Snap: Large R&D Investments With Little To Show For It

Summary

- Snap's Q1 results were poor, keeping the stock price low, even as many tech stocks have surged.

- Snap still needs to demonstrate that AR is a viable business and that its advertising products are viable in a privacy-first world.

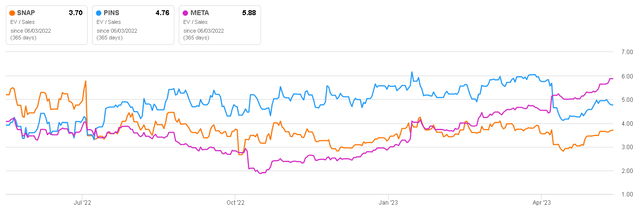

- Snap trades at a significant discount to peers, in part due to poor margins, and while it has better growth prospects, the near term remains clouded by macro factors.

stockcam

Snap's (NYSE:SNAP) first quarter results were poor, which has kept the stock price low, even as many other tech stocks have done well. Some of Snap's problems are likely the result of genuine macro weakness, with platform policy changes and company-specific issues also contributing. Snap's management believes that the macro environment has stabilized, although remains weak. Inflation, declining excess savings and the resumption of student loan repayments will likely pressure consumer spending in the second half of 2023, which could cause the macro environment to materially weaken. As a result, there is further downside risk, despite Snap trading on a fairly low valuation already.

Snap

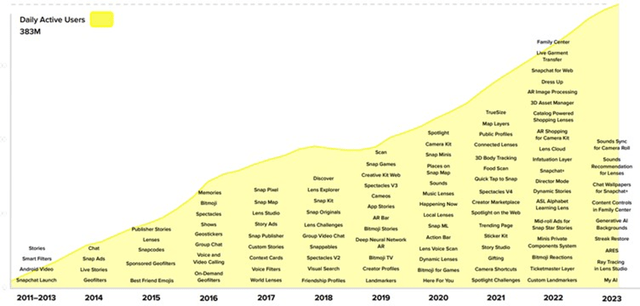

Snap continues to register strong user growth, and now reaches 383 million daily active users and over 750 million monthly active users. Snapchat's user demographics are also differentiated, potentially making the platform attractive to advertisers. Snapchat reaches 90% of the 13-24 year-old population and 75% of the 13-34 year-old population in over 20 countries.

Figure 1: Snapchat Daily Active Users (source: Snap)

While Snap's differentiated user base is attractive, there remain questions about how well the company can monetize these users. In addition to the user base, Snap has been making heavy investments in R&D for a long period of time, although this hasn't translated to revenue growth. IP in areas like maps and AR could be valuable, but any financial impact is likely to lie further in the future.

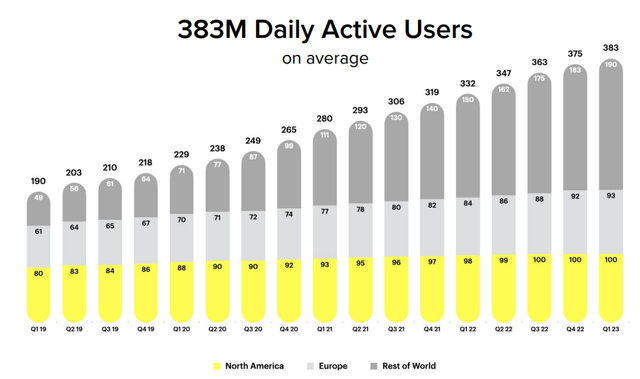

Figure 2: Focus Area to Reaccelerate Growth (source: Snap)

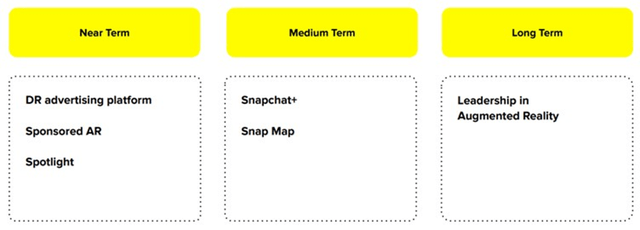

Snap is currently touting its investments in ML infrastructure to support its recommendation systems. Another advertising focus area is signal recovery using privacy safe integrations. Snap is also trying to improve the post-click experience with ads by making it easier to convert on the platform. This has the added benefit of closing the gap between first-party and third-party reporting. Snap also recently transitioned to click-based ad interactions across all of its advertising formats. Snap previously utilized a variety of interaction methods and believes the change will benefit users and advertisers.

