CEF Weekly Review: Why Are Investors Souring On Loan CEFs?

Summary

- We review CEF market valuation and performance through the fourth week of May and highlight recent market action.

- CEFs had another down week - the fourth in a row - as rising Treasury yields and weak sentiment keep the market under pressure.

- Loan CEFs discounts have been trading relatively wide despite strong income gains and resilient NAV performance. We take a look at possible reasons why.

- And highlight the share buyback announced by multi-sector CEF HFRO.

- Systematic Income members get exclusive access to our real-world portfolio. See all our investments here »

Darren415

This article was first released to Systematic Income subscribers and free trials on May 28.

Welcome to another installment of our CEF Market Weekly Review, where we discuss closed-end fund ("CEF") market activity from both the bottom-up - highlighting individual fund news and events - as well as the top-down - providing an overview of the broader market. We also try to provide some historical context as well as the relevant themes that look to be driving markets or that investors ought to be mindful of.

This update covers the period through the fourth week of May. Be sure to check out our other weekly updates covering the business development company ("BDC") as well as the preferreds/baby bond markets for perspectives across the broader income space.

Market Action

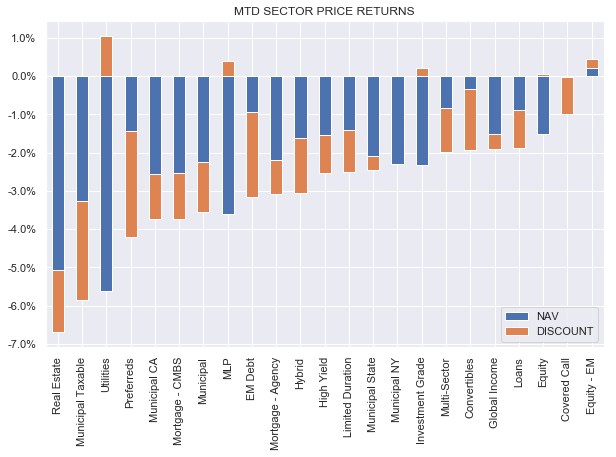

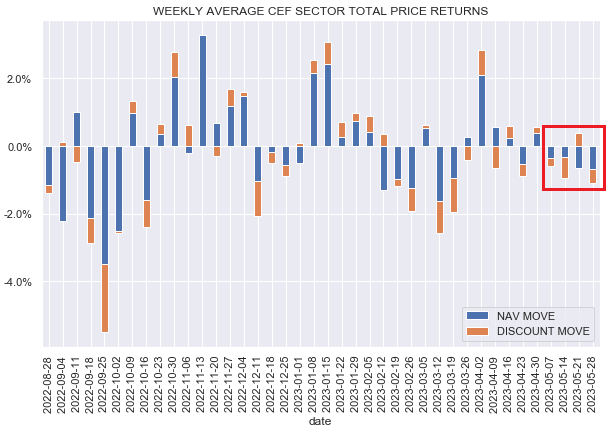

Nearly all CEF sectors were lower on the week as higher Treasury yields took their toll. Month-to-date, all sectors are down, save for one.

Systematic Income

This is the fourth down week in a row for the CEF market.

Systematic Income

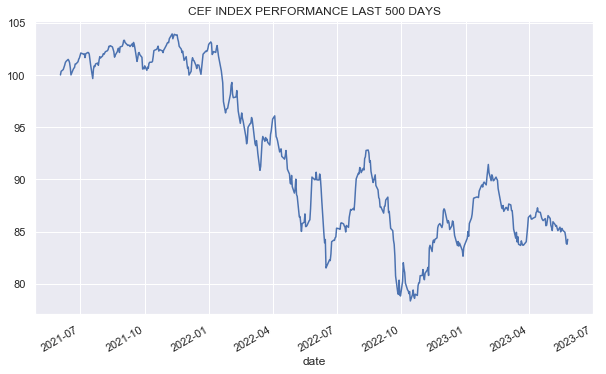

The CEF market has unwound all of its rally this year, though it remains well off its low in October of last year.

