NorthWest Healthcare Properties REIT: High Dividend In Deep Value Territory

Summary

- NorthWest Healthcare Properties REIT stock experienced a significant decline of 40% over the past year as rates rose and short-term liquidity problems emerged.

- Their ~10% yield is not covered by operations, jeopardizing their 2 decade long history of paying the same dividend monthly.

- The stock trades at steep discounts to P/NAV and P/Tang BV ratios despite a high quality portfolio of properties with strong tenancy agreements.

- Management has outlined an excellent plan to optimize the balance sheet and grow adjusted funds from operations by 10-20%, thereby saving the dividend.

- A refined capital structure and organic runway for growth via their property asset management business gives the REIT expansion room without the need for pilling on additional liabilities.

Editor's note: Seeking Alpha is proud to welcome Ali Mecklai as a new contributor. It's easy to become a Seeking Alpha contributor and earn money for your best investment ideas. Active contributors also get free access to SA Premium. Click here to find out more »

Olivier Le Moal

Thesis

While NorthWest Healthcare Properties REIT (TSX:NWH.UN:CA) (OTC:NWHUF) is facing numerous challenges relating to meeting short-term liquidity requirements, previous debt mismanagement, a questionably high dividend, and equity dilution - the stock price has more than reflected all of these headwinds. As it remains, management has begun executing on a turnaround plan of deleveraging, optimizing the balance sheet, and not only saving the dividend, but growing the core businesses' profitability. At current prices, if management can execute, NWH could be a true winner within portfolios.

Note: Unless otherwise stated, all figures are in CAD.

Company Overview

NorthWest Healthcare Properties REIT is a leading player in the healthcare real estate sector (owning hospitals, clinics, offices, and labs) with a diverse portfolio of 233 properties across the United States, Canada, Brazil, Australia, New Zealand, the UK, and the Netherlands.

With a focus on high-quality tenants (97% occupancy and 80% of tenants supported by government funding), long-term leases (average lease length of 14 years), and rent indexation (83% of rents tied to inflation), the underlying quality of the portfolio is strong.

In total, there are $10.8 billion in assets under management ($6.8 billion owned and $4.1 billion managed for third parties) and a consolidated loan-to-value ratio of 50%, the REIT has accumulated significant equity in its properties. Consistently distributing dividends of $0.6667 per unit per month since 2010, the REIT relies on its adjusted funds from operations (AFFO) to sustain its attractive yield of ~10%. However, not everything about the REIT has been going well and the sustainability of the dividend has been put into question by investors.

Above figures are from Q1 2023 investor presentation.

Recent Underperformance

Recently, the REIT has been battered. Year to date 2023, NWH is down 20%, lagging behind both the TSX real estate index (TTRE: -0.2%) and the healthcare index (TTHC: +3.5%).

Essentially, an interplay of rising rates, debt mismanagement, declining AFFO, equity dilutions, and short-term liquidity issues have all contributed to battered shares and a pessimistic investor outlook. For context, current shares trade at ~$7.60 while just 1 year ago they were $13.60 (-42%).

I will explain these issues below. But before you get too bearish on the stock, understand that it trades at extraordinary discounts to NAV and tangible book value, and if management can execute its plan to optimize the balance sheet and change business strategy (as I believe it will), the company and its shares could see a major turnaround while investors have the possibility to secure an incredible distribution yield during these turbulent moments for management. First, let us understand what happened to make shares so cheap.

Debt Mismanagement

Interest costs have been a rapidly growing problem for the company as in 2022 rates had skyrocketed. Unlike many other debtors taking advantage of the ultra-low interest rates of the post-COVID environment, NWH chose not to fix their debt costs when rates were low and had over 1/3 of its total debt in floating/variable rate loans and mortgages.

To get a sense of how catastrophic the interest expenses have been to the company's financials, in Q1 2022 interest expenses were just $20.7 million, about 44% of the quarterly AFFO (adjusted funds from operations). Just a year later, that figure is now at $51.6 million, or about 129% of the quarterly AFFO. Note that AFFO is still positive as it is calculated after interest costs are deducted. This has been the primary driver of shrinking AFFO falling 15.3% from $47.4 million to $40.1 million yoy.

