Western Alliance: The Banking Crisis Is Likely Over, Buy The Preferreds

Summary

- Western Alliance Bancorporation is a core consideration for investors looking to ride the post-crisis recovery.

- The bank's Series A preferred shares offer a 7.34% yield and are trading at a 42% discount to their $25 par value.

- Strong deposit growth and the Fed pausing interest rate hikes would likely signal that the banking crisis has come to an end.

Art Wager/iStock Unreleased via Getty Images

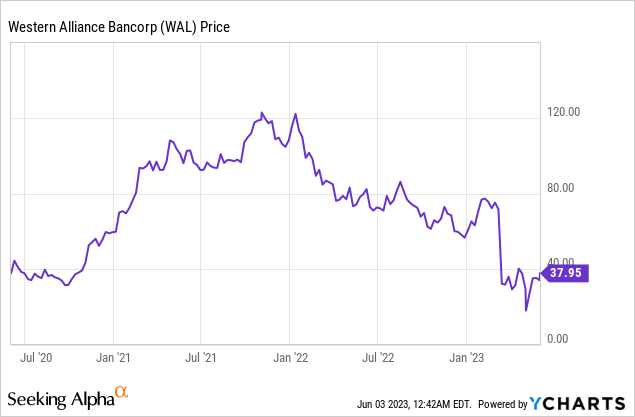

The panic-induced banking crisis of early 2023 is likely over, and Western Alliance Bancorporation (NYSE:WAL) forms one of the core considerations for those looking to ride the post-crisis recovery. The Phoenix, Arizona-based regional banking holding company was once penned to become another high-profile casualty as one of the most chaotic chapters of the marked rise in the Fed funds rate played out. This would see a 60% intraday drop in early May on the back of unsubstantiated reports that the bank was exploring a sale. For bears, who form the 12.3% short interest in the common shares, the 36.5% decline in the common shares of the bank year-to-date is not enough. Silicon Valley Bank's collapse was a near-generational event, and a similar happening for other banks has become the barometer through which the short position still functions.

At the core of this crisis is the flow of deposits in an age where the Fed funds rate at 5% to 5.25% sits at its highest level since 2008. Western Alliance updated the market in May during the intense selloff that its deposits sat at $48.8 billion as of May 2, this was up $1.2 billion from the end of March. The bank continues to defy fears that depositors will flow to the more systematically important banks Wells Fargo (WFC), JPMorgan Chase (JPM), Citi (C), and Bank of America (BAC). Critically, the regional bank collapses were self-fulfilling prophecies whose likelihood of happening again reduces the further away we pull away from the zeitgeist and conditions that spurred it. Michael Burry's Scion Asset Management is buying Western Alliance's common shares to add an institutional vote of confidence that also includes Bill Gross, the "Bond King" who co-founded active fixed income manager PIMCO.

The Series A Preferreds For 58 Cents On The Dollar

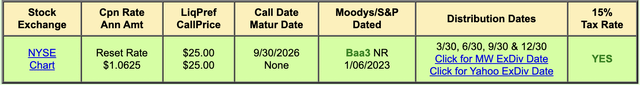

Western Alliance Bancorporation Reset Rate Preferred Stock Series A (NYSE:WAL.PA) currently swap hands for $14.47 per share after a 29% decline since the start of the year. These pay out a $1.0625 annual coupon for a 7.34% yield on cost. The bank holding company last declared a quarterly cash dividend of $0.36 per share for its common shareholders, this payout was in line with its prior payout and forms a 3.8% forward annualized yield. Hence, the preferreds offer a yield that's 354 basis points in excess of the commons. The preferreds have several distinct benefits that render them a good security to play the post-crisis recovery, even with the commons offering a better overall upside potential.

Firstly, they're trading at a roughly $10.53 difference, around a 42% discount to their $25 par value. This means you're buying the 7.34% yield for 58 cents on the dollar. Further, they come up for redemption on September 9, 2026, so their yield to call stands at 21.8%. Western Alliance has no other preferreds trading with the Series A going public in September 2021 when they were used to refinance 6.25% subordinated debentures which came up for redemption in the same month.

The preferreds are non-cumulative, so any possible future dividend suspension won't accrue as a liability for repayment at a later date. However, the bank has maintained its common share payments against the chaos, which bodes well for the preferreds as they form a first line of defense for preferred dividend payments. For some context, the company paid $39.4 million in common share dividends during its fiscal 2023 first quarter versus $3.2 million in dividends to the holders of the Series A preferred shares.

The Upcoming Pause

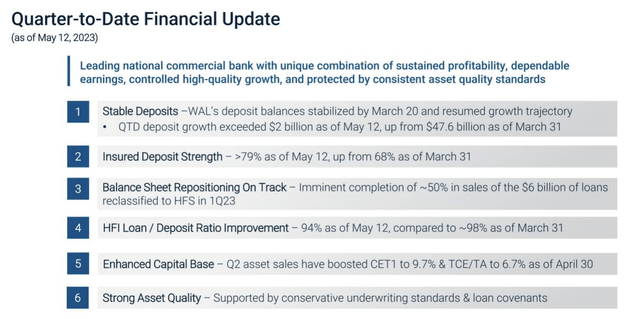

Western Alliance Bancorporation Form 8-K

The bank last declared quarterly earnings for its fiscal 2023 first quarter that saw revenue come in at $712.2 million, a 28.2% increase over its year-ago comp and a beat by $45.08 million on consensus estimates. Net income was $142.2 million, down from $293.0 million in the year-ago quarter, with adjusted earnings per share of $2.30 only falling by $0.44 from $2.74 in the year-ago quarter. The bank has further updated the market on deposits as of May 12 stating that this has grown by $2 billion since the end of March with 79% of these being insured depositors.

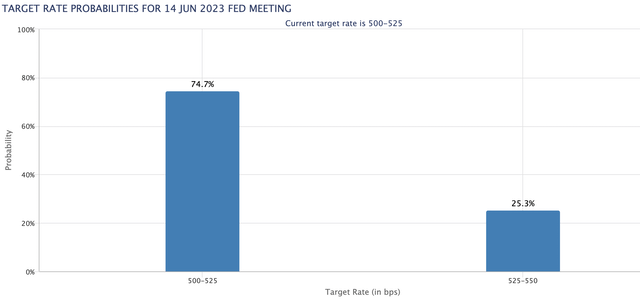

Strong deposit growth against one of the most turbulent periods in the banking crisis is a strong vote of confidence in Western Alliance and a signal that the banking crisis for it has come to an end just as the Fed is set to pause its interest rate hikes. The market is currently pricing in a 74.7% probability of the Fed pausing rates at the upcoming meeting on the 14th of June following a job report that saw unemployment rise to 3.7% albeit with strong payroll figures. This pause would form a watershed moment and would begin the normalization of conditions that have disrupted the balance sheet of banks. Hence, with the likelihood of a dividend suspension on the preferreds near zero, the Series A is a buy.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in WAL.PA over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.