BSJQ: Locking In High Returns With Fixed Term Bond Funds

Summary

- High-yield bonds yielding over 8% are looking attractive if investors can avoid credit defaults, and one solution is to seek out high-yield bond funds with fixed terms like the Invesco BulletShares 2026 High Yield Corporate Bond ETF.

- Investors buying BSJQ today may be able to lock in a ~6.0% forward return assuming credit defaults stay within a 3-3.5% range.

- In the event of a bad recession, investors should still be able to generate positive average annual total returns if the fund is held to maturity.

Andrii Sedykh/iStock via Getty Images

Recently, I listened to a podcast from Oaktree Capital's Wayne Dahl, discussing current credit market conditions. What stuck with me from the podcast was his discussion on the current state of the high yield bonds market.

Paraphrasing the podcast, if investors can find high quality high yield bonds today yielding over 8%, as long as the bonds can avoid default, investors can lock that 'decent 8% return', irrespective of the volatility in the rest of the markets.

Furthermore, high yield bond markets are dramatically different from a decade ago. Due to the credit stress experienced during the COVID pandemic, many formerly investment grade companies have been downgraded from investment grade into 'high yield' territory (i.e. fallen angels). At the same time, many formerly high risk CCC-rated companies have defaulted due to the COVID-pandemic, so the high yield bond market is actually higher quality than before.

Finally, when interest rates reached their lows after the COVID-pandemic, many high yield issuers took the opportunity to refinance their debts. This means they are actually cashed up and may be able to weather any upcoming economic storms.

This podcast got me thinking, with high yield bonds yielding over 8%, they are certainly looking attractive, if investors can avoid credit defaults. But how can one minimize the chance of credit defaults, or at least the impact of widening credit spreads in the event of an economic recession?

One possible solution is to seek out high yield bond funds with fixed term like the Invesco BulletShares 2026 High Yield Corporate Bond ETF (NASDAQ:BSJQ). The BSJQ ETF invests in high yield bonds with 2026 maturities.

With an 8% yield to maturity portfolio, investors buying the fund may be able to lock in a ~6.0% average annual total return for the next 3 years, assuming credit defaults stay within a manageable 3-3.5%. Even in a worst-case 2008 recession scenario, forward average annual returns should still be positive. I am a buyer of the BSJQ ETF.

Fund Overview

The Invesco BulletShares 2026 High Yield Corporate Bond ETF is a high yield bond focused ETF with a maturity date of December 15, 2026. It invests in high yield bonds with effective maturities in 2026. The BSJQ ETF tracks the Nasdaq BulletShares USD High Yield Corporate Bond 2026 Index ("Index") but does not replicate the entire index.

Investments eligible for the index are U.S. dollar denominated high yield bonds with effective maturities in 2026. The issuers may be from North America, Western Europe, or Japan. The credit rating of the bond must be between CCC- to BB+ and the issue must have at least $200 million in face value. Individual issuer weight is limited to 5% and the ETF is rebalanced monthly.

The BSJQ ETF has $278 million in assets and charges a 0.42% net expense ratio.

Portfolio Holdings

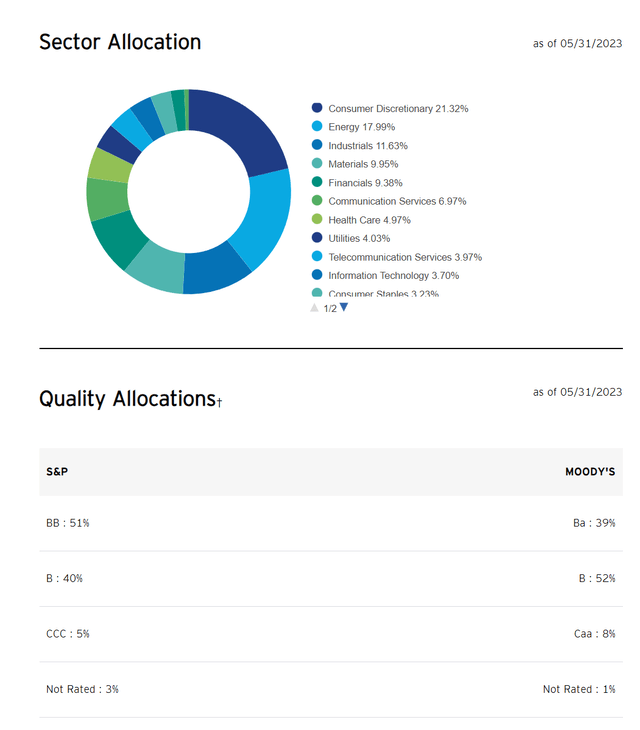

Figure 1 shows the current sector and credit quality allocations of the BSJQ ETF. The biggest sector weights are Consumer Discretionary (21.3%), Energy (18.0%), Industrials (11.6%), Materials (10.0%), and Financials (9.4%).

