JBBB: BBB CLO ETF, Low Interest Rate Risk, Growing 7.1% Yield

Summary

- JBBB offers a strong and growing 7.1% yield, making it an attractive income investment option.

- JBBB has low interest rate risk and below-average credit risk, providing a good risk-return profile for investors.

- The fund compares favorably to its peers in terms of yield, credit risk, and interest rate risk, making it a solid buy.

- This idea was discussed in more depth with members of my private investing community, CEF/ETF Income Laboratory. Learn More »

PeopleImages/iStock via Getty Images

A few months back I wrote an article on the Janus Henderson AAA CLO ETF (NYSEARCA:JAAA), an actively-managed ETF investing in AAA CLO tranches of senior secured loans. In that article, I argued that JAAA's low risk and growing 5.3% yield made the fund a fantastic investment opportunity, but one better suited for more conservative, risk-averse investors. Investors looking for a bit more yield could consider an investment in the Janus Henderson B-BBB CLO ETF (BATS:JBBB) instead.

JBBB invests in CLO tranches of senior secured loans, currently focusing on BBB tranches. Simplifying things, JAAA invests in bundles of bank loans to companies, and these investments are structured so as to have a below-average level of credit risk. These are variable rate loans, so interest rate risk is minimal. JBBB's low interest rate risk and strong, growing 7.1% yield make the fund a buy.

BBB CLOs - Overview

JBBB is an actively-managed ETF focusing on BBB CLO tranches of senior secured loans. Let's have a closer look at what this entails.

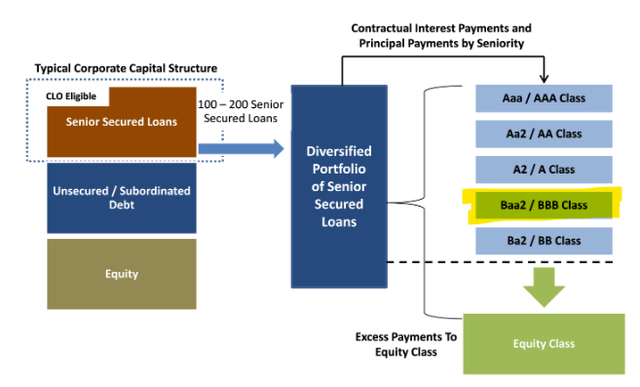

Senior secured loans are variable rate loans from banks to riskier companies. These loans are senior to other debt, and secured by company assets.

Senior loans are sometimes bundled together in CLOs. Each CLO, or bundle of senior loans, is divided into tranches. Income from the senior loans is used to make payments to all tranches. Senior tranches get paid first, junior tranches get paid last. Investors, including JBBB, can buy into these tranches, and receive income from the bundle of senior loans.

In visual form. JBBB's most important tranche highlighted in yellow.

Stanford Chemist at Seeking Alpha

So, JBBB is investing in bundles of senior secured loans, receives income from doing so, and its income is somewhere in the middle in terms of seniority. Some investors get paid first, some investors get paid later, with JBBB somewhere in the middle.

Let's go through some of the benefits and considerations of this arrangement, starting with the benefits.

JBBB - Benefits

Growing 7.1% Yield

JBBB currently yields 7.1%, a reasonably good yield, and a bit higher than average for a bond fund. Senior secured loans and high-yield corporate bonds, the fund's closest analogous, do yield a bit more, but the difference is quite small.

JBBB's dividends and yield should see further growth moving forward, due to recent Federal Reserve rate hikes. At the same time, some of the fund's yield metrics are higher than 7.1%, and these might prove to be more indicative of the dividends investors should expect moving forward.

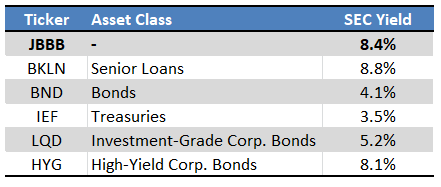

Annualizing the fund's latest monthly dividend payment nets me an 8.1% dividend yield, quite a bit higher than the fund's TTM yield. The fund's SEC yield, a standardized measure of a fund's short-term generation of income, stands at 8.4%. Said yield is quite strong on an absolute basis, higher than average for a bond fund, about average relative to its closest peers.

Fund Filings - Chart by Author

JBBB's underlying holdings see higher income and interest rate payments as rates rise, which should ultimately result in higher fund dividends. Rates have risen since early 2022, so dividends should have seen strong growth since, as was indeed the case.

