AvePoint: Downgrading To Hold After 50% Rally

Summary

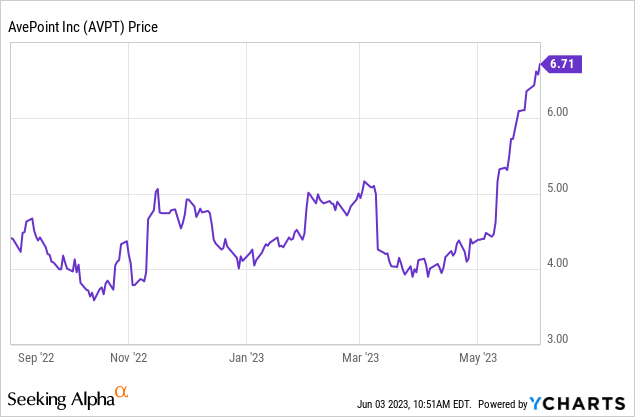

- Specialty SaaS provider AvePoint has jumped more than 50% over the past month.

- This comes following an earnings report that was good, but not nearly good enough to provoke that sort of reaction.

- I was formerly bullish on AvePoint due to valuation, but after this rally, shares no longer seem cheap.

- Looking for a helping hand in the market? Members of Ian's Insider Corner get exclusive ideas and guidance to navigate any climate. Learn More »

NoDerog/iStock Unreleased via Getty Images

AvePoint (NASDAQ:AVPT) is a technology company focused on helping enterprises manage their Microsoft (MSFT) 365 and cloud systems. The company came public via a SPAC and saw the usual reception; that is to say, AVPT stock sold off sharply after the SPAC deal was completed. I highlighted AvePoint shares last fall as A Beaten Down SPAC SaaS Worth a Look.

Over the past month, AVPT stock has begun to live up to that potential, with shares going on an impressive rally following its Q1 earnings:

Unfortunately, after digging through the Q1 results, I simply don't see enough to justify this sudden run from the low $4s to almost $7 per share. While I still like AvePoint's business model and the company is making progress, shares appear to be getting ahead of themselves at today's price. Here's why I'm moving to a hold rating on AVPT stock today.

Earnings And Guidance Were Good, But Not Great

On May 10, AvePoint announced its Q1 earnings. The company lost five cents per share on a GAAP basis, which was one penny better than expected. Revenues of $59.6 million came in comfortably ahead of the consensus for $58.2 million. However, a one cent EPS beat and $1.4 million revenue beat is hardly the sort of thing that normally leads to a 50% rally in a company's stock price.

Was it guidance that led to the enthusiasm? Perhaps. AvePoint did raise its full-year outlook for revenues, operating income, and annualized recurring revenues.

The catch is, however, that Wall Street analysts already had higher numbers than AvePoint has previously suggested. Thus, even with AvePoint's new and improved full-year revenue guidance, things are still pretty modest. For example, AvePoint is setting its revenue guidance at a midpoint of $259.5 million versus the Street's prior figure of $258.1 million. This is not a significant difference.

Bulls can argue that AvePoint is intentionally setting conservative guidance once again and the figure will come in a little north of $260 million. That's fine. Still, at the midpoint guide, AvePoint is suggesting revenues will grow 12% this year. That's not terrible given the downturn in the outlook for enterprise software spending this year, but it's hardly the sort of growth rate that tends to sustain large valuation multiples or significant stock price rallies.

If AvePoint traded up 5% or 10% on these numbers, that would totally make sense. It beat the Q1 forecast by a bit, and slightly boosted its outlook for full-year 2023. It's positive incremental progress. But was it a game-changer for the thesis? Not at all.

AvePoint's Longer-Term Positives

An AvePoint bull can argue that the company will fare better than the average SaaS firm during this industry downturn. A key part of AvePoint's business proposition is on reducing costs for its clients and improving productivity.

The point being that in a climate where companies are trying to cut costs and reduce workforces, AvePoint can continue to garner new spend from clients that are focused on lowering operational expenses. When the market was booming in 2021, investors were nervous to give AvePoint a high multiple since its main services were seen as a slower-growth verticals that had limited upside. But in a recessionary climate for SaaS companies, being an essential cost-saving utility is arguably a better position to be in than aiming for flashier high-growth verticals.

