AMC: A Movie Of Toxic Financing From Mass Dilution

Summary

- AMC's stock is up 16% year-to-date despite concerns about the health of movie-going in the post-pandemic era and a large net debt burden.

- Strong box office receipts have helped boost revenue and counter dominant bearish views.

- However, AMC's debt burden and rising interest expenses, along with a potential lawsuit regarding preferred share conversion, could pose significant challenges for the company's future.

Massimo Giachetti/iStock Editorial via Getty Images

AMC Entertainment (NYSE:AMC) is actually up year-to-date by around 16%, not just bucking wider market chaos sparked by a Fed funds rate that has been hiked to its highest level since 2008 but a regional banking crisis and still pertinent concerns around the health of moviegoing in the post-pandemic zeitgeist. However, box office receipts are currently amidst a revival as an incredibly strong slate of movies drives strong moviegoing. At stake here is AMC's full recovery from the pandemic which saw its theatres shut and its balance sheet saddled with debt for it to remain a going concern. The Leawood, Kansas-based company which only went public in 2013 now faces an almost existential situation almost a decade later.

Bears, who form the 20% short interest in the common shares, have rendered the company one of the most heavily shorted stocks on the NYSE. One in five of AMC's shares are now sold short with the near-term bearish view being that the company's large net debt burden and rising interest expenses will form an insurmountable headwind. Bulls take the opposite view on the back of strong box office receipts that puts to a concrete end the notion that moviegoing was out of touch with the post-pandemic reality. Nintendo's (OTCPK:NTDOY) The Super Mario Bros. Movie has so far pulled in a $1.3 billion global box office to become the third-highest-grossing animated film ever made with Disney's (DIS) Guardians of the Galaxy Vol. 3 on track to be the best-performing release of the trilogy.

The Debt Burden And Rising Interest Expenses

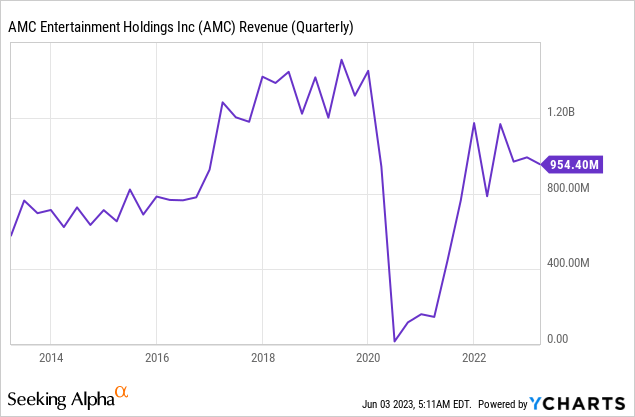

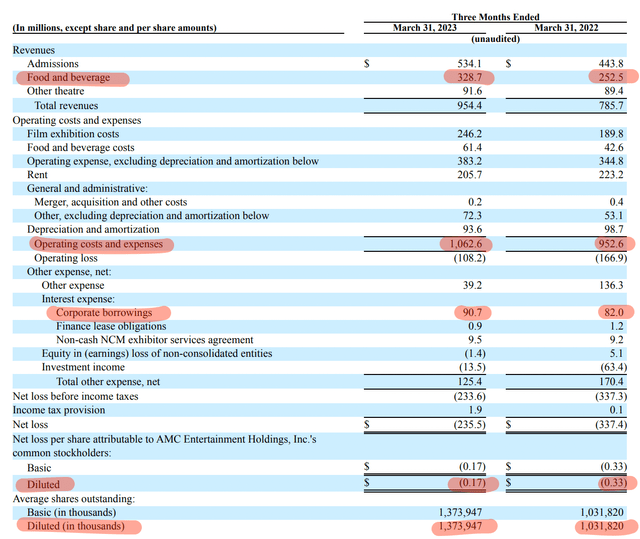

AMC earnings for its fiscal 2023 first quarter saw revenue come in at $954.4 million, a 21.5% increase over its year-ago quarter and a beat by $22.73 million on consensus estimates. The company realized growth across all its revenue components with food and beverage sales growing by 30% over its year-ago comp to $328.7 million. This was a quarter still boosted by Avatar: The Way Of The Water and several other strong releases like Ant-Man and the Wasp: Quantumania. The number of releases in the quarter was up 35% versus the year-ago quarter.

