Canadian Utilities: A Cheap Utility With A Growing Dividend, But Consider A Better Option

Summary

- Few utilities screen cheap on metrics while having excellent credit metrics.

- Canadian Utilities meets these two hurdles today.

- We like the company but think direct ownership is rather pointless.

- Looking for a helping hand in the market? Members of Conservative Income Portfolio get exclusive ideas and guidance to navigate any climate. Learn More »

Marvin Samuel Tolentino Pineda/iStock Editorial via Getty Images

All values are in CAD unless noted otherwise.

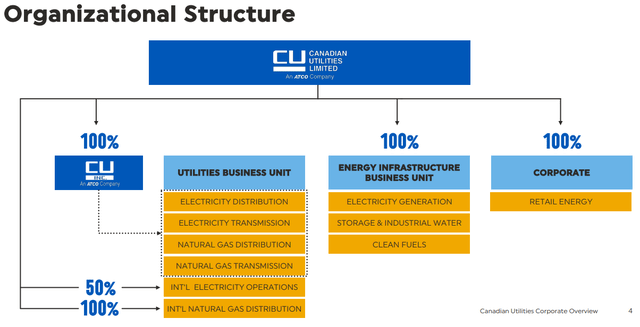

Canadian Utilities Ltd. (OTCPK:CDUAF) (TSX:CU:CA) has three business segments. The first one is regulated and involves transmission and distribution of electricity and natural gas. The second is non-regulated and pertains to energy infrastructure such as clean energy generation, natural gas (including liquids) storage, transmission of the same and industrial water solutions. The retail arm comprises the third segment and is the smallest by far compared to the former two.

ATCO Ltd. (OTCPK:ACLLF) (TSX:ACO.X:CA) (ACO.Y:CA) holds the majority stake in Canadian Utilities Ltd. While primarily operating in the province of Alberta, Canadian Utilities does have a presence in Mexico, South America and Australia.

2023 Corporate Overview Presentation

We covered the parent-child duo back in January of this year. CU had delivered one of its best earnings quarters (Q3), flying high in the face of inflationary winds. Trading at a 16X earnings multiple at the time, we thought it was cheaper relative to its Canadian peers, despite having the lowest debt to EBITDA. We were confident of incoming investors earning 7% total returns over the long term, with most of it coming from dividends. We liked it, but what we liked even more was that we could get it at an additional discount and more than double the upside by buying the parent, ATCO Ltd. instead. There were so many reasons to like ATCO more and we expanded on those in that piece. One of the main ones the discount apparent in the parent's market capitalization.

If you like CU, then the natural extension of that is to see if ATCO makes sense as well. As we previously mentioned, the bulk of the valuation for ATCO derives from CU. Added to that are the structure and logistics segment that ATCO owns as well as the investment in Neltume Ports.

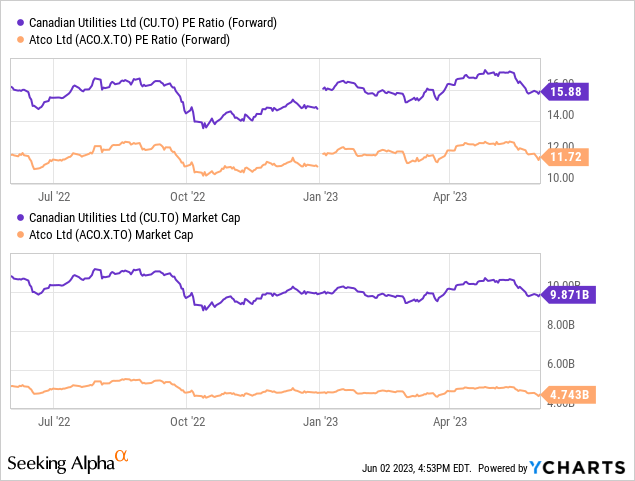

Those two non-utility segments are worth about $1.0-$1.5 billion in our opinion. So the kicker here is that ATCO's current market capitalization is less than even the directly held stake in CU. At about 53% of the $10 billion market capitalization of CU, ATCO should be worth at least $5.3 billion. Instead, it is worth about $4.85 billion.