AvePoint has also made numerous tuck-in acquisitions and launched new products to broaden its line of services. While the company got its start helping clients migrate from legacy IT to Microsoft software solutions, AvePoint is slipping some of its own proprietary offerings into the mix. The company deems this a land and expand approach where it gets clients from the flagship product lines involving supporting Microsoft software and then build on customer relationships further from there.

CEO Tianyi Jiang gave a concrete example of this on the most recent conference call:

"Our tyGraph offering, which we acquired last year, provides the capability our customers needed to discover critical workplace communication insight with tyGraph implementation, and interoperability with our competence platform.

The firm replaces prior analytic solution for Microsoft 365, and can now effectively measure employee engagement, which in turn drives improved decision making and organizational performance. [...]

The breath of AvePoint confidence platform bolstered by our acquisition of critical technologies allowed us to address compelling customer needs, and we will continue to evaluate opportunities of all sizes to further expand our platform offering and provide greater value to customers and partners."

Monitoring worker efficiency -- especially for hybrid or remote work models -- seems like a vital function, and AvePoint should be able to significantly increase its annualized recurring revenue per customer from continuing to implement these complimentary offerings into the broader ecosystem.

Finally, I'd highlight that AvePoint has greatly prioritized subscription revenues over one-time service revenues. Services are now down to 16% of the revenue mix, and management sees that going to 10% over time. This is crucial as services still have a higher cost of goods sold than all the rest of the company's revenue streams put together.

Meanwhile, SaaS revenues, which were under half of the company's business in 2021, are now leading the way and are continuing to grow much faster than the rest of the business. This should lead to sharply higher profit margins over time.

AVPT Stock Verdict

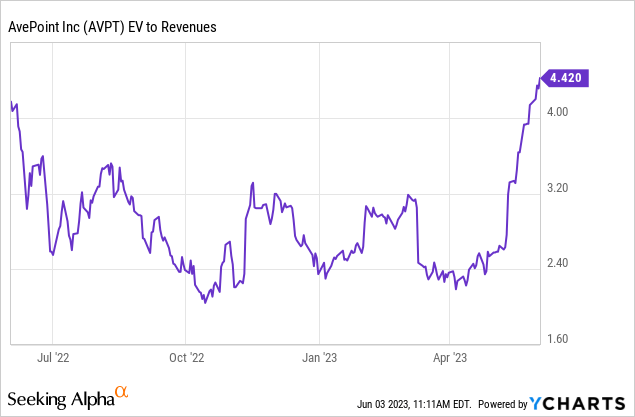

There are certainly positives to both AvePoint's overall business model and its recent operational results. That said, it's harder to get to a bullish outlook today given the big jump in valuation.

The stock was going for as low as 2.3x EV/Sales in both fall 2022 and this spring. Now it has jumped to 4.4x EV/Sales. That's not an egregious valuation by any means, but it's much closer to a normal price for a slower-grower software play in a not-so-glamorous vertical.

On the profitability side of the equation, management is now guiding to reaching GAAP profitability by the end of 2025. It's good that there is a visible pathway to profitability, but 2025 is still quite a long way off.

Given fairly modest top-line revenue growth and the lack of profitability for at least the next two years, it seems like intermediate-term upside on AvePoint shares will be fairly limited.

At $4/share, AvePoint seemed like a reasonable way to get exposure to the large and growing Microsoft enterprise software universe. At nearly $7/share, however, AvePoint has to do significantly more to generate further shareholder value. If you are interested in AvePoint as a longer-term holding, I'd try to wait for a pullback before taking a position.

If you enjoyed this, consider Ian's Insider Corner to enjoy access to similar initiation reports for all the new stocks that we buy. Membership also includes an active chat room, weekly updates, and my responses to your questions.

This article was written by

Ian worked for Kerrisdale, a New York activist hedge fund, for three years, before moving to Latin America to pursue entrepreneurial opportunities there. His Ian's Insider Corner service provides live chat, model portfolios, full access and updates to his "IMF" portfolio, along with a weekly newsletter which expands on these topics.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.