ChargePoint: The Problems Are Getting Bigger

Summary

- ChargePoint delivered a better-than-expected earnings release. Management also expects to post fewer losses by the end of FY24.

- The company's AC charging leadership is strong but faces significant challenges in the DC fast-charging market, especially with the recent Ford-Tesla partnership.

- ChargePoint remains a "show-me" story with rapidly evolving competitive dynamics and an unattractive valuation.

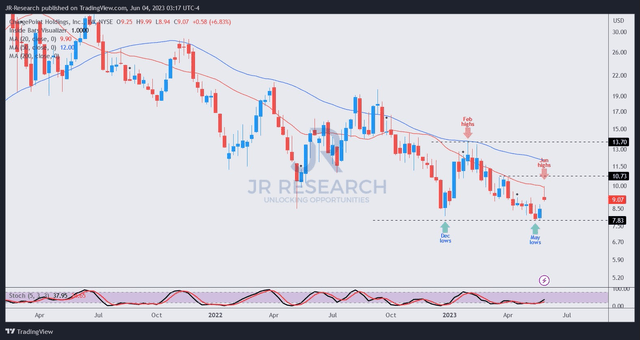

- Dip buyers who bought in May likely took profit last week. CHPT remains trapped in a medium-term downtrend.

- Ultimate Growth Investing members get exclusive access to our real-world portfolio. See all our investments here »

jetcityimage

Leading AC charging infrastructure ChargePoint Holdings, Inc.'s (NYSE:CHPT) recent earnings release could have given more optimism to buyers. The company delivered a better-than-expected Q1 scorecard while guiding toward a more robust profitability outlook by the end of the fiscal year (FY24).

As such, I noted that dip buyers likely anticipated a marked improvement in ChargePoint's performance as CHPT surged nearly 30% from its May lows toward last week's highs.

Accordingly, ChargePoint expects improvement on headwinds that held back its profitability growth. Previously, adverse supply chain dynamics and costs have led to a marked decline in its gross margin. However, the company reported an adjusted gross margin of 25% in its most recent quarter, well above last year's 17%.

In addition, management telegraphed its confidence that it expects margin accretion moving ahead, as it benefited from "reduced supply chain and logistics expenses, operational improvements, and better scale."

CFO Rex Jackson stressed that ChargePoint's current dynamics aren't at a steady state, with "room for further improvement." Management is confident that the company will continue to gain operating leverage as it scales its asset-light model while maintaining "disciplined OpEx management."

Notably, management accentuated its confidence in its OpEx management by communicating that it intends to slash its FQ1 adjusted EBITDA loss of $49M by "two-thirds by the fourth quarter."

Therefore, I assessed that CHPT's recent dip buyers could point to management's constructive commentary to vindicate their pre-earnings move, anticipating that ChargePoint's asset-light EV charging business model is working.

However, the recent charging infrastructure partnership between Ford (F) and Tesla (TSLA) could have affected investors' sentiments. Keen investors should note that ChargePoint's leadership is mainly predicated on the AC market, which reportedly has a 50% market share.

However, it doesn't have a dominating position in the DC or fast-charging market. As such, Ford's decision to partner with Tesla in fast charging is significant. Accordingly, the deal will allow "Ford owners access to Tesla's Supercharger network starting in early 2024." The announcement was touted as a surprise in the EV charging industry, as it corroborated the efficacy and superiority of Tesla's supercharger network.

As such, investors must assess how it could affect the competitive dynamics of ChargePoint's early DC charging ambitions. Ford CEO Jim Farley reminded EV makers why Ford decided to partner with Tesla, as he stressed that "other automakers, like General Motors (GM), will have to decide between offering fast charging or sticking to their standard and providing less charging."

It likely implies that the current non-Tesla standard in fast charging is not good enough to accelerate EV adoption. How about ChargePoint? Does the company believe that it can manage the uncertainties of this development?

Management assured investors at its earnings conference that "the impact of the Supercharger network is already factored into ChargePoint's numbers and business model."