Despite this, management chose not to shrink the dividend and instead pay out $7.1 million more in dividends than they generated from AFFO. This leads to our next problem.

Current Dividend Underwater

As mentioned earlier, management funds the dividend through AFFO. However, while AFFO has shrunk, the dividend has remained constant, signaling an unsustainable dividend profile.

So how are they funding their dividend? According to tax filings discussed by management, in 2022 the REIT's distributions were classified as 45% return of capital.

This was done primarily by issuing more equity, thereby diluting shareholders, and tapping into cash balances. Take these annualized Q1 2023 figures to get a sense of how the REIT's current financials are unable to support the dividend:

Financial statements and author's calculations

Unfortunately, simply returning cash back to the company you gave it to is not an indicative sign of financial health. Continuing on this long list of problems...

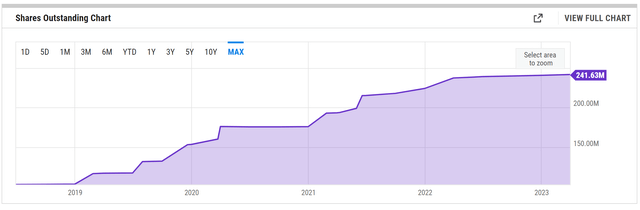

Equity Dilution

As part of the company's generous dividend policy is an additional and unique shareholder reward of bonus shares if subscribed to DRIP (Dividend Reinvestment Program). Essentially, the company will reward you with another 3% on top of your monthly income if you are enrolled in DRIP, encouraging investors to buy even more shares with their dividends.

This of course would be great if the company were using their profitable streams of income to reward DRIP investors with more. However, seeing as the current dividend cannot even be funded, it comes with management issuing even more shares, issuing debt, and/or draining cash.

While the levels of dilution have certainly tapered off about mid-last year, management has said explicitly that covering their debt and dividend obligations would be funded by dilution if not generated through other cash flow activities.

Liquidity Issues

Lastly is perhaps the most important problem with the company as it stands today, tying in the aforementioned financial problems into one is a big issue in liquidity. Specifically, how the company can meet its short-term obligations.

Figures below are taken from management Q1 2023 MD&A and financial statements.

With current assets of $1.2 billion and current liabilities of $1.4 billion, it isn't hard to see a shortfall in the REIT's next twelve months obligations. In total, this working capital deficiency is $256 million.

The consequences of this can be dire. Firstly, the REIT has reserved around ~$1 billion of properties to be classified as held for sale, meaning they plan to liquidate the properties in the coming year. After paying off the respective mortgages associated with the properties held for sale ($522.36 million), the selling should expunge around $481 million of additional short-term liabilities.

While this is good for cash flow, being forced to sell property quickly could result in higher transaction costs, which typically run in the millions for large deals, and possible fire sales, leading to a sale of properties below market values.

Management has also said they can roll over $117.3 million of term debt from their Australian and Canadian channels and issue $86.3 million of convertible debentures. Again, the hastiness of rolling over debt in today's environment is possibly locking in higher rates given the current environment, and equity dilution through the potential for the convertible debentures to be transformed into equity can exacerbate the already aggressive dilutive policies the company has engaged in historically.

Management Plan

Here is the saving grace. Management seems to understand their mistakes and actually has a sound plan to reverse the damage done. The good thing is that in a business like this, one can have a good understanding of what will happen in the next 6-12 months because rents are contracted well in advance with little variability as well as costs, and we know which assets and liabilities are held for sale.

Selling Properties, Optimizing Debt

The most pressing matter is meeting the working capital deficiency of $256 million and getting debt and interest costs under control. For the remainder of 2023 (Q2, Q3, & Q4) I expect contractual outflows of $1.477 billion. This includes the following (found in Q1 2023 MD&A and financial statements):

- Accrued accounts, distributions, and taxes payable of $163.2 million.

