, and if such an upgrade were to happen, we could see AY trade again in the $33 - $35 region.

The ongoing issues with AQN provide a case for potential upside with similar grounds. If AQN were to sell its sponsor stake in AY to raise cash, it would likely be in a private transaction that involves a peer. Should Brookfield Renewable Partners (BEP) get involved, we could see AY fetch a similar price tag, even because Brookfield would likely leverage the assets up and extract a higher return on equity anyways.

On a forward basis, AY trades at a 9.6x EV/EBITDA against almost 25x for BEP, making a deal immediately accretive for Brookfield. Combinations aside, AY appears to be modestly undervalued even as a standalone entity from an EV/EBITDA perspective. Peers CWEN and NEE trade closer to 11x fwd EV/EBITDA, and AY could trade back to about $28 just by closing the gap. Given CWEN's 5-year EV/EBITDA average of 13x and AY's 12x, it seems only reasonable to expect mean reversion to lift AY's price right back towards $30 (12x fwd EV/EBITDA).

Risks

Although long-term contracts protect Atlantica's revenues, the counterparties of such off-take agreements may not fulfill their obligations. Kaxu Solar One, for example, is a project initially developed by Abengoa in South Africa, with Eskom Holdings SOC as an off-taker. Atlantica lists this project on its website as a "BBB" rating because Eskom Holdings is a public company guaranteed by the South African Department Of Energy. However, the off-taker actual credit rating is CCC-, which is not precisely investment grade.

While I am not stating there is an immediate threat to the company's cash flow or that the overall credit standing of AY's off-takers is terrible, it is vital to remember that, in the event of a recession, there is a lot that could go wrong even with this type of take-or-pay contracts that seem insulated from macro risks. Certain agreements could also be subject to revocation or termination at the sole discretion of the off-takers' government.

Finally, as the agreements expire and the plants' edge toward the end of their useful life, there is no guarantee that AY will continue operating these at a profit (or at all). The fleet is relatively new, with most of the plants built during the early years of the last decade. Still, technology is improving fast, and renewable plants already operate at a disadvantage against conventional energy and are susceptible to changes in subsidy policies.

Takeaway

After a prolonged period in which AY traded close to fair value or above, shares have gently fallen back into buy territory. I believe this happened for reasons that are not strictly related to the company's performance, but instead revolve around uncertainties over the growth prospects of the yieldCo model in a long-term scenario of higher interest rates and depressed macro-outlook. Things could get worse before they get better, and the current valuation certainly does not entice me to go all-in, but rather start dipping my toes and see where things go from here.

AY has an interesting business model. As a utility, its operating cash flow is relatively stable and predictable. CAFD can grow modestly over time, providing retirees and high-yield investors an attractive total return if the share purchase price is low enough. Below $24, I expect long-term return potential to exceed 10% with relatively low risks, which is why I rate AY shares a BUY.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AY either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.