Source: ATCO: Go For The Dividend Aristocrat, Not The Dividend King

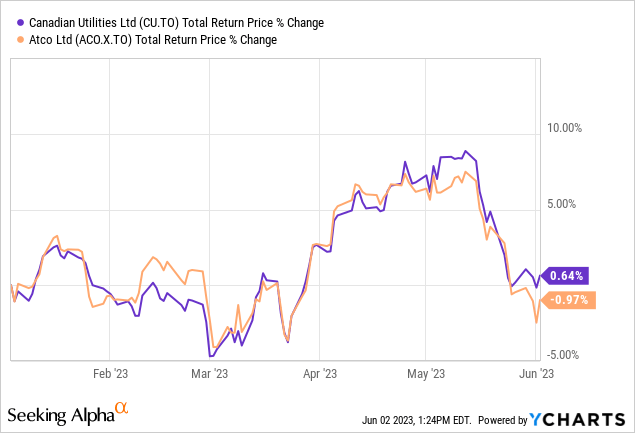

While neither has made any ground breaking movement since then, CU has come out slightly ahead.

Let's review the Q1-2023 numbers for CU to see if this growth oriented utility still has us impressed.

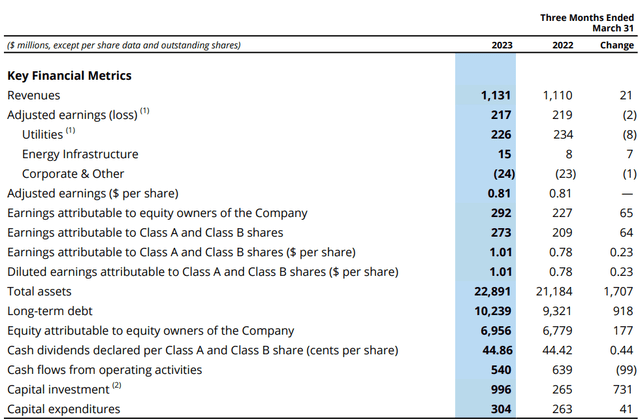

Q1-2023

CU once again beat consensus estimates by 5 cents coming in at 81 cents per share. While it beat consensus for the quarter, it was flat year over year.

Cost efficiencies, rate base growth, and timing of the CPI indexing in their international operations, were among the factors contributing to the year over year revenue growth. The higher revenues did not have a trickle down effect on the earnings mainly due to the cost of service rebasing framework in the Alberta distribution utilities this year. Essentially, rebasing is sharing of the cost savings from the previous period with the customers. Management expects the impact of rebasing to be felt more strongly in the subsequent quarters of this year.

Moving on to our Alberta distribution utilities, the work that we were able to advance into the latter part of 2022, combined with key regulatory decisions on the 2023 cost of service framework, and the timing of cost, all helped soften the earnings impact of our rebasing in the first quarter of 2023. However, despite the strong showing from this business in the first quarter, I want to caution that the rebasing of our Alberta distribution utilities will still result in lower achieved ROEs and earnings for 2023 when we compare that to the prior year.

Source: Q1-2023 Earnings Call Transcript

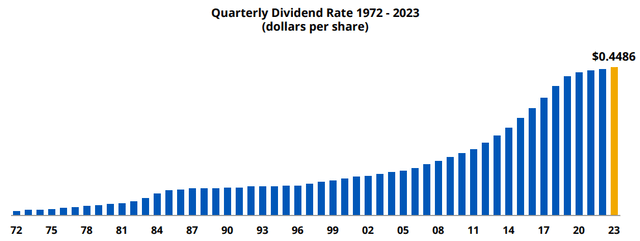

Keeping with the tradition, this dividend aristocrat increased its quarterly dividend in 2023 from $0.4442 to $0.4486, making its yield close to 5%.