- Liabilities (mortgages) related to assets held for sale $515.3 million.

- Mortgages, leases, and loans due of $351.8 million.

- Convertible Debentures Due of $125 million.

- Expenses of $342.8 million (annualized Q1 numbers adjusted for sale of properties).

This amounts to a total of ~$1.5 billion of cash needing to flow out of the REIT by 2024.

Here is what I expect to cover those liabilities (assuming all held for sale properties can be sold by end of year):

- Assets held for sale of $985 million.

- Cash of $76.2 million.

- Rental, management, and other revenues of $386.1 million (annualized Q1 numbers adjusted for sale of properties).

- Issuance of convertible debentures of $86.1 million.

- Rollover of term debt of $117.3 million.

- Accounts receivable of $32.1 million.

- Distributions receivable of $18.2 million.

This amounts to a total of ~$1.7 billion of cash cushioning for the REIT by 2024.

As such, the cash coverage ratio is approximately 115% of liabilities which can be covered by liquid or soon-to-be liquid assets. Again, this is primarily due to selling properties and rolling over debt. I, therefore, believe that management will be able to cover its current liabilities.

Additionally, management has indicated that it is exclusively targeting the highest interest debt first to reduce immediate interest expenses. As an example, during the first quarter, management fixed the rates of $901.3 million of floating rate debt resulting in 470 bps in interest cost reduction. This should be accretive to AFFO as total debt and interest expenses decline.

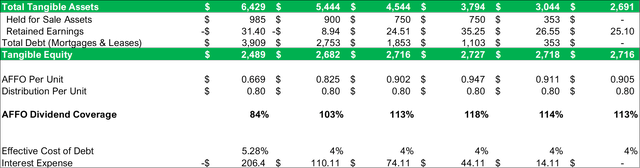

Management lays out the target of reducing debt from $3.9 billion to $2.5 billion and reducing the weighted average interest rate on debt from 4.7% to 4.0%. Importantly, management does not give a timeline for this.

Per my calculation by the end of the year, management would be able to reduce debt to $2.75 billion, which is still $250 million more than their target. This comes from using 100% of proceeds of the assets held for sale to pay down mortgages, repaying convertible debt, and draining 50% of the cash balance.

Grow AFFO by 10-20% and Sustaining the Dividend

Management believes that through interest and debt reductions, and operational improvements, they can grow AFFO by 20% thereby saving the dividend from drowning.

Per my analysis, all else equal, by year-end debt, can be reduced to $2.75 billion, and interest savings alone would be between $61.05 million and $96.29 million (high end if management achieves a weighted average interest rate of 4.0% (70 bps reduction)).

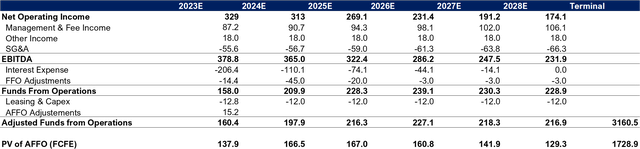

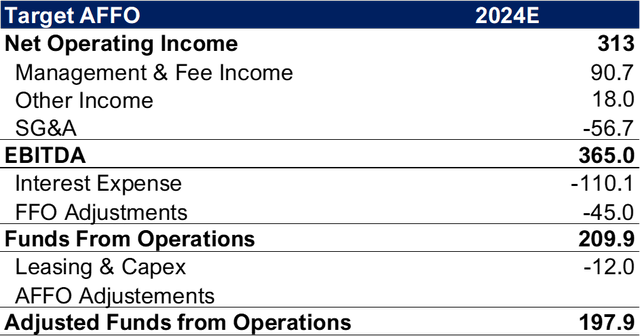

These numbers are significant given that AFFO in Q1 alone was just $40.1 million. My target for 2024 AFFO is as follows:

Target AFFO Q1 2023 financials with anticipated changes

Above we assume that 2023Q1 numbers are annualized and adjusted for a reduction of owned properties due to sales, and a refined capital structure.

