NVDS: Beware High Underlying Volatility Of Nvidia

Summary

- Nvidia's stock price has risen significantly due to hype surrounding its AI offerings, leading some traders to consider shorting the shares.

- The AXS 1.25X NVDA Bear Daily ETF provides daily inverse exposure to Nvidia, but it is not recommended for shorting the stock due to compounding risk and high volatility.

- Investors may be better off avoiding overvalued market segments instead of shorting them.

Justin Sullivan

With the meteoric rise of NVIDIA's (NVDA) stock price in recent months due to the hype surrounding its offerings in the 'artificial intelligence' arena, many traders may be tempted to 'short' the shares of NVDA, since its valuation is at astronomical levels.

Investors are reminded of this famous quote from the former CEO of Sun Microsystems ("SUNW"), one of the darlings of the dot-com bubble:

“…2 years ago we were selling at 10 times revenues when we were at $64. At 10 times revenues, to give you a 10-year payback, I have to pay you 100% of revenues for 10 straight years in dividends. That assumes I can get that by my shareholders. That assumes I have zero cost of goods sold, which is very hard for a computer company. That assumes zero expenses, which is really hard with 39,000 employees. That assumes I pay no taxes, which is very hard. And that assumes you pay no taxes on your dividends, which is kind of illegal. And that assumes with zero R&D for the next 10 years, I can maintain the current revenue run rate. Now, having done that, would any of you like to buy my stock at $64? Do you realize how ridiculous those basic assumptions are? You don’t need any transparency. You don’t need any footnotes. What were you thinking?”

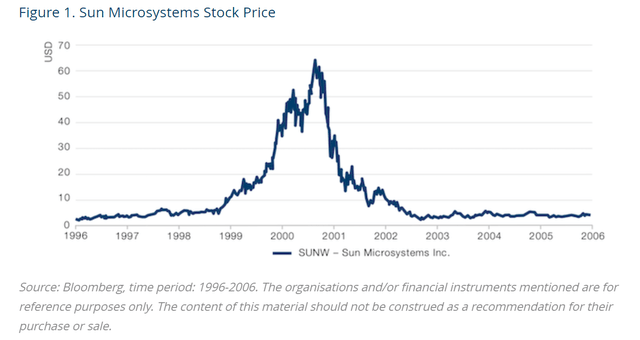

Of course, shortly after Sun Microsystems reached those absurd valuation levels, the Dot-com bubble burst and shares of SUNW cratered from a high of $64 / share to sub $5 (Figure 1).

Figure 1 - What were they thinking on Sun Microsystems? (Man.com)

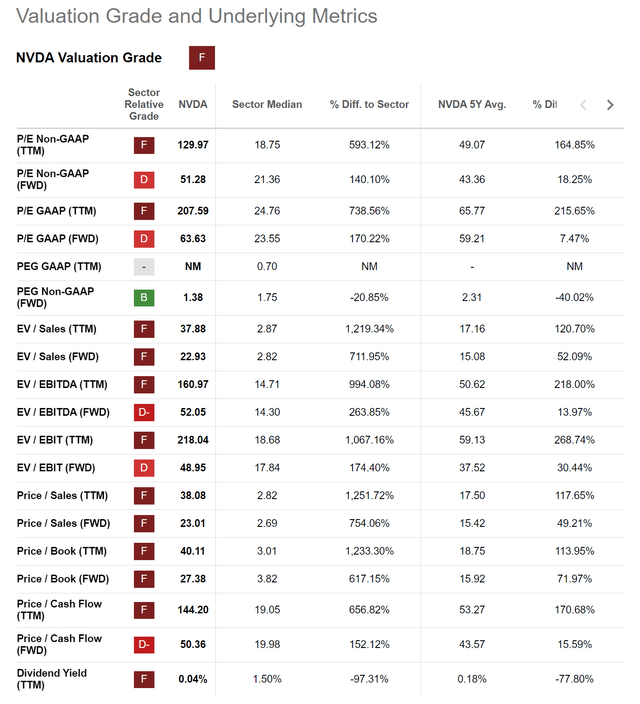

Currently, NVDA is trading at an incredible 23x Fwd Price/Sales and an eye-watering 64x Fwd P/E (Figure 2). So NVDA today is more than twice as expensive as Sun Microsystems was back in 2000. Can anyone really blame punters wanting to short NVDA shares?

Figure 2 - NVDA is trading at absurd valuations (Seeking Alpha)

However your predisposition to NVDA, one thing you should not do is to use a leveraged vehicle like the AXS 1.25X NVDA Bear Daily ETF (NASDAQ:NVDS) to short NVDA.