Figure 1 - BSJQ sector and credit quality allocations (invesco.com)

The credit ratings are predominantly rated BB (51%) and single-B (40%).

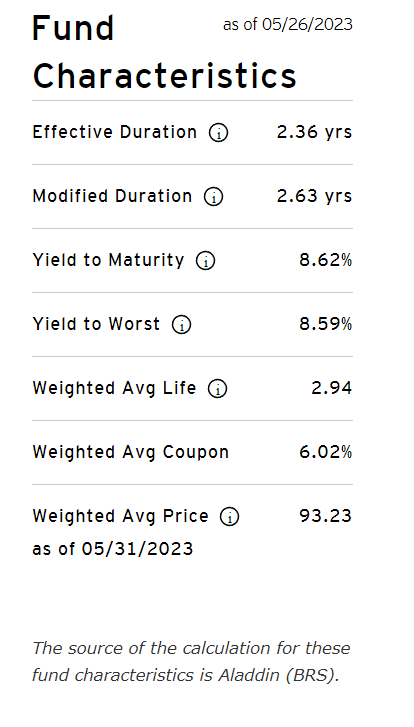

BSJQ's portfolio has an effective duration of 2.4 years and yield-to-maturity of 8.6%. With weighted average coupon of 6.0%, that means the average bond within BSJQ's portfolio is trading at a discount, with a weighted average price of $93.23 (Figure 2).

Figure 2 - BSJQ portfolio statistics (invesco.com)

Returns

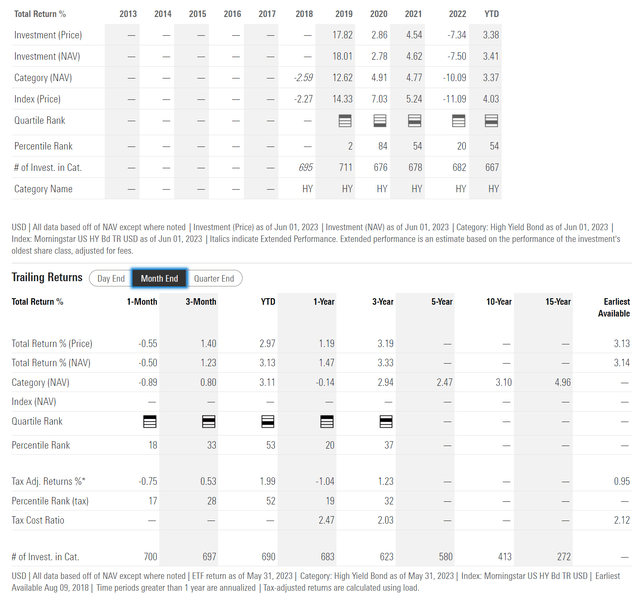

Figure 3 shows the historical returns for the BSJQ ETF. Returns have been modest, with 1 and 3Yr average annual returns of 1.5% and 3.3% respectively.

Figure 3 - BSJQ historical returns (morningstar.com)

On an annual basis, 2022 returns were notably weak at -7.5% as interest rates rose and credit spreads widened modestly.

Distribution & Yield

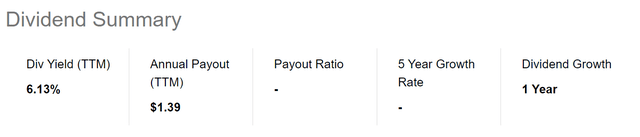

Currently, the BSJQ ETF is paying an attractive $1.39 / share trailing 12 month distribution or 6.1%, commensurate with the average coupon of its portfolio (Figure 4).

Figure 4 - BSJQ is paying a 6.1% yield (Seeking Alpha)

Can Investors Really Lock In An 8% Return?

Assuming there are no defaults within BSJQ's portfolio, investors buying the fund today can earn an ~8% annualized forward return, calculated as 6% from yield and ~2% from appreciation of the bond portfolio towards par at maturity in 2026.

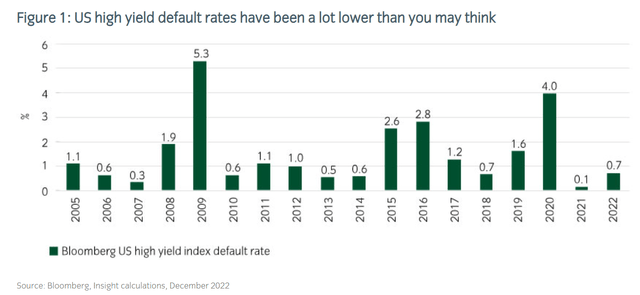

Offsetting this return will be credit defaults. According to data from Insight Investment, U.S. high yield default rates have averaged 1.5% over the past 15 years with peak default rates of 5.3% and 4.0% in 2009 and 2020 due to the Great Financial Crisis and the COVID-pandemic respectively (Figure 5).

