Hancock Whitney: Attractive, But With A Catch

Summary

- Hancock Whitney Corporation has experienced a decline in shares totaling 20.5% year to date due to concerns regarding the banking industry.

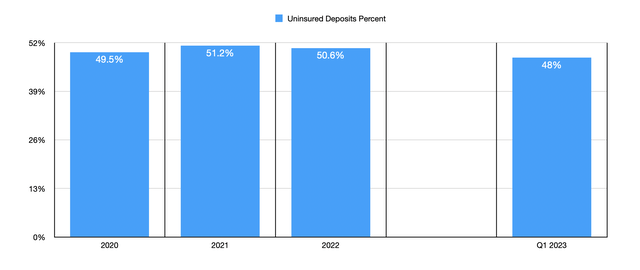

- The company has shown growth in loans and deposits, with a decrease in uninsured deposits from 50.6% at the end of 2022 to 48% in the most recent quarter.

- Despite some concerns, the company's overall financial performance and low price to earnings multiple make it an intriguing investment option, rated as a 'buy', but with an important caveat.

- Looking for a helping hand in the market? Members of Crude Value Insights get exclusive ideas and guidance to navigate any climate. Learn More »

Hero Images Inc/DigitalVision via Getty Images

Like pretty much every company in the banking sector, Hancock Whitney Corporation (NASDAQ:HWC) has been hit pretty hard this year. Even though the stock is up 23.3% from its 52-week low mark earlier this year, shares are still down 20.5% year to date. This decline has been driven by concerns regarding the banking industry, with the overarching fear being that the contagion that caused the collapse of a few major regional banks already could spread. To be clear, Hancock Whitney Corporation does have some facets that could cause one to worry about its own stability. But given how the company has held up so far, it looks as though the worst for it has passed. This should give investors at least some degree of optimism that the future for the company will be bright.

Dissecting Hancock Whitney Corporation

According to the management team at Hancock Whitney Corporation, the company is a bank holding company that provides comprehensive financial services through Hancock Whitney Bank, a Mississippi state bank, as well as other non-bank affiliates. As of the end of the 2022 fiscal year, the business had 177 banking locations and 226 ATMs across the country, with its footprint largely centered around parts of Mississippi, Alabama, Louisiana, Florida, and Texas. As with most regional banks, Hancock Whitney Corporation provides a variety of services for its customers, including various loans that it makes out to consumers, small and middle market businesses, larger corporate clients, and more.

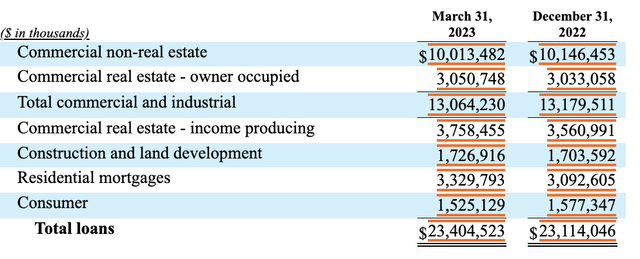

Hancock Whitney

As of the end of the most recent quarter, the company had $23.4 billion worth of loans on its books. Though if we strip out the loans that are held for sale, this number comes in lower at $23.1 billion. Of its overall loan portfolio, 55.8%, or $13.1 billion, is in the form of commercial and industrial loans. These seem to be well diversified, with the largest chunk being only $1.4 billion that's dedicated to healthcare and social assistance end uses. Outside of the commercial and industrial category, the next largest group for the company is commercial real estate that is income producing. Only about $3.8 billion worth of its loans fall under that category. After that, we end up with residential mortgages at $3.3 billion. Despite the market turbulence that we have seen, the company did experience growth in its loans during the most recent quarter. That growth was roughly 5%, or $290.5 million, compared to what the company had on its books at the end of 2022.