Dividends should see further growth moving forward, as a delayed impact from recent Fed hikes, and due to the possibility of further hikes in the near future. Although this is the case for most bond funds, it is particularly the case for JBBB, as the fund focuses on variable rate loans, and so directly benefits from higher rates. Growth is somewhat dependent on future Fed policy, so growth is not certain, and would almost certainly stall if the Fed pivots in the near future. Still, positive dividend growth is very likely, under current conditions at least.

Low Interest Rate Risk

JBBB's interest rate risk is quite low, as the fund (indirectly) invests in variable rate loans, which see higher interest rates when benchmark rates rise. Simplifying things a bit, if the Fed hikes rates, variable rate loans hike rates too. Investor demand for these securities increases as their rates increase, which helps support their prices and returns. The extra income, from the higher rates, boosts returns further. JBBB currently sports a duration, a measure of interest rate risk / sensitivity, of zero, indicating zero risk in this area. I would not take these figures too seriously, markets are sometimes irrational, but risk is low regardless.

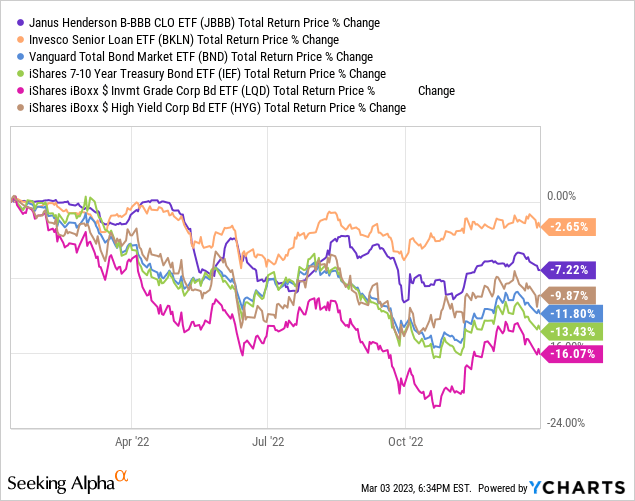

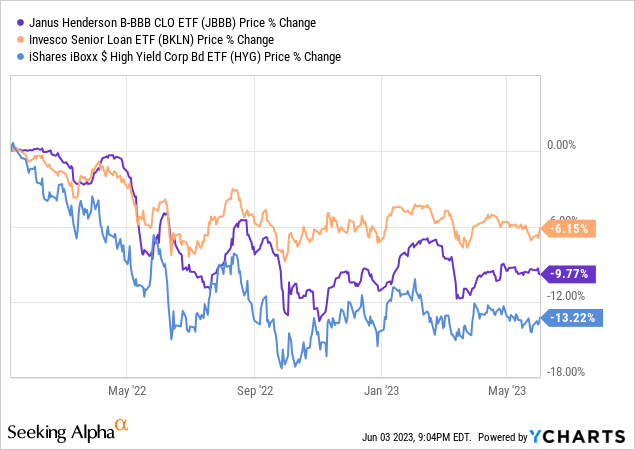

Considering the above, JBBB should outperform when rates are rising, as was the case in 2022. The fund did underperform relative to senior loans, however. It is somewhat unclear to me why this was the case, as both JBBB and senior loans have basically the same interest rate risk (JBBB invests in senior loans, after all). From what I've seen, both JAAA and JBBB are a bit more volatile than expected based on their fundamentals, so it could simply be that CLOs are a bit more volatile than expected, as the market sees them / trades them like that. Still, results were broadly in-line with expectations, and JBBB's performance was not terribly odd.

Data by YCharts

JBBB's low interest rate risk is an important benefit for the fund and its shareholders, and one which is particularly important when rates are rising, as they currently are.

On a more negative note, JBBB's low interest rate risk does mean that the fund should underperform during a period of decreasing interest rates. Rates have been decreasing for decades, past few years notwithstanding, and could continue to decline moving forward.

As an aside, long-time readers probably noticed that JBBB is quite similar to JAAA. This is, off course, because both funds invest in CLOs, so have broadly similar characteristics.

JBBB - Other Considerations

Credit Risk

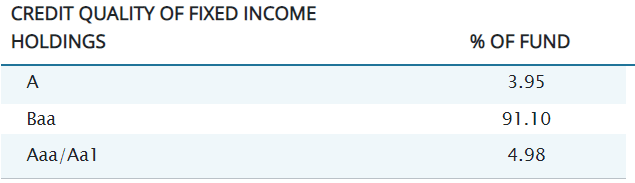

JBBB targets CLOs rated from B to BBB. Currently, the fund strong focuses on CLOs rated BBB, with a small allocation to A rated CLOs.