Snap has been trying to improve measurement by driving Conversions API (CAPI) adoption and through partner integrations. CAPI integrations have doubled within the last six months. Snap is also expanding its Conversion Lift scalability and performance to boost measurability for emerging advertisers. During Q1 Snap continued to test SKAN 4.0 with select key advertisers and plans to broaden adoption during Q2.

These types of initiatives have the potential to boost ARPU in time, particularly if Snap can build on its repository of first-party data, but this is unlikely to matter in the near term due to demand headwinds.

Figure 3: Snap's Goal-Based Bidding Objectives (source: Snap)

Snap continues to introduce features which it hopes will deepen user engagement with the platform. This includes My AI, an AI-powered chatbot. My AI will supposedly allow Snap to develop a better understanding of user interests and intent, which can be used to accelerate growth. Chatbots could provide a treasure trove of user insights, depending on engagement levels, but there is a risk that users will push back against their personal data be collected like this.

Snap is trying to increase engagement with the Snap Map by introducing features that drive utility, including:

- Making Places visual by launching Place Stories on the basemap

- Updating Place Profiles to include video reviews

- Making the Map 3D

- Dynamic place suggestions as users navigate the map

Place Story views are up 150% YoY. Snap currently offers place recommendations on the Snap Map, which could be lucrative in time, and there is likely a range of other monetization options for maps.

Stories continues to be an area of strength, but unsurprisingly, management have suggested that engagement drops off significantly outside of users' close friends. Spotlight or Discover therefore becomes an important means of driving engagement beyond this. Spotlight aims to showcase entertaining snaps created by the community (user created or content publisher), and appears to an attempt to create more viral content. Snap is now reaching 350 million monthly active users on Spotlight, with time spent up 170% YoY.

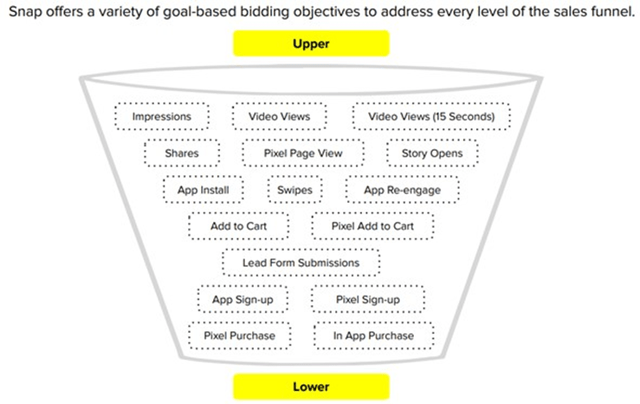

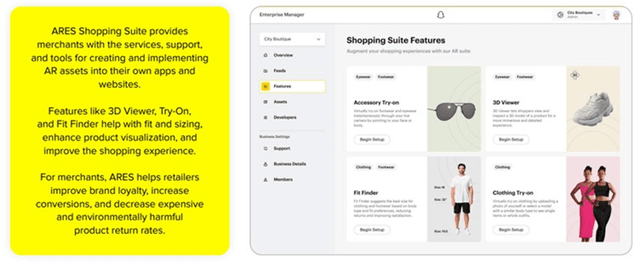

Snap recently launched AR Enterprise Services with Shopping Suite, a SaaS offering that helps retailers embed AR in their own applications and websites. ARES enables other companies to utilize Snap's AR technology in their apps, websites and physical locations. It could diversify Snap's revenue and help better monetize the investments Snap has made in AR.

Figure 4: Snap AR Enterprise Services (source: Snap)

Financial Analysis

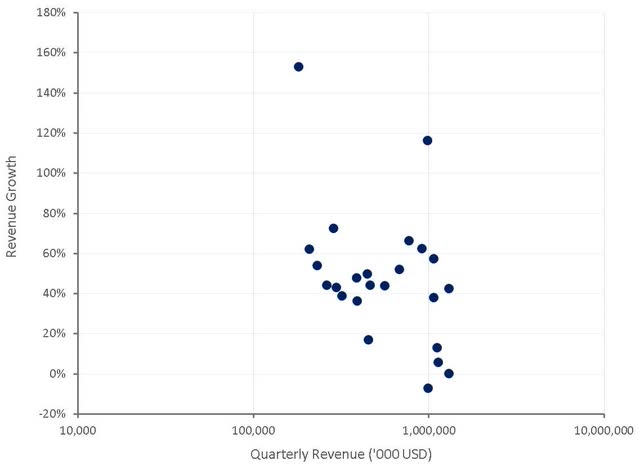

Snap's revenue decreased by 7% YoY in the first quarter. Some of this weakness was due to macro conditions, but demand was also impacted by changes that Snap made to its ad platform to drive more click-through conversions. Some advertisers have had difficulty finding success after the changes, and this could be a growth headwind going forward. Snap believes that in time a more diverse base of smaller advertisers will begin to drive growth though.