Fund Overview

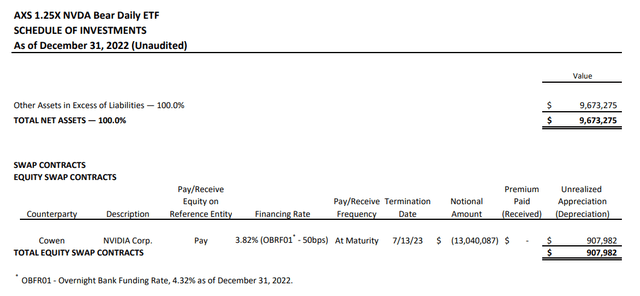

The AXS 1.25X NVDA Bear Daily ETF provides daily inverse exposure to Nvidia Inc. The NVDS ETF is part of a family of 'innovative' single stock ETFs that allow investors to short NVDA through the use of total return swaps struck with investment banks. Figure 3 shows the NVDS ETF's holdings, which are simply cash plus total return swaps. Investors should note that although the latest holdings report says the ETF only has $10.6 million in assets, the report is from December 31, 2022.

Figure 3 - NVDS holdings report (axsinvestments.com)

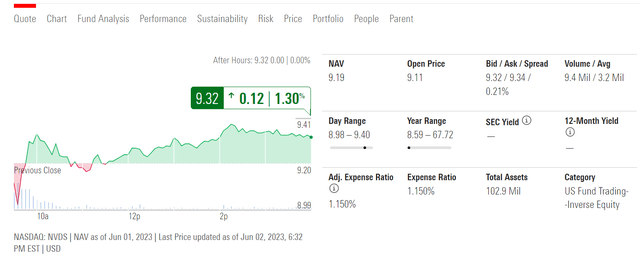

As of June 1, 2023, the assets in the ETF has grown exponentially to over $100 million as investors have been clamouring to short the 'AI bubble' (Figure 4).

Figure 4 - NVDS have more than $100 million in assets (morningstar.com)

Leveraged ETFs Have Compounding Risk

Investors should note that the NVDS ETF is only designed to provide -1.25x exposure to NVDA on a 1-day basis. For holding periods longer than 1 day, the returns of the NVDS ETF may differ materially from the inverse of the underlying due to 'compounding risk'. According to the fund's prospectus:

Compounding affects all investments, but has a more significant impact on a leveraged fund. This effect becomes more pronounced as NVDA volatility and holding periods increase.

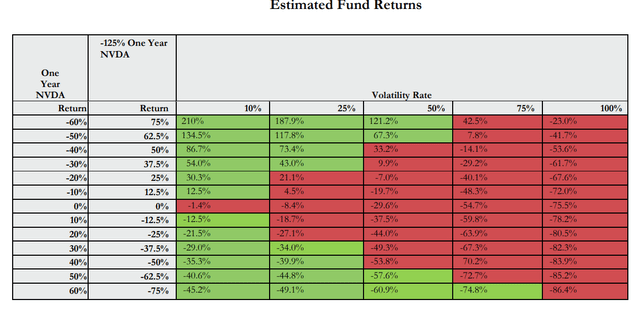

Figure 5 shows the estimated returns of the NVDS ETF depending on the returns of Nvidia shares and the stock's volatility. From the manager's estimates, the NVDS ETF can be significantly better than the inverse of Nvidia's returns if Nvidia's returns are negative and volatility is low (i.e. Nvidia's shares decline at a consistent pace for a long time).

Figure 5 - Estimated returns of NVDS (NVDS prospectus)

However, when volatility is high, NVDS can perform significantly worse than expected. For example, if NVDA returned -20% over a year, but volatility was very high (i.e. 75% volatility), the NVDS ETF is expected to lose -7% instead of delivering positive returns.

Actual Fund Returns To Date

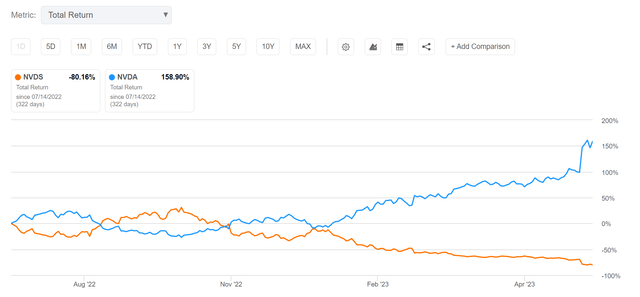

The NVDS ETF was only incepted in July 2022. Since inception, the NVDS ETF has returned -80% in total returns compared to a 159% gain in NVDA shares (Figure 6).