JBBB

As mentioned previously, CLO tranches are paid based on seniority. Senior tranches get paid first, starting from AAA. Junior tranches get paid last. BBB tranches are somewhere in the middle, but their overall credit risk is decisively below-average. The vast majority of senior loans are paid back, in full, at maturity. Only around 3.0% - 4.0% of these default every year, although figures do vary depending on economic conditions. The other +95% get repaid without issue, and these almost always generate more than sufficient cash to pay back investment-grade CLO tranches, including BBB tranches. As per S&P, BBB CLOs have annual default rates of just 0.01%, effectively equivalent to zero.

Considering the above, it seems that JBBB's credit risk is extremely low. I chose to describe it as below-average before, as the fund is actively-managed, and targets the B-BBB tranches, with the lowest of these having a bit more credit risk. It currently focuses on BBB, but that might not necessarily be the case moving forward.

Volatility

JBBB has minimal interest rate risk, and below-average credit risk. The result should be an incredibly safe, stable fund, but that is not the case. JBBB's share price fluctuates month to month, and although these fluctuations are not excessive, they are reasonably large, and comparable to those of broader senior loan and / or high-yield corporate bond funds.

JBBB's volatility seems a bit higher than expected considering its fundamentals, low credit / interest rate risk. It is not immediately clear to me why this is the case, but JAAA experiences the same, so it likely is due to the CLO structure / perceptions thereof.

Notwithstanding the above, JBBB's volatility is by no means excessive, nor significantly different from expectations.

JBBB - Peer and Market Comparison

Finally, a quick look at how JBBB compares relative to some of its peers.

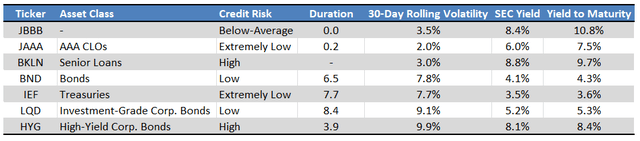

JBBB boasts an above-average 8.4% SEC yield. The fund's 10.8% yield to maturity, the expected returns of its portfolio if held to maturity, is highest in its peer group, and by a very healthy margin. JBBB's interest rate risk is significantly below average, credit risk too, although only slightly, perhaps moderately, so. Volatility is below average too, although senior loans themselves are less volatile.

JBBB compares favorably to senior loans in all relevant metrics except volatility.

JBBB compares favorably to high-yield corporate bonds in all relevant metrics except SEC yields (underlying generation of income).

JBBB is a higher-yield higher-risk alternative to JAAA. Both funds are fine, just different risk-return profiles.

In general terms, I find JBBB's overall risk-return profile to be quite strong. Risks are comparatively low, while potential returns are comparatively high.

A quick table with more detailed information of the above. Credit risk is a qualitative assessment on my part, based on the credit ratings plus default rates on each fund's portfolio.

Fund Filings - Chart by Author

Conclusion

JBBB's low interest rate risk and strong, growing 7.1% yield make the fund a buy.

Profitable CEF and ETF income and arbitrage ideas

At the CEF/ETF Income Laboratory, we manage ~8%-yielding closed-end fund (CEF) and exchange-traded fund (ETF) portfolios to make income investing easy for you. Check out what our members have to say about our service.

At the CEF/ETF Income Laboratory, we manage ~8%-yielding closed-end fund (CEF) and exchange-traded fund (ETF) portfolios to make income investing easy for you. Check out what our members have to say about our service.

To see all that our exclusive membership has to offer, sign up for a free trial by clicking on the button below!

This article was written by

Juan has previously worked as a fixed income trader, financial analyst, operations analyst, and economics professor in Canada and Colombia. He has hands-on experience analyzing, trading, and negotiating fixed-income securities, including bonds, money markets, and interbank trade financing, across markets and currencies. He focuses on dividend, bond, and income funds, with a strong focus on ETFs, and enjoys researching strategies for income investors to increase their returns while lowering risk.

---------------------------------------------------------------------------------------------------------------

I provide my work regularly to CEF/ETF Income Laboratory with articles that have an exclusivity period, this is noted in such articles. CEF/ETF Income Laboratory is a Marketplace Service provided by Stanford Chemist, right here on Seeking Alpha.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.