The market recouped the previous day's losses and snapped a two-day losing streak on June 2, on broad-based buying, with the Sensex closing 119 points higher at 62,547 and the Nifty50 ending at 18,534, up 46 points.

The Nifty, which traded within the previous day's range, formed a small bodied bearish candlestick with minor upper and long lower shadows on the daily charts. The pattern indicates formation of Inside Bar candle with overlapping candles.

"The positive chart pattern like higher tops and bottoms continued as per daily timeframe chart and the present consolidation could be in line with the higher bottom formation of the pattern. The higher bottom reversal pattern has not been confirmed yet," Nagaraj Shetti, Technical Research Analyst, HDFC Securities, said.

Considering the recent consolidation and the subsequent negation of such bearish patterns, one can expect a bounce in the market in the coming week, he said. For Nifty, immediate support is at 18,400-18,300 and the upside hurdle is at 18,650-18,850, Shetti said.

The broader market outperformed the benchmark. Nifty midcap 100 and smallcap 100 indices gained half a percent each.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks in this article are the aggregates of three-month data and not just the current month.

Key support, resistance levels on Nifty

The Nifty may get support at 18,492 followed by 18,470 and 18,433. If the index advances, 18,565 will be the key resistance followed by 18,588 and 18,624.

The Bank Nifty also traded in line with benchmarks, rising 148 points to 43,938 on June 2 and formed a small bearish candlestick with upper and lower shadows, which resembled the Inside Bar pattern on the daily scale, indicating rangebound trade. It continued forming llower highs for the third straight day.

"At this juncture, the Bank Nifty has rising trendline support at 43,700. Going ahead, a close below 43,700 might spoil the party for the bulls and we might witness profit booking in the markets," Jigar S Patel, Senior Manager - Equity Research, AnandRathi, said.

On the upside, 44,500 would be an initial resistance on way to the 45,000 milestone.

As per the pivot point calculator, the Bank Nifty is expected to take support at 43,841 followed by 43,776 and 43,670. Resistance will be at 44,052 then 44,117, and 44,223.

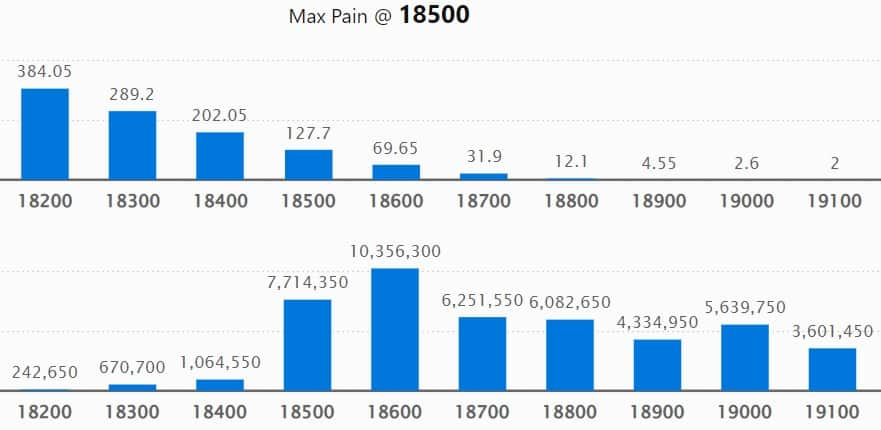

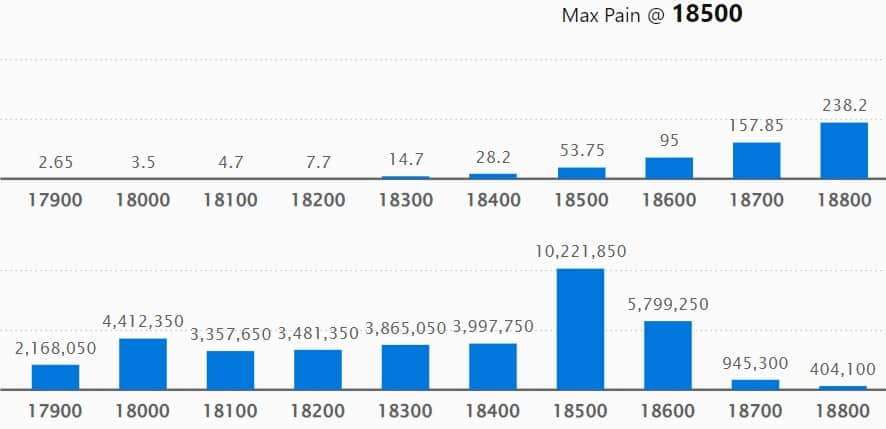

On the weekly options front, the maximum Call open interest (OI) was at 19,500 strike, with 1.06 crore contracts, which is expected to be a crucial resistance level for the Nifty.

This was followed by 18,600 strike comprising 1.03 crore contracts and 18,500 strike with more than 77.14 lakh contracts.

