Ares Commercial Real Estate: A Risky 14% Yield

Summary

- Ares Commercial Real Estate Corporation offers a 14% dividend yield, but a dividend cut is possible due to its significant office exposure and uncertain market conditions.

- ACRE's valuation on a price-to-book basis is low, trading at just 0.7x book value, which could help protect its shares from further downside.

- The total return outlook for ACRE is not bad, but due to its mediocre track record and market uncertainties, it may not be an ideal investment at this time.

- Looking for more investing ideas like this one? Get them exclusively at Cash Flow Club. Learn More »

breakermaximus

Article Thesis

Ares Commercial Real Estate Corporation (NYSE:ACRE) is a mortgage REIT that offers a hefty dividend yield of 14% at current prices. While high income yields are attractive, other factors have to be considered as well. In this report, we'll look at whether Ares Commercial Real Estate is a good investment.

Company Overview

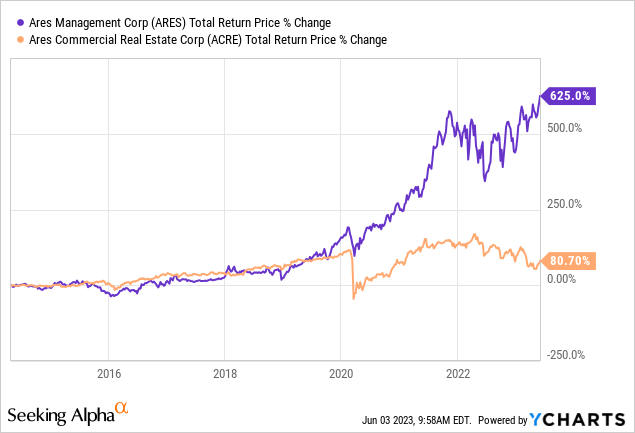

Ares Commercial Real Estate Corporation is a mortgage real estate investment trust ('mREIT') that is primarily focused on commercial real estate loans and related investments. These loans are originated by Ares Commercial Real Estate and the company also invests in them, holding a portfolio of CRE loans. Ares Commercial Real Estate is, like some other mREITs, externally managed. Its manager is the publicly-traded alternative asset manager Ares Management Corporation (ARES). While externally managed mREITs, REITs, etc. don't have to be bad investments automatically, external management can be an issue -- the external manager oftentimes is incentivized to grow the company at all costs without focusing on per-share value creation. Ares Management Corporation is a large capital manager that doesn't want to damage its brand, which is why the company has good reasons not to abuse shareholders of ACRE, but it should nevertheless be noted that ARES, the parent company/manager, has easily outperformed ACRE in the past:

In the time frame during which both companies have been traded publicly (ARES IPO'd after ACRE), ACRE has generated a total return of 80%, while ARES, the manager, has delivered an outstanding 600%+ return over the same time frame. That is not solely attributable to the phenomenon of managers oftentimes outperforming their managed companies, as other factors are at play as well, such as the recent upwards move in interest rates that has hurt mortgage REITs across the board. Still, it is likely that ARES would have outperformed ACRE on a total return basis even without these headwinds from rising interest rates.

Ares Commercial Real Estate Corporation primarily holds senior loans in its investment portfolio, as those make up well above 90% of its assets. Commercial real estate includes many different types of assets. Some of those have been doing badly in recent quarters, such as office properties, especially when not class A and when located in cities that have a negative net migration, such as San Francisco. But while these underperforming commercial real estate properties -- and related loans -- have gotten a lot of attention in the recent past, there are other commercial properties that are doing a lot better. Hotels have seen strong demand from consumers as the pandemic has come to an end and as more and more people want to travel and experience the world. Malls are an uneven segment -- lower-grade malls outside of large urban centers have had problems for years, but grade-A malls in densely populated areas are in high demand and are doing well. Multifamily properties have also performed well thanks to strong rent growth, and with high interest rates making home ownership less affordable, it seems possible that more and more people will rent space in multifamily properties.

Exposure to commercial real estate is thus not bad per se, even though the market seems to dislike everything CRE-related right now. It makes sense to take a closer look to see the exposure to different subsets of the CRE market, as the outlook for multifamily properties in the Sun Belt, for example, is very different compared to the outlook for lower-grade office properties in areas that experience a decline in population (and popularity).

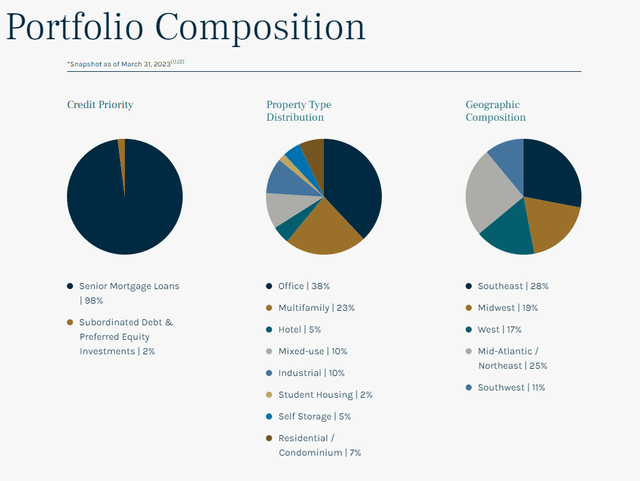

Ares Commercial Real Estate Corporation's current portfolio looks like this:

Ares Commercial Real Estate Corporation presentation

We see that the vast majority of loans are senior mortgage loans, i.e. the type of loans with the lowest risk level. If a company were to default on its loans, e.g. due to a commercial real estate property being underwater, the non-senior loans, preferred equity, and so on would be hit first. Only if the losses are drastic, senior mortgage loans would feel a hit.