Figure 5 - US HY defaults have averaged 1.5% in past 15 years (Insight Investments)

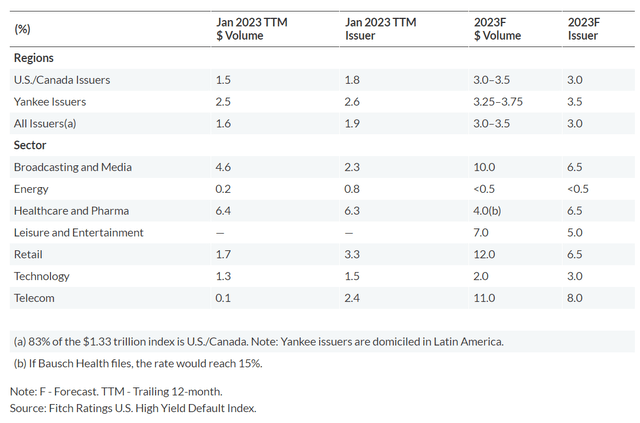

Ratings agencies like Fitch expect 2023 default rates to be between 3.0-3.5%, significantly above the lows seen in 2021 and 2022 (Figure 6).

Figure 6 - Fitch expect HY default rates of 3-3.5% for 2023 (Fitch)

If Fitch is correct and defaults come in at 3.0-3.5% in the next few years, combined with 30-50% recoveries upon default, then investors could be looking at a 1.5-2.5% drag from defaults within the typical high yield portfolio.

Since the BSJQ ETF is a passive ETF tracking high yield bonds with maturities in 2026, there is no reason to expect its credit performance will be better than market expectations. Therefore, instead of locking in an 8% return, investors may actually experience 5.5% - 6.5% annualized total returns over the coming 3 years.

Please note that this is the expected average annual forward return. If the U.S. economy experiences a deep recession in H2/2023, then credit spreads may widen dramatically and BSJQ's NAV may decline. However, this NAV decline should be 'earned back' as the underlying portfolio of bonds march towards maturity.

What Are The Upside Vs. Downside?

On the upside, assuming the U.S. economy is able to avoid a recession, perhaps the default experience will be better than what the ratings agencies are modeling. As Mr. Dahl alluded to in his podcast, if many high yield issuers have refinanced their debts during 2021 and 2022, then they have enough resources to weather any upcoming economic weakness. If we assume a more sanguine credit default forecast of 1.5-1.8% (similar to the 2023 YTD trends shown by Fitch), then forward total returns for BSJQ could be 6.0-6.5% p.a.

On the downside, if we assume a worse than expected default experience, for example, 5% average over the next 3 years (note, this would be worse than the Great Financial Crisis which saw 1.9% and 5.3% in 2008 and 2009), then total returns may turn out to be 4.5-5.5%.

Why Can't We Do A Similar Strategy With Perpetual Bond Funds?

One question investors may have regarding my analysis above is why can't they perform similar analyses with perpetual high yield bond ETFs like the SPDR Bloomberg Barclays High Yield Bond ETF (JNK) or a high yield closed-end fund like the Blackstone Long-Short Credit Income Fund (BGX)?

With the hold to maturity strategy I am proposing above, we want to find a portfolio of high yield bonds that we can hold to maturity to earn the accretion to par. The main problem I see with the JNK ETF and the BGX fund is that these funds do not have a fixed termination date like the BSJQ ETF. This means they are constantly churning their portfolios and crystallizing MTM losses in order to maintain portfolio durations within a certain range. For example, the BGX fund has a 94% turnover; meaning they turn over their entire portfolio every year.

So while the BGX and JNK ETF may see similar yields and credit default experience as the BSJQ ETF, they would not earn the ~2% accretion to par that investors in BSJQ should experience as the portfolio nears maturity.

Furthermore, in the event of a recession, we could see significant widening of credit spreads, which would impact the NAV of these perpetual bond funds. On the other hand, while the NAV for the BSJQ ETF will also decline, if it is held to maturity, investors can 'ride out' the volatility.

Conclusion

With high yield bonds yielding north of 8% in the current normalized interest rate environment, they are starting to look interesting for investors. While I am still hesitant to buy perpetual high yield bond funds due to the risk of NAV declines from widening credit spreads, a limited term high yield bond fund like the Invesco BulletShares 2026 High Yield Corporate Bond ETF may make sense.

Investors buying the fund today may be able to lock in a ~6.0% forward return assuming credit defaults stay within a 3-3.5% range. In the event of a bad recession, investors should still be able to generate positive average annual total returns if the fund is held to maturity in 2026, as the coupons and accretion to par should more than offset even the worst historical default experience.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in BSJQ over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.