Meaningful call writing was seen at 18,600 strike, which added 42.43 lakh contracts, followed by 19,500 strike, which added 41.63 lakh contracts, and 18,800 strike, which added 24.66 lakh contracts.

Call unwinding was at 18,300 strike, which shed 21,750 contracts, followed by 18,100 strike, which shed 17,250 contracts, and 17,700 strike, which shed 6,400 contracts.

On the put side, the maximum open interest was at 18,500 strike, with 1.02 crore contracts, which is expected to be an important support level in the coming sessions.

It was followed by the 18,600 strike, comprising 57.99 lakh contracts, and the 18,000 strike with 44.12 lakh contracts.

Put writing was seen at 18,500 strike, which added 46.89 lakh contracts, followed by 18,600 strike, which added 34.3 lakh contracts, and 18,000 strike, which added 18.73 lakh contracts.

Put unwinding was seen at 19,000 strike, which shed 2,450 contracts, followed by 19,600 strike, which shed 50 contracts.

Stocks with high delivery percentage

A high delivery percentage suggests that investors are showing interest in the stock. The highest delivery was seen in Container Corporation of India, Sun Pharmaceutical Industries, Cholamandalam Investment and Finance, Infosys and Shriram Finance among others.

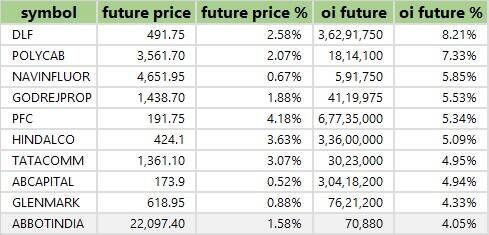

An increase in open interest (OI) and price indicates a build-up of long positions. Based on the OI percentage, 66 stocks, including DLF, Polycab India, Navin Fluorine International, Godrej Properties and Power Finance Corporation, saw long buildups.

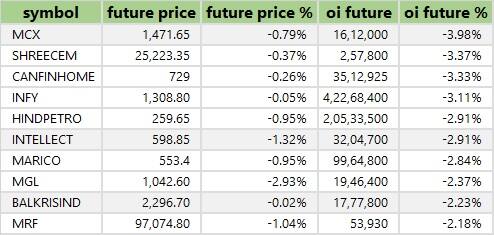

A decline in OI and price generally indicate a long unwinding. Based on the OI percentage, 20 stocks, including MCX India, Shree Cement, Can Fin Homes, Infosys, and Hindustan Petroleum Corporation, saw a long unwinding.

33 stocks see a short build-up

An increase in OI along with a price decrease indicates a build-up of short positions. Based on the OI percentage, 33 stocks, including Indraprastha Gas, Biocon, Voltas, Syngene International and Gujarat Gas, saw a short build-up.

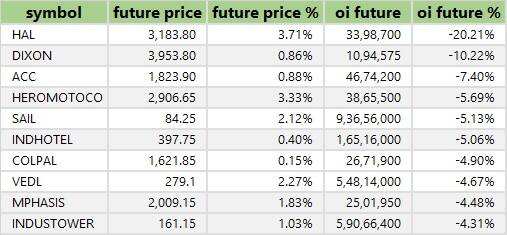

A decrease in OI along with a price increase is an indication of short-covering. Based on the OI percentage, 67 stocks were on the short-covering list. These included Hindustan Aeronautics, Dixon Technologies, ACC, Hero MotoCorp, and SAIL.

Jtekt India: Malabar India Fund sold 22.05 lakh equity shares, or a 0.9 percent stake, in the auto ancillary company via open market transaction at an average price of Rs 125.03 a share.

Lyka Labs: Quant Mutual Fund-Quant Small Cap Fund sold 1.5 lakh shares in the pharma company at an average price of Rs 101.93 per share. Quant Mutual Fund through Quant Active Fund holds 8.86 lakh shares, or a 2.68 percent stake, in the company.

Speciality Restaurants: Promoter Anjan Chatterjee has offloaded 5 lakh shares, or a 1.06 percent stake, in the fine and casual dining restaurants chain through an open market transaction at an average price of Rs 226.99 a share. Promoters' shareholding in the company stood at 52.53 percent as of March 2023.

Ceinsys Tech: Alternate investment fund Zodius Technology Fund has been offloading its stake in the company since May. In the latest transaction, it sold 1.8 lakh shares in the software solutions provider at an average price of Rs 168.25 a share. Zodius has sold 5.73 lakh shares since May, out of 10.94 lakh held as of March 2023.

(For more bulk deals, click here)

Investors Meetings on June 5

Bajaj Electricals: Officials of the company will participate in Nuvama India Conference 2023.

Dr Reddy's Laboratories: Company officials will participate in non-deal roadshow organised by Nomura.

Nazara Technologies: Officials of the company will interact with SBI MF.

