Preferreds Weekly Review: Gauging Preferreds Strength

Summary

- We take a look at the action in preferreds and baby bonds through the fourth week of May and highlight some of the key themes we are watching.

- Preferreds were roughly flat as Tech strength offset broader weakness due to rising Treasury yields.

- Gauging preferred strength via prices is easy to do but requires some caution.

- BDC GAIN is issuing a new baby bond GAINL at an attractive coupon.

- High Treasury yields in an environment of modest credit spreads make higher-quality / fixed-rate preferreds increasingly attractive.

- I do much more than just articles at Systematic Income: Members get access to model portfolios, regular updates, a chat room, and more. Learn More »

Darren415

This article was first released to Systematic Income subscribers and free trials on May 29.

Welcome to another installment of our Preferreds Market Weekly Review, where we discuss preferred stock and baby bond market activity from both the bottom-up, highlighting individual news and events, as well as top-down, providing an overview of the broader market. We also try to add some historical context as well as relevant themes that look to be driving markets or that investors ought to be mindful of. This update covers the period through the fourth week of May.

Be sure to check out our other weekly updates covering the business development company ("BDC") as well as the closed-end fund ("CEF") markets for perspectives across the broader income space.

Market Action

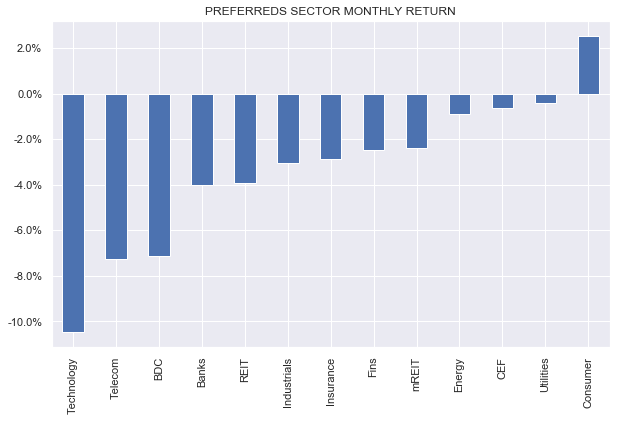

Preferreds were fairly flat as the ongoing strength in Tech shares offset the weakness in REITs and other sub-sectors. Month-to-date, most sectors are still under water, however, as rising Treasury yields put a damper on returns.

Systematic Income

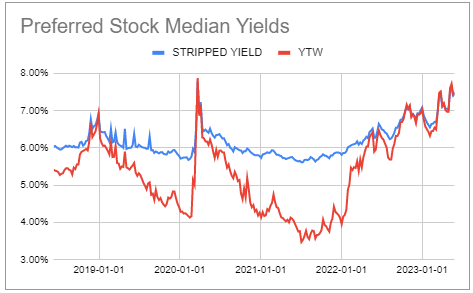

Preferreds yields remain at attractive levels despite coming off a bit after touching the previous 2020 peak.

Systematic Income Preferreds Tool

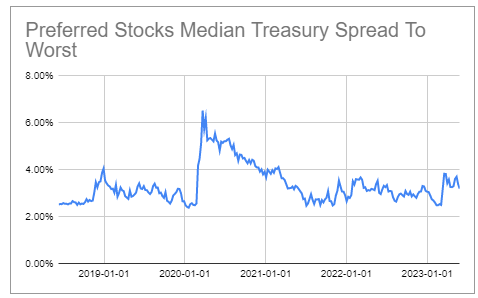

Credit spreads remain fairly tight, indicating little credit-related concerns for the asset class.

Systematic Income Preferreds Tool

Market Themes

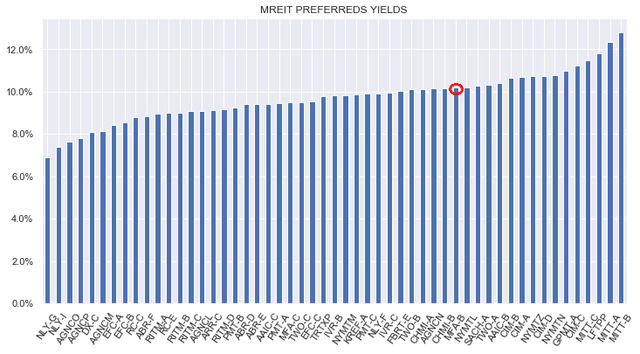

This week we got an interesting question of why the mortgage REIT preferred Cherry Hill Series B (CHMI.PB) seems to be trading "stronger" i.e. at a higher price than many other hybrid mREIT preferreds. For instance, CHMI.PB is at $20.60 while the average mREIT preferred trades at $19.40 or close to 6% lower.