As such, I assessed that ChargePoint doesn't expect a near-term impact, but I think it's too early to determine how other EV makers could react. If they follow Ford's lead subsequently, it could interfere with ChargePoint's traction in the DC market, even though management articulated that such partnerships have "no direct impact on ChargePoint's AC chargers."

Notwithstanding, the company emphasized that it's "exploring innovative ways to address potential needs, such as adding direct Tesla cables." Hence, I believe it implies that ChargePoint sees challenges with the partnership but believes it can still manage to resolve these issues moving ahead.

While management highlighted that it doesn't see a "long-term negative impact" on ChargePoint, investors must continue to pay close attention to the developments.

ChargePoint's leadership in the AC market has helped it to cement its influence. However, the company needs to build on its momentum in the DC market, as "the addressable market for DC charging is expected to be larger than AC charging due to higher hardware prices."

However, ChargePoint is still expected to post negative free cash flow or FCF till the end of FY25 (year ending January 2025). As such, it might be limited in its ability to scale quickly enough to capitalize on the momentum of the DC market. Coupled with its higher-margin AC products and leadership, assessing whether an improved fleet network could mitigate the recent slowdown in residential and commercial demand is vital.

CHPT price chart (weekly) (TradingView)

CHPT remains in a medium-term downtrend, and momentum remains with sellers.

Last week's surge likely saw dip buyers from CHPT's May lows taking profits/cutting exposure based on its price action.

CHPT's "D+" valuation grade by Seeking Alpha Quant indicates that its valuation isn't attractive.

While the company has committed to an improved profitability trajectory, I assessed that it had been reflected in CHPT's recent surge, as the market is forward-looking.

As such, I urge investors to keep their distance from loss-making ChargePoint. Tesla's partnership with Ford could also have massive ramifications for EV charging players' ambitions in the DC market.

While the secular growth drivers in EV adoption remain a tailwind, it hasn't given buyers enough confidence to load up on CHPT aggressively and hold long enough before sellers overwhelm them.

ChargePoint's thesis remains a "show-me" story, with rapidly evolving competitive dynamics that could weaken its ability to justify its unattractive valuation.

Rating: Hold (Reiterated).

Important note: Investors are reminded to do their own due diligence and not rely on the information provided as financial advice. The rating is also not intended to time a specific entry/exit at the point of writing, unless otherwise specified.

We Want To Hear From You

Have additional commentary to improve our thesis? Spotted a critical gap in our thesis? Saw something important that we didn't? Agree or disagree? Comment below and let us know why, and help everyone in the community to learn better!

A Unique Price Action-based Growth Investing Service

- We believe price action is a leading indicator.

- We called the TSLA top in late 2021.

- We then picked TSLA's bottom in December 2022.

- We updated members that the NASDAQ had long-term bearish price action signals in November 2021.

- We told members that the S&P 500 likely bottomed in October 2022.

- Members navigated the turning points of the market confidently in our service.

- Members tuned out the noise in the financial media and focused on what really matters: Price Action.

Sign up now for a Risk-Free 14-Day free trial!

This article was written by

Ultimate Growth Investing, led by founder JR Research, helps investors better understand a range of investment sectors with a focus on technology. JR specializes in growth investments, utilizing a price action-based approach backed by actionable fundamental analysis. With a powerful toolkit, JR also provides insights into market sentiments, generating actionable market-leading indicators. In addition to tech and growth, JR also offers general stock analysis across a wide range of sectors and industries, with short- to medium-term stock analysis that includes a combination of long and short setups. Join the community today to improve your investment strategy and start experiencing the quality of our service.

Seeking Alpha features JR Research as one of its Top Analysts to Follow for the Technology, Software, and the Internet category, as well as for the Growth and GARP categories.

JR Research was featured as one of Seeking Alpha's leading contributors in 2022.

About JR: He was previously an Executive Director with a global financial services corporation and led company-wide, award-winning wealth management teams consistently ranked among the best in the company. He graduated with an Economics Degree from Asia's top-ranked National University of Singapore and currently holds the rank of Major as a Commissioned Officer (Reservist) with the Singapore Armed Forces.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of F, TSLA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.