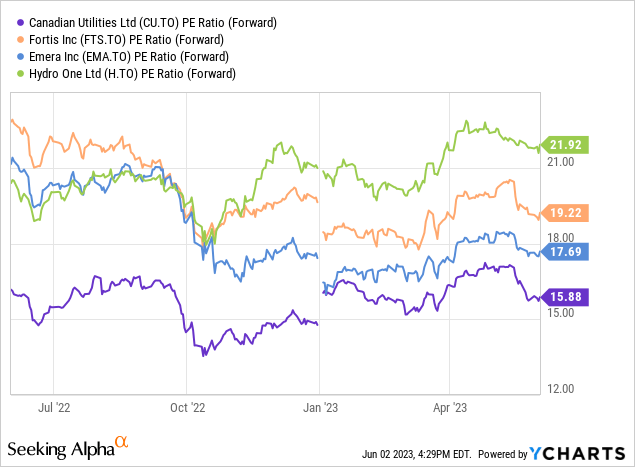

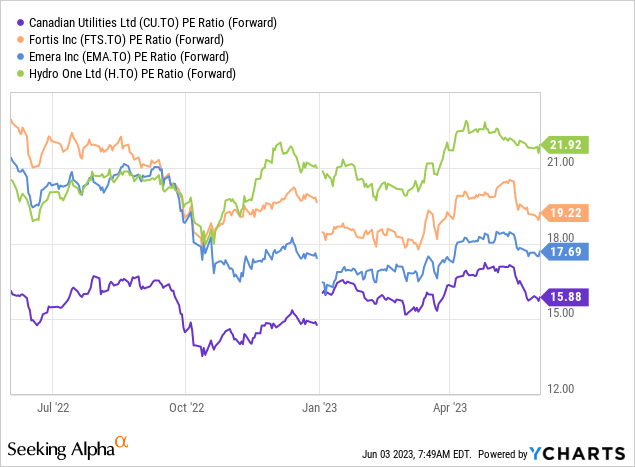

The story remains the same as our prior coverage. CU continues to trade at a lower multiple compared to its Canadian peers.

We recently wrote on the fan favorite, Hydro One Ltd. (OTCPK:HRNNF). Enjoying government backing along with consistently strong results, this one yields the lowest in the group. We rated this one a sell due to its unrealistic valuation.

Verdict

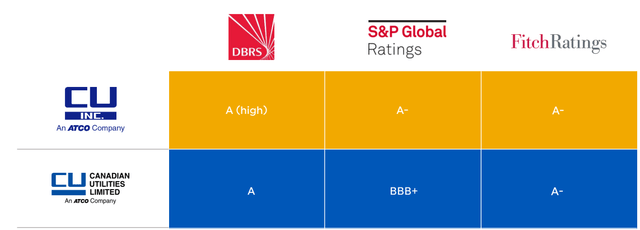

CU has the investment grade stamp of approval from the credit agencies.

It also trades slightly cheaper than its peers. Hydro One is clearly the most expensive of the group but even Fortis Inc. (FTS) (FTS:CA) and Emera Inc. (EMA:CA) will make you pay more.

So among its peers, Canadian Utilities is possibly the only one to pony up for at this stage of the cycle. If you want to own this one at an even bigger discount, the parent, ATCO still remains the best route. ATCO trades even cheaper at 12X forward earnings.

This is thanks to its secondary infrastructure plays (which we have described before) and the fact that the market does not even give it credit for its Canadian Utilities stake. ATCO's market capitalization is less than its 53% ownership in CU, without even taking into account its other businesses. For getting this tremendous discount, your tradeoff is a slightly lower yield (4.55% vs 4.9%). That is acceptable to us. Those looking for an even safer play with higher yield, can consider the Canadian Utility preferred shares.

We rate Canadian Utilities as Hold as it is pointless to buy it directly as long as the discount persists. We continue rating ATCO a strong buy and think it will provide strong risk-adjusted returns.

Please note that this is not financial advice. It may seem like it, sound like it, but surprisingly, it is not. Investors are expected to do their own due diligence and consult with a professional who knows their objectives and constraints.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Are you looking for Real Yields which reduce portfolio volatility? Conservative Income Portfolio targets the best value stocks with the highest margins of safety. The volatility of these investments is further lowered using the best priced options. Our Enhanced Equity Income Solutions Portfolio is designed to reduce volatility while generating 7-9% yields.

Give us a try and as a bonus check out our Fixed Income Portfolios.

Explore our method & why options may be right for your retirement goals.

This article was written by

Conservative Income Portfolio is designed for investors who want reliable income with the lowest volatility.

High Valuations have distorted the investing landscape and investors are poised for exceptionally low forward returns. Using cash secured puts and covered calls to harvest income off value income stocks is the best way forward. We "lock-in" high yields when volatility is high and capture multiple years of dividends in advance to reach the goal of producing 7-9% yields with the lowest volatility.

Preferred Stock Trader is Comanager of Conservative Income Portfolio and shares research and resources with author. He manages our fixed income side looking for opportunistic investments with 12% plus potential returns.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of ACO.X:CA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.