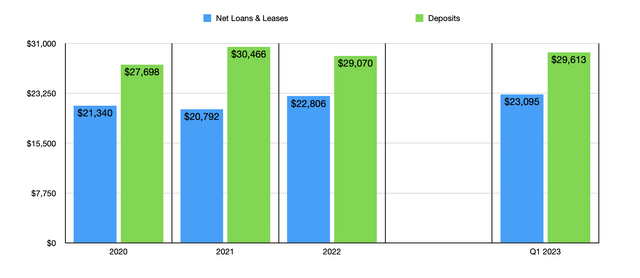

Author - SEC EDGAR Data

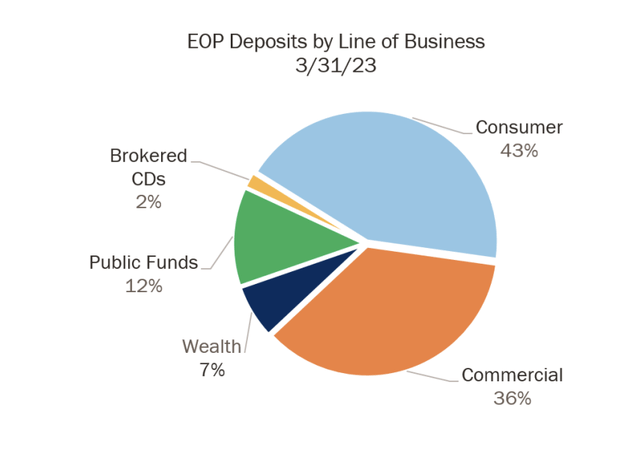

While the loan data is most certainly important, the deposit data is even more significant at this time. And this is where the company has some mixed results. During the most recent quarter, Hancock Whitney Corporation had $29.6 billion worth of deposits. While this is lower than the $30.4 billion that the business had at the end of 2021, it is higher than the $29.1 billion that it boasted at the end of 2022. It's great to see an increase in overall deposits at a time when so many other banks were seeing deposit outflows. According to management, 43% of its deposit base by value is from consumers. Another 36% involves commercial clients. Next we have public funds at 12%, followed by its wealth services operations at 7%.

Hancock Whitney

This is not to say that everything regarding its deposits have been positive. At the end of the most recent quarter, 48% of its deposits, or about $14.2 billion, was uninsured. However, this number does drop to $10.7 billion, or 36.1% of deposits, if we remove collateralized deposits from the equation. That 48% figure is, however, down from the 50.6% figure that the company had at the end of 2022. But this is not necessarily because of the increase in overall deposits. Rather, it's because the company saw a decline of roughly $0.5 billion from its uninsured deposit base during that three-month window. It's impossible to know how much of this may have been caused by customer uncertainty. But we do know that the overall amount of uninsured deposits have been declining recently. At the end of 2021, for instance, the company had $15.6 billion, or 51.2% of its deposit base, that was classified as uninsured.

Author - SEC EDGAR Data

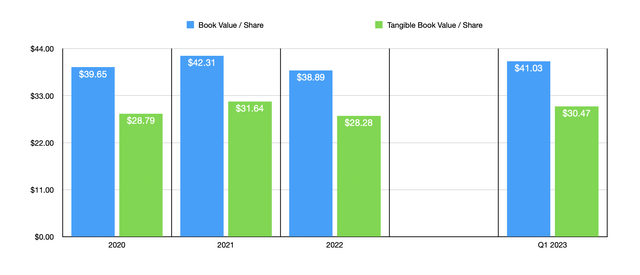

Before moving on their profitability matters, one thing I would like to touch on briefly is the book value of the company. This number has bounced around over the past few years. However, it was nice to see book value per share rise from $38.89 at the end of 2022 to $41.03 at the end of the most recent quarter. During that same window of time, tangible book value per share grew from $28.29 to $30.47. This on its own is not a big win for the company. I say this because some of the other firms that ended up collapsing or coming close to it also saw their book value and tangible book value figures rise on a per share basis leading up to and during the collapse. But when factored in with the other data points, it is positive to see. It is worth mentioning that, between cash and securities that the company has on its books and borrowing capacity it has from regulators, that it has overall liquidity of $18.7 billion. That would be more than enough to cover any deposit outflows. But it would not be an ideal scenario to have to tap a significant portion of this.

