Shift4 Payments: An Interesting Company That Was Recently The Subject Of A Short Report

Summary

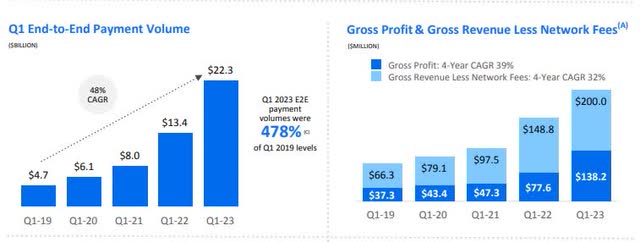

- Shift4, a fast-growing company in the payment sector, reported strong Q1 results with a 66% YoY increase in payment volume and a 34% YoY increase in gross revenue excluding network fees.

- Despite facing competition from Adyen and Stripe, Shift4's focus on specific industries and its lower valuation compared to competitors could lead to strong long-term returns if it can build a moat in its niche.

- Shift4's international expansion and growth in the US market could lead to strong revenue growth, but deleveraging should be a priority as net debt is quite high.

megaflopp/iStock via Getty Images

Thesis

Shift4 (NYSE:FOUR) is a fast-growing company that got into a bit of trouble over a short report, but the underlying business is still intact and growing nicely. The big question now is whether the market will give credibility to this report. And at the moment it looks like they are not. So I think if we focus on the business model, we see that Shift4 has strong growth opportunities but is a bit behind its direct competitors. Let me show you why I think that.

Analysis

Shift4 reported strong Q1 results with a 66% year-on-year increase in payment volume and a 34% year-on-year increase in gross revenue excluding network fees. Restaurants account for 40% of the payment volume, but the fastest growing sector is hotels. And this is one thing that sets them apart from the competition, such as Adyen (OTCPK:ADYEY), as Shift4 has a strong focus on a few industries where they try to gather as much expertise as possible. Sector-specific analysis based on the data collected is their unique selling point. And right now they are focusing on the restaurant, hospitality and sports + entertainment industries.

Another point where they differ from Adyen is that they have more SMB customers, as smaller companies do not have the pricing power of large merchants and therefore the take rate and margins are more favorable. But they still have the problem of being dependent on Mastercard (MA) and Visa (V), even though they could pass on higher fees to their merchants. And that is an advantage, because it is more difficult for Adyen, for example, to pass on higher costs to its large merchants, who have much more pricing power.

The long-term development of payment volumes and gross sales is also what you would expect from a growth stock. However a major topic is the Blue Orca short report. It might seem that companies in the payments sector are the target of short reports, as DLocal (DLO) recently received one from Muddy Waters Report. But in the case of Wirecard (OTC:WRCDF), the short reports were important and helpful. However, I am not suggesting that Shift4 or DLocal could be anything like Wirecard.

The main points of criticism in the report are that the accounting is aggressive because Shift4's CEO could be at risk of a margin call. The risk of a margin call for the CEO should be relatively low given the information right now but for an informative take on the whole issue, take a look at Twitter, where Goncalo Fernandes has an interesting thread going through the points.

At the moment, however, the market does not seem to think much of the short report. But as always, if you are an investor with a low risk tolerance, this could be important for you as there is always the possibility that Blue Orca or another company will publish a new short report. Personally, I would have liked to have seen more questions on this in the last earnings call and perhaps a more detailed statement.

Growth Opportunities

At the moment the main market is the US, but with the planned expansions with Finaro and Online Payments Group the focus will be more international, especially in Europe. However, they are currently awaiting regulatory approval from banking regulators in the EU, but through this acquisition we can again see that the priority for capital allocation for Shift4 is growth through acquisition. And this is a challenging way to grow, as the integration of new companies is often fraught with difficulties.