Figure 6 - NVDS has returned -80% since inception (Seeking Alpha)

On the positive side, NVDS unitholders can be thankful they have not been completely wiped out, as arithmetically, a 159% return in the underlying should have translated into a 199% loss with -1.25x leverage.

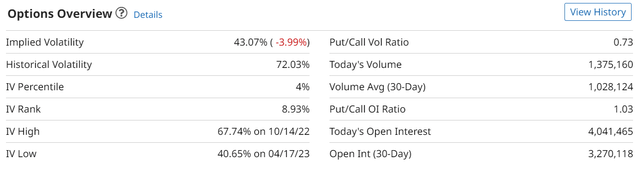

However, investors should also realize that an 'investment' in NVDS may be a losing bet in the long run, because of NVDA's high volatility. NVDA currently has a 47% implied volatility ("IV") and a historical volatility of 72% (Figure 7).

Figure 7 - NVDA is a highly volatile stock (barcharts.com)

NVDA's current IV is actually low relative to history, as its IV has ranged from 41% to 68% in the past year.

What this means is that within the manager's estimates shown in Figure 5, at the current implied volatility of 47% or realized volatility of 72%, the NVDS ETF is almost guaranteed to underperform a simple short of shares.

Furthermore, when stocks decline, their volatilities tend to rise, so if NVDA shares do start heading lower, we can expect its volatility to increase even further and NVDS to underperform even more.

Distribution & Yield

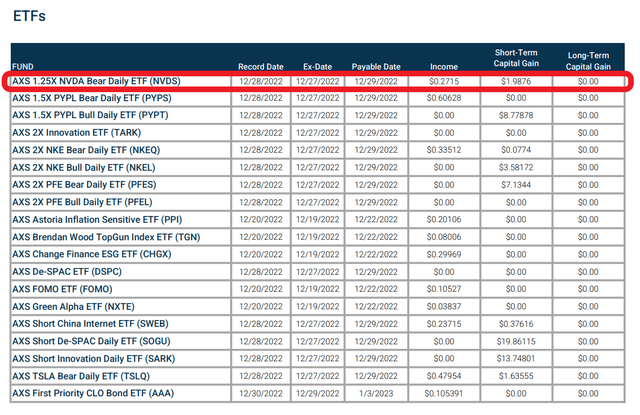

According to the fund's website, the NVDS ETF paid an annual distribution of $2.26 / share at the end of 2022, which would give the ETF a trailing yield of 24.6% (Figure 8)

Figure 8 - NVDS paid a $2.26 / share distribution in 2022 (axsinvestments.com)

However, investors need to remember that the NVDS ETF was trading at $42 / share when the distribution was paid at the end of 2022, so if there were a distribution for 2023, the distribution amount will most likely not be $2.26 / share.

Fees

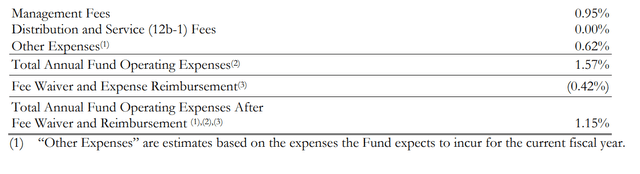

The NVDS ETF charges a 1.15% net expense ratio after fee waivers that are in place until July 31, 2023 (Figure 9). After the fee waivers expire, the fund is expected to charge 1.57% in net expenses.

Figure 9 - NVDS fees (NVDS prospectus)

Capped Vs. Uncapped Exposure

The only benefit that I can see on an inverse ETF like the NVDS is it caps investors' exposure to the capital invested in the ETF whereas a short position in the underlying stock can have potentially unlimited (uncapped) downside. For example, since NVDS' inception, NVDA has rallied 159%, so if investors were short shares at 1.25x leverage, they would have lost almost double the initial capital.

Conclusion

The NVDS ETF is designed to provide daily inverse 1.25x exposure to Nvidia. An inverse ETF on a highly volatile stock like NVDA is almost guaranteed to underperform. I fail to see the reason for most of AXS's single stock ETF offerings except for short-term speculation. While traders may be able to 'hit it out of the park' with a swing trade on NVDS, I would recommend most long-term investors avoid these single stock ETFs.

Correctly shorting bubbles may prove very lucrative and give traders 'bragging rights'. However, 9 times out of 10, investors are not going to be able to time the shorts. Investors may be better off just avoiding segments of the market they feel are overvalued instead of shorting.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.