Systematic Income

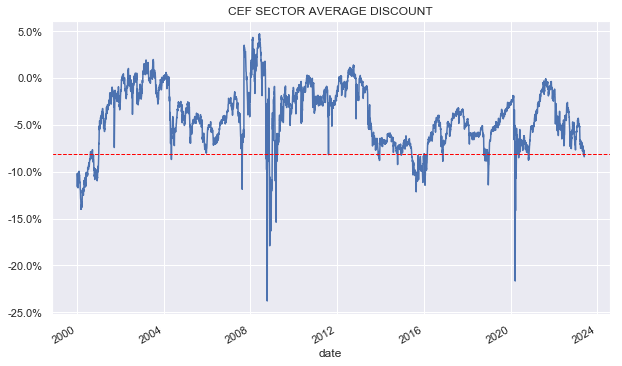

Outside of exceptional, and mostly brief periods, like the Tech recession, GFC, Energy crash, Fed autopilot tantrum and COVID crash, discounts have tended to be tighter than the current level. This tells us that the market is priced in for a recession, if not a particularly unusual one.

Systematic Income

Market Themes

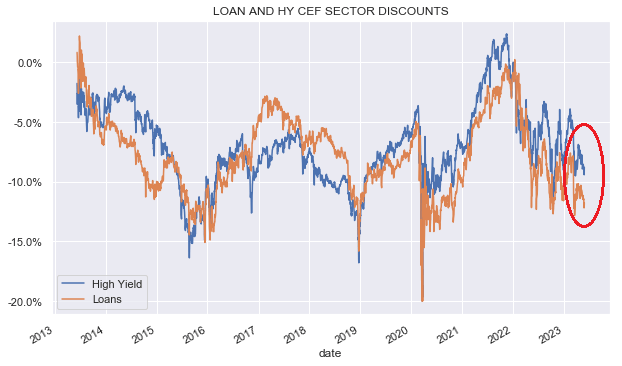

Many investors have noticed that Loan CEF have been trading fairly weak, in the sense that their discounts have been wide both in absolute terms as well as relative to the broader CEF space.

For example, in the chart below, we plot the Loan CEF sector discount (orange line) against the discount of the High Yield corporate bond CEF sector (blue line).

Systematic Income

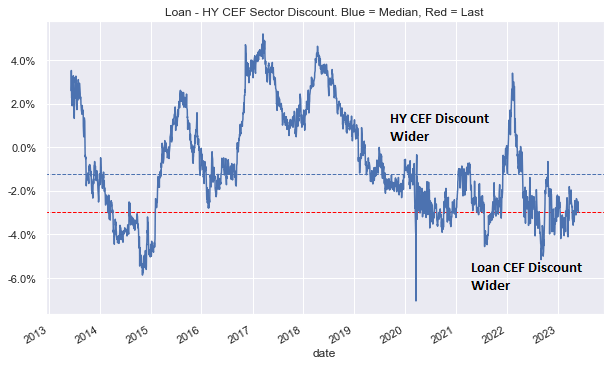

If we plot the differential between the two sectors, we get the chart below. What we see is that over the past decade, Loan CEFs have tended to trade at a discount about 1% wider of HY CEFs. Currently, that differential is about 3%, i.e., Loan CEFs are trading weaker vs. HY CEFs in both absolute terms and relative to their historical relationship to HY CEFs.

Systematic Income

The chart also shows that Loan CEFs got a big boost in early 2022 as the Fed's hikes got going, but then weakened quickly and remain fairly depressed versus corporate bonds.

This may be surprising in the context of what's happened to Loan CEF income and distributions. Loan CEFs have benefited from rising short-term rates, whereas HY CEFs have not. In short, loan CEF income has increased since the start of 2022 while HY CEF income has decreased.

On the distribution front, the median loan CEF has boosted its payout by 34% while the median HY CEF has made no change (the average HY CEF change is -4% outside of JHAA which has cut its distribution for other reasons).

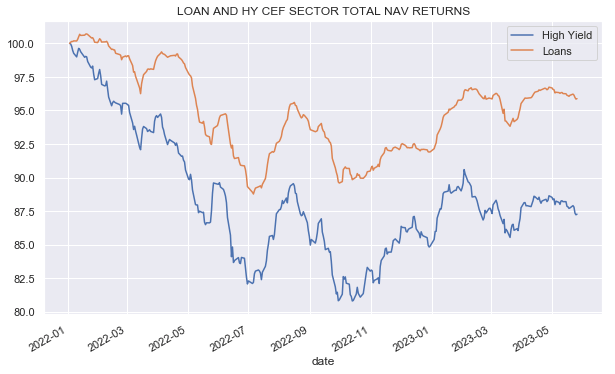

Not only have loan CEFs done better on the distribution front, but they have also outperformed since the start of 2022 in total NAV terms. Loan CEFs are down around 4% versus 12.5% for HY CEFs.

Systematic Income

So, clearly, distribution disappointment or total NAV returns are not what's driving loan CEF weakness. What else could be going on? There are several potential reasons.