With expected AFFO of $0.888 per unit, I predict a 23% growth per unit by 2024. Slightly higher than the 20% growth expected by management, but this could be explained by them having a different timeline to achieve this than me. This results in a dividend coverage ratio of 103%, in the safe territory from a deficiency of 84% as it is currently.

In this case, I believe the dividend is safe in the long run with a coverage ratio of 103%.

Focus on Asset Light Business Model

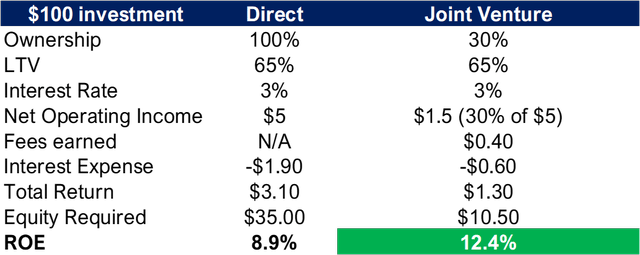

In their last earnings call, management has said they plan to grow their asset management business and expand through joint ventures rather than direct investments. This is smart for several reasons.

Firstly, asset management and joint ventures yield a higher return on equity. This is because you earn additional fees for managing the property. When you do it all yourself, no one pays you, when you do it for someone else, and even have joint equity in the property, it becomes even more lucrative.

See here:

Investor presentation NWH Q1 2023

By owning indirectly, or jointly, the REIT can further focus on bringing down total debt and earning additional fees it otherwise would not have earned.

Valuation

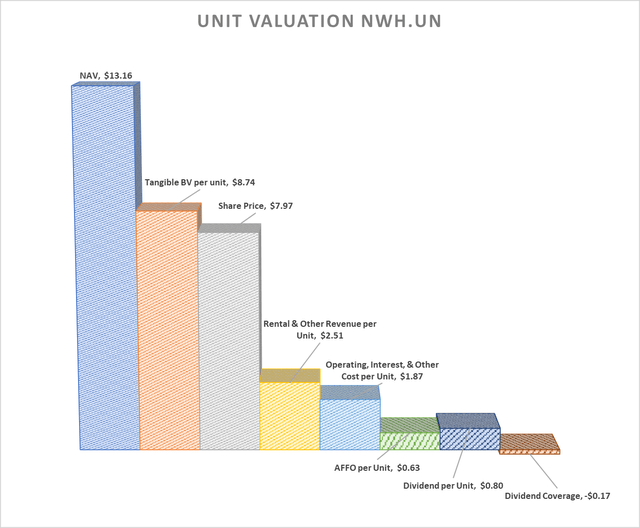

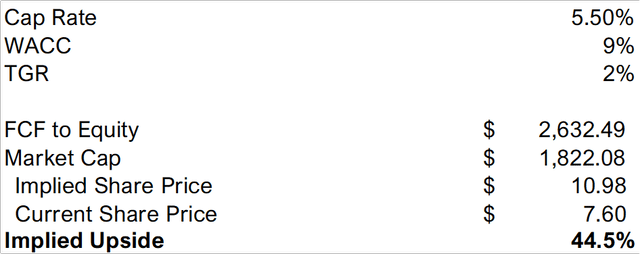

With a NAV and tangible book value of $13.16 and $8.74 per unit respectively, shares trading at $7.60 are just too cheap. To value the shares of NWH I use a DCF model combined with elements of a NAV model.

Modelling assumptions

- Rent operating income per investment property increases by 3% per annum.

- Management fees grow by 4% per annum due to change in business model.

- Consistent sale of assets until 2028 whereas debt is eliminated.

- Interest costs of 4% per management guidance.

- SG&A cost growth of 4%.

- FFO adjustments for taxes only.

- Assume no loss/gain of FX, interest rates, or other derivatives.

- No fair market adjustments to value of assets.

- Terminal growth rate of 2% AFFO.

- WACC of 9% given cap rates of 5.50% + 4.5% risk premium to account for shares trading at a discount to NAV.