Snap's brand-oriented business was down 12% YoY and the direct-response business was down 9%. The retail, CPG, travel and restaurant verticals have been areas of strength.

Snapchat+ now has more than 3 million subscribers, which at 4 USD per month has been a small contributor to growth.

Figure 5: Snap Revenue Growth (source Created by author using data from Snap)

An argument could be made that Snap remains relatively underpenetrated, even in more mature markets, and that the product is still under monetized. This certainly appears to be the tact that management is taking to try and engender investor confidence. Snapchat is far more of a niche product than Facebook though, and given the attributes of the product, it is unlikely to ever monetize as well. Snap likely still has a lot of room for growth in ARPU , but it may not be an order of magnitude like management is implying.

Figure 6: Snap and Facebook North America User Metrics (source: Snap)

Infrastructure cost per DAU is the largest component of cost of revenue and Snap expects it to rise by around 17% in the next quarter. Fixed content costs have been reduced by an annualized 84 million USD, with the benefit of this beginning to flow through the income statement in Q4 of last year.

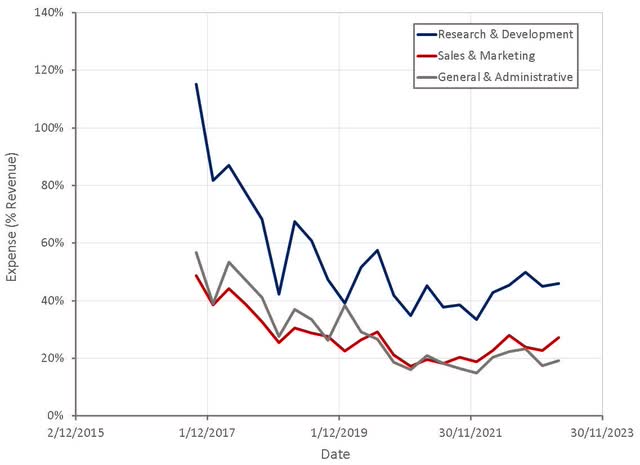

Snap has taken action to reduce costs over the past year, and achieved the cost reduction target set in Q3 of 2022. Management was targeting the removal of 500 million USD from the company's cost structure, and reportedly reduced cash costs by 533 million USD. Operating expenses remain high though, and the company still has significant work to do before reaching breakeven.

Figure 7: Snap Operating Profit Margins (source: Created by author using data from Snap) Figure 8: Snap Operating Expenses (source: Created by author using data from Snap)

Snap has been making large R&D investments for many years now, and while the company can point to a long list of features and new products, the financial impact of these investments appears to be minimal. Even when facing a market that is hostile to loss generating companies, Snap has not really pulled back on R&D. Investors must hope that at some point AR begins to pay off for Snap, or that management has a change of heart and begins to focus on the bottom line, as they have little recourse to force a change in behavior.

Figure 9: Timeline of Snap Innovations (source: Snap)

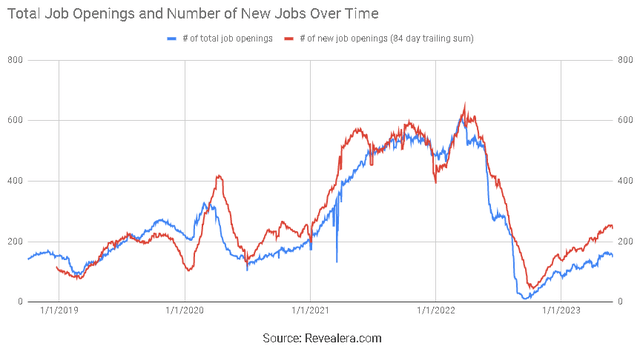

Snap has not provided any forward guidance for the second quarter, which is probably not a positive. Job openings data would seem to indicate that if nothing else the demand environment has not deteriorated significantly in recent months.

Figure 10: Snap Operating Expenses (source: Revealera.com)

Valuation

Snap now trades at a significant discount to peers, which is likely in large part due to the company's poor margins. Snap has better growth prospects than a company like Meta (META), although it is a far weaker company. While the digital advertising market appears to be stabilizing, there continues to be an oversupply of inventory and weak demand. Engagement and user figures are strong across a number of platforms, but ad spend is weak. A recovery in demand will be a large tailwind for Snap, but the near term remains clouded by soft consumer spending, a weakening labor market and the specter of student loan repayments restarting.

This could represent an attractive entry point, although there is significant risk. The recent run-up in tech stocks looks manic, and could reverse sharply if sentiment shifts.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.