KPIT Technologies, Adani Ports and Special Economic Zone: Companies' officials will attend Nomura Conference.

Asahi Songwon Colors: The company will hold the earnings conference call on the performance in Q4FY23 with investors and analysts.

SJVN: The company's officials will participate in non-deal road shows and meet prospective investors.

Can Fin Homes: Officials of the company will interact with Tata AIA Life Insurance.

Stocks in the news

Tech Mahindra: The IT company said subsidiary Comviva Technologies along with the company’s step-down subsidiary Comviva Technologies BV agreed to sell 0.04 percent and 99.96 percent shareholding in Comviva Technologies do Brasil Indústria, Comércio, Importação e Exportação Ltda. The buyer is Druid Internet Systems Comércio E Serviços Ltda. The transaction is expected to be completed by August 2023. The company will exit the product line without impacting its customers being served, it said.

Wipro: The IT services company has fixed June 16, 2023 as the record date for determining the entitlement and the names of equity shareholders who are eligible for the buyback offer. On April 27, the company received approval from the board for the share buy back worth up to Rs 12,000 crore, at a price of Rs 445 per share.

SBI Life Insurance Company: Insurance Regulatory and Development Authority of India has identified SBI Life as the acquirer insurer of the life insurance business of Sahara India Life Insurance Company (SlLIC) to protect the interest of the policyholders. SBI Life will take over the policy liabilities of around 2 lakh policies of SILIC, backed by the policyholders’ assets, with immediate effect.

Zydus Lifesciences: The US Food and Drug Administration (USFDA) has closed the inspection of the company's animal health drug manufacturing facility in Ahmedabad, with nil observations. The USFDA inspected the plant from May 30 to June 2.

Indian Overseas Bank: The Reserve Bank of India (RBI) has imposed a penalty of Rs 2.20 crore on Indian Overseas Bank for deficiencies in regulatory compliance.

Lupin: The pharma major has launched Darunavir tablets, in 600 mg and 800 mg strength, to market a generic equivalent of Prezista tablets of Janssen Products, LP, which reduces the amount of HIV in the blood. Darunavir tablets had estimated annual sales of $308 million in the US, as per IQVIA MAT March 2023.

IIFL Finance: The board has approved Tranche II public issue of non-convertible debentures of Rs 300 crore with a green-shoe option of up to Rs 1,200 crore. This is within the shelf limit of Rs 5,000 crore. The issue will open on June 9 and close June 22.

Wonderla Holidays: The Tamil Nadu government has granted a waiver of local body tax (LBT) of 10 percent to its Chennai project for 10 years from the commencement of commercial operations. This is subject to the condition that the commercial operation shall commence within two years from June 2.

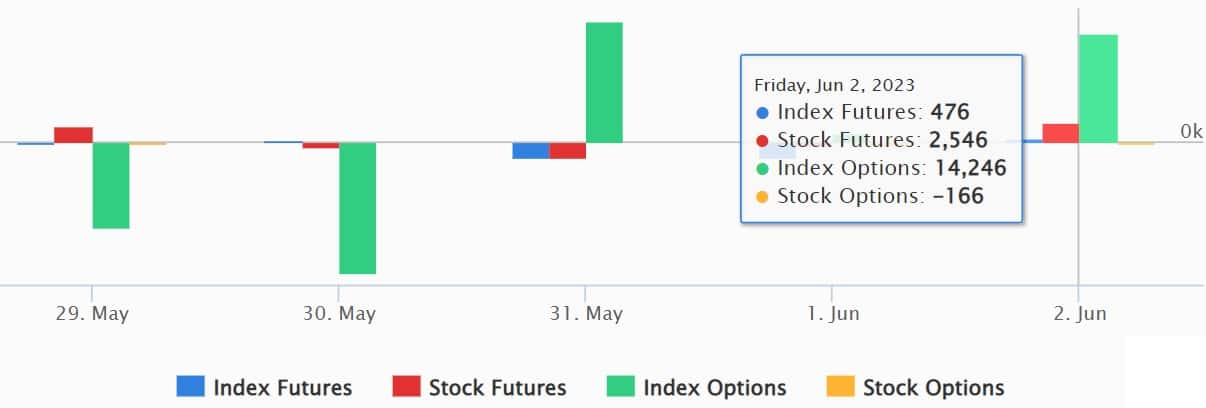

Fund Flow

Foreign institutional investors (FIIs) sold shares worth Rs 658.88 crore, whereas domestic institutional investors (DIIs) bought shares worth Rs 581.85 crore on June 2, provisional data from the National Stock Exchange shows.

Stocks under F&O ban on NSE

The National Stock Exchange has not added any stock to its F&O ban list for June 5.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol are their own and not those of the website or its management. Moneycontrol advises users to check with certified experts before taking any investment decisions.

Disclaimer: MoneyControl is a part of the Network18 group. Network18 is controlled by Independent Media Trust, of which Reliance Industries is the sole beneficiary.