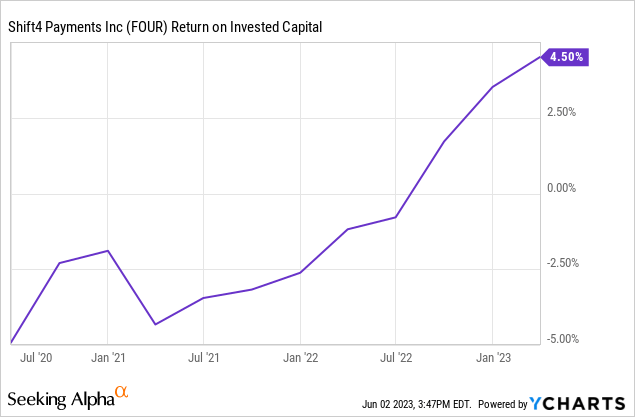

And I think we can see that in the low ROIC, where other competitors, despite growing faster, are in the 20%+ range. Nevertheless, I think they will improve on this metric and be in the double digits in the next few years.

Another thing to consider is that Shift4 has its product integrated into other software solutions where they have Independent Software Vendors and Value Added Resellers and both receive a revenue share. And unfortunately most of the time they do not have exclusive partnerships. This could lead to margin problems as the ISV and VAR try to get higher commissions.

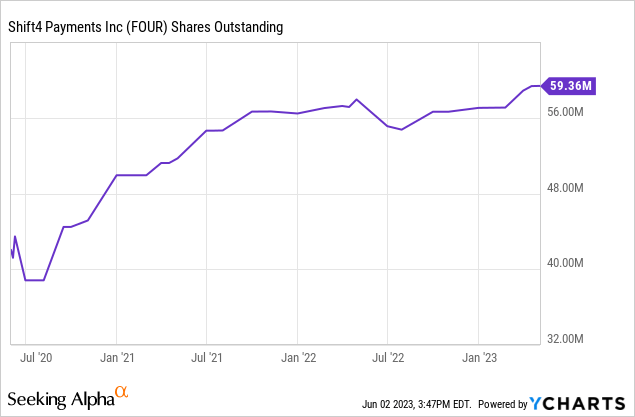

Another issue we need to address is the relatively rapid increase in shares outstanding, which is a problem for some growth companies these days. And this has clearly diluted shareholders in recent years.

Reverse DCF

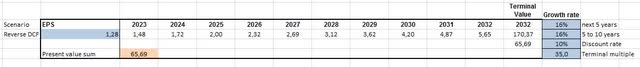

The reverse DCF is based on TTM diluted EPS of $1.28. And the result is that a 16% CAGR over the next 10 years is currently priced in. And I think that is something that a growth company in such an interesting market with great future growth potential can achieve if they execute properly.

Competition

In my opinion, Adyen is the closest competitor and that is why I am comparing the two. If you are interested in Adyen, I have written about it here.

| EV/EBIT | P/E GAAP TTM | |

| Shift4 | 46x | 50x |

| Adyen | 63x | 85x |

In the table above we can clearly see that Adyen has a premium in terms of valuation and that both are relatively expensive, but unfortunately high growth and high quality companies come at a price.

Author + Data from Seeking Alpha

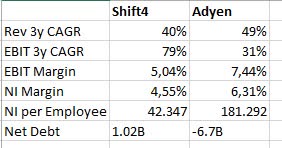

In the graph shown here, based on data from the Seeking Alpha's Comparison tab, we can clearly see that Adyen's premium is justified. Adyen has the better balance sheet in terms of cash and debt and is growing faster. In addition, its EBIT and Net Income margins are also stronger. But probably the biggest advantage that Adyen has is that it has a really high NI per employee. Most European companies have not hired as many people as their American competitors, but they have still grown considerably. Also, wages are lower in Europe, which helps to improve margins. And lower employee costs are a big competitive advantage.

Conclusion

Shift4 is an interesting company with great potential for the future, focusing on a few industries in which it is trying to build its niche. Their use of data to improve their customers' revenues in these industries could lead to a major competitive advantage in the future, as they could build a large knowledge base that no other competitor has, as most of them are not as specialized as Shift4.

In contrast to the competition, Shift's valuation tends to be lower, so the risk of multiple compression is not quite as high. However, deleveraging should be a priority as net debt is quite high and the positive FCF could be deployed for this purpose.

International expansion and growing business in the US could lead to strong revenue growth, but competition from the likes of Adyen and Stripe is fierce. However, the market is huge and there is likely to be room for more than one major player. With a market capitalization of only ~$5.3bn at the moment and huge market opportunities, Shift4 could achieve really strong long-term returns if it can capture its niche and build a moat.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.