AMC Entertainment Fiscal 2023 First Quarter 10-Q

Operating costs and expenses grew by $110 million year-over-year to $1.063 billion with interest expenses rising 10.6% over its year-ago comp to reach $90.7 million. AMC's total debt as of the end of the first quarter was $9.66 billion, down sequentially from $10 billion in the prior fourth quarter and the seventh consecutive quarter of total debt decreasing. Cash and equivalents as of the end of the quarter including restricted cash at $518.6 million declined from $654.4 million in the prior fourth quarter.

A Chapter 11 filing happens when a company is unable to meet its debt obligations. AMC's debt burden currently comes with an annualized $363 million bill for its servicing. To place this in context, the company's current market cap sits at $2.36 billion, roughly 26% the level of its net debt with its annualized interest rate bill amounting to 70% of its current cash position. AMC has not made a net profit since before the pandemic and does not anticipate this position changing in the near term. To be clear here, the company has less than 6 quarters of cash left against just its interest expenses. AMC's trailing 12-month cash burn from operations as of the end of the first quarter stood at $523.4 million, down sequentially from $628.5 million in the fourth quarter but at a level where the company's ability to remain a going concern should rightfully be questioned.

The APE Conversion Saga

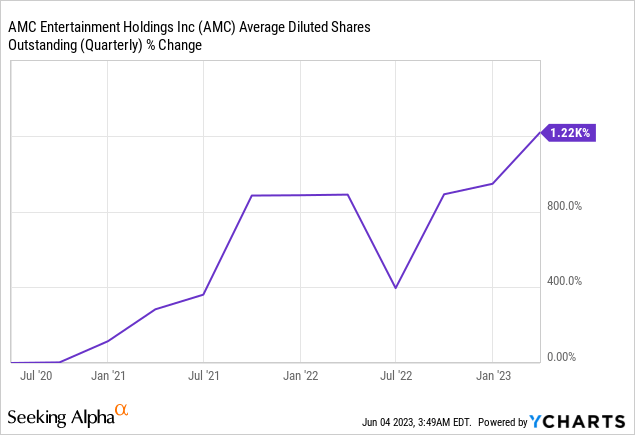

AMC, whose common shares grew by 33% year-over-year during its first quarter, is currently attempting to convert its preferred shares (NYSE:APE) to common equity and raise more funds after reaching the upper limit to the number of authorizable shares it can issue. Its convertible preferred stock is not subject to the cap and would be aggregated with a 1-for-10 reverse stock split once the lawsuit to block the conversion and declare the preferreds is overcome by AMC.

AMC has of course got off on the right foot this year with such a strong movie slate, but bears would flag that this has still not been able to help the company incur a profit. The lawsuit is set to be resolved by June 29-30 at a hearing at the Delaware Court of Chancery where AMC will hope its settlement agreement with the plaintiff passes. This has set a date for the binary fate of the world's largest theatre chain.

However, whilst success for AMC at the end of June would ensure its future, shareholders are set for another marked period of dilution from July as the company would almost certainly look to start boosting its cash position immediately. This would of course allow the company to raise significantly more cash through another round of mass dilution. Indeed, shares outstanding are up over 1000% since the early pandemic. It would cut debt significantly, reducing quarterly interest expenses and extending out the currently tepid cash runway. Fundamentally, this would be a better outcome than a Chapter 11 filing. The stock is to be avoided but AMC's movie is likely not yet over.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.