Moving My Cheese - An Income Compounder Portfolio Update

Summary

- Change is inevitable and this article discusses how my investing strategy, goals, and risk tolerance have changed to adapt over time.

- My investment strategy shifted from capital appreciation to generating passive income for retirement, focusing on high-yield positions in BDCs, MLPs, REITs, CEFs, and ETFs.

- I highlight the benefits of the Schwab platform, such as the ability to easily track investment income and monitor portfolio performance.

Galeanu Mihai

Some of you may be old enough to remember the seminal business fable that was published in 1998 by Spencer Johnson called “Who Moved My Cheese? An Amazing Way to Deal with Change in Your Work and in Your Life” that made the New York Times bestseller list. The essence of the book is that a) Change Happens, b) you need to anticipate change, c) you should monitor the change, d) it is best to adapt to change quickly, e) make the change and then enjoy it, and f) be ready to change quickly and enjoy it again.

When I first started my personal, self-directed IRA to build additional long-term investment income for my pending retirement, I opened an account with a small online brokerage that was called Scottrade. After a while, many of the online brokers including Scottrade began to charge $0 commissions on trades where previously it would cost around $7 per transaction to buy or sell shares, regardless of the stock price. Then in 2017, TD Ameritrade announced that they were buying Scottrade. My cheese got moved!

I was worried that I may lose my zero commission trades but that did not happen, and in fact, TD Ameritrade introduced some additional products and services that were even better than what Scottrade offered at the time, including the Thinkorswim electronic trading platform. Just as I was starting to adjust to, and enjoy TDA, Charles Schwab Corporation (SCHW) announced that they were buying TDA! My cheese got moved again.

Then I was concerned that Schwab would not honor the DRIP policies that certain CEFs allow for reinvesting shares at NAV and that trade at a premium. For example, I own rather large positions in the Cornerstone funds - Cornerstone Strategic Value Fund (CLM) and Cornerstone Total Return Fund (CRF). Both funds offer a high yield currently exceeding 18% and hold high quality equities in their portfolios that are staples in the market like Apple, Microsoft, Alphabet, Amazon, United Health, and Berkshire Hathaway. Both funds have traded at very high premiums for the last several years and therefore reinvesting at NAV offers an additional discount of 15-18% (based on the current premiums) to the market price.

The move to Schwab was just completed this week and on May 30 after the Memorial Day weekend my TDA holdings became Schwab holdings, and all of my information was seamlessly transferred. Considering that today is only June 3, 2023, it is too soon to say for sure whether the DRIP policy will be honored but I am being told that it will be. That is very good news, especially compared to those investors who use brokers that do not allow or make it difficult to take advantage of the DRIP at NAV policy. There are several other funds that I hold, and which also trade at a substantial premium that allow the DRIP at NAV including Guggenheim Strategic Opportunities Fund (GOF), which currently yields nearly 14%, trades at a 28% premium and has never cut the distribution since its inception in 2007.

So far, I am enjoying the change to Schwab and today I discovered something new that got me even more excited about the change. But first, let me review my investing style, goals, and strategies to help you understand why this is exciting to me.

The Income Compounder Back Story

With apologies and a nod of appreciation to my fellow SA analyst/author Steven Bavaria, who first introduced me to his concept of an Income Factory (which he has trademarked, so I can’t use it), I have in the past year become an income investor with a goal of generating a passive income stream for my retirement, which is now just two months away. I call my approach the Income Compounder portfolio because like Steve’s factory, my portfolio compounds the income earned by reinvesting and by buying more shares at lower prices to generate ever more income increasing my future river of cash. At this stage of my life, I am still building an income stream and not as concerned with the total value of my portfolio, which means that I am okay with unrealized losses on many of my holdings because I have no intention of selling those shares.

Prior to my Income Compounder strategy, I was building my overall portfolio value and was more interested in capital appreciation along with dividend income, which is more of what I would call a total return strategy. During that time, I was still several years away from retirement, and I was concerned with unrealized losses and would trade shares to capture profits. Initially, I held a mix of pure growth stocks like Apple, AMD, and others that I would “swing trade” to generate cash which I would then use to buy shares of high yield positions. This helped me to build up my overall portfolio value but did not necessarily generate long-term passive income.

Then in 2022, another change occurred (cheese moved again), and the multi-year low interest rate bull market suddenly ended with the Russian invasion of Ukraine followed by skyrocketing inflation in a post-pandemic world. It was no longer such a simple strategy to capture profits from swing trading growth stocks and I changed my investment approach. I also began to realize after doing lots of research, that income-oriented funds such as BDCs, MLPs, REITs, CEFs, and some ETFs can generate a steady and even growing stream of income even during rising inflation or a recession (in some cases).

Meanwhile, I continued contributing to my employer retirement plans (401k and 457b) and am getting closer to my official retirement date when I can collect a pension. In June of 2022 as the market was crashing and everything from stocks to bonds to gold and cryptocurrencies all declined in value, I was getting concerned about not having control over my relatively few mutual fund options in my employer retirement accounts. I learned that I could do what is referred to as an in-service rollover of my 401k, meaning that I could rollover my 401k funds into my IRA even though I am still employed. This was a huge relief as I helplessly watched the overall value of my 401k drop in value in the first half of 2022 and there was very little that I could do about it. After the rollover, I now have complete control of my investments and can purchase all sorts of income producing investment products versus a handful of mutual fund options.

So that leads me to the change that I discovered after the move to Schwab was completed. With the Schwab interface, I now can quickly see in a bar chart what my actual and estimated income is for each month of the year. Before, with TDA I could have created a spreadsheet and made my own bar chart from compiled data taken off monthly statements, but that would have been time consuming and difficult to easily update as my individual holdings change. It also helped me to realize the enormous change in my income stream that I am now seeing in my No Guts No Glory Income Compounder portfolio, which I last wrote about here.