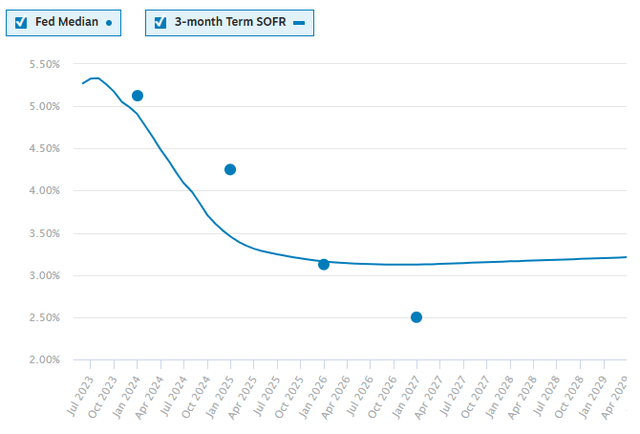

One reason could be that investors are worried about Loan CEFs is because they expect the net income benefit that Loan CEFs enjoyed to reverse. The chart below shows that both the market and the Fed expect short-term rates to move towards a 2.5-3% level over the next couple of years. This move would certainly hurt loan CEFs more than HY CEFs, though it would still leave Loan CEFs better off since the start of 2022.

Another view could be that higher short-term rates since 2022 are all well and good; however, it ignores the impact this has on loan borrowers. Specifically, the higher the interest rate these borrowers have to pay, the worse off they are and the greater the likelihood they are tipped into default. This increases the chance of defaults for Loan CEFs over HY CEFs.

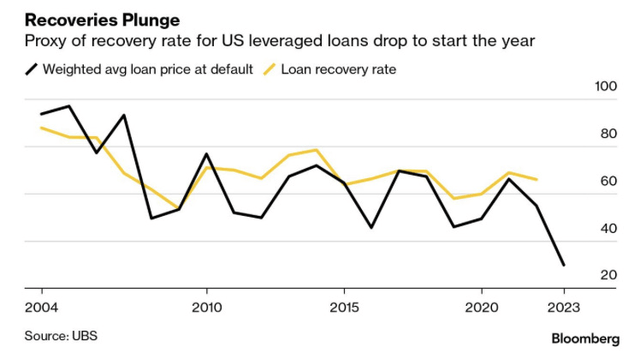

Finally, there is a strong argument that the underlying quality of the two sectors has diverged over the last few years. The BB-rating bucket (i.e., the highest sub investment-grade rating) of the HY sector has continued to increase over time while the bank loan quality has been under pressure from cov-lite underwriting, EBITDA add backs, asset stripping, sidecars and other tricks that have favored borrowers.

This is why many investors expect loan recoveries to be significantly lower than the historic average - something which already seems to be taking place.

Overall, it's not clear exactly what's driving this weakness. However, we continue to see value in Loan CEFs, particularly those with a mixed allocation profile that has positions across loans as well as CLO Debt and bonds. We remain allocated to funds like the Apollo Tactical Income Fund (AIF) and the Ares Dynamic Credit Allocation Fund (ARDC).

Market Commentary

The Highland Income Fund (HFRO) announced an approval of a $100m share repurchase program. The near-40% discount was, perhaps, sufficiently embarrassing for the fund, so it's going to do something about it.

Obviously, a buyback approval is not the same as an actual buyback, so we'll have to see whether the fund actually buys any shares back. There is a disincentive to buy back shares for management as it reduces the total amount of assets, which also reduces total management fees.

The fund has been an oddball one for a long time and is one of several "barge pole" funds in our view. The manager has also been involved in a number of colorful lawsuits.

HFRO appears to have increased its REIT allocation as well as its affiliate allocations. Its largest exposures are other funds run by the same asset manager, none of which are very transparent. Over the longer term, its total NAV return has done OK, though it has underperformed over the past year.

Check out Systematic Income and explore our Income Portfolios, engineered with both yield and risk management considerations.

Use our powerful Interactive Investor Tools to navigate the BDC, CEF, OEF, preferred and baby bond markets.

Read our Investor Guides: to CEFs, Preferreds and PIMCO CEFs.

Check us out on a no-risk basis - sign up for a 2-week free trial!

This article was written by

At Systematic Income our aim is to build robust Income Portfolios with mid-to-high single digit yields and provide investors with unique Interactive Tools to cut through the wealth of different investment options across BDCs, CEFs, ETFs, mutual funds, preferred stocks and more. Join us on our Marketplace service Systematic Income.

Our background is in research and trading at several bulge-bracket global investment banks along with technical savvy which helps to round out our service.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AIF, ARDC either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.