- 2023E numbers are annualized 2023 Q1 numbers, before adjustments to a business plan and balance sheet.

Because equity trades at a discount to NAV, I would expect and recommend to management to continue selling properties until either debt is completely eliminated, or, the shares begin to trade at a premium to NAV. This is because the additional equity beyond market cap needs to be converted into shareholder value.

Key notes from the above: Virtually all gains in AFFO are due to debt reductions and balance sheet optimization. These are the most accretive actions which management can take.

With a total present value of FCFE of $2.6 billion, well above the current $1.8 billion market cap, there appears to be an ample margin of safety between intrinsic and market values with an implied upside of 44.5%.

DCF Inputs (author's calculations)

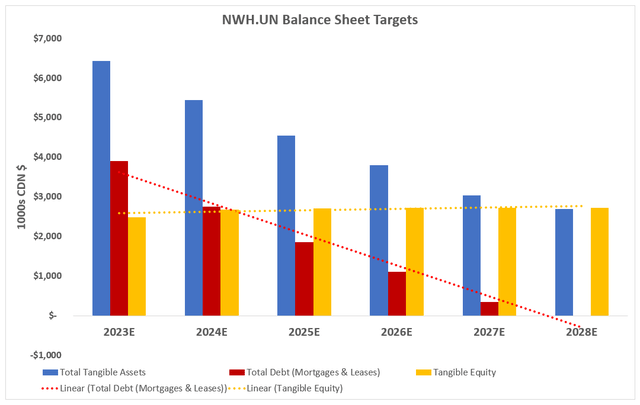

As management can continue to aggressively sell properties over the coming years, we could expect the balance sheet to look something like the below:

Author's calculations Author's calculations

Per unit, tangible equity targets for next year stand at $10.38 per unit, growing to $11.33 per unit due to retained earnings/AFFO additions. This is placed nicely between my DCF target price of $10.98 and I would consider these to be reasonable bands of expected fair value.

Additionally, as seen in the table above, dividend coverage can and should grow over time leveling off at around 113% once the balance sheet is optimized. This long-term safety in my view is much more important than the possibility of a short-term dividend cut to meet changes in working capital. In the long term, dividends likely seem protected.

Risks

There are several things that would make me reverse my thesis.

Firstly, if management backtracks on plans to sell more properties and does not sell all held for sale properties at appropriate prices by 2024. Per my modelling assumptions, I would hope and expect that management continues to cash out the built-up equity within its properties until the share price nears intrinsic value and the balance sheet is optimized. Secondly, I do not wish for management to over correct the refinancing of debt. If management fixes debt at rates equal to or greater than floating rate debt (as yield curve is inverted, rates should fall and locking in long-term debt now is simply a short-term liquidity measure). Lastly, if management relies on issuing more shares to cover the liquidity problem before exhausting all other options, it would be detrimental to equity holders. In my analysis, I do not anticipate management to have the need to do this, however, it is a risk worth noting.

Note that nowhere above do I reference real estate fundamentals. NWH is not a residential nor commercial REIT, and I do not anticipate its tenants or buildings to be exposed to the same degree of short-term economic fluctuations. However, large changes to global real estate markets will always acutely impact any REIT, but it is not a risk we explore in this analysis.

Conclusion

There is no doubt of the numerous challenges that NorthWest Healthcare Properties REIT faces in the short term. Overcoming these hurdles of liability management while simultaneously protecting equity holders is a tricky balance to strike, but one which is certainly possible.

If management can execute, the turnaround story could catalyze the stock, all while locking in a staggering 10% yield now. Looking beyond the short term, we see a runway for the business to grow. Growth in their third-party asset management business, joint ventures, and an inflation-indexed tenant base gives the REIT ample space to expand organically, without jeopardizing its balance sheet.

Over time, the REIT should return to its intrinsic value. Once the balance sheet and capital structure are refined, investors may realize that the stock is in deeply oversold territory, making NWH potentially, one of the most lucrative value plays for any REIT in the market.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.