I am going to share some high-level information here regarding the total portfolio value in my IRA, the estimated income, current yield on cost (based on statements from TDA), and current unrealized losses from January 2022 through the end of April 2023. Then I will show how that actual and estimated income is displayed using the new Schwab platform. Keep in mind as you look at these numbers that this is just one cog in my income retirement wheel. I have additional income sources from my upcoming pension (both a lump sum and monthly annuity), Social Security whenever I decide to take it, and additional retirement savings in my employer plans that I have not yet rolled over. Therefore, this portfolio represents about 25% of my total net worth currently (not including other sources of income like real estate, Treasury bonds, and cash). This also means that I am willing to take on more risk in this portfolio than other, more conservative investors might be willing to take.

I created a summary of my portfolio balance and income based on monthly statements, but I just used quarterly numbers to keep from getting too detailed. Here are the raw numbers in a table.

| Parameter | 4/30/2022 | 7/31/2022 | 10/31/2022 | 1/31/2023 | 4/30/2023 |

| Starting Value | $ 76,000 | $ 73,700 | $ 168,000 | $ 152,000 | $ 209,637 |

| Unrealized Loss $ | $ (6,285) | $ (4,875) | $ (18,000) | $ (6,955) | $ (11,895) |

| Unrealized Loss % | -8.5% | -2.9% | -11.8% | -3.3% | -6.1% |

| Yield | 11.8% | 11.1% | 14.2% | 10.6% | 13.2% |

| Est Annual Income | $ 8,740 | $ 18,705 | $ 21,545 | $ 22,312 | $ 25,810 |

| Contrib/Withdraw | $ 2,000 | $ 86,000 | $ - | $ 38,500 | $ (2,000) |

| Total Portfolio Value | $ 73,700 | $ 168,000 | $ 152,000 | $ 209,637 | $ 196,173 |

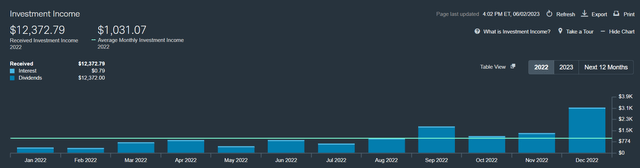

To put it in perspective, I am including a snapshot of the Investment Income chart from my Schwab account for 2022, which includes actuals. Note the big jump in December when several of the stocks and funds that I hold paid special or supplemental year-end dividends, despite the unrealized losses piling up. The yields also rose higher as prices of the underlying holdings fell, and also because I shifted into higher yielding positions over time.

I also got a little bit lucky with my timing as I was able to buy a lot of positions in June at low prices, and then again in October when the market bottomed. In March of this year, there was also another swoon that allowed me to add to existing holdings or start new positions at higher yields. I took advantage of the lower prices in March to add to several BDC holdings including ARCC, CSWC, FSK, CION, and TRIN.

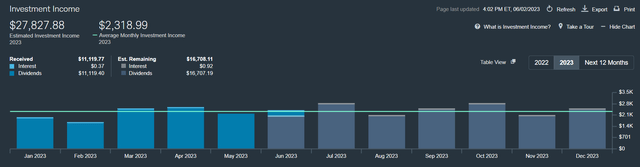

Although I do not yet have numbers for May, the market continued to move mostly sideways during the month, yet the dividend stream continued to increase as shown in the chart for 2023 with actuals through June 2 and estimated income for the remainder of the year. As you can see, the estimated income now is up to nearly $28,000 after being estimated at $25,800 at the end of April.

Note that December does not look that much higher than other months because there is no way to estimate any special or year-end supplemental distributions that may get paid out at year end. This chart is likely to look even better by this time next year as several of my holdings, including OXLC and XFLT have recently increased the distribution.

Furthermore, I have been swapping out some of my holdings this year for even higher yielders as opportunities arise. For example, I discovered a CEF that currently yields over 15% and invests in the midstream energy sector. That fund, NXG Cushing Midstream Energy fund (SRV), I wrote about here and again after I spoke with the fund manager which you can read about here.

Earlier this year I also added a position in Simplify Volatility Premium ETF (SVOL). That ETF generates income from shorting the VIX volatility index, which has been declining for most of the last year. The current yield for SVOL is just over 17% and it is now one of my largest holdings. It appears poised to continue to perform well as market volatility abates. You can read more about my analysis of SVOL here.

Another recent addition to my holdings this year is the abrdn Income Credit Strategies Fund (ACP). The ACP fund completed a merger with another CEF in March that had the ticker IVH, the Ivy High Income Opportunities fund. After the merger, ACP began to trade at a slight discount after trading at a premium for most of the past year. The current yield is nearly 18% and the fund managers stated on the Q123 earnings podcast that they have no intention of cutting the $.10 monthly distribution, and in fact the distribution coverage is likely to improve because of the merger.

One comment that I often read when discussing these high yield investments is that they must be very high risk. While it can be true that an exceedingly high yield may indicate a higher degree of risk, each investor needs to perform their own due diligence to determine if the potential reward is worth the risk. One way that I mitigate the risk to individual holdings is to limit exposure to no more than 2.5% of my total portfolio value, with some exceptions for those that I have a high conviction in such as the Cornerstone funds. For example, CRF has now been in existence for 50 years and has paid out far more in distributions over that period than it has lost in NAV. But these are not all “buy and hold” investments either. There is some degree of market timing required to successfully invest without losing capital. The best time to buy is when fear is high, prices are low, and the perceived risk is much higher than the actual risk. Ay, there’s the rub.

Editor's Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of ACP, SVOL, SRV either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I hold a long position in all tickers mentioned in my portfolio.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.