Author - SEC EDGAR Data

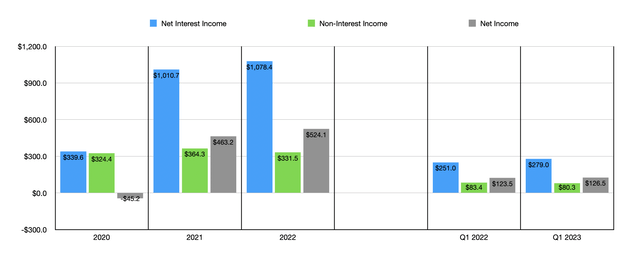

In recent years, the overall financial trajectory of the company has been positive. Net interest income for the firm grew from $339.6 million in 2020 to $1.08 billion in 2022. Non-interest income has bounced around between a low point of $324.4 million and a high point of $364.3 million over this same window of time. But the rise in net interest income was more than enough to push the company up from generating a net loss of $45.2 million in 2020 to generating a profit of $524.1 million in 2022. As you can see in the chart below, overall financial performance for the company has grown so far this year relative to the same time of 2022. Despite non-interest income dipping slightly year over year, both net interest income and net income improved during this time.

Author - SEC EDGAR Data

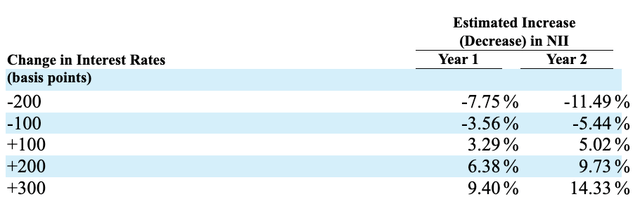

Hancock Whitney Corporation may make the most sense for investors who believe that interest rates are going to remain stubbornly high or may even increase from here. I say this because, based on a sensitivity analysis that management provided, an estimated 1% increase in interest rates would push its net interest income up by nearly 3.3%. If such an increase were to last into a second year, then the rise would be 5%. As you can see in the image below, a decrease in interest rates would negatively affect net interest income as well. Given the nature of the company, this should not be all that surprising. But even if we see some volatility on this front, the overall picture for the company it looks positive. Based on data from 2022, the firm is trading at a price to earnings multiple of just 6.2. That's quite low in the grand scheme of things.

Hancock Whitney

Takeaway

From what I can see, Hancock Whitney Corporation is an intriguing company that investors would be wise to pay attention to. I'm not terribly comfortable with the large amount of uninsured deposits on its books. Having said that, the firm has managed to grow its deposits modestly at a time when you would expect them to decline. Profits continue to rise and, with overall borrowings of only $3.8 billion, the company does not have a great deal of leverage. Given these factors, I have no problem rating the business a ‘buy’, with the caveat that investors should continue to keep a close eye on the firms uninsured deposit exposure.

Crude Value Insights offers you an investing service and community focused on oil and natural gas. We focus on cash flow and the companies that generate it, leading to value and growth prospects with real potential.

Subscribers get to use a 50+ stock model account, in-depth cash flow analyses of E&P firms, and live chat discussion of the sector.

Sign up today for your two-week free trial and get a new lease on oil & gas!

This article was written by

Daniel is an avid and active professional investor. He runs Crude Value Insights, a value-oriented newsletter aimed at analyzing the cash flows and assessing the value of companies in the oil and gas space. His primary focus is on finding businesses that are trading at a significant discount to their intrinsic value by employing a combination of Benjamin Graham's investment philosophy and a contrarian approach to the market and the securities therein.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.