Boston Properties: Hefty 8% Yield On This Contrarian Bet

Summary

- Boston Properties offers a historically high dividend yield and has financial flexibility.

- It's demonstrating strong operating fundamentals, while headline risks are more than priced into the stock.

- Contrarian investors may see potentially strong total returns from the current deeply discounted price.

- Looking for a portfolio of ideas like this one? Members of Hoya Capital Income Builder get exclusive access to our subscriber-only portfolios. Learn More »

Mlenny

It’s easy to go with the crowd and say that you’re invested in high-flying names. Some people may even toast you and ask for investment tips. The same can’t be said, however, with contrarian picks that are unfavored by the market.

However, it may be far better to pick up durable names with risks that are already priced in rather than to pick up a stock trading at a nosebleed valuation based on investor exuberance and speculation about the future.

That’s why I like the fact that it’s a market for stocks rather than the stock market, as there are plenty of bargains to be had even with the S&P 500 (SPY) now having fully recovered to where it was at the start of the year.

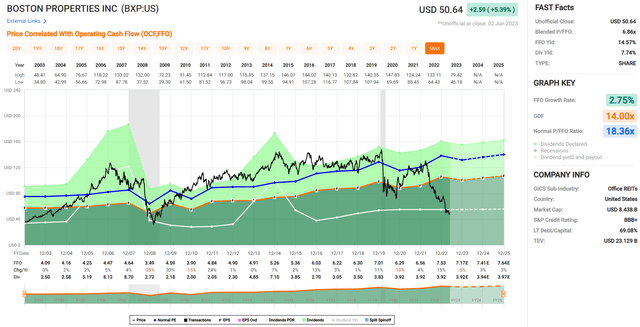

This brings me to Boston Properties (NYSE:BXP), which as shown below, is down 54% since the start of the year and currently yields 7.7%. In this article, I discuss recent operating fundamentals and why now may be a great time to pick up this contrarian bet, so let’s get started.

Why BXP?

Boston Properties is an S&P 500 company and is the largest owner and developer of office properties across the U.S. It currently has 192 properties that are spread across Tier 1 markets of Boston, Washington D.C., San Francisco, Seattle, and Manhattan.

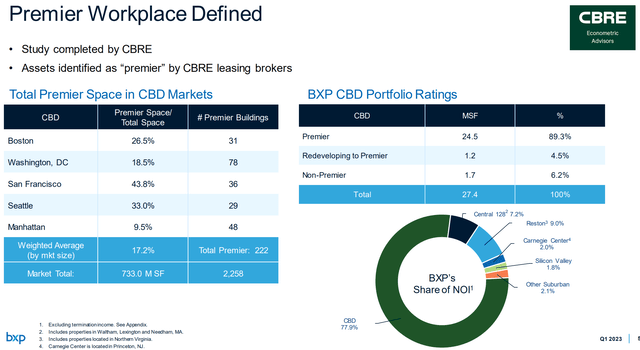

These markets are generally considered to be high barrier-to-entry due to high costs and very limited new space for development. As shown below, 89% of BXP’s properties are located in what real estate services firm CBRE (CBRE) identifies as Premier assets, which come with more pricing power, with an additional 4.5% that are being redeveloped to Premier.

Meanwhile, BXP hasn’t demonstrated the level of strains that headline risks around the office sector suggest. This is reflected by revenue rising by 6.5% YoY and vacancy for BXP’s Premier workplaces rising by just 20 basis points YoY to 10.7%.

It’s worth noting that FFO per share of $1.73 did come in 5% lower than the prior year period, but that was due to higher interest expense as what most all REITs are experiencing. This was higher than what the market was expecting and what management had previously guided. Encouragingly, management raised full year FFO/share guidance to $7.17 at the midpoint, which is $0.04 higher than the previous guidance.

Importantly, in this higher interest rate environment, BXP maintains a BBB+ rated balance sheet. It also carries a staggering $2.4 billion in total liquidity, comprised of $900 million of cash and full availability under its $1.5 billion line of credit. Management also believes that it could issue a new 10-year bond at an interest rate between 6.4% and 6.7%, which is below the initial cash yield on a 5-year deal last November.

Looking ahead, interest rate pressures may begin to ease, as JPMorgan (JPM) now sees the Fed raising the rate to 5.5% before pausing. Moreover, the current higher interest rate environment makes it more expensive for new development to come online, thereby resulting in lower competition.

Nonetheless, I would expect near-term headwinds around commercial real estate and higher interest rates to persist for sometime, and therefore investors shouldn’t expect a quick turnaround. While the 7.7% dividend yield is well-covered by a 55% payout ratio, based on FFO/share guidance of $7.17, management hinted at the need to maintain flexibility around its policy, as noted during the recent conference call:

We have maintained a consistent dividend since the beginning of 2020. Our FAD provides reliable coverage of our dividend, such that we're able to reinvest excess cash flow into the growth of our business. We've been successful in selling assets annually and fitting the gains on sale within our regular dividend policy without the need for special dividends.

Long term, our goal is to maintain a steady dividend and increase it over time as our developments add to our income. In the near term, a slowdown in expected sales activity would create room in our dividend relative to the REIT distribution requirements. If our outlook for the economy and the capital markets become more negative and asset sales slow, we do have flexibility to modify our policy.

Turning to valuation, I see near-term headwinds as being more than priced into the stock at the current price of $50.64 with a forward P/FFO of just 7.1, sitting far below its normal P/FFO of 18.4. This appears to be far too cheap considering that analysts expect 3.6% FFO/share growth next year.

Sell side analysts have a consensus Buy rating on the stock with an average price target of $65.89, implying a potential 30% return over the next 12 months based on price appreciation alone.

Investor Takeaway

Boston Properties stock is currently trading at a hefty discount to its normal valuation, and the market seems to have more than priced in near-term headwinds. The company has demonstrated resilience during tough times with strong operating fundamentals and management recently increased guidance. Moreover, this contrarian pick yields a historically high 7.7% with potential upside in the share price. For investors looking to buy on weak market sentiment, now may be a great time to layer into this contrarian bet.

Gen Alpha Teams Up With Income Builder

Gen Alpha has teamed up with Hoya Capital to launch the premier income-focused investing service on Seeking Alpha. Members receive complete early access to our articles along with exclusive income-focused model portfolios and a comprehensive suite of tools and models to help build sustainable portfolio income targeting premium dividend yields of up to 10%.

Whether your focus is High Yield or Dividend Growth, we’ve got you covered with actionable investment research focusing on real income-producing asset classes that offer potential diversification, monthly income, capital appreciation, and inflation hedging. Start A Free 2-Week Trial Today!

This article was written by

I'm a U.S. based financial writer with an MBA in Finance. I have over 14 years of investment experience, and generally focus on stocks that are more defensive in nature, with a medium to long-term horizon. My goal is to share useful and insightful knowledge and analysis with readers. Contributing author for Hoya Capital Income Builder.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of BXP either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I am not an investment advisor. This article is for informational purposes and does not constitute as financial advice. Readers are encouraged and expected to perform due diligence and draw their own conclusions prior to making any investment decisions.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.