ACRE's portfolio is relatively well-diversified when it comes to the class of commercial properties. The largest portion, however, is made up by office property loans, at a little more than one-third of ACRE's overall loan book. Multifamily, likely the least risky type of property, is the second-largest contributor to ACRE's loan book. Other property types the company makes loans for include the following:

- Hotels, which aren't very risky in the current environment where many consumers are traveling, but which could become riskier in case we see a major recession.

- Industrial properties, which aren't very risky, either, as major corporations such as Amazon (AMZN) or United Parcel Service (UPS) need logistics properties -- these are "mission-critical" and not threatened by work-from-home.

- Self-storage, which has been resilient in the past, even during recessions, and is thus lower-risk as well.

- Mixed-use, which is, especially when with a housing component, a not very cyclical or risky property class, either.

All in all, the majority of the types of assets ACRE makes loans for seem lower-risk, although the fact that office is the largest individual category adds a significant risk component. These are still mostly senior loans, thus ACRE is not necessarily impacted even if the owner of one such property fails, but the office loan portfolio nevertheless should not be disregarded.

ACRE's Recent Results, Dividend, And Valuation

Ares Commercial Real Estate Corporation announced its most recent quarterly results in May. The company generated earnings of $0.27 per share (distributable earnings, a non-GAAP metric). That included a headwind of $0.10 per share from realized losses in its portfolio, which explains the majority of the earnings decline versus the previous year's quarter.

At this rate, the dividend is not covered by ACRE's distributable earnings -- the dividend totals $0.33 per share per quarter right now, which makes for a dividend payout ratio of more than 120% for the most recent quarter. Of course, not every quarter will have a sizeable headwind from realized losses, thus it seems at least possible that ACRE's profitability improves during the current quarter and the second half of the year.

That being said, depending on how high interest rates rise in the coming months, and depending on how the market evolves for commercial real estate properties, especially office properties, it is also possible that profits decline further during the remainder of the year.

I would not necessarily bet on that, but analysts predict that profits will total $0.93 per share this year -- which is less than the Q1 earnings pace. This would be substantially less than the current $1.32 per share per year dividend.

A dividend cut is far from guaranteed, but seems possible -- and with shares trading at a dividend yield of around 14%, it looks like the market is pricing in a dividend reduction already. The good news is that even if ACRE were to cut its dividend, the yield would likely be far from bad for someone buying today. A 40% dividend reduction would result in a ~$0.80 per share dividend, which would be well-covered by the expected profit for the current year. At the same time, the yield would still be north of 8%, which is quite high.

On an earnings multiple basis, ACRE seems far from expensive, but not ultra-cheap. Shares trade for just above 10x this year's profits -- for a CRE lender with a significant office allocation, that seems like a reasonable valuation, I believe.

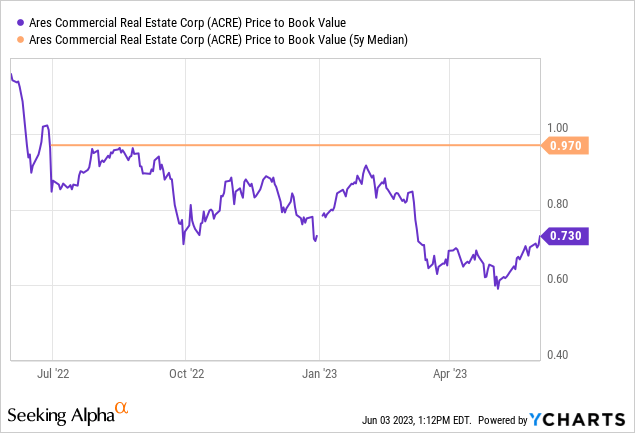

Looking at ACRE's book value, we see that the stock trades at a pretty significant discount compared to its historic valuation:

In the past, ACRE mostly traded more or less in line with its book value. Today, ACRE trades at just 0.7x book value. Shares could climb by more than 30% if they were to be valued at the historic median book value multiple. While a discount is warranted due to the recent CRE/Office headwinds, the discount seems rather large, which could help protect ACRE's shares from further downside.

Takeaway

ACRE has fallen substantially in the recent past, which has made its dividend yield explode to 14%. The valuation, on a price-to-book basis, is pretty low. That being said, a dividend cut is possible, and the significant office exposure could be a headwind going forward. I believe the total return outlook isn't bad right here, but due to ACRE's mediocre track record and the uncertainties, I'm not a buyer right here -- for that, I'd like to either see improvements in the CRE market or an even higher valuation discount.

Is This an Income Stream Which Induces Fear?

The primary goal of the Cash Flow Kingdom Income Portfolio is to produce an overall yield in the 7% - 10% range. We accomplish this by combining several different income streams to form an attractive, steady portfolio payout. The portfolio's price can fluctuate, but the income stream remains consistent. Start your free two-week trial today!

The primary goal of the Cash Flow Kingdom Income Portfolio is to produce an overall yield in the 7% - 10% range. We accomplish this by combining several different income streams to form an attractive, steady portfolio payout. The portfolio's price can fluctuate, but the income stream remains consistent. Start your free two-week trial today!

This article was written by

If you want to reach out, you can send a direct message here on Seeking Alpha, or an email to jonathandavidweber@gmail.com.

Disclosure:

I work together with Darren McCammon on his Marketplace Service Cash Flow Club.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.