Our view is that in gauging strength we wouldn't focus as much on the price that the stock trades at but the yield. The reason CHMI.PB trades at a higher price than other mREIT preferreds is because it has a higher coupon. The average coupon in the sector is about 7.3% while CHMI.PB coupon is 8.25%. This coupon differential roughly implies that CHMI.PB should trade about $2.5 above the average stock in the sector, all else equal, which is double the actual price differential.

What this also shows is that the stock's yield is actually elevated in the sector as the chart below shows.

Its yield is particularly elevated relative to Agency mREIT preferreds which is arguably the better population for comparison. The company's portfolio is allocated 72% to Agency MBS and 28% to Agency MSRs.

Once we take this into account, we see that its yield of 10.2% is actually well above the yield of the average Agency-focused mREIT preferred of sub-9%. Interestingly, its yield is also above the average hybrid mREIT preferred which has a yield of 10%, despite taking no explicit credit risk.

All of this means that the stock's apparent strength is nothing of the sort. In fact, its relatively high coupon hides its weakness.

The stock's elevated yield makes sense to us given its rock-bottom equity / preferred coverage ratio. If the company chooses to redeem its Series A (CHMI.PA), which would boost its coverage ratio, we might reconsider our view. Until that happens, we are steering clear of the stock.

Market Commentary

BDC Gladstone Investment (GAIN) is issuing another 5Y baby bond (GAINL) with an 8% coupon. The company has two other baby bonds which trade at yields of 7.2-7.7% so it’s worth trying to snag GAINL when it starts trading as it looks cheap at par.

GAIN baby bonds are fairly attractive given the company’s strong NAV profile (indicative of decent underwriting) and the fact that there is very little secured debt ahead of the unsecured baby bonds (the typical breakdown in the sector is roughly half secured and half unsecured).

After the bond issuance, the small credit facility will likely go away, resulting in no secured debt ahead of the baby bonds. This means that the baby bonds will have a claim on all the company’s assets rather than just the stuff that’s left over after paying out the secured creditors. GAINZ remains in the Defensive Portfolio - there could be decent relative value opportunities between the three bonds in the future.

Stance And Takeaways

Treasury yields have recently been rising despite a clear slowdown in the economy. For example, the number of people reporting that jobs are plentiful moved from 57% to 48%. That’s still a healthy amount however it’s clearly peaking. Job sentiment tends to trend in one direction over time so, historically, a peaking indicator resulted in an extended downtrend. The labor market has been one of the key strengths of the economy and this is now being slowly eroded.

The carryover to the broader economy is also clear - worsening job confidence leads to a slowdown in consumption which reduces aggregate demand, lowers corporate earnings etc.

It’s interesting that longer-term Treasury yields have backed up recently which is unusual in this environment. However, this is likely due to the FDIC selling the $100bn or so bonds they acquired from failed banks. With credit spreads still at fairly benign levels, we are eyeing longer-duration / higher quality preferreds such as investment-grade fixed-rate preferreds like PSA.PH, LBRDP, WFC.PL and others.

Check out Systematic Income and explore our Income Portfolios, engineered with both yield and risk management considerations.

Use our powerful Interactive Investor Tools to navigate the BDC, CEF, OEF, preferred and baby bond markets.

Read our Investor Guides: to CEFs, Preferreds and PIMCO CEFs.

Check us out on a no-risk basis - sign up for a 2-week free trial!

This article was written by

At Systematic Income our aim is to build robust Income Portfolios with mid-to-high single digit yields and provide investors with unique Interactive Tools to cut through the wealth of different investment options across BDCs, CEFs, ETFs, mutual funds, preferred stocks and more. Join us on our Marketplace service Systematic Income.

Our background is in research and trading at several bulge-bracket global investment banks along with technical savvy which helps to round out our service.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of WFC.PL, LBRDP either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.